U.S. - Inflation Comes Back in Focus

- Market attention was concentrated on the January consumer price data, as inflation has come back into focus. There is renewed concern among market participants that inflation is about to take off once the economy re-opens and demand accelerates. But, such concerns have not yet meaningfully presented themselves in consumer price data, with the core consumer price index unchanged for the month of January.

- While we expect inflation to firm later this year, we believe the Federal Reserve remains less concerned about inflation and more worried about labor market scarring. The labor market recovery continues to stumble, with an additional 793K workers having filed an initial claim for unemployment insurance last week.

- President Biden and Chinese President Xi had their first conversation this week since Biden was elected. Reports suggest numerous topics were discussed, but no new policy concerning tariffs was put in place.

Global - Mixed Finish to 2020, Soft Start to 2021

- The European economy showed mixed, albeit overall subdued, trends at the end of last year. United Kingdom Q4 GDP surprised to the upside with a 1.0% quarter-over-quarter gain. In contrast, national level manufacturing data for December from the Eurozone were mixed, and Eurozone-wide industrial output is expected to fall 0.5% for December. The mixed trends were not just in Europe, with Brazil reporting a large decline in December retail sales but an increase in December overall economic activity.

- While 2020 finished on a mixed note, it is likely that Europe's economy will show further weakness in early 2021. February PMI surveys are due from both the Eurozone and the U.K. next week. While the services PMI is expected to rise modestly for both economies, they are also expected to remain below the breakeven 50 level. That suggests a further (Eurozone) or renewed (U.K.) contraction in economic activity, and we forecast Q1 GDP declines for both economies.

This Week's State Of The Economy - What Is Ahead? - 16 July 2021

Wells Fargo Economics & Financial Report / Jul 30, 2021

Visiting from Texas, it felt more like fall, which like the Texas cold-snap last February just goes to show that it’s a case of what you’re used to.

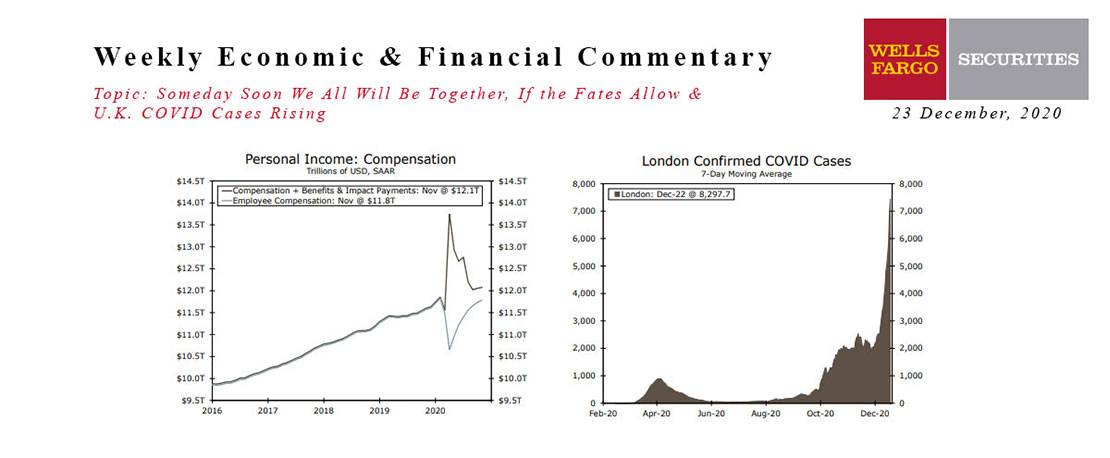

This Week's State Of The Economy - What Is Ahead? - 23 December 2020

Wells Fargo Economics & Financial Report / Dec 26, 2020

Vaccines are here, but they are not yet widely available in a way that can stem the spread of a disease that grows by 200K a day.

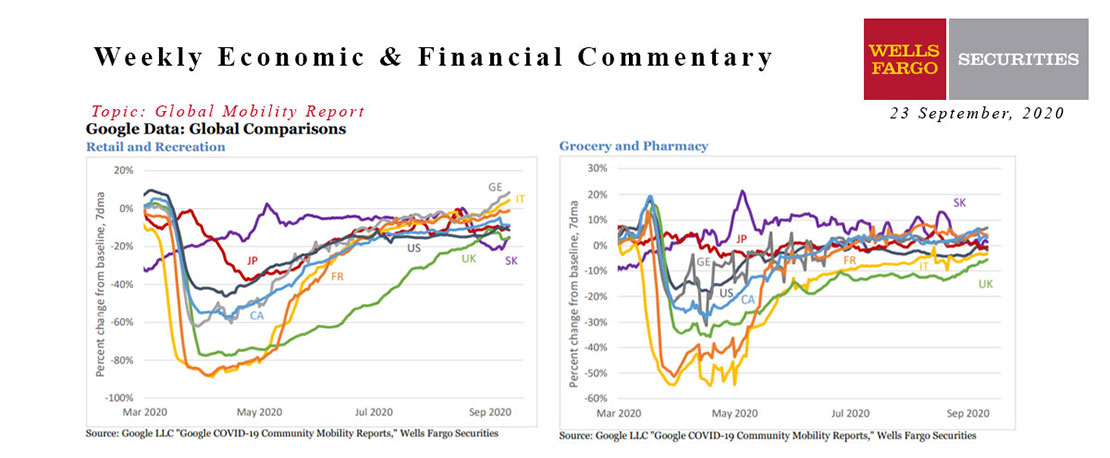

This Week's State Of The Economy - What Is Ahead? - 23 September 2020

Wells Fargo Economics & Financial Report / Sep 22, 2020

European activity is surging. Germany and Italy are leading the way, but France is close behind despite an ongoing rise in cases. The Google data are a bit outdated, but are hard to reconcile with today’s weak Eurozone services PMI figures.

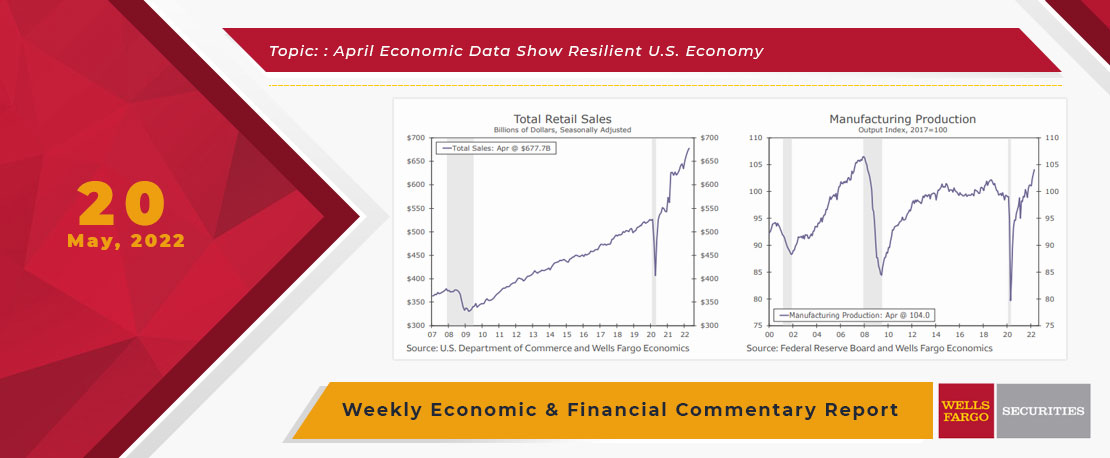

This Week's State Of The Economy - What Is Ahead? - 20 May 2022

Wells Fargo Economics & Financial Report / May 29, 2022

U.S. retail sales topped expectations in April, while industrial production also grew more rapidly than economists expected. Data on housing starts, home sales and homebuilder sentiment, however, showed tentative signs of cooling.

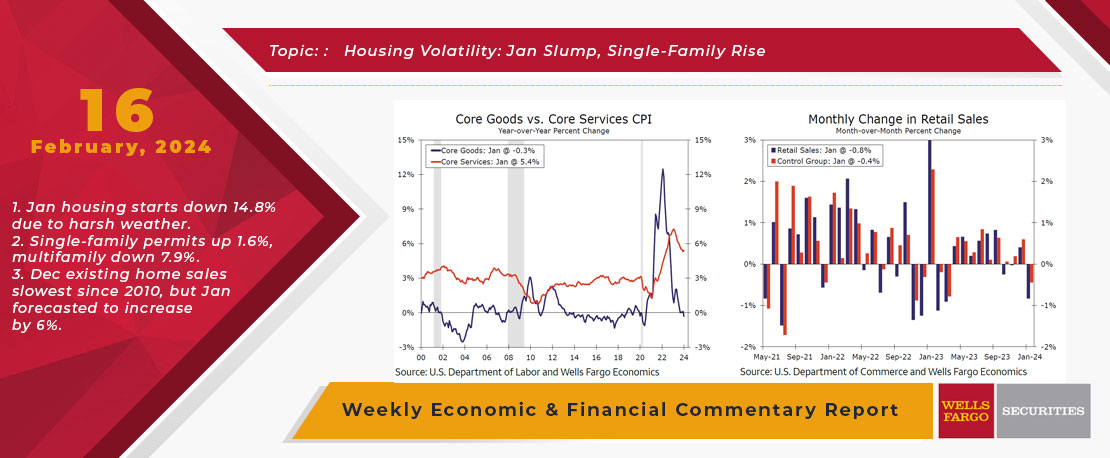

This Week's State Of The Economy - What Is Ahead? - 16 February 2024

Wells Fargo Economics & Financial Report / Feb 20, 2024

The out-of-consensus start to the year for economic data continued with a slip in retail sales and industrial production followed by a startling 14.8% drop in housing starts during January.

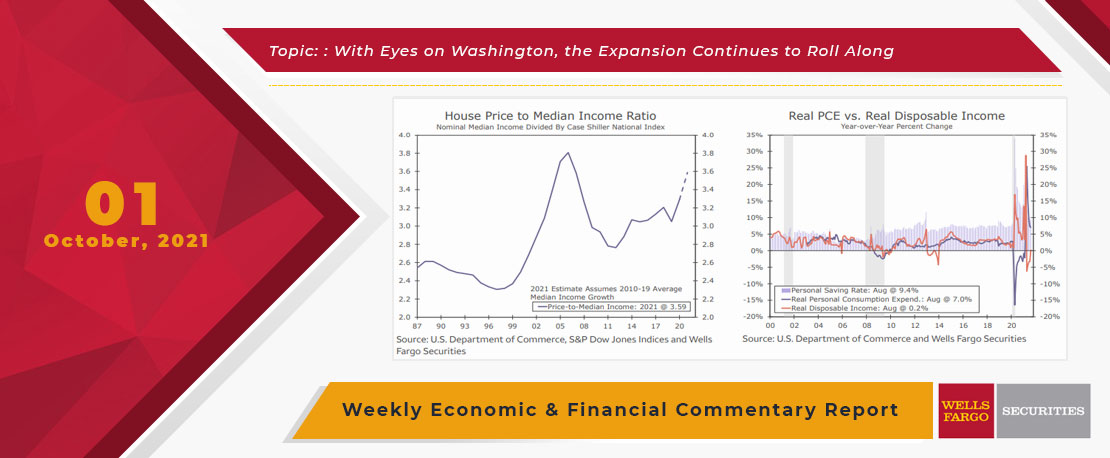

This Week's State Of The Economy - What Is Ahead? - 01 October 2021

Wells Fargo Economics & Financial Report / Oct 10, 2021

Economic data this week indicated that the ongoing expansion still has some momentum despite some familiar headwinds, though this week\'s releases were largely overshadowed by a busy week on Capitol Hill.

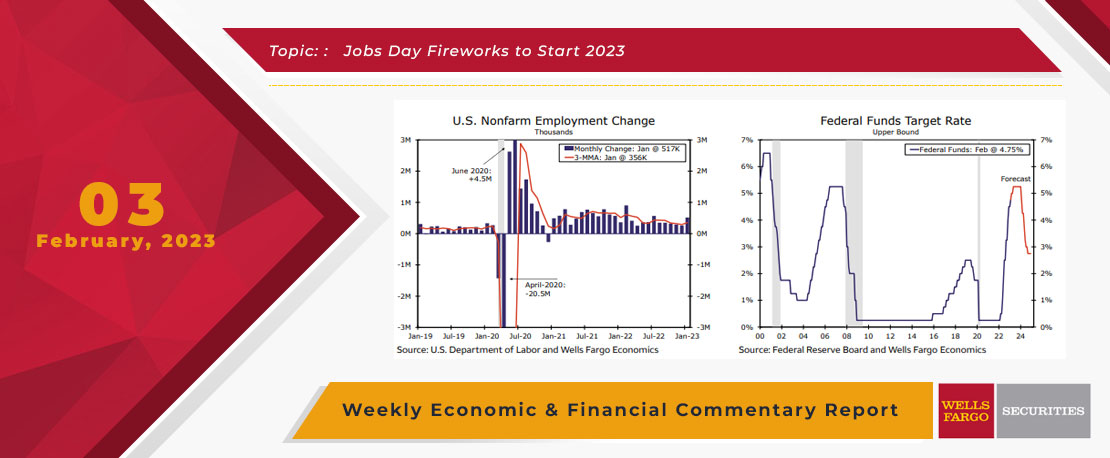

This Week's State Of The Economy - What Is Ahead? - 03 February 2023

Wells Fargo Economics & Financial Report / Feb 04, 2023

During January, payrolls jumped by 517K, the unemployment rate fell to 3.4% and average hourly earnings rose by 0.3%. The FOMC raised the fed funds target range by 25 bps to 4.5%-4.75% this week.

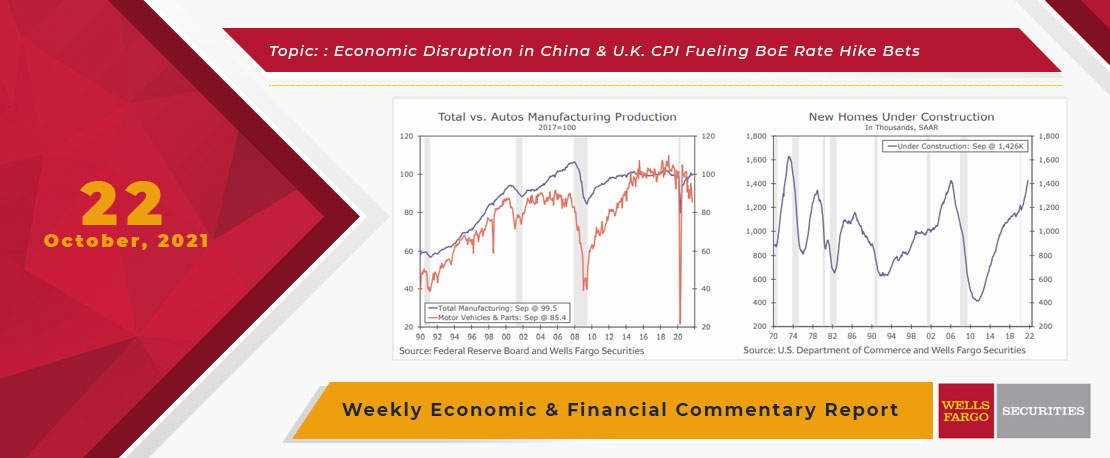

This Week's State Of The Economy - What Is Ahead? - 22 October 2021

Wells Fargo Economics & Financial Report / Oct 25, 2021

Restrictions from a renewed COVID outbreak in China, regulatory changes weighing on local financial markets and a potential collapse of Evergrande have all contributed to a slowdown in Chinese economic activity.

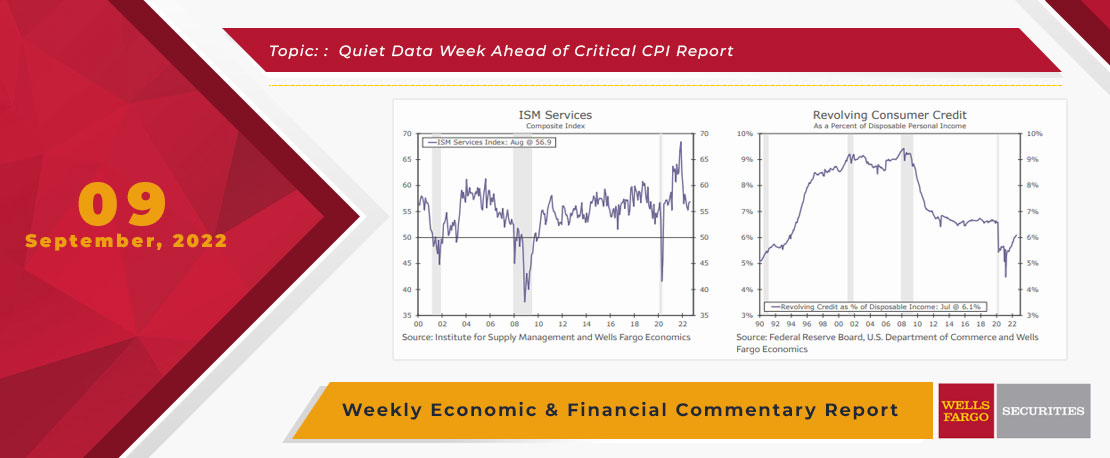

This Week's State Of The Economy - What Is Ahead? - 09 September 2022

Wells Fargo Economics & Financial Report / Sep 10, 2022

The ISM services index came in stronger than expected, and the underlying details pointed to service sector resilience with business activity and new orders notching their highest reading this year.

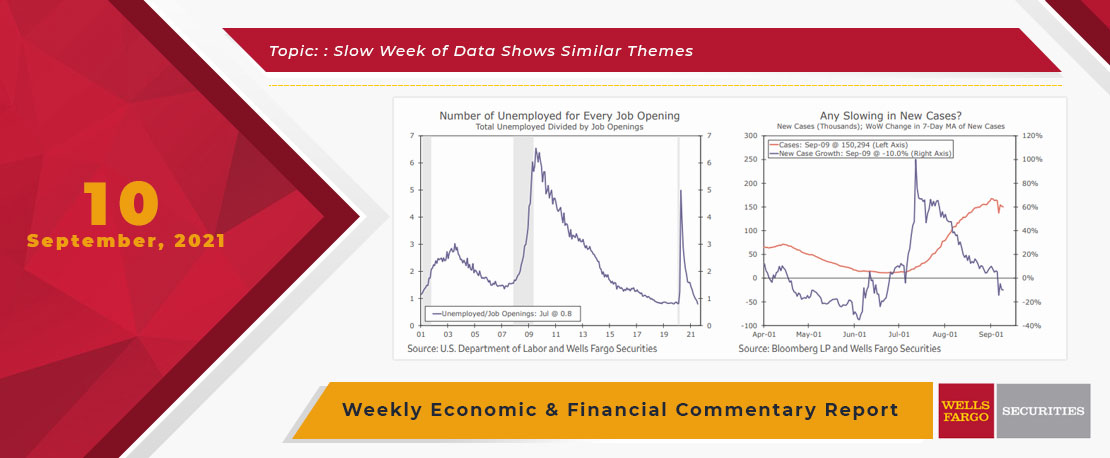

This Week's State Of The Economy - What Is Ahead? - 10 September 2021

Wells Fargo Economics & Financial Report / Sep 13, 2021

Data from the opening weekend of College Football indicates that we will have to endure another season of Nick Saban deification.