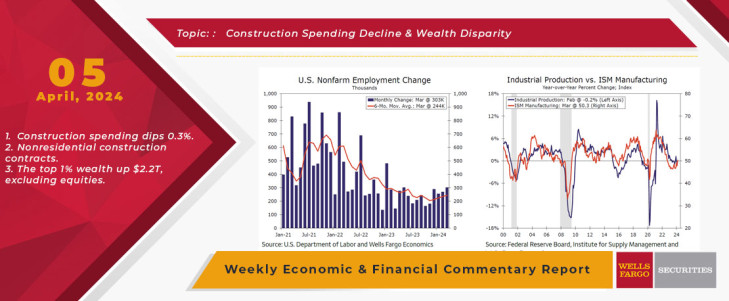

Another upside surprise in the books. Nonfarm payrolls expanded 303K in March, surpassing all estimates submitted to Bloomberg. Modest upward revisions to the prior two months of data sweeten the outturn and point to a labor market in full bloom.

Digging into the industry details, healthcare (+81K), government (+71K) and leisure & hospitality (+49K) saw solid additions. With this report, jobs in the leisure & hospitality sector finally surpassed their pre-pandemic level, which corroborated the increase in the employment component of the ISM services index in March. As the service sector continues to staff up to meet robust demand, service firms have little incentive to show restraint on pricing.

The household survey's separate measurement of employment also showed a robust gain of 498K in March, which far outstripped the 29K decline in the number of unemployed and led the labor force to expand by 469K. Consequently, the unemployment rate ticked down 0.1 percentage points to 3.8%. The labor force's improvement coincides with labor demand stabilizing at an elevated level and quits moving sideways at a low level. The greater pool of available workers amid cooled employee churn points to subsiding wage growth in the months ahead. Average hourly earnings picked up 0.3% in March, but slipped 0.2 percentage points on a year-over-year basis to 4.1%.

The continued strength in hiring suggests less urgency for policymakers at the Federal Reserve to lower the target range of the fed funds rate. Recent comments from FOMC members have homed in on the jobs market's underlying momentum as justification to wait and allow for more inflation data. The progress in goods disinflation attributable to the normalization in supply chains in the wake of the pandemic has largely run its course, implying softer demand, especially for services, will be needed to pull consumer price inflation down to the 2% target on a sustainable basis. Yet with continued tightness in the labor market supporting solid wage growth, demand is showing few signs of weakness.

Before the payroll report, markets had priced in a roughly 60% chance of the FOMC cutting its target range by 25 bps in June. That probability is sitting closer to 53% at the time of this writing. With expectations for the start of policy easing being pushed back later into the year, elevated borrowing costs will continue to weigh on interest-rate sensitive sectors of the economy. Construction spending slipped 0.3% in February, marking the second straight month of decline. Broad-based retrenchment in nonresidential construction outweighed the steady climb in single-family home building. We suspect investment in nonresidential structures will contract in the coming quarters as commercial construction project starts have slowed to a crawl amid tight credit conditions.

The factory sector also remains in the doldrums. In February, manufacturing production was down nearly half-a-percentage-point on a year-ago basis. Despite the contraction in output, the ISM manufacturing index unexpectedly broke into expansionary territory in March for the first time in 16 months. Improving expectations for new orders in the second half of the year helped lift overall sentiment. While it is encouraging to see the ISM back above 50, we remain cautious on the trajectory of industrial production until we have more clarity on the timing of monetary policy easing.

This Week's State Of The Economy - What Is Ahead? - 23 October 2020

Wells Fargo Economics & Financial Report / Oct 24, 2020

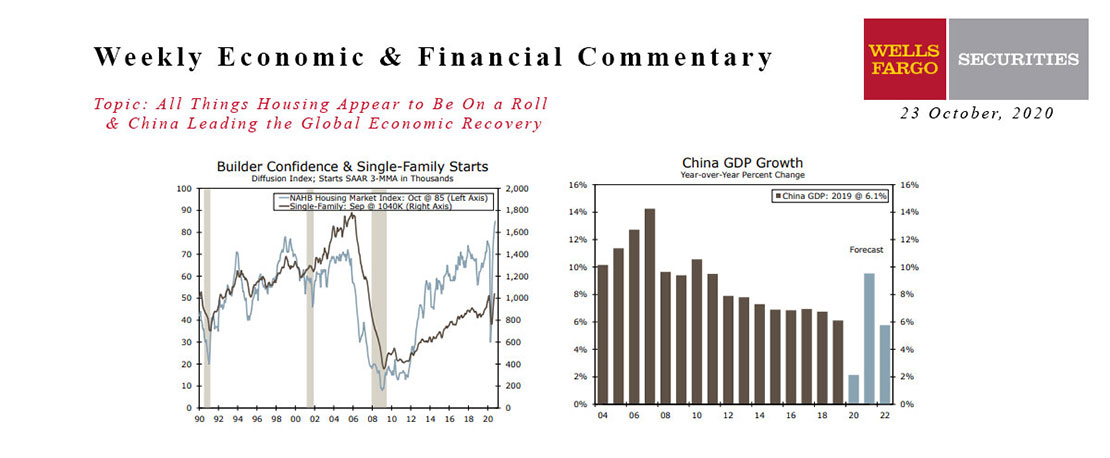

A recent strong report from the National Association of Homebuilders set the tone for another round of strong housing data. The NAHB index rose two points to a record high 85.

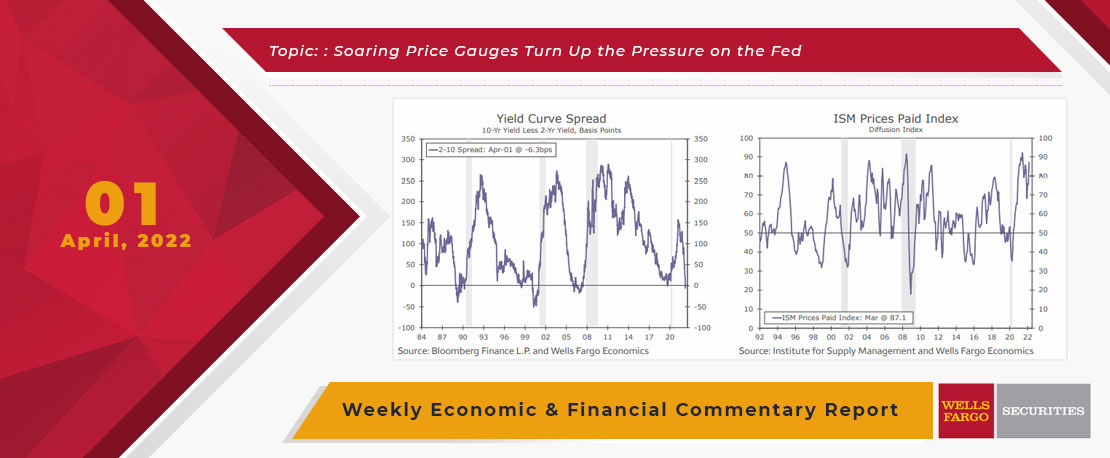

This Week's State Of The Economy - What Is Ahead? - 01 April 2022

Wells Fargo Economics & Financial Report / Apr 05, 2022

The key factor that will drive interest rates is the Fed’s belated effort to rein-in inflation.

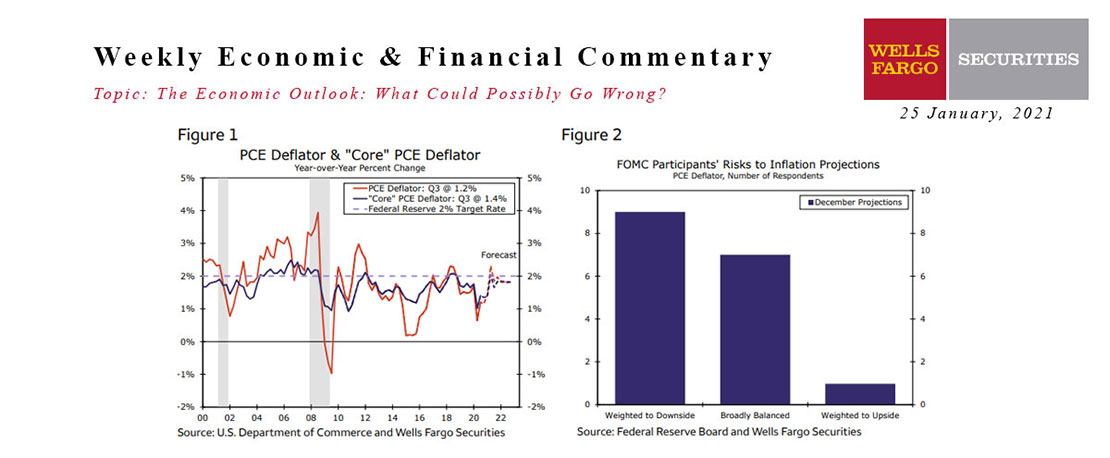

25 January 2021 Economic Outlook Report

Wells Fargo Economics & Financial Report / Jan 30, 2021

In the second installment of our series on economic risks in the foreseeable future, we analyze the potential for higher inflation in coming years stemming from excess demand.

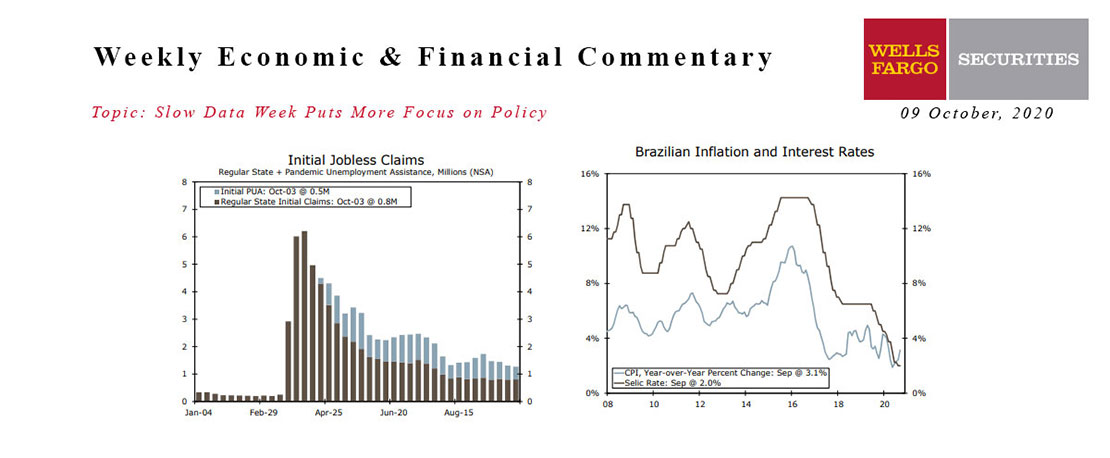

This Week's State Of The Economy - What Is Ahead? - 09 October 2020

Wells Fargo Economics & Financial Report / Oct 12, 2020

Weekly first time unemployment claims highlighted an extraordinarily slow week for economic news. Jobless claims fell slightly but continuing claims fell by one million.

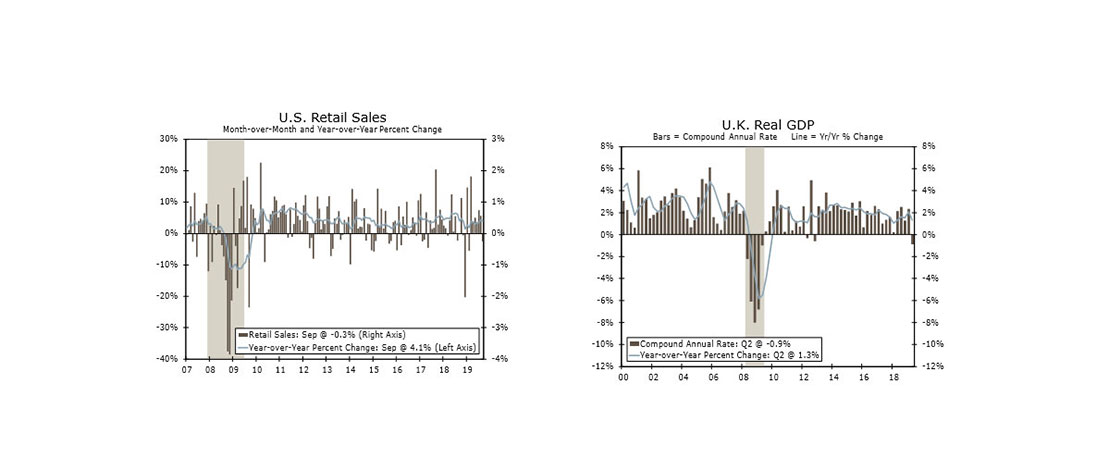

This Week's State Of The Economy - What Is Ahead? - 18 October 2019

Wells Fargo Economics & Financial Report / Oct 19, 2019

Personal consumption is still on track for a solid Q3, but retail sales declined in September for the first time in seven months.

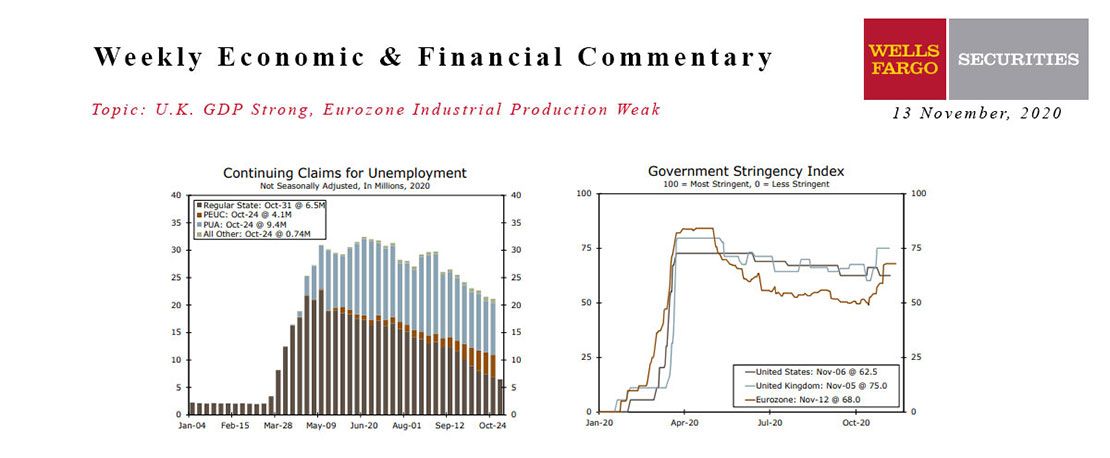

This Week's State Of The Economy - What Is Ahead? - 13 November 2020

Wells Fargo Economics & Financial Report / Nov 14, 2020

The combination of the election outcome and a workable vaccine boosted financial markets and set the background music for this week’s short list of indicators.

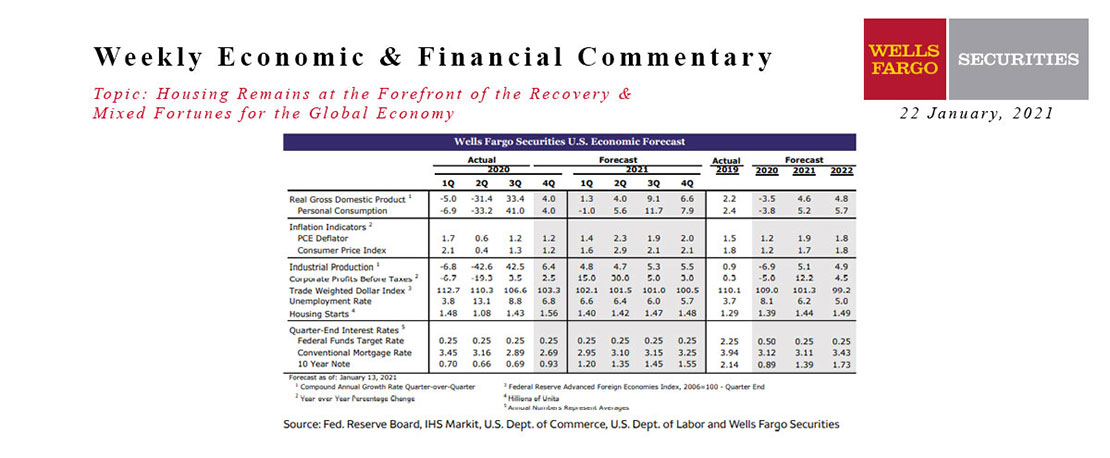

This Week's State Of The Economy - What Is Ahead? - 22 January 2021

Wells Fargo Economics & Financial Report / Jan 23, 2021

Housing starts jumped 5.8% during December. Single-family starts soared 12%, while multifamily starts dropped 13.6%.

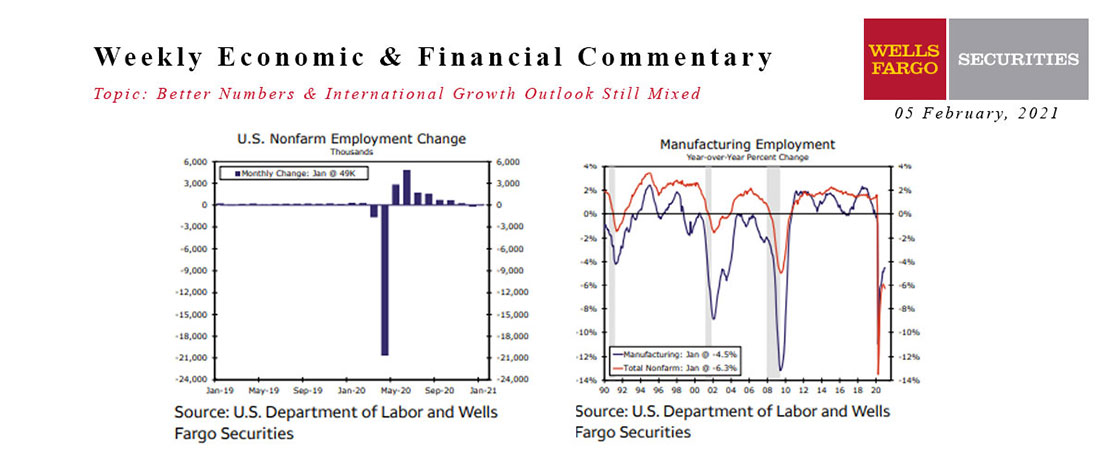

This Week's State Of The Economy - What Is Ahead? - 05 February 2021

Wells Fargo Economics & Financial Report / Feb 10, 2021

Nonfarm employment rebounded in January, with employers adding 49,000 jobs following the prior month\'s 227,000-job drop.

This Week's State Of The Economy - What Is Ahead? - 03 January 2020

Wells Fargo Economics & Financial Report / Jan 04, 2020

Markets were also pressured from the latest ISM manufacturing report, which signaled further deterioration in the sector with the index falling to its lowest level since 2009.

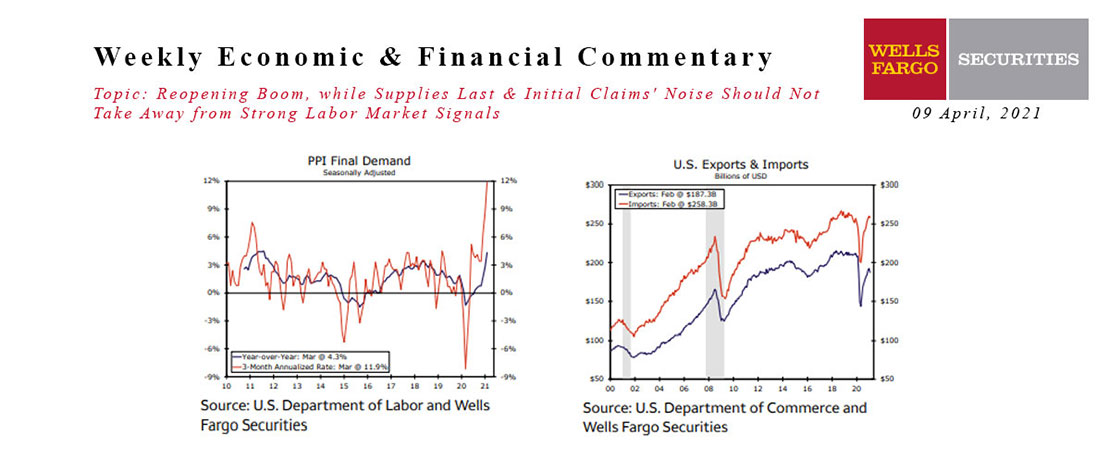

This Week's State Of The Economy - What Is Ahead? - 09 April 2021

Wells Fargo Economics & Financial Report / Apr 10, 2021

This week\'s economic data kicked of with a bang. The ISM Services Index jumped more than eight points to 63.7, signaling the fastest pace of expansion in the index\'s 24-year history.