Are you leaving money on the table? When it comes to your investment property you need to be earning maximum returns. After all, you aren't in this to give away money, am I right? However, too often, investors fail to collect the maximum earnings on their property. Leasing to late tenants, avoiding repairs, or simply not doing the proper market research can all be taking a toll on your profits. Does this sound familiar? If so, never fret!

Below are some relatively easy ways to avoid the common mistakes investors make. Avoid these and you'll be maximizing your earnings in no time.

Market Research

Before you purchase you should be considering the longevity of your investment. A good decision on the front end, purchasing property that is likely to retain its long-term value, is the foundation to making a sound investment. It is ill-advised to purchase property solely based upon its projected investment returns over the next few years, without giving serious consideration to the long-term viability of the investment. When considering commercial real estate, one must ask themselves: Are there factors that will limit demand for the property when vacancies occur? Are the current rents likely to be above market when it comes time to renew the leases?

Preserve and Enhance value

In order to maximize profits, you need to continue investing in your property. Small updates and maintenance can help to maintain the property at a high standard. Too often investors defer maintenance in order to keep costs to a minimum. Not only does this affect the value when it comes time to sell, but may impact your business revenues as tenants and customers drive away with a negative impression. In extreme cases, maintenance shortcomings result in hazards and potential liability to the property owners. Consider going so far as to create a reserve fund so that capital is available when it comes time to replace the roof or paint the building.

Tenant Screen

Attracting tenants is easy, but attracting good tenants is NOT. You need to prioritize tenant screening. In order to be profitable, you need tenants who pay on time, and prevent damage to the property.

Of course, you collect a security deposit, but major repairs will still be a cost to you. Not to mention, the cost of evicting a tenant can be as costly as 5,000 dollars.

Avoid the headache and screen your tenants. Simple actions like checking the clients credit report in order to determine their paying history, or acquiring pay statements to verify their affordability can be a major reflection of a tenants future rental behavior. You can also assess their behavior by looking into their criminal background and calling past landlords for references.

Consider Hiring A Property Manager

A hiring manager can help you manage issues like payments, and fees effectively eliminating the headache of dealing with tenants. However, their fees can take up to 10% of your returns. In today's real estate market, that could reduce your cash flow to the point of barely turning a profit.

While it may be most beneficial to a larger property, or a owner of multiple properties, even new investors can benefit from virtual applications such as Rentlit, which can help you collect rent easily and without hassle.

Ultimately, the value of commercial property is determined by either what the market is willing to pay today for a given stream of future cash flows, or what a buyer perceives as the value of the property by locating his or her business there. Enter into solid leases with your tenants, maintain the property to a high standard and don't over-burden it with debt that will impact your ability to readily sell the property in the future. By following these guidelines and more, you will greatly enhance the likelihood that your experience as a property owner is a profitable one.

Stocks Or Real Estate? Which Is The Better Investment?

Real Estate Articles / Feb 09, 2022

Want to invest and make money? We have listed out the pros and cons of the real estate market and the stock market so that you can decide if you want to invest in stocks or real estate.

Wealth management tips. How to create wealth?

Real Estate Articles / Jun 08, 2022

We have listed the best ways through which you can make money in a low risk manner. Create wealth using these investment options. It is the easiest way to get rich.

Navigating the Future of Real Estate: Trends in Houston and Beyond

Real Estate Articles / Jul 19, 2024

the real estate landscape is rapidly evolving, with online homebuying, smart home integration, and virtual interior design becoming increasingly prevalent.

US REAL ESTATE REMAINS TOP DRAW FOR FOREIGN INVESTORS

Real Estate Articles / Mar 02, 2019

The US continues to be the world\'s leading recipient of cross-border capital, and it has no plans of slowing down. During the first half of 2017 the United States attracted 19.8 billion U.S dollars from foreign investors.

Navigating Challenges in Affordable Housing Finance: Strategies for Developers

Real Estate Articles / Dec 08, 2023

Developers in the affordable housing sector face unprecedented challenges in financing that are primarily revolving around construction-related hurdles.

Not All Industrial Real Estate Is The Same

Real Estate Articles / Jun 25, 2023

Industrial real estate includes manufacturing, logistics, and flex or R&D buildings. Find out which of these real estate investments is the most profitable for you.

What developers are saying about the 2023 real estate market

Real Estate Articles / Apr 26, 2023

The 2023 market condition,specifically commercial real estate development and construction industry is set for significant growth and innovation. Developers are saying that recession may be mild, and many growth and investment opportunities\'ll arise.

What You Need To Know About Closing

Real Estate Articles / May 11, 2022

Whether you are buying property or selling property, closing is a crucial part that will make or break your deal. We have listed major pointers that will help you deal with your next closing much better.

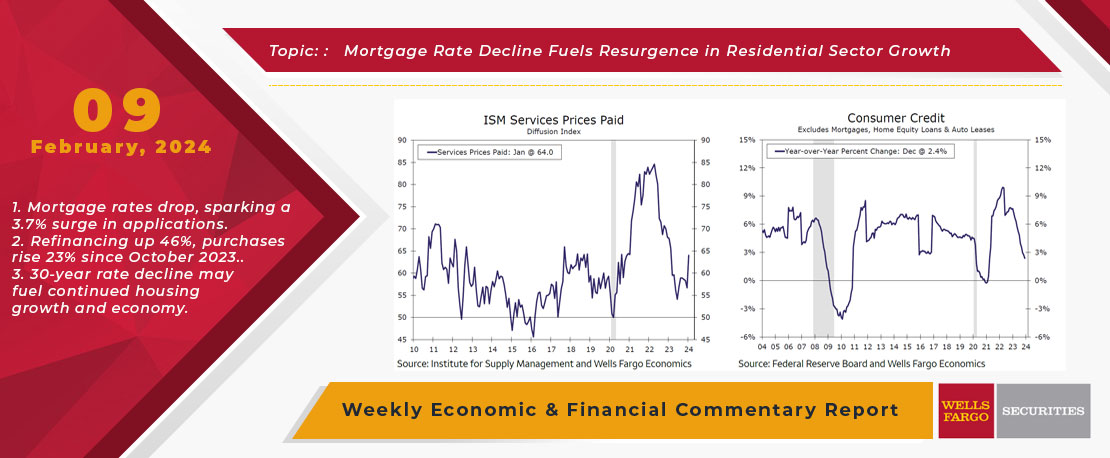

This Week's State Of The Economy - What Is Ahead? - 09 February 2024

Real Estate Articles / Feb 14, 2024

The ISM services index shot higher into expansion territory during January, which is the latest piece of evidence that economic growth is still firmly in positive territory.

Late 2022, Early 2023 Market Trends

Real Estate Articles / Dec 05, 2022

Real estate investors are keen to invest in real estate. End of year real estate trends and market predictions and trends that can be expected in commercial real estate for 2023.