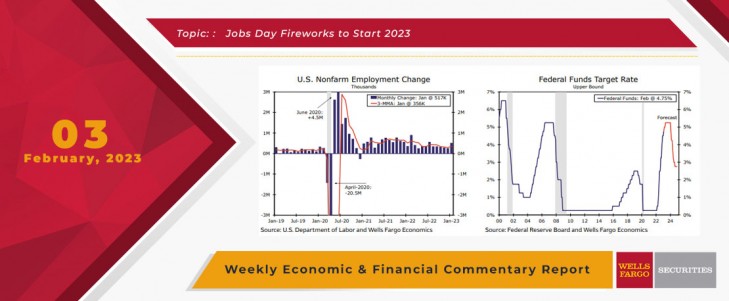

The big news of the week was that the economy added 517K jobs in January, significantly ahead of the 188K consensus expectation. Alongside the robust payroll gain, the unemployment rate fell to 3.4% during the month, the lowest rate in 53 years. The monthly jobs gain comes with the usual caveats that monthly gains can be highly volatile, vulnerable to seasonal adjustment noise and subject to large revisions. That said, the jump in jobs occurred as labor force participation improved and wage growth moderated, both of which are positive signs of a labor market moving into better balance. Average hourly earnings cooled to 0.3%, a monthly pace that was in line with consensus estimates. That noted, wage growth has yet to return to a pace consistent with 2% inflation. All told, January's employment report adds to the evidence that a recession is still a ways off and raises the probability the FOMC will move forward with another 25 bps rate hike at its next meeting in March.

The deceleration in hourly earnings helps corroborate a slowdown in other wage growth measures. On Tuesday morning, the Employment Cost Index (ECI) for Q4-2022 was released. The ECI is a comprehensive measure of wage growth and is closely monitored by the Fed to shed light on the labor market and inflation. The ECI rose 1.0% in Q4, the third straight quarterly moderation and a pace slower than market expectations. In the Fed’s view, slower labor cost growth is required for disinflation in the labor-intensive service sector, where price pressures remain elevated even as goods prices move down.

Overall, the slower increase in the ECI suggests that wage growth is easing without a material deterioration in the labor market. The softer ECI gain was likely well-received by Committee members when the FOMC meeting commenced on Tuesday morning. At the conclusion of the meeting, the FOMC raised the fed funds rate target range by 25 bps to 4.50%-4.75%. The hike was widely expected, but comments provided by Fed Chair Powell at the press conference were more of a surprise. For more on the FOMC rate decision, please see the Interest Rate Watch.

The Fed will very likely become even more data dependent as it begins to fine-tune monetary policy. Another indicator that the Fed has been monitoring closely, the Job Openings and Labor Turnover Survey (JOLTS), was released on Wednesday morning. The December JOLTS revealed that the count of openings unexpectedly jumped to 11.0 million over the month. Fed Chair Powell has frequently cited the elevated ratio of job openings relative to unemployed, which rose to 1.9 during the month, as evidence of an imbalanced labor market. Seasonal factors were likely behind December's jump in total openings. What's more, the underlying details of the survey suggest some cooling in labor market conditions. Quits fell slightly and layoffs increased a touch, indicating less tightness in the labor market and presaging slower labor cost growth on the horizon.

2021 Annual Economic Outlook

Wells Fargo Economics & Financial Report / Dec 16, 2020

The longest U.S. economic expansion since the end of the Second World War came to an abrupt end earlier this year as the COVID pandemic essentially shut down the economy.

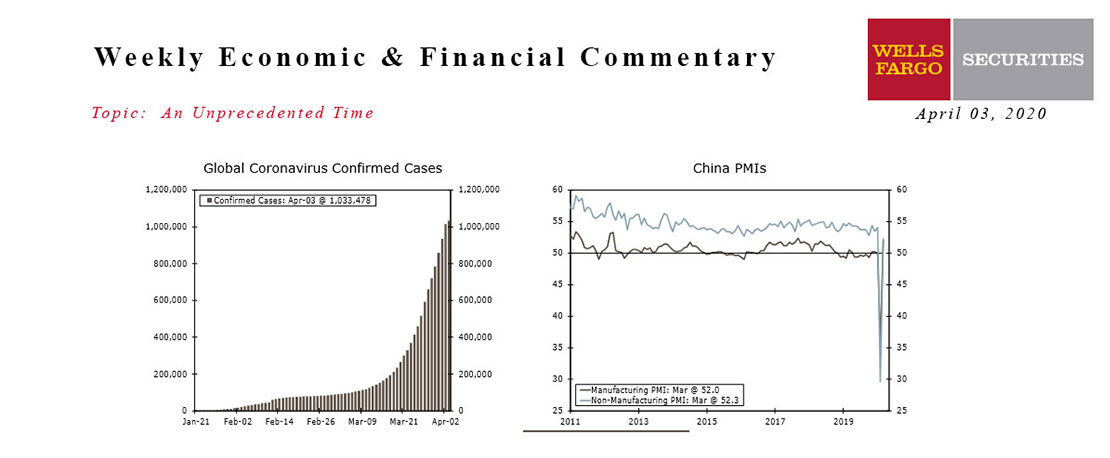

This Week's State Of The Economy - What Is Ahead? - 03 April 2020

Wells Fargo Economics & Financial Report / Apr 04, 2020

Efforts to contain the virus are leading to millions of job losses and it’s likely only a matter of time before a majority of economic data reveal unprecedented declines.

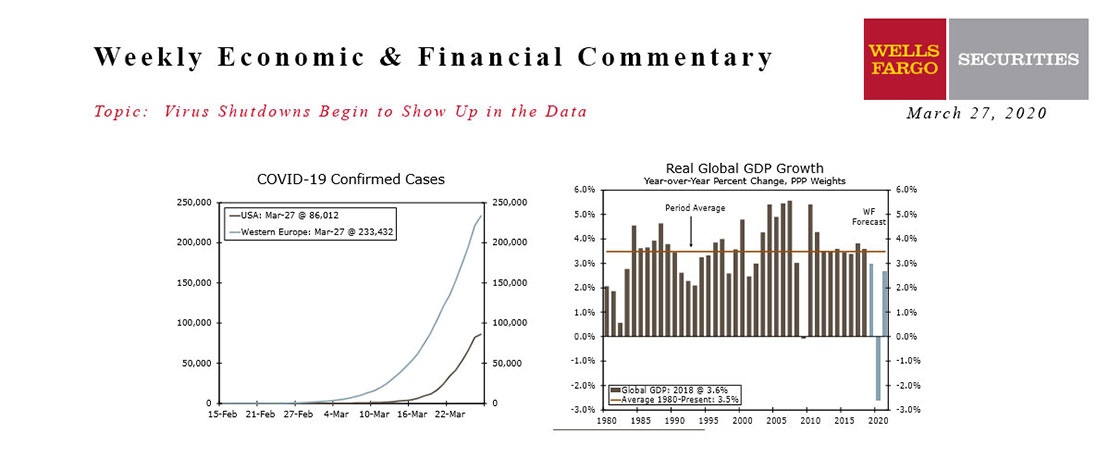

This Week's State Of The Economy - What Is Ahead? - 27 March 2020

Wells Fargo Economics & Financial Report / Mar 28, 2020

The U.S. surpassed Italy and China with the most confirmed cases of COVID-19. Europe is still the center of the storm, with the total cases in Europe’s five largest economies topping 230,000.

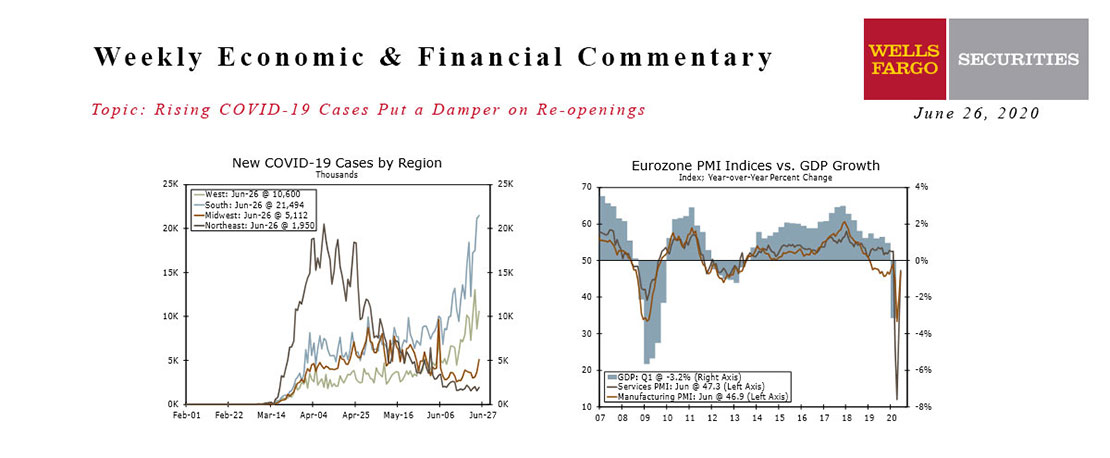

Rising COVID-19 Cases Put A Damper On Re-openings

Wells Fargo Economics & Financial Report / Jun 27, 2020

The rising number of COVID-19 infections gained momentum this week, with most of the rise occurring in the South and West. The rise in infections is larger than can be explained by increased testing alone and is slowing re-openings.

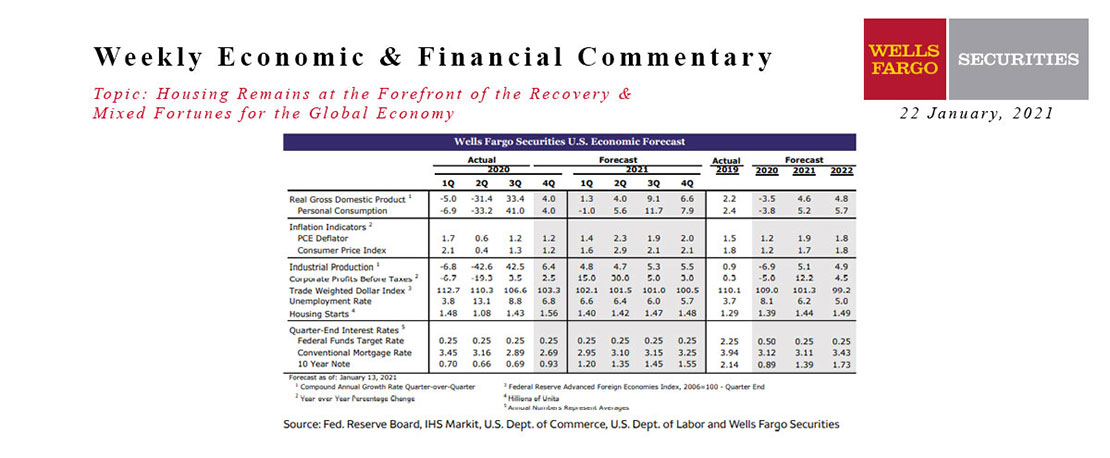

This Week's State Of The Economy - What Is Ahead? - 22 January 2021

Wells Fargo Economics & Financial Report / Jan 23, 2021

Housing starts jumped 5.8% during December. Single-family starts soared 12%, while multifamily starts dropped 13.6%.

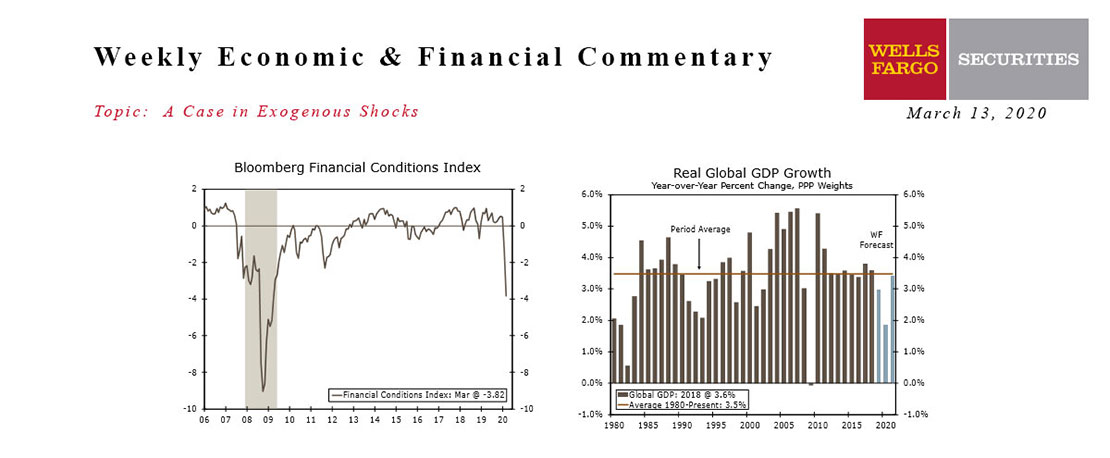

This Week's State Of The Economy - What Is Ahead? - 13 March 2020

Wells Fargo Economics & Financial Report / Mar 14, 2020

Financial conditions tightened sharply this week as concerns over the coronavirus and the economic fallout of containment efforts mounted.

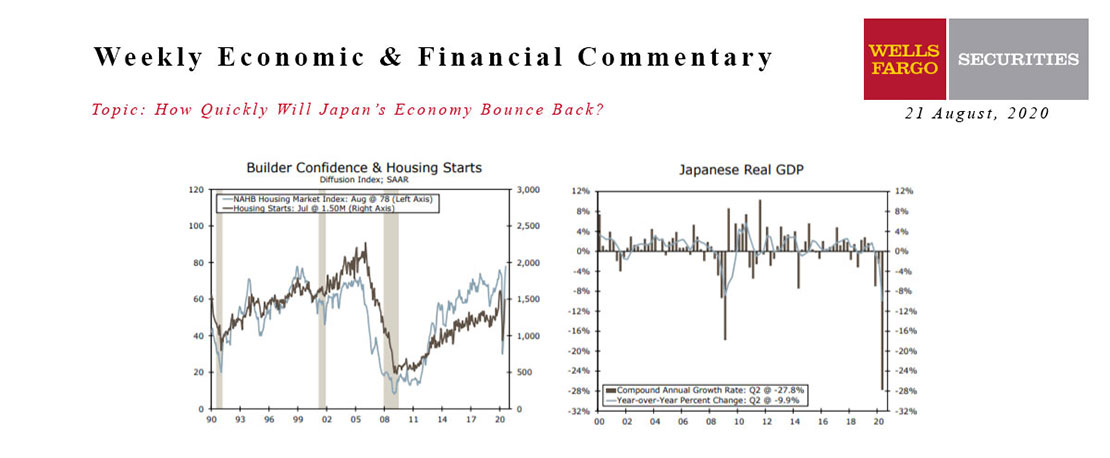

This Week's State Of The Economy - What Is Ahead? - 21 August 2020

Wells Fargo Economics & Financial Report / Aug 18, 2020

Despite indications of lost momentum elsewhere, residential construction activity is picking up steam.

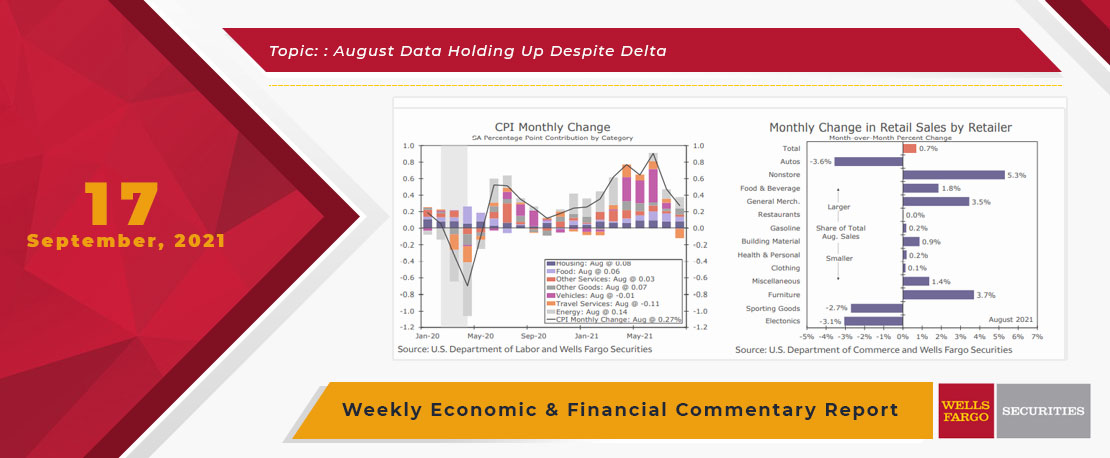

This Week's State Of The Economy - What Is Ahead? - 17 September 2021

Wells Fargo Economics & Financial Report / Sep 23, 2021

While we were picking up tree limbs from the yard, data released this week generally showed a stronger economy in August than many expected in the wake of surging COVID cases.

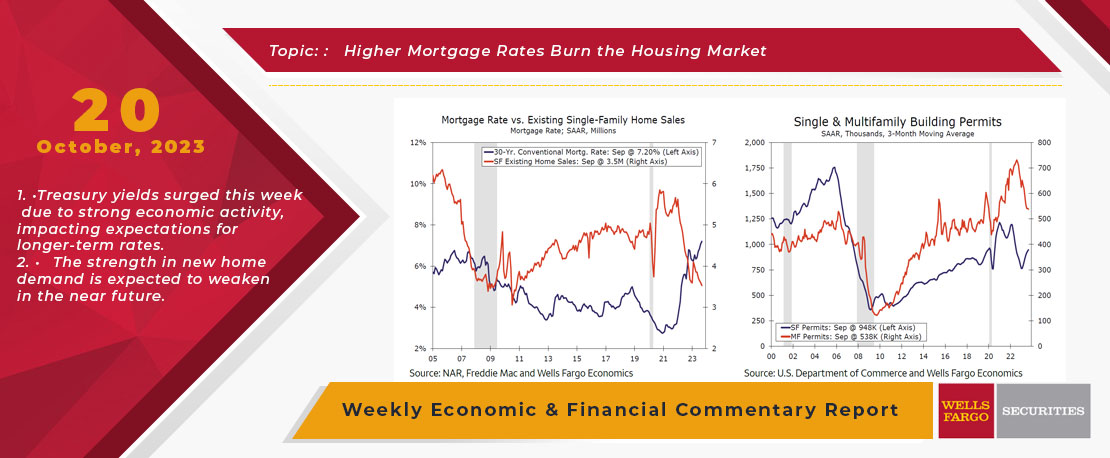

This Week's State Of The Economy - What Is Ahead? - 20 October 2023

Wells Fargo Economics & Financial Report / Oct 27, 2023

Treasury yields surged this week due to strong economic activity, impacting expectations for longer-term rates. New home sales led to a rise in single-family permits, but spiking mortgage rates are testing builder affordability strategies.

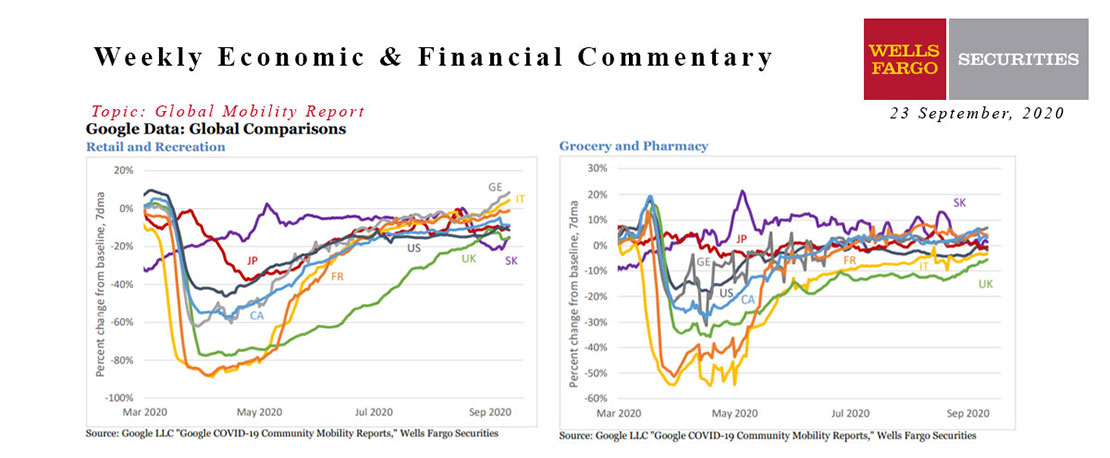

This Week's State Of The Economy - What Is Ahead? - 23 September 2020

Wells Fargo Economics & Financial Report / Sep 22, 2020

European activity is surging. Germany and Italy are leading the way, but France is close behind despite an ongoing rise in cases. The Google data are a bit outdated, but are hard to reconcile with today’s weak Eurozone services PMI figures.