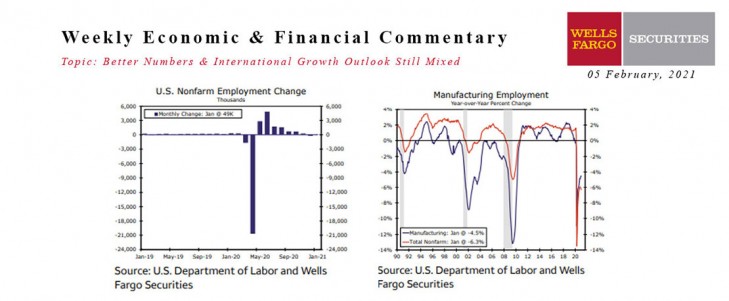

U.S. - Better Numbers

- Nonfarm employment rebounded in January, with employers adding 49,000 jobs following the prior month's 227,000-job drop. The annual revisions to the prior data provide a more accurate assessment of job losses during last spring's lockdown, as well as the subsequent recovery. Job losses in March and April of last year were 202,000 jobs larger and the recovery has been slightly stronger. The unemployment rate fell to 6.3%.

- Manufacturing, construction and logistics continue to lead the recovery, which looks more like an old-school variety rebound. While the ISM manufacturing index declined in January, it remains relatively high at 58.7 and the ISM services survey rose to that same level. Both are consistent with strong economic growth. Severe supply-chain disruptions are bolstering both surveys. Nonfarm productivity plummeted 4.8% during the fourth quarter and unit labor cost surged 6.8%. Labor costs are likely to put pressure on operating margins this year, even though there is still considerable slack in the labor market.

Global - International Growth Outlook Still Mixed

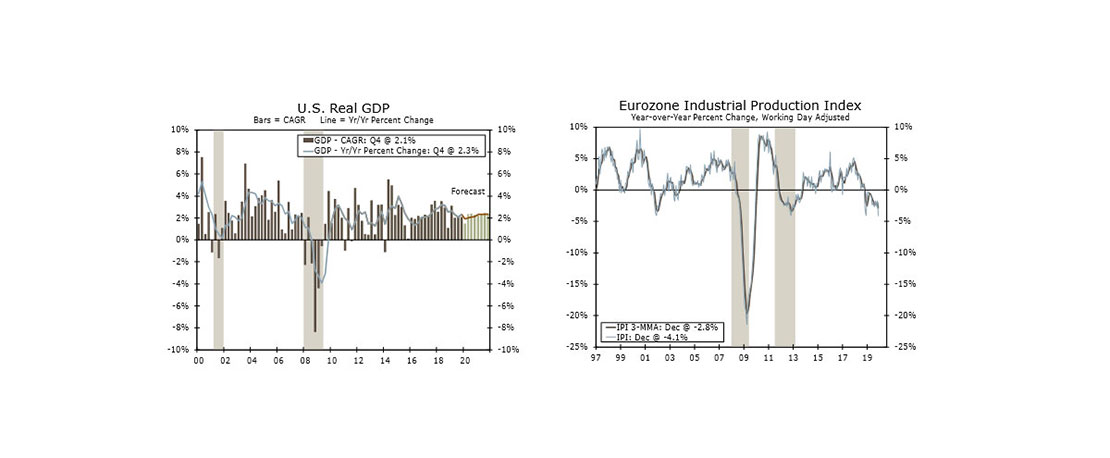

- PMI data in China indicate renewed restrictions in small provinces outside of Beijing are having a modest impact on the Chinese economy. China's economy is still outperforming, but prolonged lockdowns could introduce risks to the economy. Eurozone growth and inflation data beat expectations to the upside; however, these data should not be interpreted as the broader European economy recovering from COVID quite yet.

- The Reserve Bank of Australia's monetary policy meeting this week yielded an ultra-dovish response as the central bank opted to double the size of its asset purchase program. Prior to the meeting, we were optimistic regarding Australia's economic prospects, and with more bond buying to materialize, there are upside risks to our GDP forecasts.

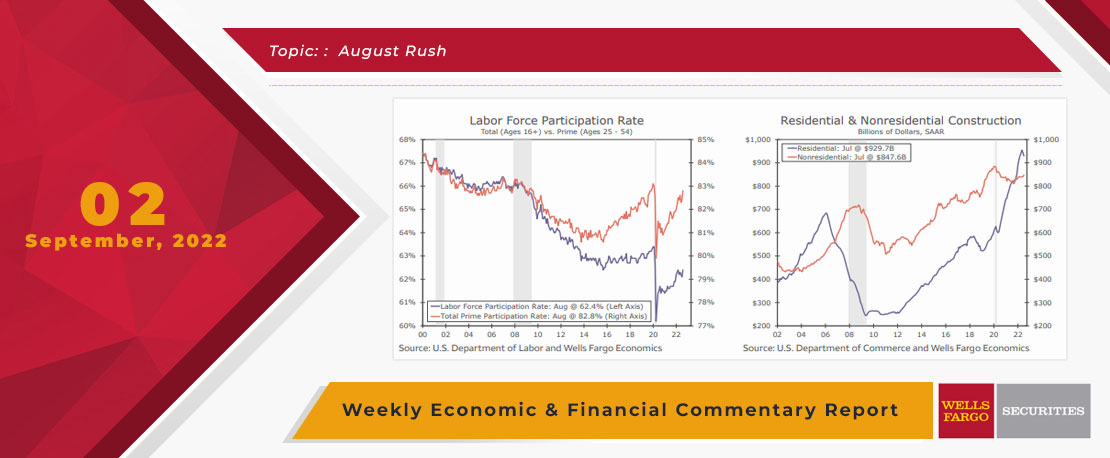

This Week's State Of The Economy - What Is Ahead? - 02 September 2022

Wells Fargo Economics & Financial Report / Sep 05, 2022

More job seekers also lifted the participation rate to 62.4% and thus easing some tightness in the job market even as payrolls expanded.

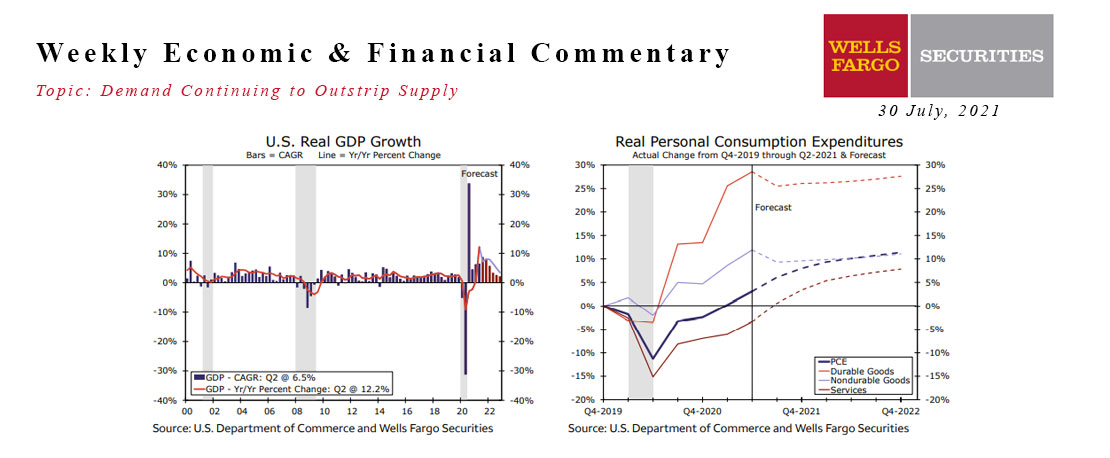

This Week's State Of The Economy - What Is Ahead? - 30 July 2021

Wells Fargo Economics & Financial Report / Aug 11, 2021

Despite a few misses on the headline numbers, economic data this week highlighted a theme of demand continuing to outstrip supply and ongoing slack in the labor market.

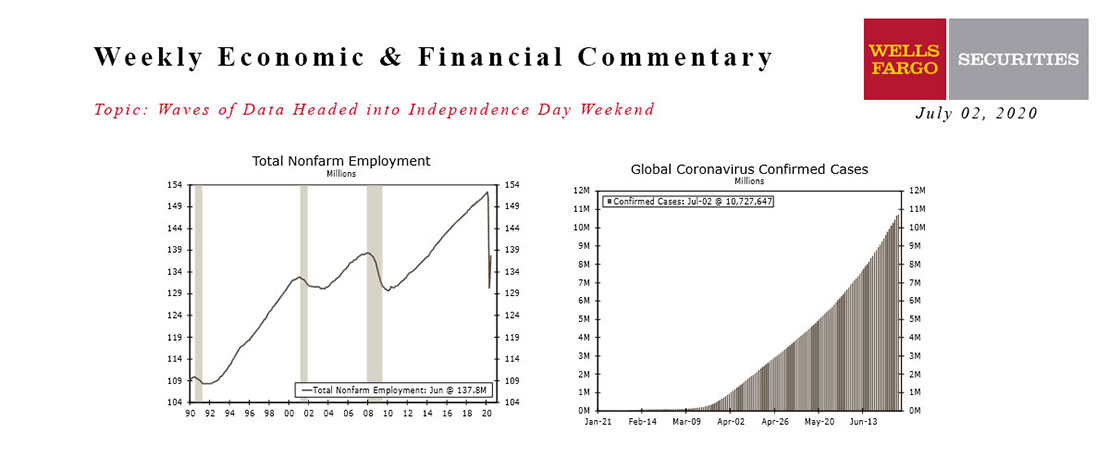

This Week's State Of The Economy - What Is Ahead? - 02 July 2020

Wells Fargo Economics & Financial Report / Jul 04, 2020

It was a mildly busy week for foreign economic data and events, while global COVID-19 cases continued to rise.

This Week's State Of The Economy - What Is Ahead? - 16 September 2022

Wells Fargo Economics & Financial Report / Sep 20, 2022

Financial markets reacted in a zig-zag pattern to this week\'s economic data ahead of the next FOMC meeting. Price pressure is still not showing the sustained slowdown the Fed needs before it takes its foot off the throttle of tighter policy.

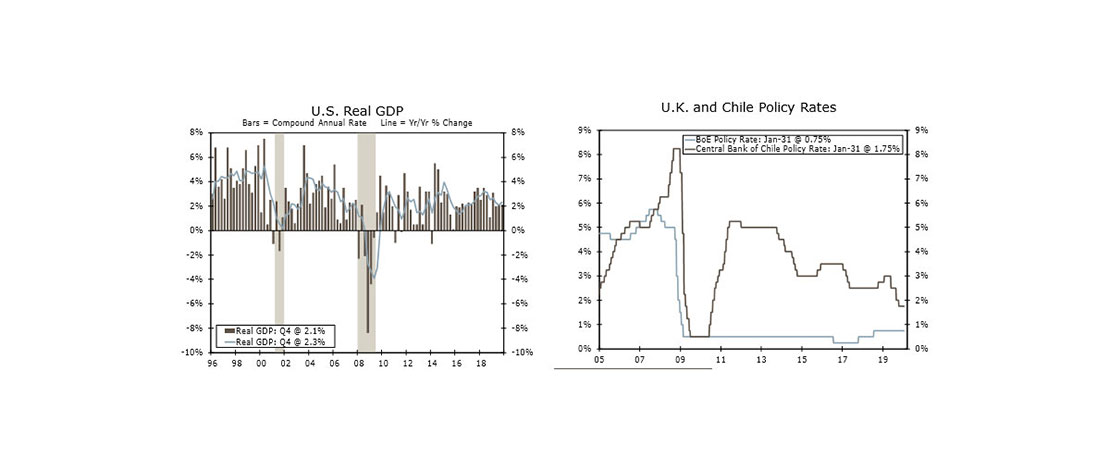

This Week's State Of The Economy - What Is Ahead? - 31 January 2020

Wells Fargo Economics & Financial Report / Feb 01, 2020

Mexico’s economy has slowed notably over the last year, with the economy contracting again in Q4, indicating a full-year contraction for 2019.

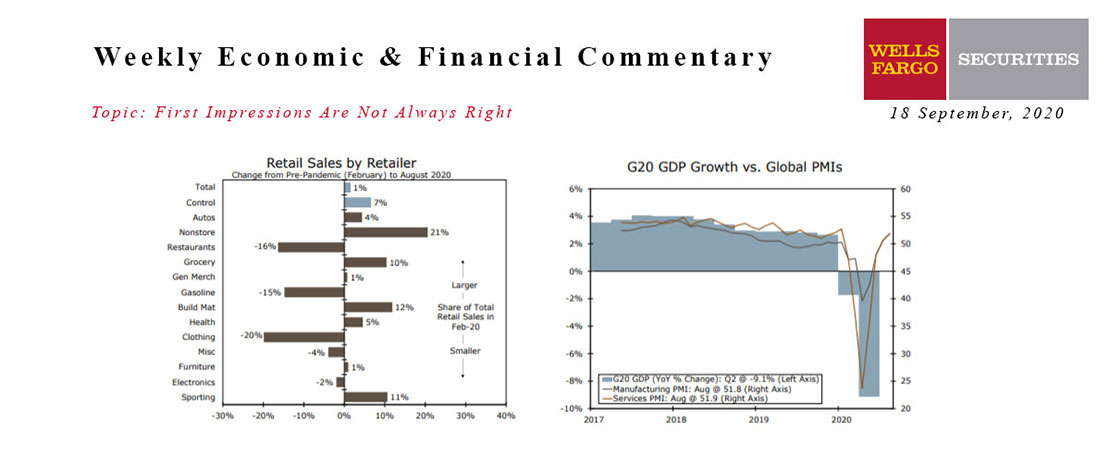

This Week's State Of The Economy - What Is Ahead? - 18 September 2020

Wells Fargo Economics & Financial Report / Sep 15, 2020

The details were generally more favorable. The retail sectors hurt most by the pandemic saw gains in August, factory output is growing and soaring homebuilder confidence suggests soft construction data this week may be transitory.

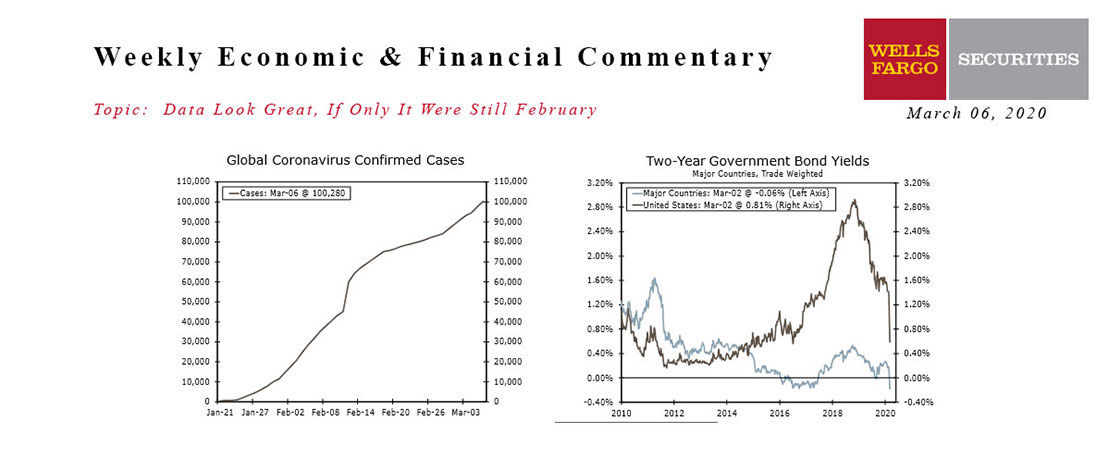

This Week's State Of The Economy - What Is Ahead? - 06 March 2020

Wells Fargo Economics & Financial Report / Mar 07, 2020

An inter-meeting rate cut by the FOMC did little to stem financial market volatility, as the number of confirmed COVID-19 cases continued to climb.

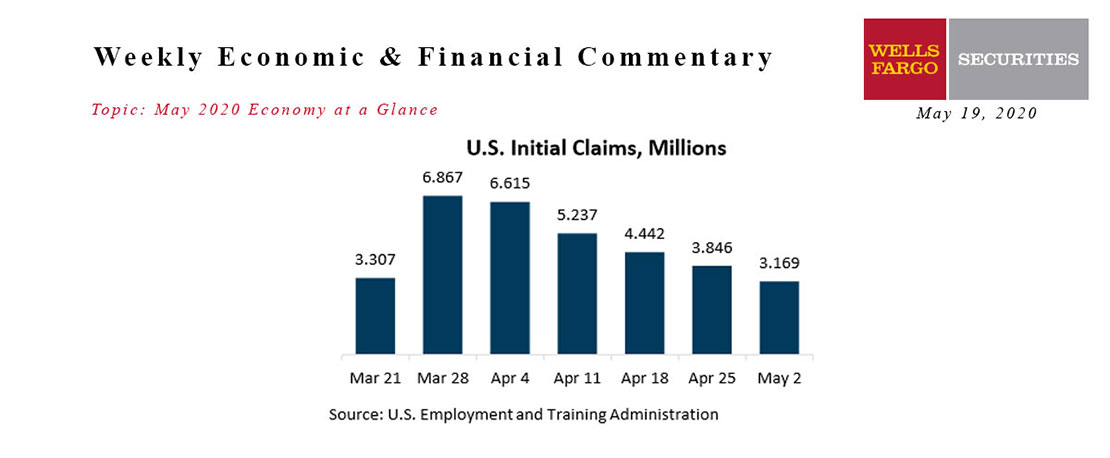

May 2020 Economy at a Glance

Wells Fargo Economics & Financial Report / May 19, 2020

The U.S. is in a severe recession caused by the sudden shutdown due to the COVID-19 pandemic. Since the lock down began, the nation has lost 21.4 million jobs.

This Week's State Of The Economy - What Is Ahead? - 14 February 2020

Wells Fargo Economics & Financial Report / Feb 15, 2020

Retail sales increased for a fourth straight month in January, underscoring the resiliency of the U.S. consumer. Fundamentals are solid and support our expectations for healthy consumer spending gains in coming months.

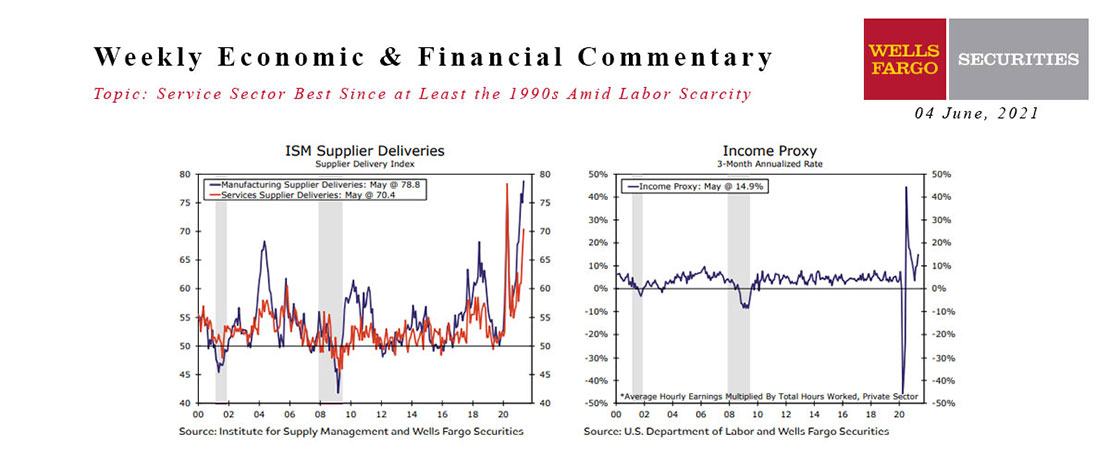

This Week's State Of The Economy - What Is Ahead? - 04 June 2021

Wells Fargo Economics & Financial Report / Jun 08, 2021

The CDC\'s relaxation of its mask mandate occurred mid-May, and as data for that month begins rolling in this week, it is evident there is no lack of demand. Supplies, on the other hand, are a worsening problem.