Financial system instability overshadowed a week replete with economic data. U.S. policymakers’ swift reaction to the collapse of several regional banks initially calmed concerns of rising stress in the banking sector. However, a plunge in share prices of a global systemically important bank toward the end of the week shows that contagion fears remain highly elevated. For more insight on the state of the banking sector, please see the Topic of the Week. Recent events have led us to make a few adjustments to our monthly U.S. Economic Outlook, which we published on March 17.

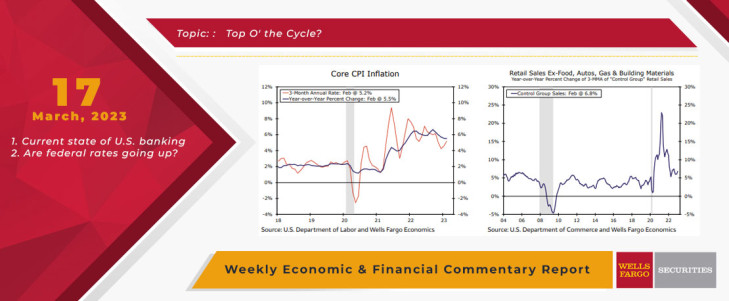

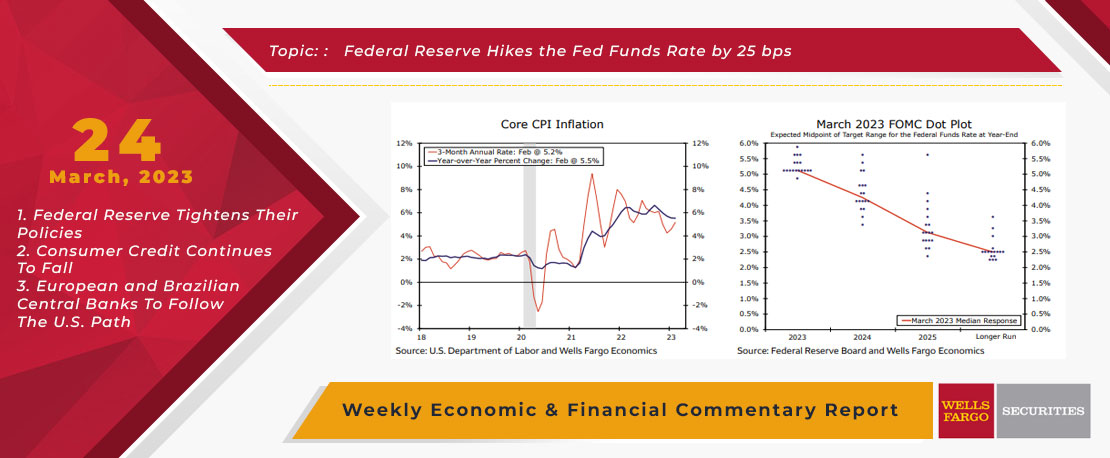

Financial system strain presents the latest challenge for the Federal Reserve, which is still in the trenches in the battle against inflation. The Consumer Price Index (CPI) has been moderating on trend over the past several months. Additional signs of meaningful cooling were absent in February's CPI print, however. The headline CPI rose 0.4% during the month, just slightly slower than the 0.5% monthly rate registered in January. The increase in the headline index was in line with market expectations, but the monthly change in the core index, which excludes more volatile food and energy prices, was a bit hotter than anticipated. The core CPI increased 0.5% during the month and is now running at a 5.2% three-month annualized rate, well above the FOMC’s 2% inflation target.

On the other hand, producer prices declined during the same period, with an unexpected 0.1% fall in the Producer Price Index (PPI) during February. On a year-over-year basis, the headline final demand PPI moderated to 4.6%, down from 5.7% the month prior. Overall, the easing in the PPI is an encouraging sign that underlying inflation pressures are not intensifying. That noted, the stickiness in consumer price inflation indicates that the path back to the Fed's target is likely to be long and winding.

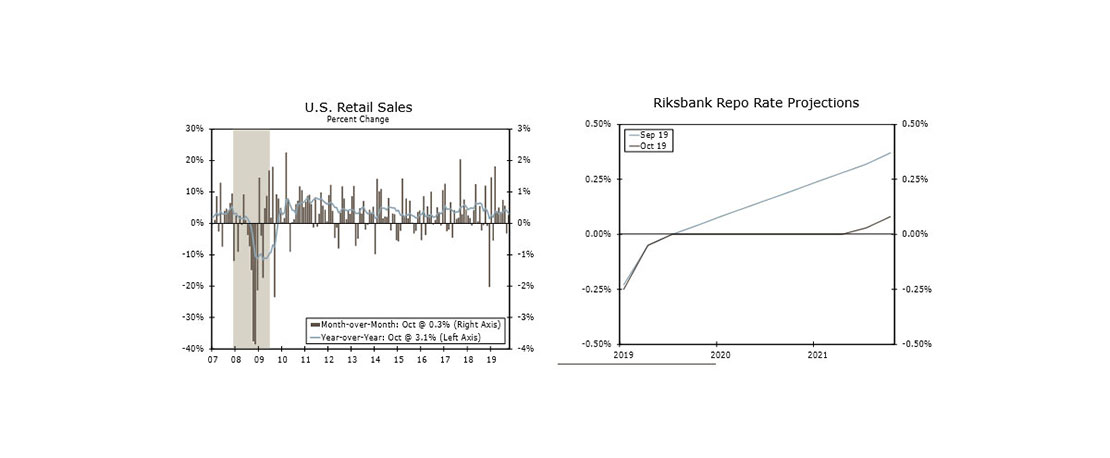

On balance, the rest of the economic data released this week demonstrated that the U.S. economy remains on a positive trajectory. Retail sales pulled back 0.4% in February. The drop was not a surprise, however. Sales rose a robust 3.2% in January and some payback was expected in February. Furthermore, control group retail sales rose 0.5% during the month. Control group sales are an input to personal consumption expenditures, a major subcomponent of GDP. All told, the solid gain in control group sales, as well as upward revisions to prior months' sales, paints a positive picture for real GDP growth in the first quarter of 2023.

An uptick in manufacturing production is another sign that economic growth is still holding its head above water. Total industrial production was essentially unchanged in February. Similar to retail sales, however, estimates for production during January were revised higher. Digging deeper, February's flat reading occurred as mining production fell 0.6%, utilities production rose 0.5% and manufacturing production edged up 0.1%. All that being said, February's report shows that, while still expanding, factory output is moderating alongside rising interest rates and slowing demand for goods.

Housing production is another area that has been hit hard by higher interest rates. Total housing starts jumped 9.8% to a 1.450 million-unit annual pace in February. The monthly gain in total starts was mainly owed to a surge in multifamily construction, however. Single-family starts inched up during the month but are still running almost 32% below the prior year's pace. Still, single-family permits rose for the first time in 12 months during February. The gain follows a recent improvement in the NAHB Housing Market Index, which increased for the third straight month during March. In addition to finding success with incentive programs, builder optimism has been boosted by sidelined buyers starting to return. Through March 10, mortgage applications for purchase have risen for two consecutive weeks, ending the declines seen throughout February. The turnaround in mortgage applications and jump in housing construction adds to the evidence that residential activity is starting to stabilize as buyers become more accustomed to a higher rate environment.

One economic indicator that has not improved this year is the Leading Economic Index (LEI). The LEI fell 0.3% during February, the 11th-straight drop. As we have often noted, the trend decline in the LEI is a clear warning sign that the economy is nearing an inflection point. One of the subcomponents of the LEI that has been a recent drag on the top-line index is consumer expectations, which appear to be dimming. The preliminary reading for consumer sentiment, as measured by the University of Michigan, fell to 63.4 in March from 67 the month prior. While both short- and long-term inflation expectations eased in the survey, sentiment surrounding current and future conditions declined. Overall, the economic data published this week show that the economy remains on a positive path, for now. Unfortunately, the current banking crisis will likely lead to even tighter credit conditions which lends credence to our view that the U.S. economy is headed for a recession in the second half of 2023.

This Week's State Of The Economy - What Is Ahead? - 07 June 2024

Wells Fargo Economics & Financial Report / Jun 11, 2024

The U.S. labor market continues to defy expectations. Employers added 272K net new jobs in May, which was stronger than even the most bullish forecaster among 77 submissions to the Bloomberg survey.

This Week's State Of The Economy - What Is Ahead? - 05 August 2022

Wells Fargo Economics & Financial Report / Aug 08, 2022

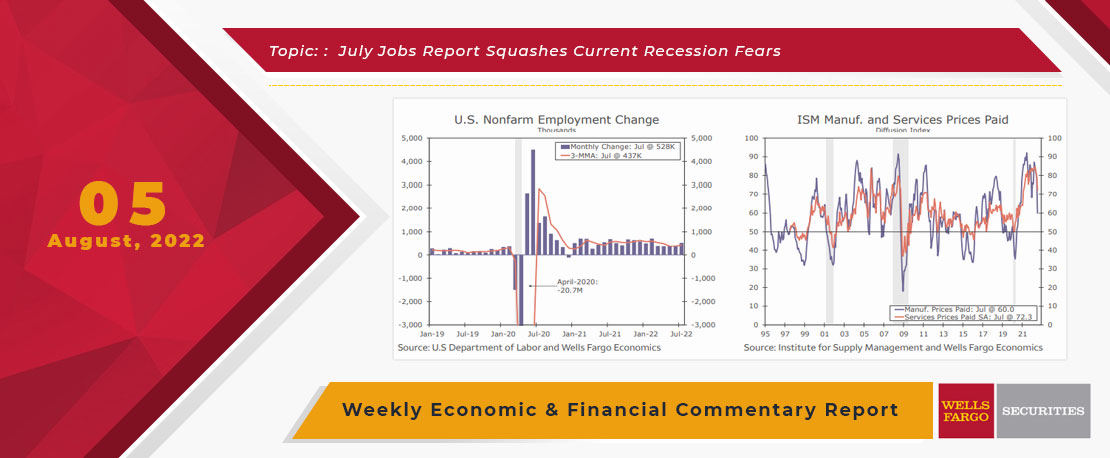

The Bureau of Labor Statistics reported this morning that nonfarm payrolls increased 528,000 for the month of July, easily topping estimates, lowering the unemployment rate to 3.5%.

This Week's State Of The Economy - What Is Ahead? - 01 July 2022

Wells Fargo Economics & Financial Report / Jul 14, 2022

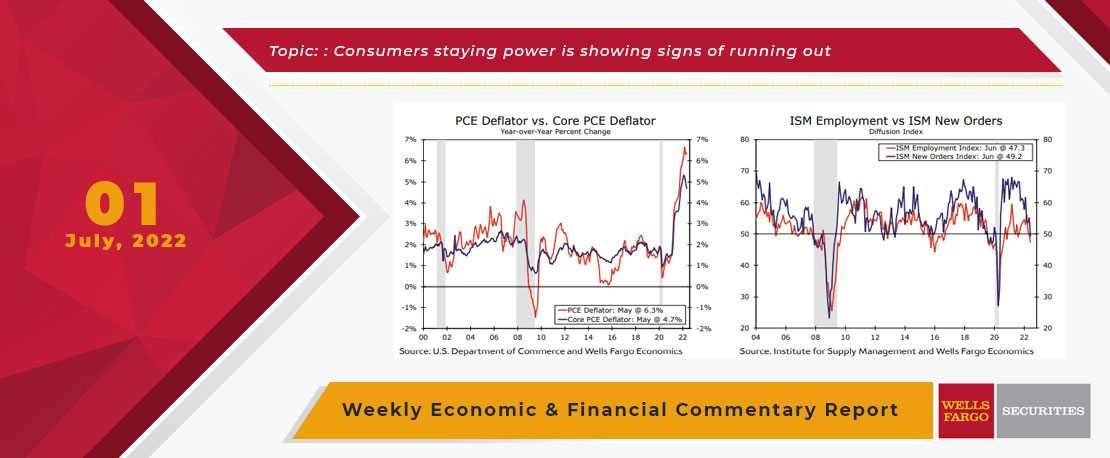

As with the Mets and Yankees when they ran into the Astros over the last couple days, consumers staying power is showing signs of running out as inflation persists and confidence moves sharply lower.

This Week's State Of The Economy - What Is Ahead? - 23 April 2021

Wells Fargo Economics & Financial Report / Apr 26, 2021

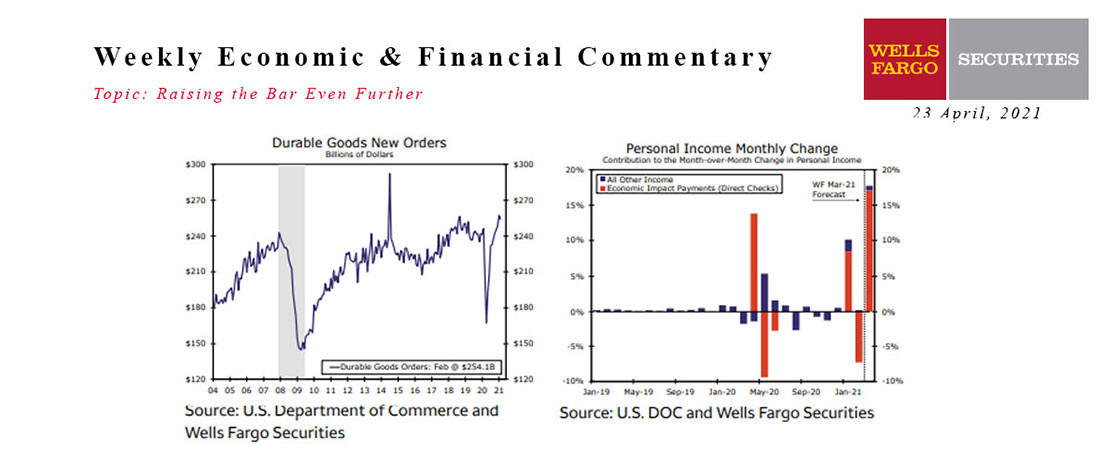

This week\'s lighter economic calendar allowed forecasters more time to assess the implications from the prior week\'s blowout retail sales report.

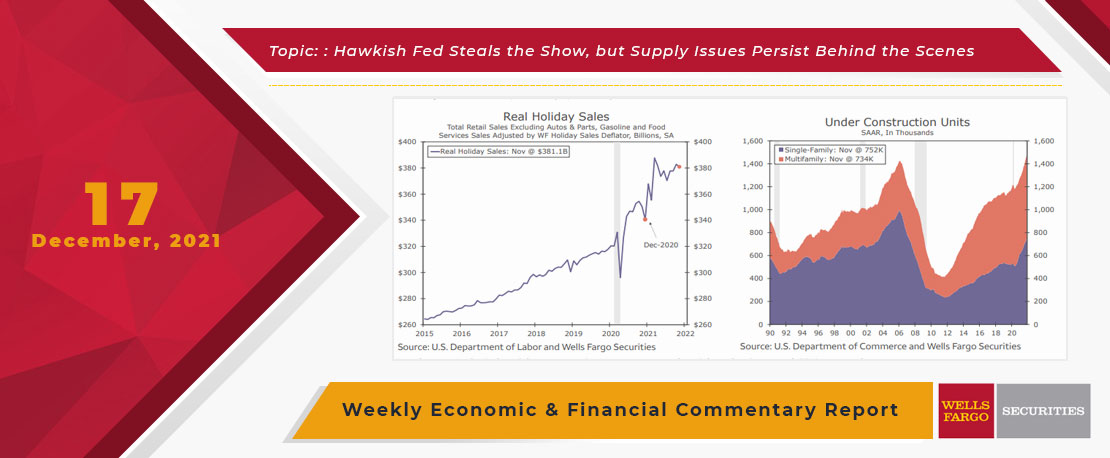

This Week's State Of The Economy - What Is Ahead? - 17 December 2021

Wells Fargo Economics & Financial Report / Dec 21, 2021

7 Interest Rate Watch for more detail. In other news, retail sales data disappointed as higher prices factor into spending and industrial activity continued to recover but remains beset by supply issues.

This Week's State Of The Economy - What Is Ahead? - 24 March 2023

Wells Fargo Economics & Financial Report / Mar 29, 2023

The FOMC hiked the federal funds rate by 25 bps on Wednesday amid continued strength in the labor market and elevated inflation.

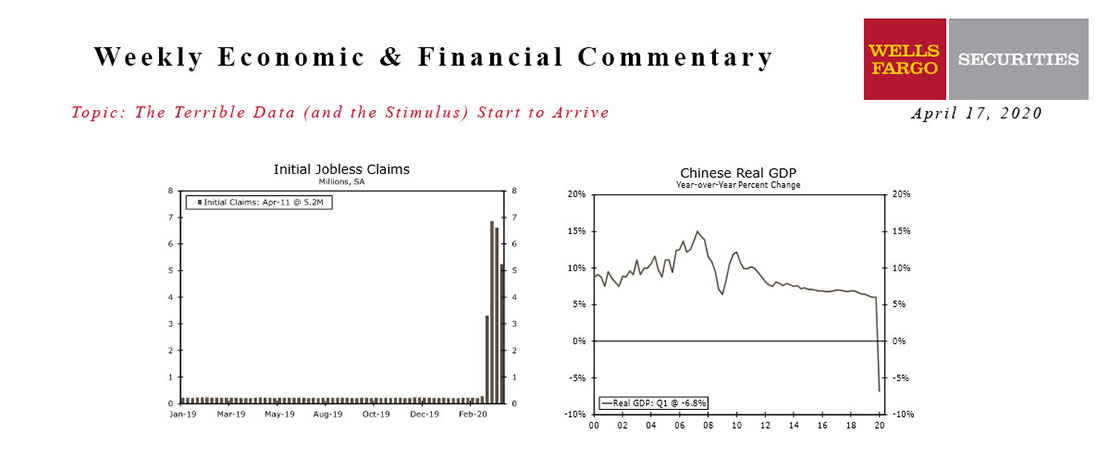

This Week's State Of The Economy - What Is Ahead? - 17 April 2020

Wells Fargo Economics & Financial Report / Apr 18, 2020

Economic data from the early stages of the Great Shutdown have finally arrived, and they are as bad as feared. ‘Worst on record’ is about to become an all too common refrain in our commentary.

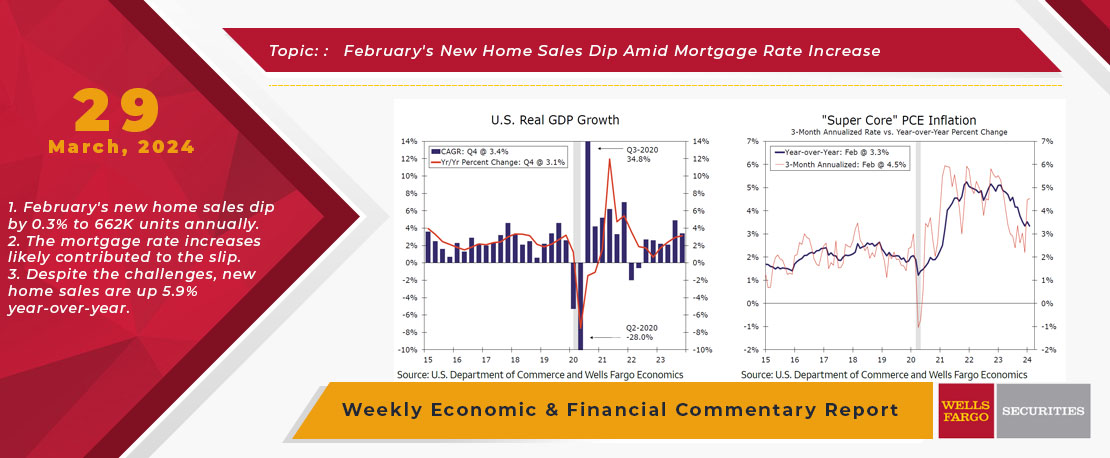

This Week's State Of The Economy - What Is Ahead? - 29 March 2024

Wells Fargo Economics & Financial Report / Apr 03, 2024

Consumer momentum remains largely intact, inflation continues to inch back down, albeit at a slower pace, and rate-sensitive sectors stayed in a holding pattern.

This Week's State Of The Economy - What Is Ahead? - 04 September 2020

Wells Fargo Economics & Financial Report / Aug 29, 2020

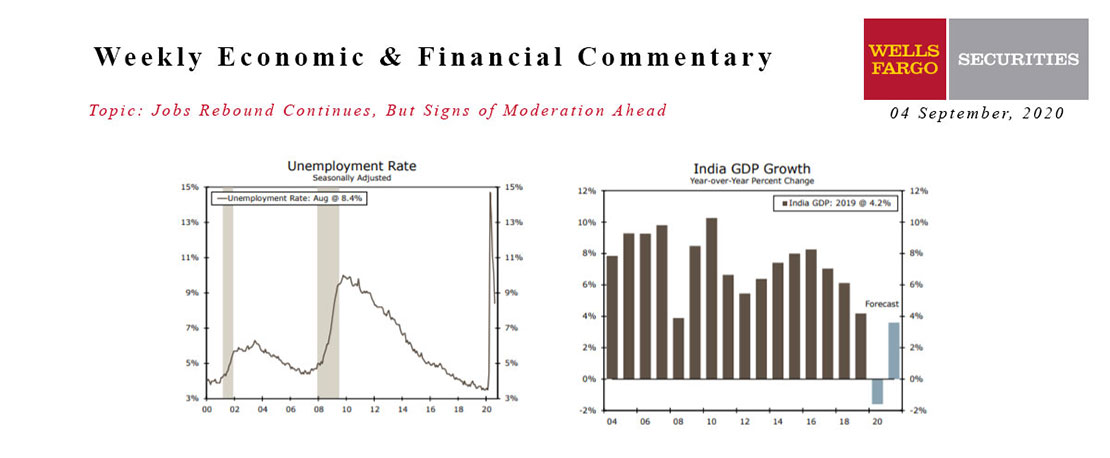

Employers added jobs for the fourth consecutive month in August, bringing the total number of jobs recovered from the virus-related low to 10.5 million.

This Week's State Of The Economy - What Is Ahead? - 15 November 2019

Wells Fargo Economics & Financial Report / Nov 16, 2019

Retail sales beat expectations and rose 0.3% in October, reflecting the ongoing strength of the consumer. Control group sales, a major input to GDP, also increased 0.3%.