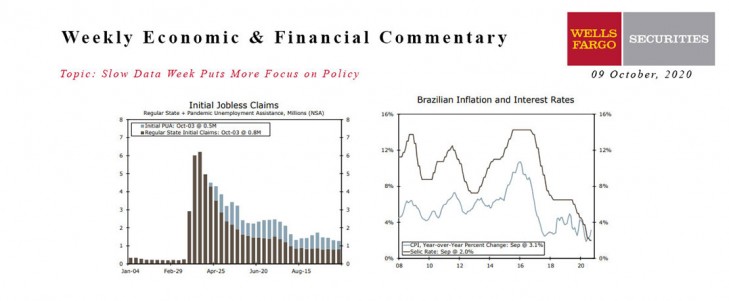

U.S. - Slow Data Week Puts More Focus on Policy

- Weekly first time unemployment claims highlighted an extraordinarily slow week for economic news. Jobless claims fell slightly but continuing claims fell by one million.

- The ISM non-manufacturing survey handily beat expectation, rising 0.9 points to 57.8.

- Job openings, as tallied by the Bureau of Labor Statistics’ JOLTS survey, fell by 200,000 to 6.49 million in August.

- The nation’s trade deficit widened sharply to $67.1 billion in August, as consumer spending on goods has rebounded well ahead of many other nations.

Global - RBA on Hold; Canadian Job Gains Accelerate

- The Reserve Bank of Australia held its cash rate and three-year yield target unchanged at 0.25%, as expected, but reiterated that fiscal and monetary support will be required for some time. Following the RBA meeting, Australia released its fiscal plan, which is now expected to push the cash deficit to a record high.

- Mexican inflation remained above the central bank’s upper bound inflation target of 4% in September, while Brazil’s September IPCA consumer prices rose to 3.14% year-over-year. Elsewhere, Canadian employment growth unexpectedly accelerated in September, while the unemployment rate slid to 9.0%.

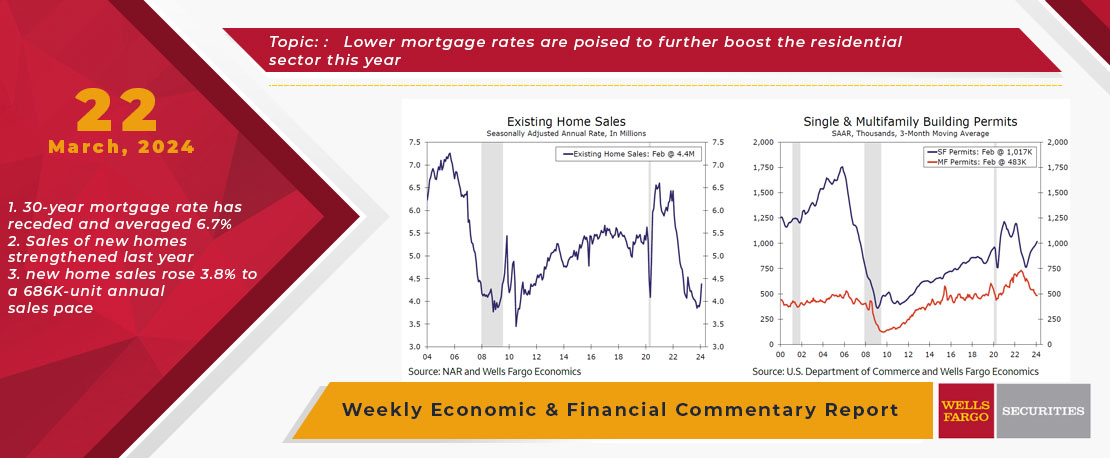

This Week's State Of The Economy - What Is Ahead? - 22 March 2024

Wells Fargo Economics & Financial Report / Mar 25, 2024

During February, existing home sales and housing starts both topped expectations and rose at robust rates. Meanwhile, initial jobless claims have remained subdued so far in March.

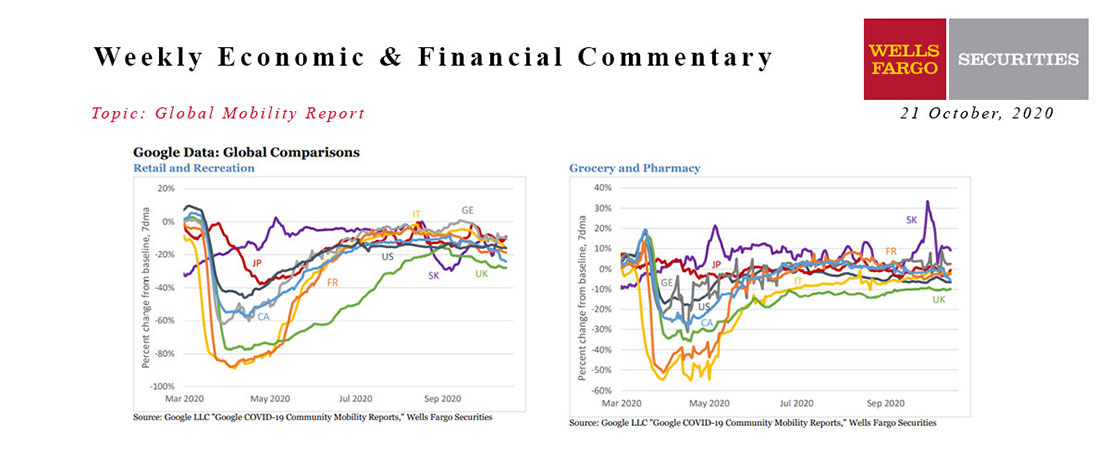

This Week's State Of The Economy - What Is Ahead? - 21 October 2020

Wells Fargo Economics & Financial Report / Oct 21, 2020

Mobility is continuing to trickle lower in several major developed market economies. The U.K., France, Italy and Canada have all seen some further modest declines in retail/recreation visits.

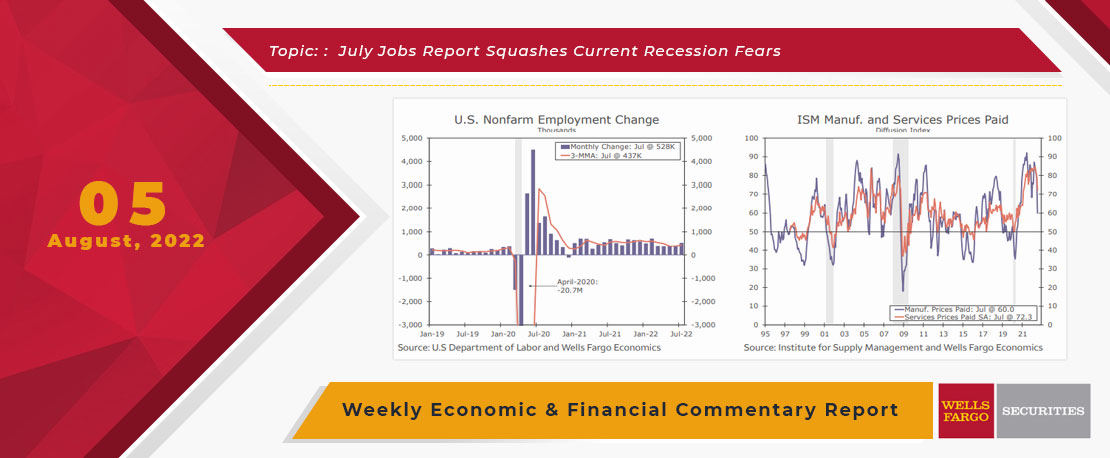

This Week's State Of The Economy - What Is Ahead? - 05 August 2022

Wells Fargo Economics & Financial Report / Aug 08, 2022

The Bureau of Labor Statistics reported this morning that nonfarm payrolls increased 528,000 for the month of July, easily topping estimates, lowering the unemployment rate to 3.5%.

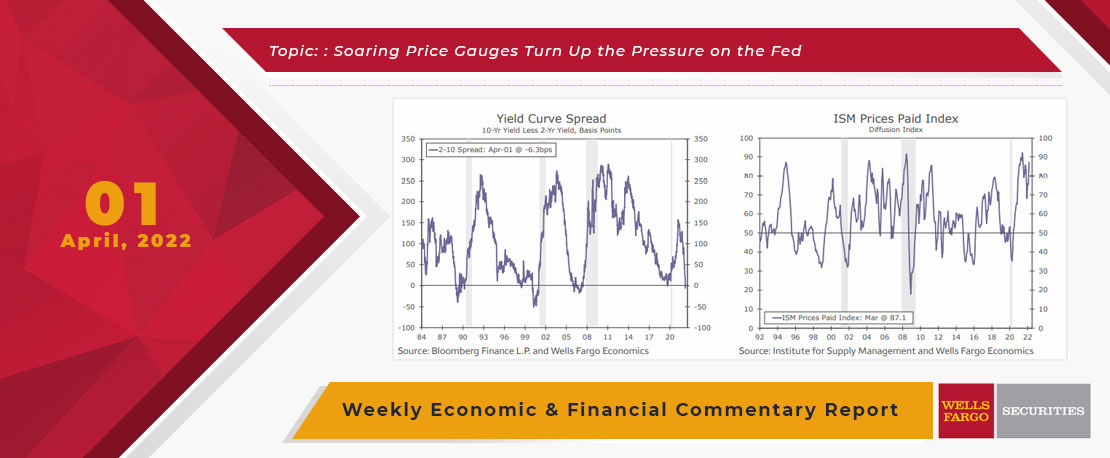

This Week's State Of The Economy - What Is Ahead? - 01 April 2022

Wells Fargo Economics & Financial Report / Apr 05, 2022

The key factor that will drive interest rates is the Fed’s belated effort to rein-in inflation.

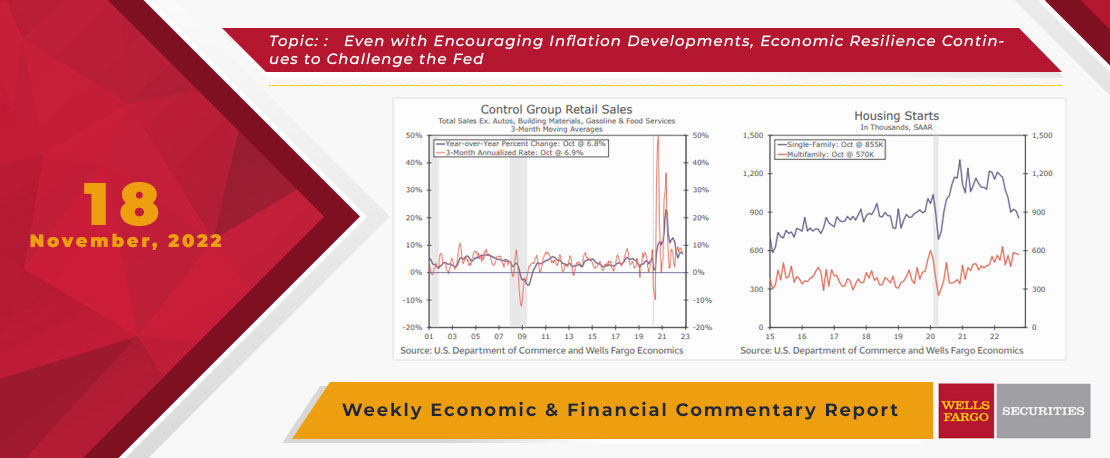

This Week's State Of The Economy - What Is Ahead? - 18 November 2022

Wells Fargo Economics & Financial Report / Nov 21, 2022

The resiliency of the U.S. consumer was also on display, as total retail sales increased a stronger-than-expected 1.3% in October, boosted, in part, by a 1.3% jump in motor vehicles & parts and a 4.1% rise at gasoline stations.

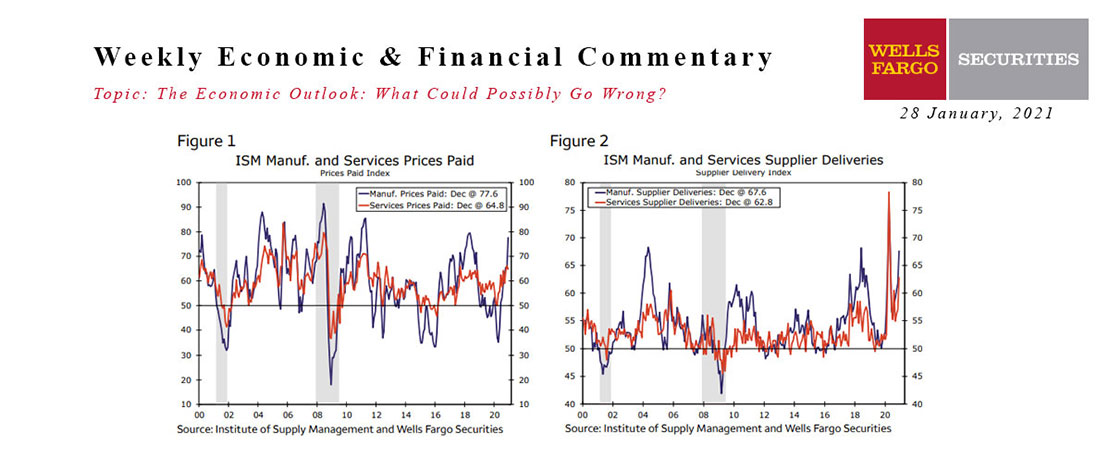

28 January 2021 Economic Outlook Report

Wells Fargo Economics & Financial Report / Feb 08, 2021

In our recently released second report in this series of economic risks, we focused on the potential of demand-side factors to lead to significantly higher U.S. inflation in the next few years.

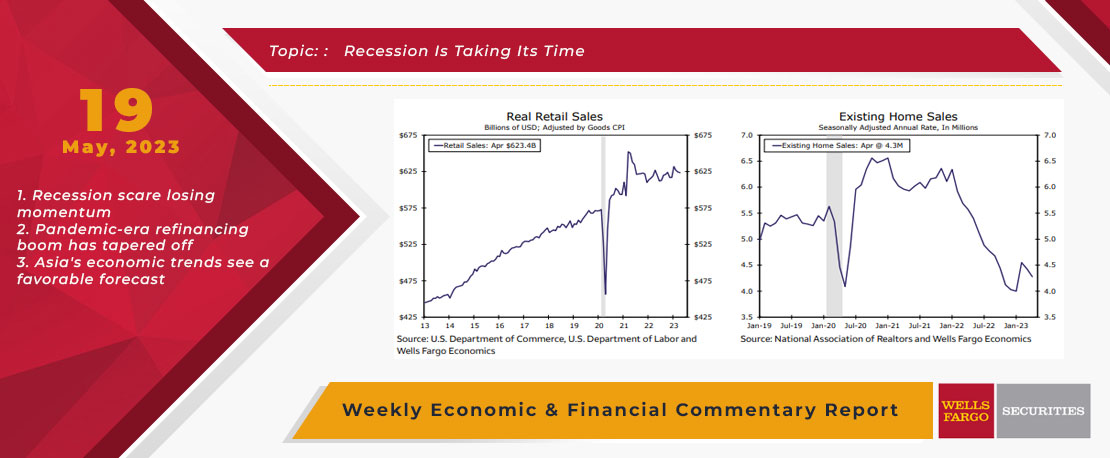

This Week's State Of The Economy - What Is Ahead? - 19 May 2023

Wells Fargo Economics & Financial Report / May 23, 2023

Economic data continue to suggest the U.S. economy is only gradually losing momentum. Consumers continue to spend, and industrial and housing activity are seeing some stabilization.

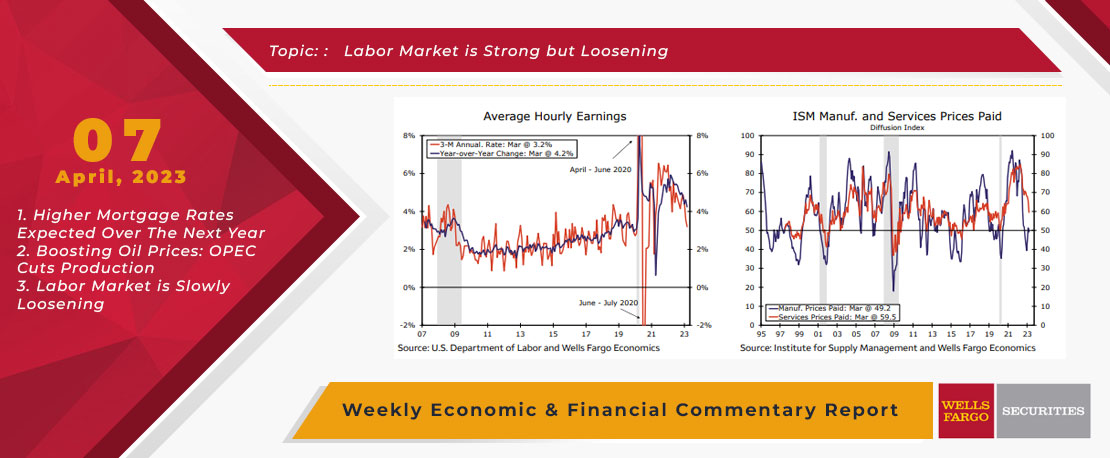

This Week's State Of The Economy - What Is Ahead? - 07 April 2023

Wells Fargo Economics & Financial Report / Apr 10, 2023

Employers added jobs at the slowest pace since 2020 in March, job openings fell and an upward trend in initial jobless claims has emerged.

This Week's State Of The Economy - What Is Ahead? - 19 July 2024

Wells Fargo Economics & Financial Report / Jul 22, 2024

Retail sales, housing starts and industrial production all surprised to the upside this week.

This Week's State Of The Economy - What Is Ahead? - 07 June 2024

Wells Fargo Economics & Financial Report / Jun 11, 2024

The U.S. labor market continues to defy expectations. Employers added 272K net new jobs in May, which was stronger than even the most bullish forecaster among 77 submissions to the Bloomberg survey.