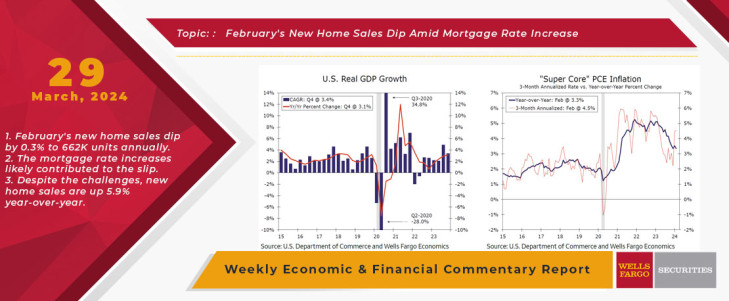

This week's economic data largely reinforced existing economic growth patterns. Consumer momentum remains largely intact, inflation continues to inch back down, albeit at a slower pace, and rate-sensitive sectors stayed in a holding pattern. Perhaps most encouraging were signs that the economy entered 2024 on stronger footing than initially observed. The Commerce Department released the latest revisions to Q4 GDP, bringing up growth to a 3.4% annualized rate from the previous 3.2% estimate (chart). Among the revisions, nonresidential spending growth jumped to 3.7% from 2.4% on upward revisions to private nonresidential construction outlays. Booming manufacturing construction has propelled structures investment, a trend we highlight in a recent special report. Government outlays were also revised higher, but the leg-up in consumer spending, specifically services outlays, was the primary driver of the upward revision to GDP. Although sustained consumer spending in the sector is on its face an encouraging sign for growth, it may be preventing a sustained cooling in services prices.

Illustrative of this point, the February personal income & spending report painted a picture of a defiant consumer that continues to splurge on services. Nominal spending rose 0.8%, the largest monthly gain in a year and a half, and once adjusted for inflation rose a still-sturdy 0.4%. But it was a 0.6% jump in real services outlays that stole the show. This was the largest jump in real services spending since the summer of 2021 when consumers were still flush with pandemic-era savings. The surge in services spending is another headache for policymakers. As long as consumers keep splashing out in the service sector, the businesses that provide these services have no incentive to ease up on pricing. To that end, the inflation rate for services less housing, or "super-core" inflation, came in at 3.3% year-over-year, but the three-month annualized rate of 4.5% points to near-term upward momentum (chart). Although the annual rate of the core PCE deflator, the Fed's preferred measure of inflation, came in at 2.8% year-over-year with a slightly smaller-than-expected monthly rise of 0.3% in February, services prices are no longer cooling as they were a few months ago.

All of that being said, a few potential roadblocks lay in the path of consumers. Income growth has moderated as of late, and household pessimism around future income growth is building, despite an improved view of the current jobs market. Personal income rose 0.3% over the month in February, but once adjusting for inflation and stripping out taxes paid, real disposable income slipped 0.1%. Waning income growth is weighing on consumer confidence, and we ultimately anticipate a slower pace of economic growth this year as households have become increasingly dependent on income to feed their spending habits.

The refreshed GDP report also shed light on economy-wide corporate profits. Pre-tax profits came in stronger than expected, rising 4.1% over the quarter on a non-annualized basis. In dollar terms, profits jumped by $105 billion, the largest quarterly gain since Q2-2022. Steady profit growth has afforded firms with the means to expand and hire, and while firms have generally reduced their capex demand, the strong end to 2023 suggests businesses entered 2024 on solid financial footing.

The February durable goods report provided some fresh manufacturing data as new orders rose 1.4% over the month. This was only a partial rebound from January’s weakness and is consistent with a manufacturing sector flying at stall speed. Core capital goods orders excluding defense and aircraft rose 0.7% following two monthly declines, but the current interest rate environment continues to weigh on capex demand. Although there are early signs of recovery in the production data, we don’t expect a sustained manufacturing recovery to take hold until the Fed begins to ease policy in the second half of the year.

High interest rates continue to keep a firm grip on the housing sector. February’s new home sales report was a dud as sales inched down 0.3% to a 662K-unit annualized pace. February’s slip was likely owed to an uptick in mortgage rates during the month. Additionally, the relative improvement in available existing homes also may have cut into new home sales during the month. That said, the growth trend for new home sales remains in place, with sales up 5.9% on a year-over-year basis. Abundant supply is also helping to dull price growth and attract buyers to the new home market; however, affordability remains a major constraint for homebuyers. Within the resale market, affordability issues have been further compounded by resurgent home price growth. The S&P CoreLogic Case-Shiller National Home Price Index (HPI) rose to 6.0% on a year-over-year basis in January, and the index is now about 1% above its previous peak set in June 2022. Despite the persistent rise in home prices, buyers appear to be re-entering the market amid incrementally improving supply. The NAR Pending Home Sales Index bounced back in February as contract signings rose 1.6% over the month. The move portends further improvement in existing home sales, which are already off to a strong start in 2024.

This Week's State Of The Economy - What Is Ahead? - 12 May 2023

Wells Fargo Economics & Financial Report / May 17, 2023

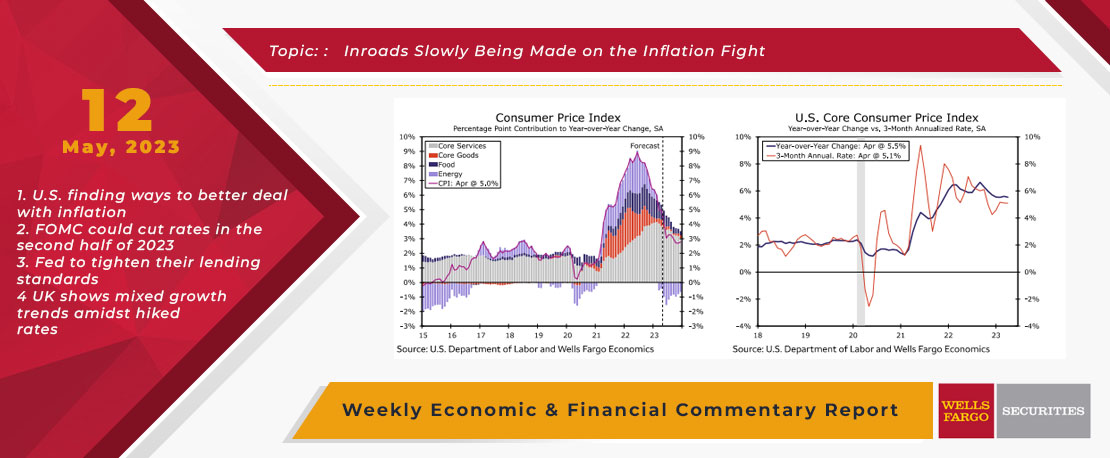

In April, the CPI rose 0.4% on both a headline and core basis, keeping the core running at a 5.1% three-month annualized rate. However, details pointed to price growth easing ahead.

This Week's State Of The Economy - What Is Ahead? - 16 April 2021

Wells Fargo Economics & Financial Report / Apr 17, 2021

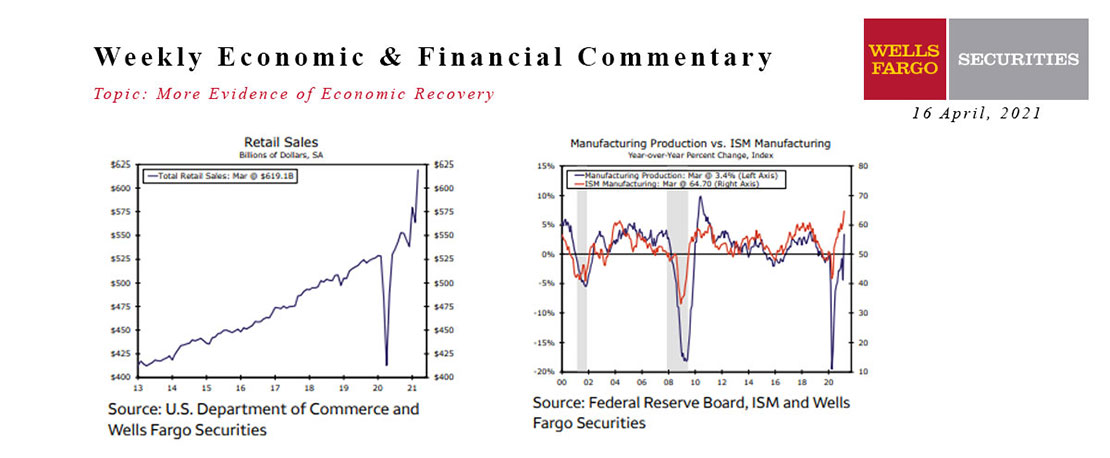

Data released this week continue to show that the economic recovery has gained momentum in March. The much anticipated consumer boom has arrived.

This Week's State Of The Economy - What Is Ahead? - 28 February 2020

Wells Fargo Economics & Financial Report / Feb 29, 2020

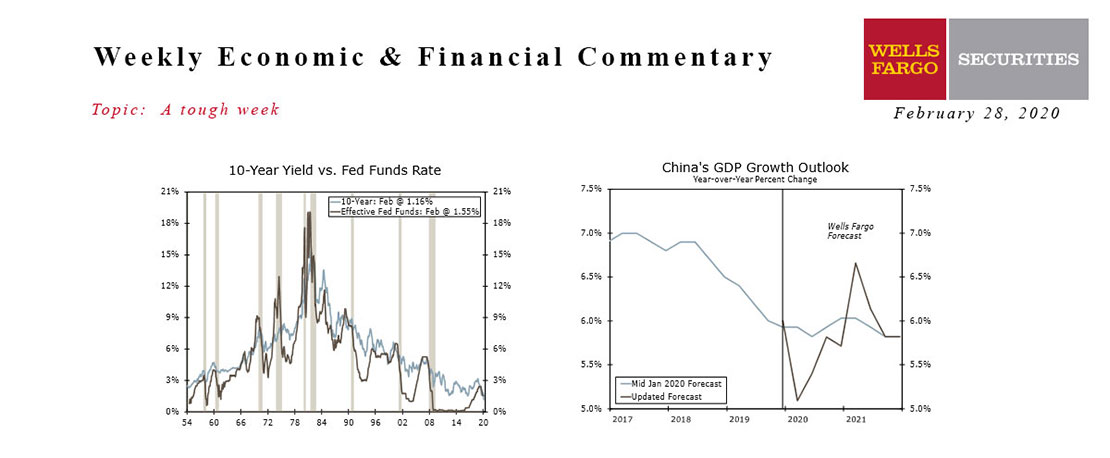

The COVID-19 coronavirus hammered financial markets this week and rapidly raised the perceived likelihood and magnitude of additional Fed accommodation.

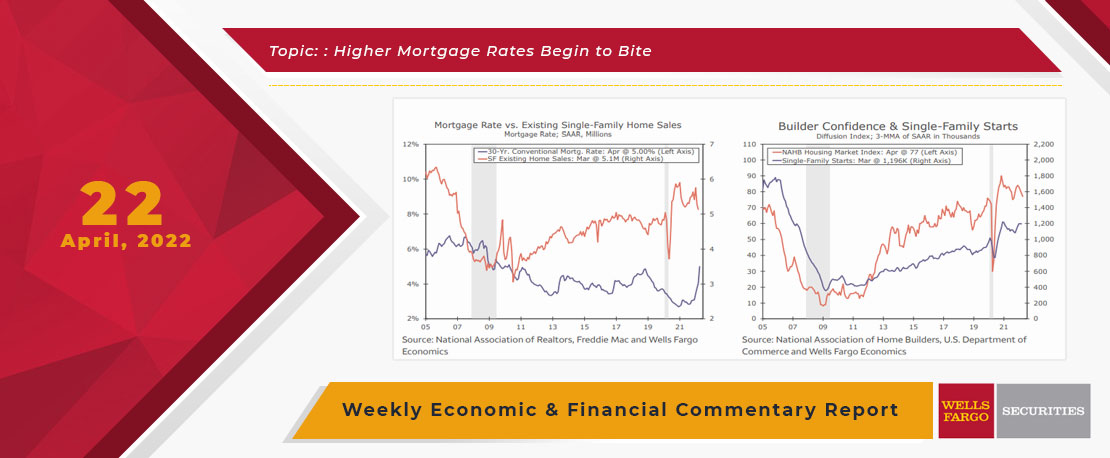

This Week's State Of The Economy - What Is Ahead? - 22 April 2022

Wells Fargo Economics & Financial Report / Apr 27, 2022

I’ll wish you a Happy Earth Day anyway. Don’t expect a card this year. While the Earth continues to thankfully revolve at a steady rate, rising mortgage rates appear to be slowing residential activity

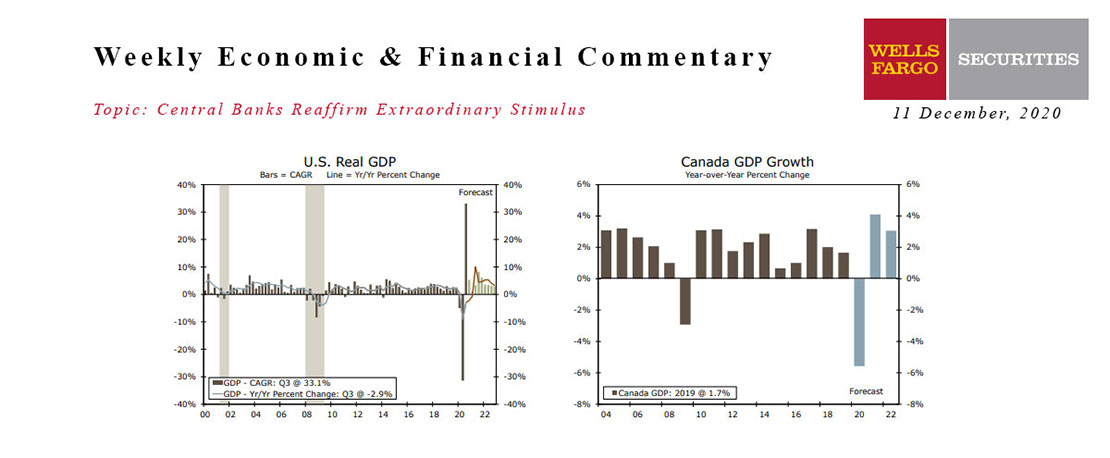

This Week's State Of The Economy - What Is Ahead? - 11 December 2020

Wells Fargo Economics & Financial Report / Dec 14, 2020

Emergency authorization of the Pfizer-BioNTech COVID vaccine appears imminent, but the virus is running rampant across the United States today, pointing to a grim winter.

Economic Uncertainty Seems Removed Going Into The New Year 2020

Wells Fargo Economics & Financial Report / Dec 28, 2019

The U.S. economy continues to expand, albeit at a moderate pace. The U.S. Bureau of Economic Analysis reports U.S. gross domestic product (GDP) grew 2.1 percent in Q3/19.

Where Will That $2 Trillion Come From Anyway?

Wells Fargo Economics & Financial Report / Apr 01, 2020

Net Treasury issuance is set to surge in the coming weeks and months. At present, we look for the federal budget deficit to be $2.4 trillion in FY 2020 and $1.7 trillion in FY 2021.

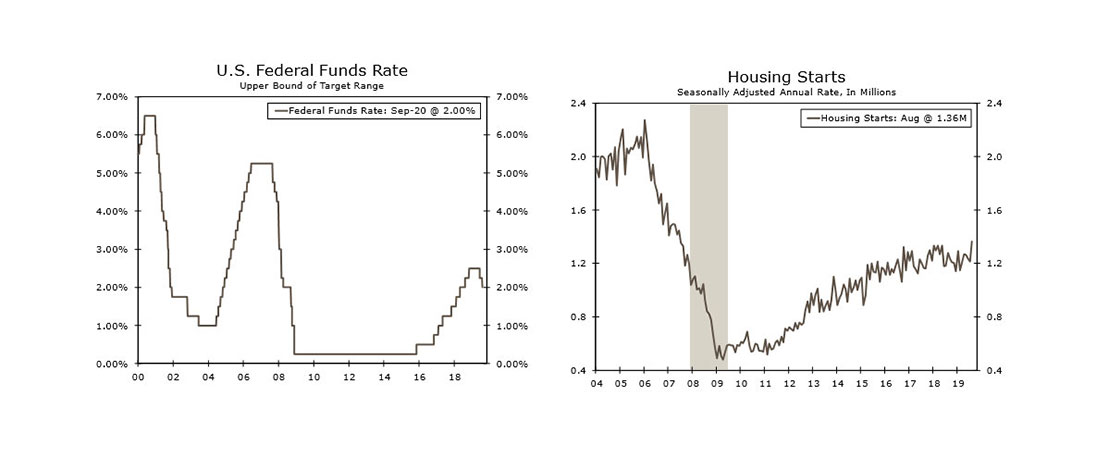

This Week's State Of The Economy - What Is Ahead? - 20 September 2019

Wells Fargo Economics & Financial Report / Sep 21, 2019

The Federal Reserve reduced the fed funds rate 25 bps this week, continuing to cite economic weakness overseas and muted inflation pressures.

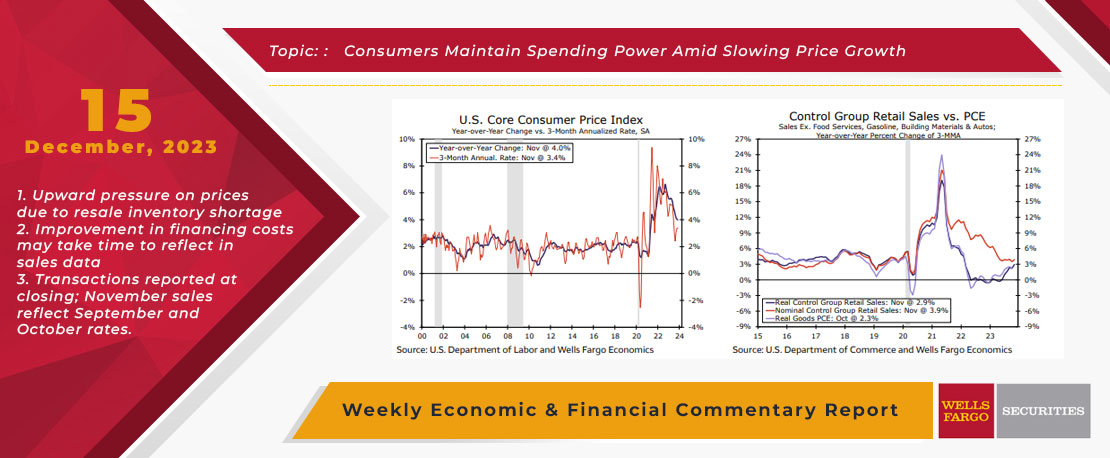

This Week's State Of The Economy - What Is Ahead? - 15 December 2023

Wells Fargo Economics & Financial Report / Dec 21, 2023

core CPI remained elevated in November at a 4.0% annual rate, a string of slower monthly prints suggests that disinflation has more room to run.

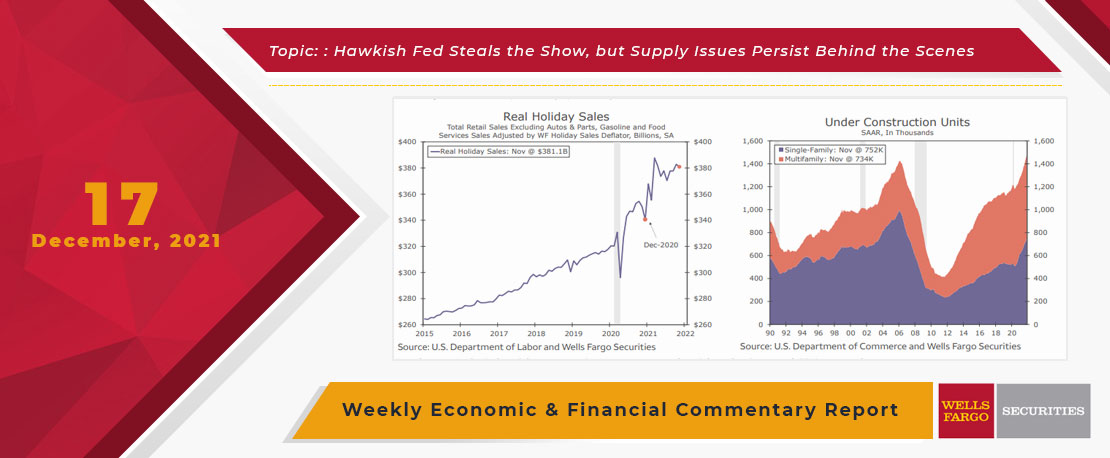

This Week's State Of The Economy - What Is Ahead? - 17 December 2021

Wells Fargo Economics & Financial Report / Dec 21, 2021

7 Interest Rate Watch for more detail. In other news, retail sales data disappointed as higher prices factor into spending and industrial activity continued to recover but remains beset by supply issues.