Whether you are a seasoned investor, or you're researching for your first property there is always a certain risk factor that makes us hesitate before signing the dotted line. Likely, you're looking to make money, and you've found that commercial real estate has the potential to expand your business. However, if not careful you could find yourself shelling out much more money than you had ever anticipated.

So how can one determine whether they're making a good decision? First, like any investment, commercial real estate does have a certain risk factor attached, but those who are most successful know to look for when purchasing.

We have rounded up the best advice shared by top real estate investors. Take a look at what tips they urged investors to consider before purchasing:

Larger Properties show more Rent Growth

Go Big or Go home; larger properties have a greater opportunity over smaller properties according to recent studies conducted by CoStar. After taking a careful analysis of retail properties, apartments, and buildings, CoStar found that buildings had the largest rent increase. assets that have a property size increase by 50% there is a $1.20 increase per square foot. This is a tidbit worth considering when deciding which type of property, you would prefer to purchase.

Know Your Market

The market is ever changing, that's why it's important to stay up to date on market trends. For instance, investors interested in space may consider looking at Texas. In 2017 Austin averaged 11-15% in vacancy in parallel of having 15 properties with approximately 2.57 million in square footage. Because Austin is expected to grow its tech industry it is a number one consideration for investors. Staying up to date on market trends, like this can allow you to invest wisely, sooner.

Consider Area Demographics and Trends

Imagine purchasing commercial property just to drown in bureaucratic red tape? Know your area-the culture of the neighborhood, the condition of the land, everything. If you plan to develop and maintain a long-term relationship at the property don't fail to do your due diligence. A local broker may be a worthy investment, helping you navigate local authoritative agencies and giving you a briefing on what to expect a long Th. way.

Be Patient

In comparison to other investments, like residential, Commercial Real Estate takes much longer. This is not something to rush into, take your time, do your homework and ask a lot of questions. It does take longer, but the payout is much larger.

Consider Hiring a Commercial Real Estate Agent

You can navigate the deal yourself of course, but sometimes the process can be overwhelming. Don't underestimate the benefits of a commercial agent. They can help you find a great property and walk you through the negotiation process.

All in all, Commercial real estate is a worthy market to place your interests. But like any good investment, it can withstand the test of research. Take your time and be knowledgeable of what you are getting into. We urge you to subscribe to our monthly newsletter complete with market updates, property listings, and area trends. Subscribe today!

Revolutionizing Student Housing: Advancements in Development and Design

Real Estate Articles / Jan 17, 2024

Capital Market Challenges and Design Evolution in Student Housing Development: Navigating Financing Hurdles, Innovative Trends, and Future Prospects in 2024

Tesla moves to Texas - Impact on real estate and economy

Real Estate Articles / Jan 27, 2022

2021 was a big year for real estate in many ways, but the biggest news of the year came towards the end of it when billionaire magnate, Elon Musk announced his move from California to Texas.

Stocks Or Real Estate? Which Is The Better Investment?

Real Estate Articles / Feb 09, 2022

Want to invest and make money? We have listed out the pros and cons of the real estate market and the stock market so that you can decide if you want to invest in stocks or real estate.

Not All Industrial Real Estate Is The Same

Real Estate Articles / Jun 25, 2023

Industrial real estate includes manufacturing, logistics, and flex or R&D buildings. Find out which of these real estate investments is the most profitable for you.

Crypto is changing the real estate industry. Invest in real estate using crypto currency!

Real Estate Articles / Sep 01, 2022

With the economic inflation rising, the real estate and financial market is undergoing changes. Crypto currency is the new trend in real estate and in the investment world as more people are using crypto to invest in real estate.

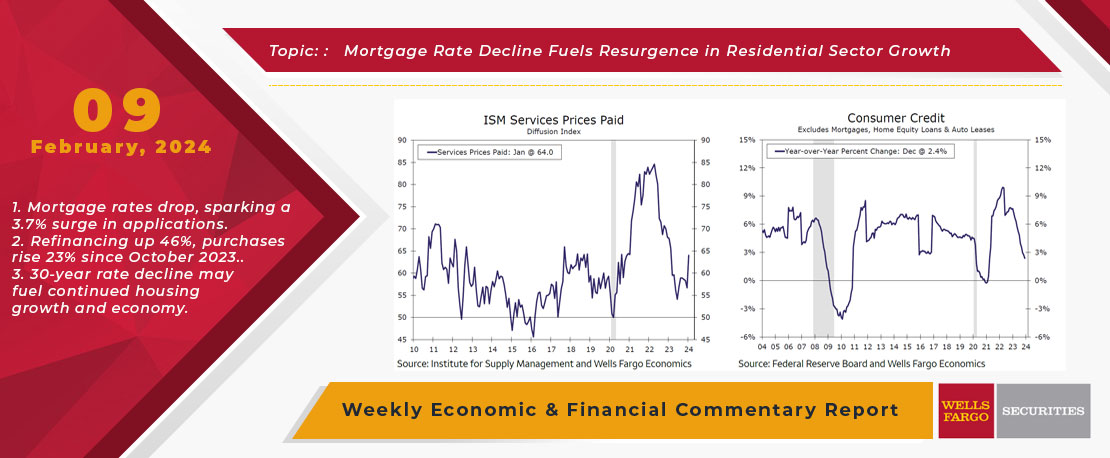

This Week's State Of The Economy - What Is Ahead? - 09 February 2024

Real Estate Articles / Feb 14, 2024

The ISM services index shot higher into expansion territory during January, which is the latest piece of evidence that economic growth is still firmly in positive territory.

Extending a Warm Welcome to Savings for All Property OWNER

Real Estate Articles / Oct 27, 2023

Texas\' Landmark Property Tax Reform: Securing Affordable and Sustainable Homeownership for Texans, Envisioning Average Yearly Savings of $1,300.

What developers are saying about the 2023 real estate market

Real Estate Articles / Apr 26, 2023

The 2023 market condition,specifically commercial real estate development and construction industry is set for significant growth and innovation. Developers are saying that recession may be mild, and many growth and investment opportunities\'ll arise.

Industrial development on the rise in Texas real estate 2023

Real Estate Articles / Apr 04, 2023

Texas has become a place of choice for businesses because of its growing population. This growth has led to increased demand for commercial real estate development, specifically industrial development. This rise is set to continue until the end of 23

The Ultimate List of Real Estate Terms

Real Estate Articles / Feb 25, 2022

We have compiled a list of top real estate words you need to know whether you are a real estate agent or are looking to buy a house or buy a commercial property. This is the real estate lingo you should know.