Multifamily Housing Can Revitalize Retail Centers

Real estate investment can seem like an impossible venture for both new and experienced investors. There are many options to choose from, each with its own benefits. A few promising investment ventures in real estate include housing, land, retail, industrial and multifamily. In today's fast-paced day and age, utilization of resources to their total capacity is a high priority, which is why we're seeing more mixed-use properties emerging.

A great way of treading into this space is via multifamily housing. Multifamily and retail go hand in hand, with one benefiting the other. We can see many neighborhoods adding retail spaces in or close to their vicinity, but an opposite situation can also be profitable. Retail centers can benefit tremendously if they include multifamily buildings in their centers. Not only is it an ideal use of the extended space, but it also adds to their clientele and improves foot traffic. Online shopping and e-commerce websites are slowly killing in-person retail but having a multifamily so close to a retail center allows residents easy access, which may lead them to increase their expenditure towards these stores rather than at e-commerce websites.

The 'work-from-home' phenomenon changed the way real estate works. The demand for rental communities that offer combined spaces for living, working, and entertainment is on the rise. People are looking for a property that allows them to work from home, meaning it needs to include or be within a distance from a retail office space. Walkability is a major deciding factor for millennials. Investors should look at units that blur the lines between work, play, and living. These are known as 'Live-Work-Play' units. Such mixed-use projects are on the rise and would be a great investment option for those looking to invest in real estate in this current market. Properties previously accessible only by car or public transport are now accessible by simply walking! This creates demand and boosts retail sales. These real estate projects can range from a single building to an entire neighborhood, so invest according to your advisor's and your discretion.

Such real estate projects have other benefits too. Usually, retail centers are either located close to highways to have easy access to get to them. Furthermore, they offer economic benefits which help residential builders save on funds that would have been used to bring in utilities. Often, these additional expenses are associated with building residential properties in greenfield spaces (new construction projects.) We've spoken about why such projects attract residents, but what makes them stand out for investors to invest in them? In these times of rising interest rates and falling consumer spending, getting an influx of people near a retail center would help increase cash flow via diversification. Furthermore, such projects are better for the environment and help reduce the builder's carbon footprint, especially if the project is built by repurposing an existing structure rather than building a new structure off the ground.

Building a residential wing inside a retail center may need additional permissions and negotiations from the local authorities. Investor discretion is advised. Please consult with a professional before investing in any type of real estate. This article has been adapted from the "Winter 2023" edition of Urban Land Magazine, written by Patrick J. Kiger.

Stocks Or Real Estate? Which Is The Better Investment?

Real Estate Articles / Feb 09, 2022

Want to invest and make money? We have listed out the pros and cons of the real estate market and the stock market so that you can decide if you want to invest in stocks or real estate.

Houston excels in the latest ranking of top U.S. cities for working-class families

Real Estate Articles / Dec 29, 2023

Houston-The-Woodlands-Sugar Land Secures 30th Spot in National Economic Prosperity Rankings, Revealing Robust Growth Amidst Population Surge and Varied Socioeconomic Challenges

What You Need To Know About Closing

Real Estate Articles / May 11, 2022

Whether you are buying property or selling property, closing is a crucial part that will make or break your deal. We have listed major pointers that will help you deal with your next closing much better.

Extending a Warm Welcome to Savings for All Property OWNER

Real Estate Articles / Oct 27, 2023

Texas\' Landmark Property Tax Reform: Securing Affordable and Sustainable Homeownership for Texans, Envisioning Average Yearly Savings of $1,300.

Late 2022, Early 2023 Market Trends

Real Estate Articles / Dec 05, 2022

Real estate investors are keen to invest in real estate. End of year real estate trends and market predictions and trends that can be expected in commercial real estate for 2023.

Navigating Challenges in Affordable Housing Finance: Strategies for Developers

Real Estate Articles / Dec 08, 2023

Developers in the affordable housing sector face unprecedented challenges in financing that are primarily revolving around construction-related hurdles.

US REAL ESTATE REMAINS TOP DRAW FOR FOREIGN INVESTORS

Real Estate Articles / Mar 02, 2019

The US continues to be the world\'s leading recipient of cross-border capital, and it has no plans of slowing down. During the first half of 2017 the United States attracted 19.8 billion U.S dollars from foreign investors.

Reviving Campus Spaces: Adaptive Reuse Solutions for Modern Education

Real Estate Articles / Jan 26, 2024

Transformative Real Estate: Navigating the Evolution of College Campuses through Adaptive Reuse and Strategic Solutions

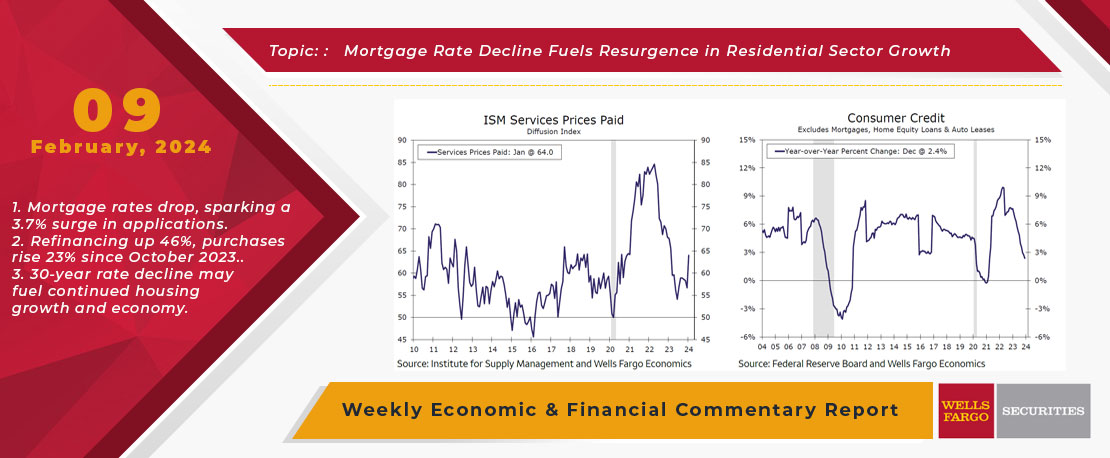

This Week's State Of The Economy - What Is Ahead? - 09 February 2024

Real Estate Articles / Feb 14, 2024

The ISM services index shot higher into expansion territory during January, which is the latest piece of evidence that economic growth is still firmly in positive territory.

Crypto is changing the real estate industry. Invest in real estate using crypto currency!

Real Estate Articles / Sep 01, 2022

With the economic inflation rising, the real estate and financial market is undergoing changes. Crypto currency is the new trend in real estate and in the investment world as more people are using crypto to invest in real estate.