The US continues to be the world's leading recipient of cross-border capital, and it has no plans of slowing down. During the first half of 2017 the United States attracted 19.8 billion U.S dollars from foreign investors.

The U.S has a market appeal that is unmatched by competitors, so we can expect that China and other developed countries will continue to drive this trend as they seek to invest in U.S. metropolitan's that are less volatile and offer greater risk-reward profiles compared to their domestic markets.

For offshore investors, U.S. real estate offers manifold attractions. Market sentiment and liquidity remain elevated, an extensive range of assets exists, and there is an active, engaged and diverse investor pool.

So, what can we expect in coming months?

Foreign investment will rise

Real estate in America is both attractive and valuable to foreign investors. This, plus changes in the 1980 Foreign Investment in Real Property Tax Act allow foreign investors to be treated similar to U.S counterparts in real estate investment trusts.

Portfolios will become diversified

While office space is the primary purchase for foreign investors, access was listed as the greatest deterrent for investors according to a report from CRBE Capital watch, who reported 1 in 4 investors listed access as the main obstacle in U.S investments. A problem that is likely to change with the onset of online investing sites; now, global investors can gain more insight on market trends and available properties.

U.S Metropolitan's will be a main attraction for Global Investors

According to the Realtors association, the top five markets that foreign buyers are searching for are Miami; Los Angeles; Bellingham, Washington; Kahului-Wailuku-Lahaina, Hawaii and New York City. All of those markets reported being hot spots for Chinese buyers in 2016. As of March 2017 though, China wasn't even in the top 5 countries searching these locations, the publication says.

Office Space is a Major Pull

Seems that office space continues to be the most invested commercial property to date. 10.6 billion dollars of foreign capital was invested int the U. S office sector. This is a reflection of 80% of all office investments from China, Singapore, Canada, Germany and Japan.

Celebrating Juneteenth: A Step Toward Freedom and Equality

Real Estate Articles / Jun 19, 2024

At Tc Global Commercial, we believe in the power of home and community. As we celebrate Juneteenth, we want to take a moment to reflect on its significance and why it holds a special place in our hearts and our history.

Falling Home Prices? Here's All You Need To Know!

Real Estate Articles / Aug 08, 2022

Here’s how you can take advantage of rising interest rates. Advantages of investing during high interest rates are listed below. Invest in real estate today.

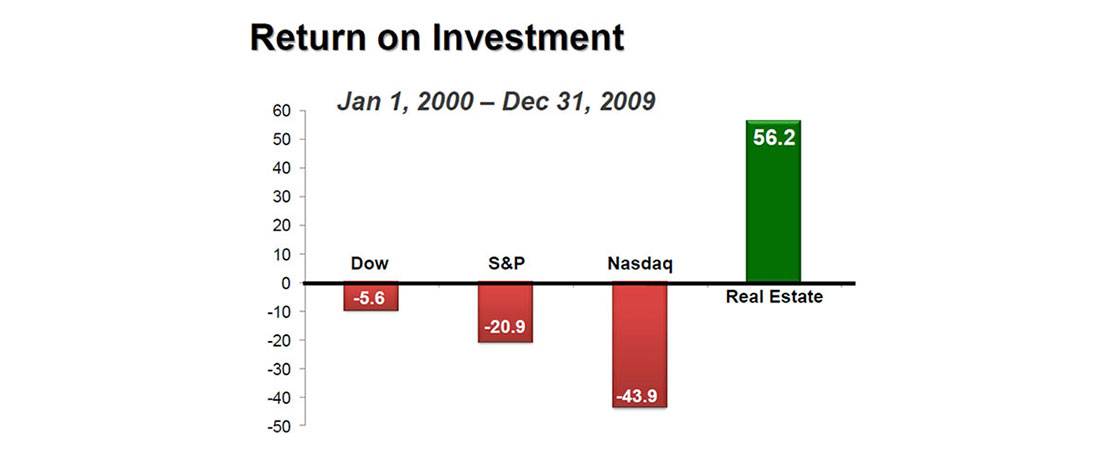

Stocks Or Real Estate? Which Is The Better Investment?

Real Estate Articles / Feb 09, 2022

Want to invest and make money? We have listed out the pros and cons of the real estate market and the stock market so that you can decide if you want to invest in stocks or real estate.

2023 Market Predictions in Commercial Real Estate

Real Estate Articles / Dec 28, 2022

2023 commercial real estate predictions are here. Find out which is the best investment opportunities are best for you. Make money with commercial real estate.

Everything you need to know about capital gains tax and real estate investment

Real Estate Articles / Apr 01, 2022

Capital gains tax is levied on the profits made when you sell property or sell investments owned by you. Here’s how you can be exempt from taxes along with the top tax tips for investors and property owners.

Navigating Challenges in Affordable Housing Finance: Strategies for Developers

Real Estate Articles / Dec 08, 2023

Developers in the affordable housing sector face unprecedented challenges in financing that are primarily revolving around construction-related hurdles.

Not All Industrial Real Estate Is The Same

Real Estate Articles / Jun 25, 2023

Industrial real estate includes manufacturing, logistics, and flex or R&D buildings. Find out which of these real estate investments is the most profitable for you.

Legal Victories Unleash Potential to Cut Property Taxes - Impact on Hospitality and more

Real Estate Articles / Nov 15, 2023

Landmark Court Decisions Pave the Way for Lower Property Taxes and Intangible Asset Considerations

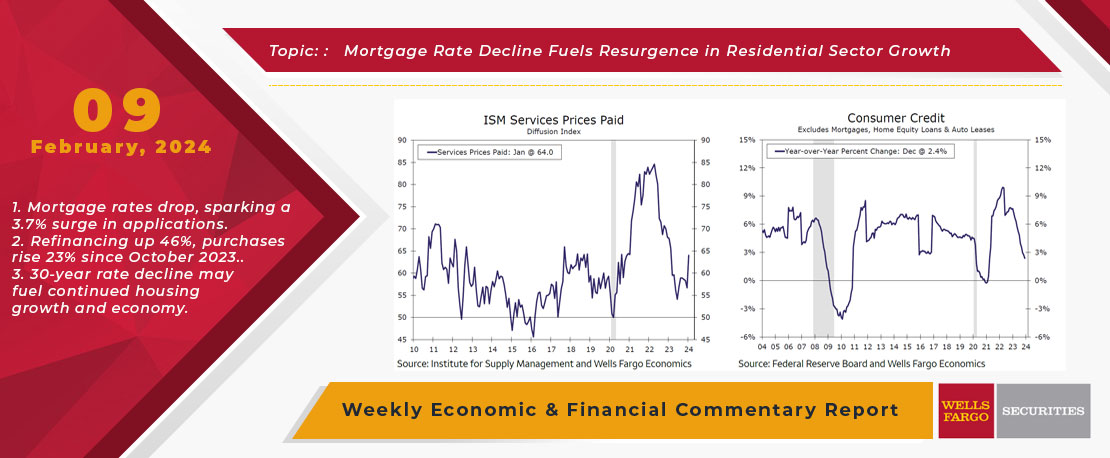

This Week's State Of The Economy - What Is Ahead? - 09 February 2024

Real Estate Articles / Feb 14, 2024

The ISM services index shot higher into expansion territory during January, which is the latest piece of evidence that economic growth is still firmly in positive territory.

Who Should Invest In Commercial Real Estate

Real Estate Articles / Mar 16, 2019

There are several reasons why someone would choose to invest in commercial real estate.