Economic data this week covered the consumer, industrial space and housing market, and continue to suggest the U.S. economy is only gradually losing momentum. We still view a recession is more likely than not by the end of the year, but there is no denying the underlying resiliency evident in the data.

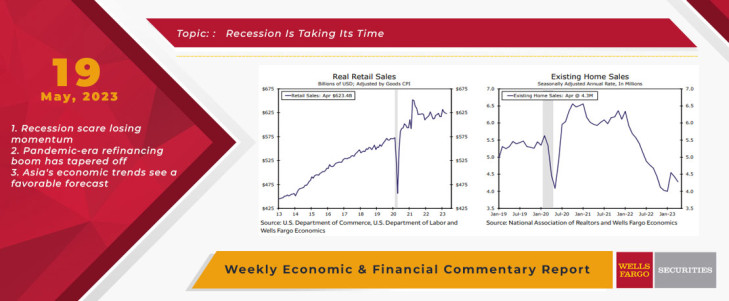

For starters, consumers continue to spend. Retail sales rose 0.4% in April, and the control group measure, which excludes volatile categories, posted its second-largest gain in seven months. This measure feeds directly into the BEA's calculation of PCE in the GDP accounts and suggests consumer spending started the quarter on the right foot. But details were a bit mixed under the hood with only seven of the 13 retailer categories reporting a rise in April sales. Auto sales surprised to the downside, as previously released data on wholesale auto sales suggested a surge in April sales. As the following chart shows, in adjusting sales for inflation, the trend in sales has broadly moved sideways in recent months.

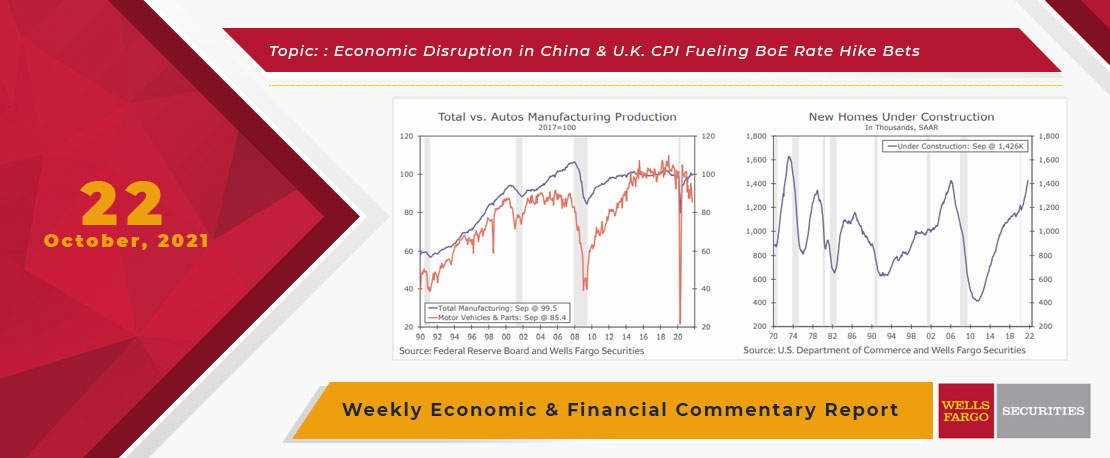

Like retail, auto sales played a role in manufacturing activity as well. Motor vehicle and parts production surged more in April alone than it did over the course of the past 12 months. Autos accounted for more than half of the 1% gain in April manufacturing. Excluding autos, manufacturing still rose by the most in four months and helped lift industrial production (IP). But after factoring in downward revisions to the prior two months, the level of IP was more or less in line with what was expected, which is to say essentially flat. IP is now roughly consistent with where it stood six months ago, signaling some stabilization in production after a weak start to the year.

Housing data also demonstrate some recent stabilization. Builder sentiment reached a 10-month high in May, according to the NAHB index, as buyer demand recovers and incentives are reigned in. Increased confidence is translating to activity. Total housing starts rose 2.2% to a 1.4 million-unit pace in April, with both single-family and multifamily starts advancing at a solid pace. Single-family construction now appears to be on the rebound, driven largely by a jump in construction in the West. Permits also notched a solid gain for single-family structures, though multifamily permits notched their second-straight decline and are on the slowest pace since July 2021. The pullback in multifamily permits comes as the apartment market begins to cool with a flood of new supply set to be delivered.

Existing home sales dipped 3.4% to a seasonally adjusted pace of 4.28 million in April, dropping for the second month in a row (chart). Low inventory and high mortgage rates continue to constrain the resale market. The drop in resales was broad-based as single-family homes, condos and co-ops all posted declines on the month. Existing sales weakened across nearly every region, with much of the weakness concentrated in the West. Despite the dip in the headline number, the sector may be stabilizing, as resales in April are now 7.0% above their recent low in January

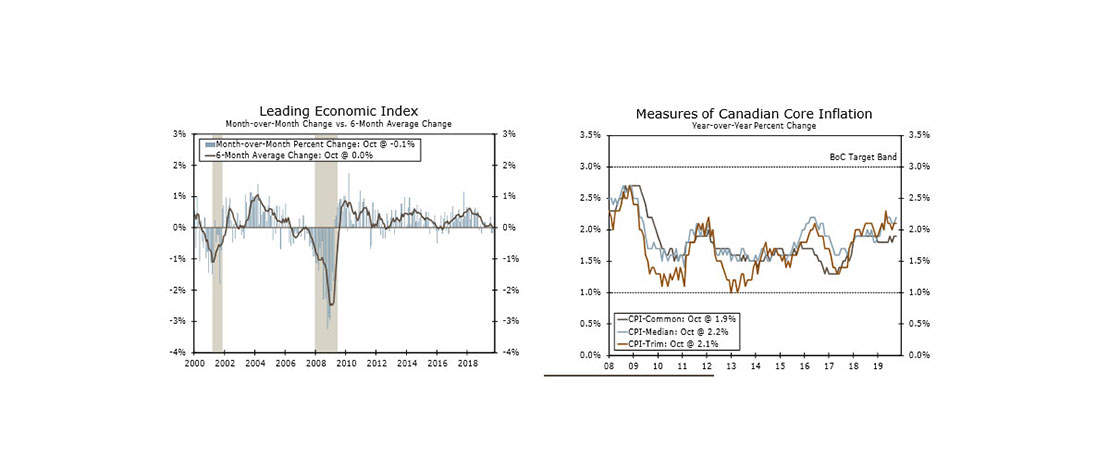

Meanwhile, despite incoming data demonstrating an underlying resilience in economic growth, the Leading Economic Index (LEI) continues to show clear signs of recession. April marks the 10th straight month in which the six-month average change in the Leading Economic Index has been below a key recession threshold. We ultimately still expect the U.S. economy to slip into a mild recession before year-end as tighter policy weighs on activity and firms' ability to hire.

This Week's State Of The Economy - What Is Ahead? - 17 September 2021

Wells Fargo Economics & Financial Report / Sep 23, 2021

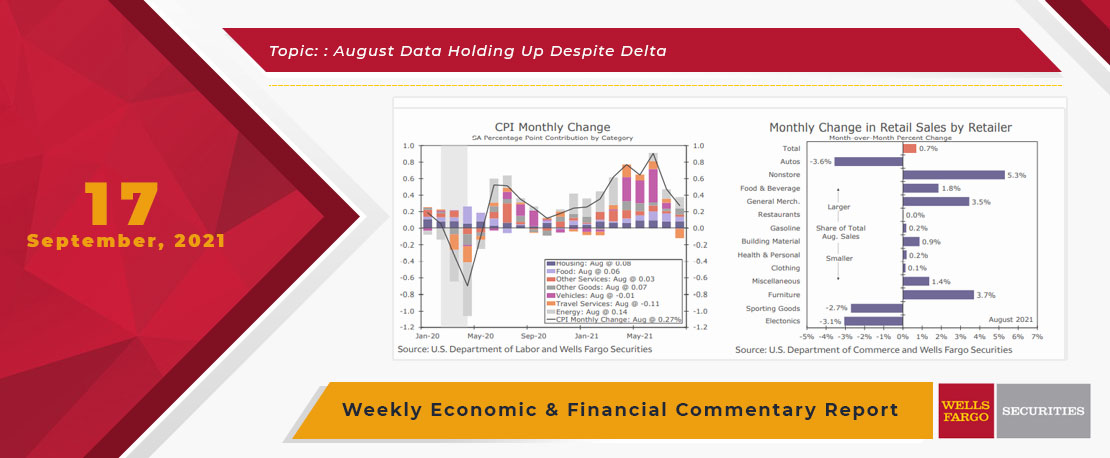

While we were picking up tree limbs from the yard, data released this week generally showed a stronger economy in August than many expected in the wake of surging COVID cases.

This Week's State Of The Economy - What Is Ahead? - 08 November 2019

Wells Fargo Economics & Financial Report / Nov 09, 2019

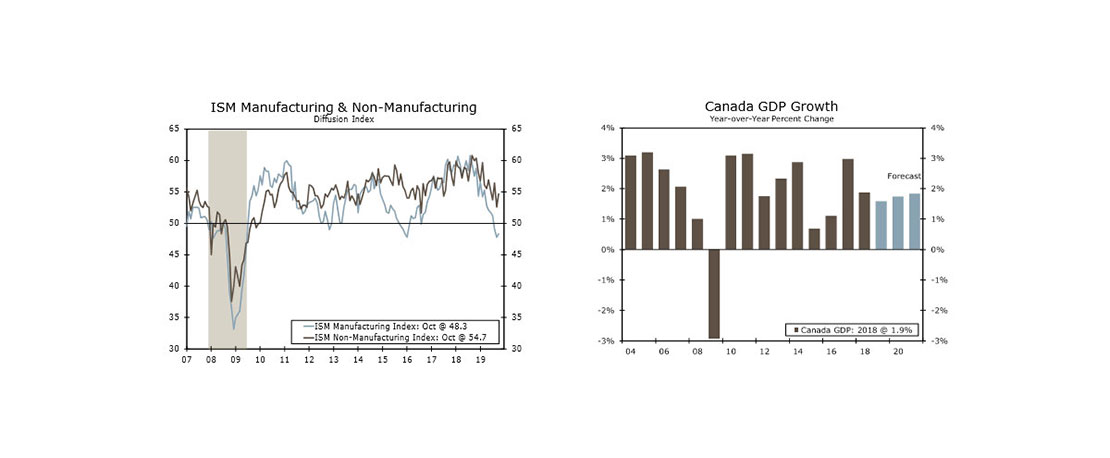

Optimism soared this week on hopes of a forthcoming trade deal, as equity markets hit all-time highs and the yield curve steepened.

This Week's State Of The Economy - What Is Ahead? - 20 October 2023

Wells Fargo Economics & Financial Report / Oct 27, 2023

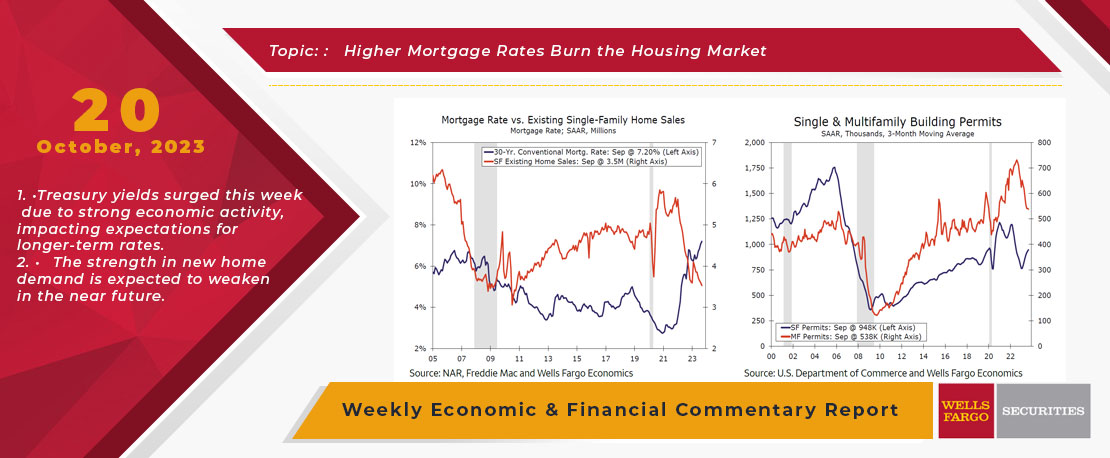

Treasury yields surged this week due to strong economic activity, impacting expectations for longer-term rates. New home sales led to a rise in single-family permits, but spiking mortgage rates are testing builder affordability strategies.

This Week's State Of The Economy - What Is Ahead? - 22 October 2021

Wells Fargo Economics & Financial Report / Oct 25, 2021

Restrictions from a renewed COVID outbreak in China, regulatory changes weighing on local financial markets and a potential collapse of Evergrande have all contributed to a slowdown in Chinese economic activity.

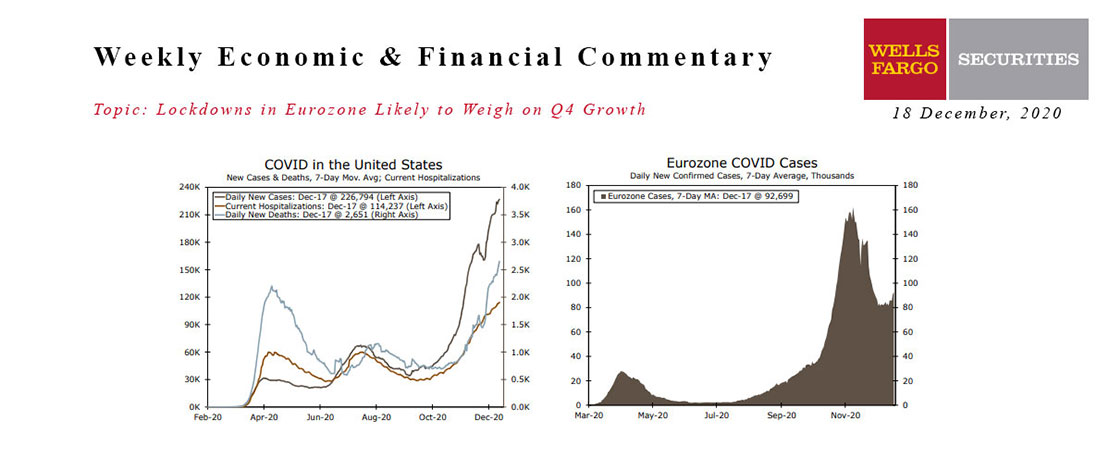

This Week's State Of The Economy - What Is Ahead? - 18 December 2020

Wells Fargo Economics & Financial Report / Dec 21, 2020

This week marked the first U.S. COVID vaccinations and the imminent rollout of a second vaccine.

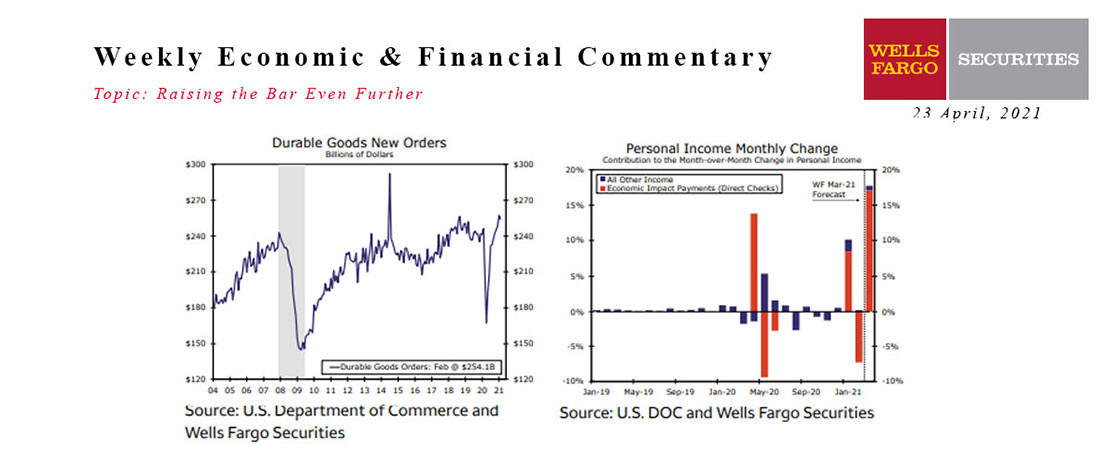

This Week's State Of The Economy - What Is Ahead? - 23 April 2021

Wells Fargo Economics & Financial Report / Apr 26, 2021

This week\'s lighter economic calendar allowed forecasters more time to assess the implications from the prior week\'s blowout retail sales report.

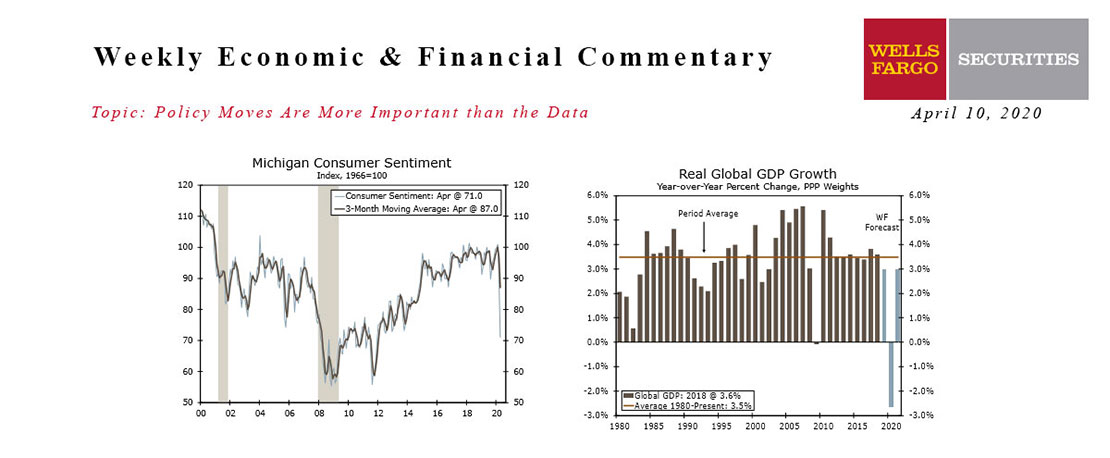

This Week's State Of The Economy - What Is Ahead? - 10 April 2020

Wells Fargo Economics & Financial Report / Apr 11, 2020

The Federal Reserve greatly expanded the collateral that it is willing to buy, further easing pressures in financial markets.

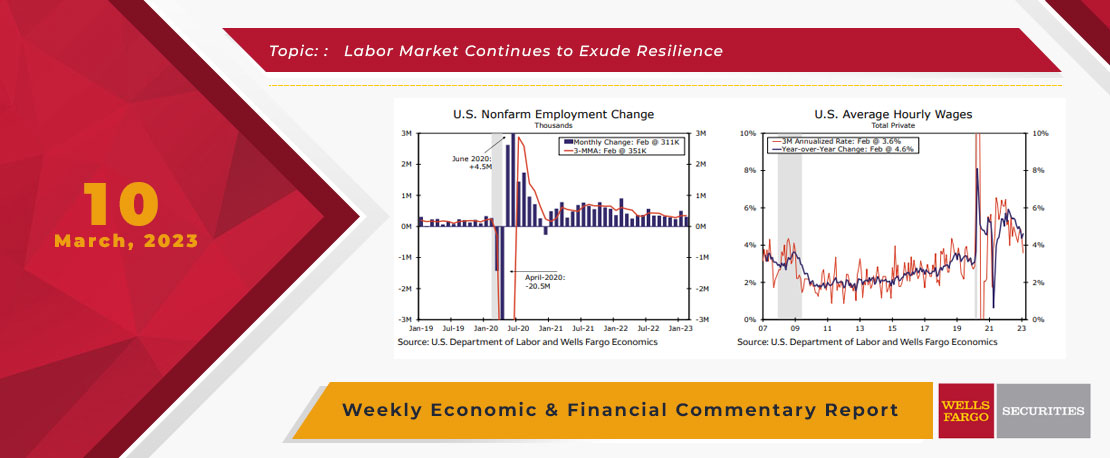

This Week's State Of The Economy - What Is Ahead? - 10 March 2023

Wells Fargo Economics & Financial Report / Mar 14, 2023

Financial markets were looking for validation that January\'s unexpected strength was not a fluke and that the downward slide in economic momentum experienced late last year had stabilized.

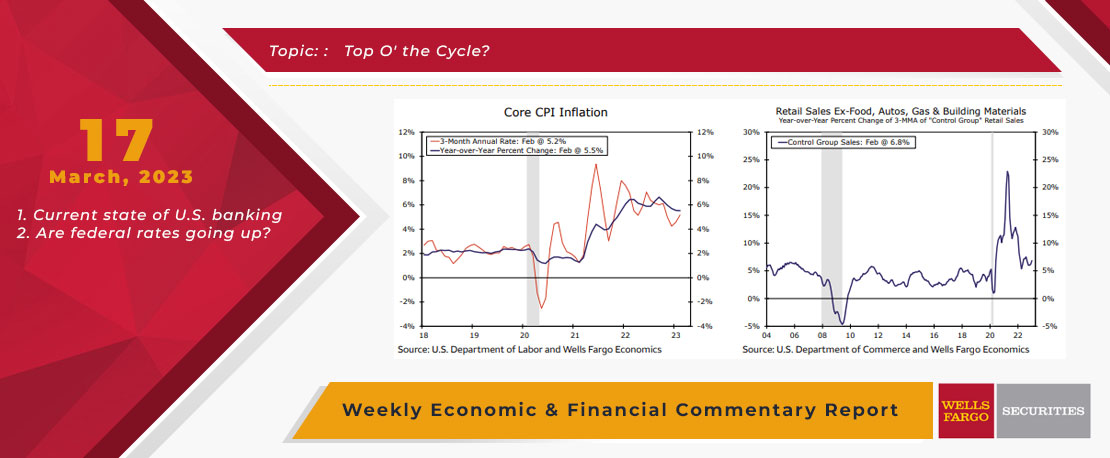

This Week's State Of The Economy - What Is Ahead? - 17 March 2023

Wells Fargo Economics & Financial Report / Mar 21, 2023

Retail sales declined 0.4% during February, while industrial production was flat (0.0%). Housing starts and permits jumped 9.8% and 13.8%, respectively.

This Week's State Of The Economy - What Is Ahead? - 22 November 2019

Wells Fargo Economics & Financial Report / Nov 23, 2019

Minutes from the October FOMC meeting indicated the Fed is content to remain on the sidelines for the rest of this year as the looser financial conditions resulting from rate cuts at three consecutive meetings feed through to the economy.