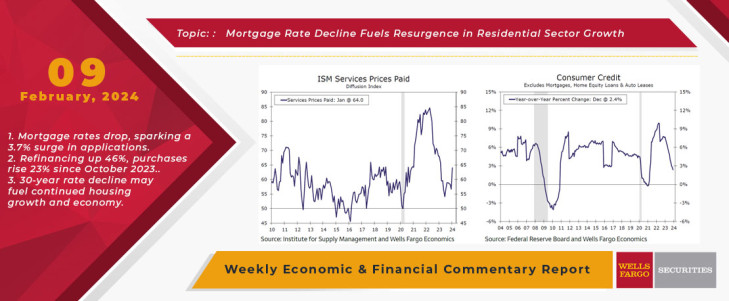

It was an unusually light week in terms of economic indicators. With only a trickle of incoming data, the ISM Services index was in the spotlight. In short, the service sector started the year off on a high note. In January, the headline index jumped to a reading of 53.4, up from 50.5 in December. The surprisingly strong upturn is evidence that service sector activity is still running at a fairly solid pace, despite markedly higher interest rates intended to cool inflation by slowing down overall economic growth. The overall resilience in services largely looks owed to consumers and businesses gradually returning to pre-pandemic spending behaviors, such as going on vacation and attending concerts or business conferences.

Most of the ISM's major underlying components improved during January. The new orders component posted a solid gain, while the employment component rebounded strongly and rose 6.7 points to 50.5 during the month, just above the 50-line designating expansion. On balance, hiring in the service sector has been hovering around break-even for some time, which is consistent with the loss in job growth breadth exhibited in recent months in the nonfarm payroll report. Nevertheless, the upturn in ISM employment suggests a broader swath of service firms increased hiring to start the year.

All told, the broad-based improvement in ISM services is the latest piece of evidence that overall economic growth is still firmly in positive territory. A sharp rise in the prices paid subindex, however, shows that inflation pressures have yet to be fully extinguished. The prices paid component jumped to 64.0 in January from 56.7 in December, marking the largest monthly percentage gain since August 2012. Notably, the majority of industries reported a rise in prices paid, with the agriculture industry being the only one to report a decrease. Overall, the increase in services prices paid serves as a reminder that the risks to the inflation are still skewed to the hot-side, given the relatively strong pace of economic growth registered recently. As we wrote in our macroeconomic forecast update for February, we continue to believe that the Fed will remain patient over the next several months and expect the FOMC to commence with a rate-cutting cycle at the May meeting.

The remarkably resilient pace of economic growth recently largely can be chalked up to an unflagging pace of consumer spending. The surprising strength of the consumer begs the question: To what extent are households using credit to fuel their spending habits? In December, consumer borrowing increased to a record $5.01 trillion. However, the absolute change in outstanding credit amounted to $1.6 billion, well below the Bloomberg consensus and the smallest gain in four months. For context, total consumer borrowing surged by $23.5 billion in November as the holiday shopping season got under way. December's smaller-than-expected gain occurred as revolving credit, which is mostly credit cards, rose $1.0 billion, and non-revolving credit increased nearly $520 million. Through the monthly volatility, consumer borrowing has downshifted as interest rates have moved higher. In 2023 as a whole, consumer credit increased 2.4%, down from a 7.6% gain in 2022. Revolving and non-revolving credit rose 8.4% and 0.4%, respectively.

Although higher interest rates should continue to weigh on consumer borrowing, sturdy income growth as a result of a strong labor market should help maintain a solid pace of consumer spending in the year ahead. On the heels of last week's stellar jobs report for January, another low reading on initial jobless claims indicates that a meaningful erosion in the labor market's momentum is not yet under way. During the week ending February 3, initial jobless claims declined to 218K, while continuing claims fell to 1.87 million in the week ending January 27. On balance, claims remain low, which suggests that layoffs are not intensifying and that those who find themselves on the job market are not staying there for long.

Elsewhere, the recent leg lower in mortgage rates looks to be breathing new life into the residential sector. Total mortgage applications rose 3.7% in the week ending February 2. Mortgage applications are highly volatile on a weekly basis, yet an improving trend has been evident for the past several months. Since October 2023, refinancing applications have risen 46%, while purchase applications are up 23%. The increase coincides with the 30-year mortgage rate falling from 7.8% last October to an average of 6.6% so far in 2024. Should mortgage rates continue to gradually decline as we currently expect, then housing activity will likely continue to climb higher and be supportive of economic growth in the year ahead.

Reviving Campus Spaces: Adaptive Reuse Solutions for Modern Education

Real Estate Articles / Jan 26, 2024

Transformative Real Estate: Navigating the Evolution of College Campuses through Adaptive Reuse and Strategic Solutions

Navigating Challenges in Affordable Housing Finance: Strategies for Developers

Real Estate Articles / Dec 08, 2023

Developers in the affordable housing sector face unprecedented challenges in financing that are primarily revolving around construction-related hurdles.

How is crypto and blockchain changing real estate business and money making?

Real Estate Articles / Oct 14, 2022

Cryptocurrency and blockchain technology is changing the real estate business in many ways. Real estate investing has started shifting to a digital and virtual space slowly.

Why Grocery-Anchored Real Estate Does Better!

Real Estate Articles / Feb 22, 2023

Grocery-anchored shopping centers are on the rise in the retail sector. They are the best investment in commercial real estate. It is low risk and long term.

Navigating the Changing Tides of Net Lease Investments

Real Estate Articles / Jul 01, 2024

Net lease property market adjusts to rising interest rates: Sales volume down, cap rates up. Financing challenges stymie development and acquisitions.

2023 Market Predictions in Commercial Real Estate

Real Estate Articles / Dec 28, 2022

2023 commercial real estate predictions are here. Find out which is the best investment opportunities are best for you. Make money with commercial real estate.

Not All Industrial Real Estate Is The Same

Real Estate Articles / Jun 25, 2023

Industrial real estate includes manufacturing, logistics, and flex or R&D buildings. Find out which of these real estate investments is the most profitable for you.

Rise In Population Is Causing This Real Estate Phenomenon To Take Place In Cypress, Texas!

Real Estate Articles / May 20, 2023

Population rise causes a rise in need for medical institutes, hospitals and other commercial real estate in Cypress, Texas.

Transforming Houston: Council Greenlights Progressive Changes for Affordable Housing and Pedestrian

Real Estate Articles / Nov 23, 2023

Revolutionizing Houston\'s Housing Landscape: City Council Approves Sweeping Changes for Affordable Housing and Pedestrian Safety

Tesla moves to Texas - Impact on real estate and economy

Real Estate Articles / Jan 27, 2022

2021 was a big year for real estate in many ways, but the biggest news of the year came towards the end of it when billionaire magnate, Elon Musk announced his move from California to Texas.