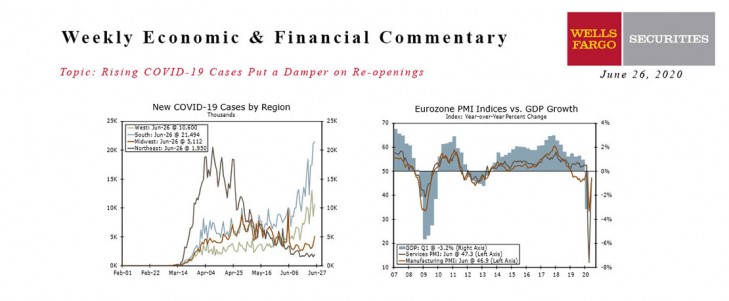

U.S. - Rising COVID-19 Cases Put a Damper on Re-openings

- The rising number of COVID-19 infections gained momentum this week, with most of the rise occurring in the South and West. The rise in infections is larger than can be explained by increased testing alone and is slowing re-openings.

- Home sales continue to show a surprising degree of resilience. New home sales rose 16.6% in May and mortgage applications for the purchase of a home are up 18% year-to-year.

- Factory orders rebounded in May. Manufacturers appear to have solid momentum headed into the summer. Demand for light vehicles has been surprisingly robust.

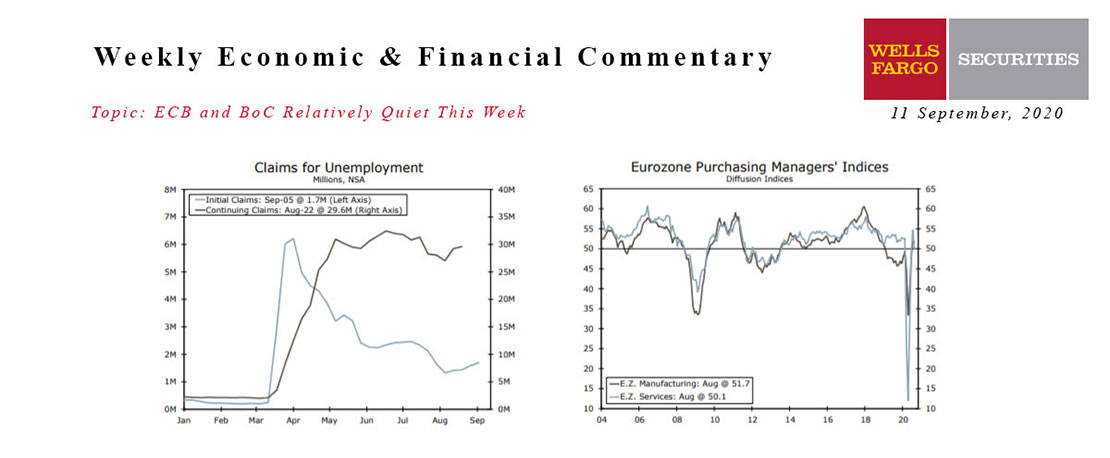

Global - Hope Springs, But Will it be Eternal?

- The news from Europe was encouraging this week, with PMI surveys for the Eurozone and United Kingdom rebounding, particularly for the service sector. The prospects of a faster Eurozone recovery are perhaps improving given aggressive monetary easing and hopes for a more coordinated regional fiscal response. In the U.K., Brexit uncertainties may remain a headwind for the speed of economic recovery.

- Mexico’s central bank cut rates 50 bps to 5.00%, saying growth risks moved sharply to the downside while inflation risks were somewhat more balanced. We expect further easing from the Bank of Mexico in the months ahead.

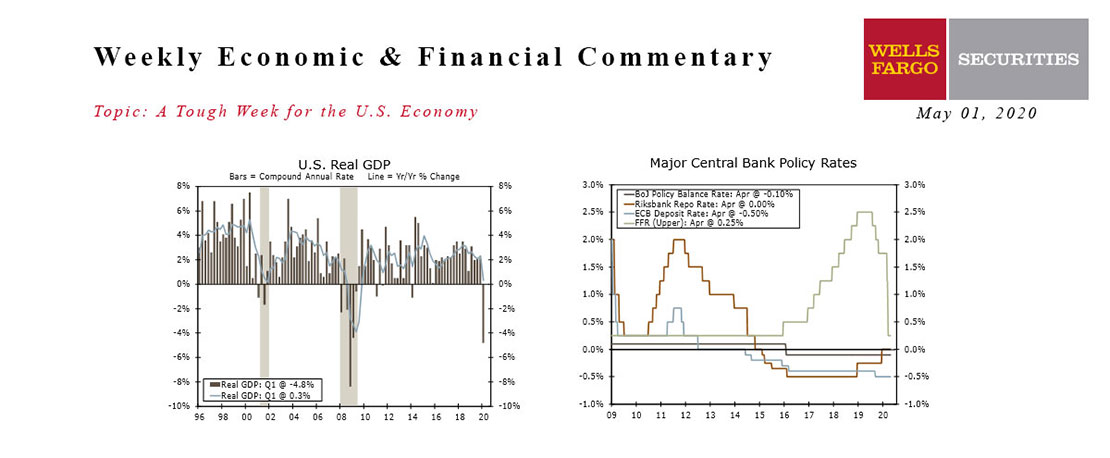

This Week's State Of The Economy - What Is Ahead? - 01 May 2020

Wells Fargo Economics & Financial Report / May 04, 2020

U.S. GDP declined at an annualized rate of 4.8% in the first quarter, only a hint of what is to come in the second quarter.

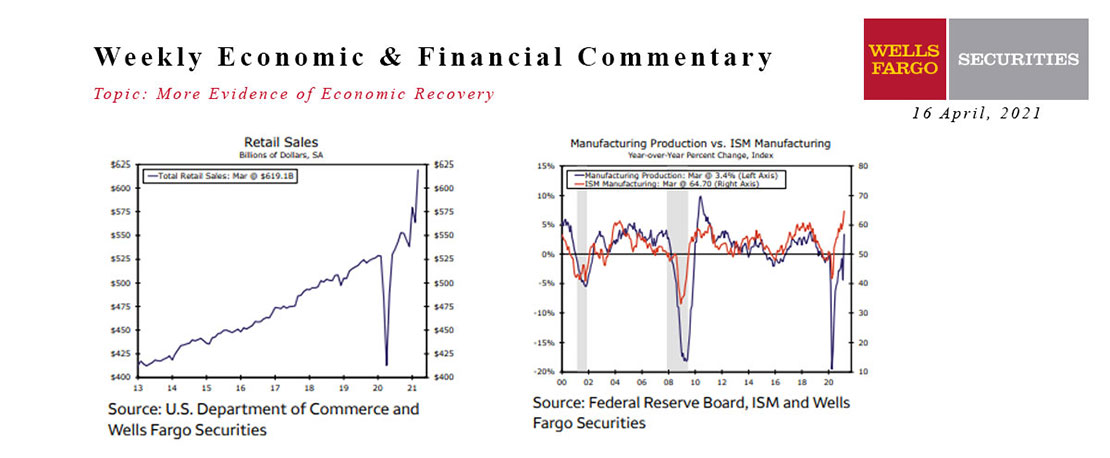

This Week's State Of The Economy - What Is Ahead? - 16 April 2021

Wells Fargo Economics & Financial Report / Apr 17, 2021

Data released this week continue to show that the economic recovery has gained momentum in March. The much anticipated consumer boom has arrived.

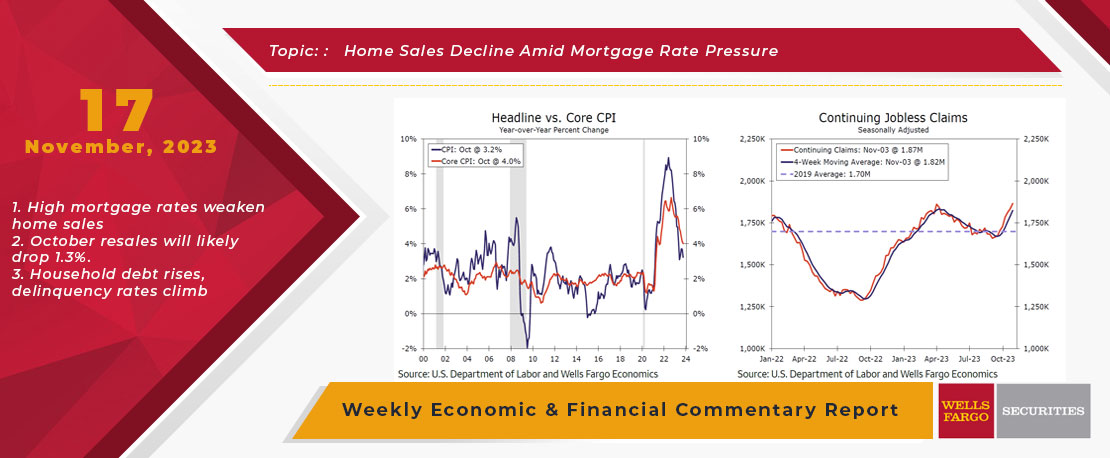

This Week's State Of The Economy - What Is Ahead? - 17 November 2023

Wells Fargo Economics & Financial Report / Nov 23, 2023

Retail and Industrial activity were stronger than the headline data suggest, there are also some signs of weakening.

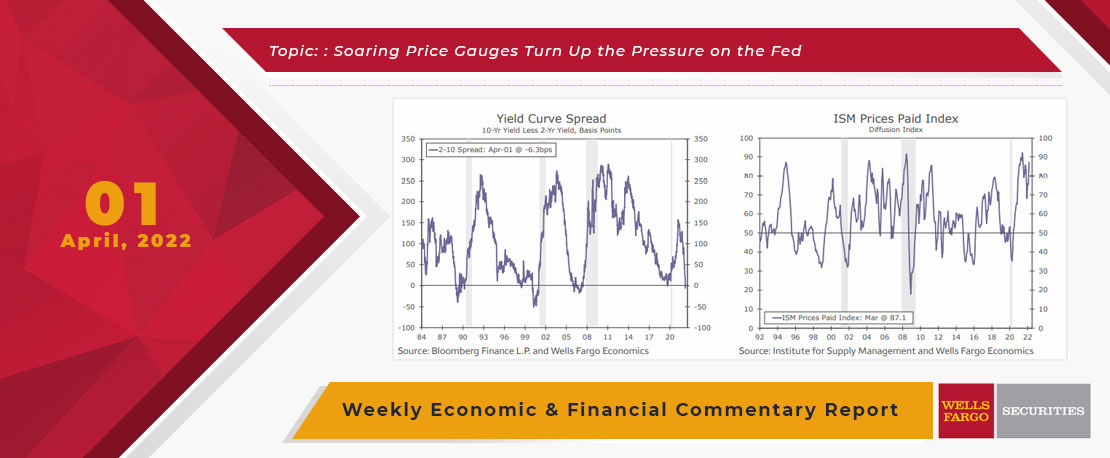

This Week's State Of The Economy - What Is Ahead? - 01 April 2022

Wells Fargo Economics & Financial Report / Apr 05, 2022

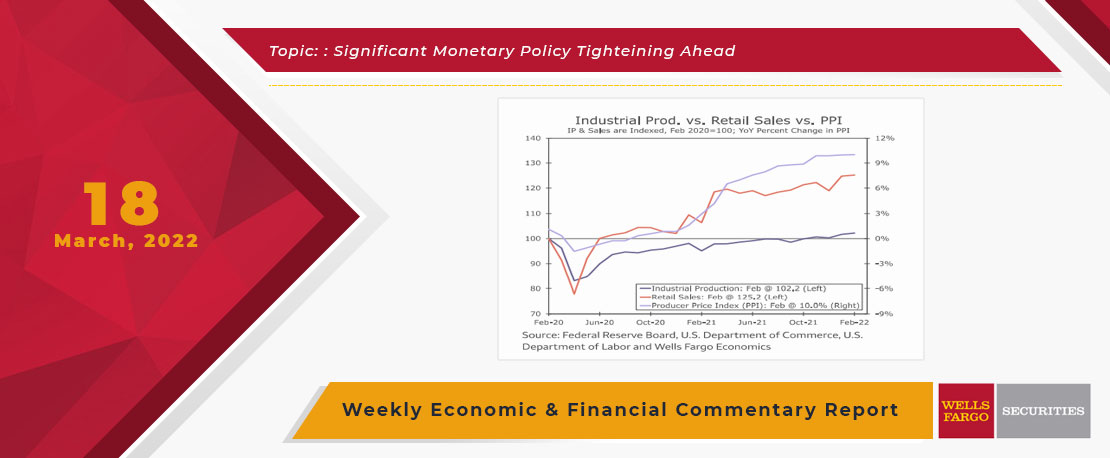

The key factor that will drive interest rates is the Fed’s belated effort to rein-in inflation.

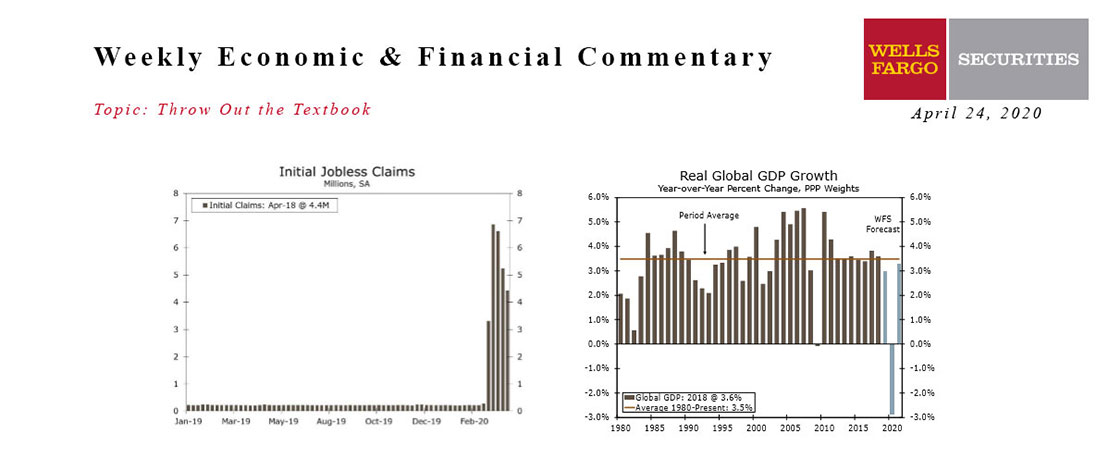

This Week's State Of The Economy - What Is Ahead? - 24 April 2020

Wells Fargo Economics & Financial Report / Apr 27, 2020

Oil prices went negative for the first time in history on Monday as the evaporation of demand collided with a supply glut. In the past five weeks, 26.5 million people have filed for unemployment insurance, or more than one out of every seven workers.

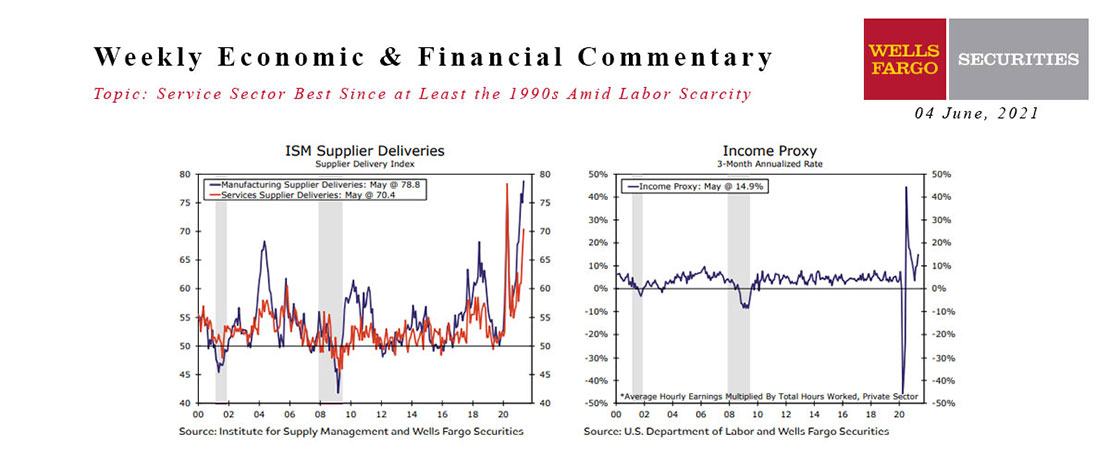

This Week's State Of The Economy - What Is Ahead? - 04 June 2021

Wells Fargo Economics & Financial Report / Jun 08, 2021

The CDC\'s relaxation of its mask mandate occurred mid-May, and as data for that month begins rolling in this week, it is evident there is no lack of demand. Supplies, on the other hand, are a worsening problem.

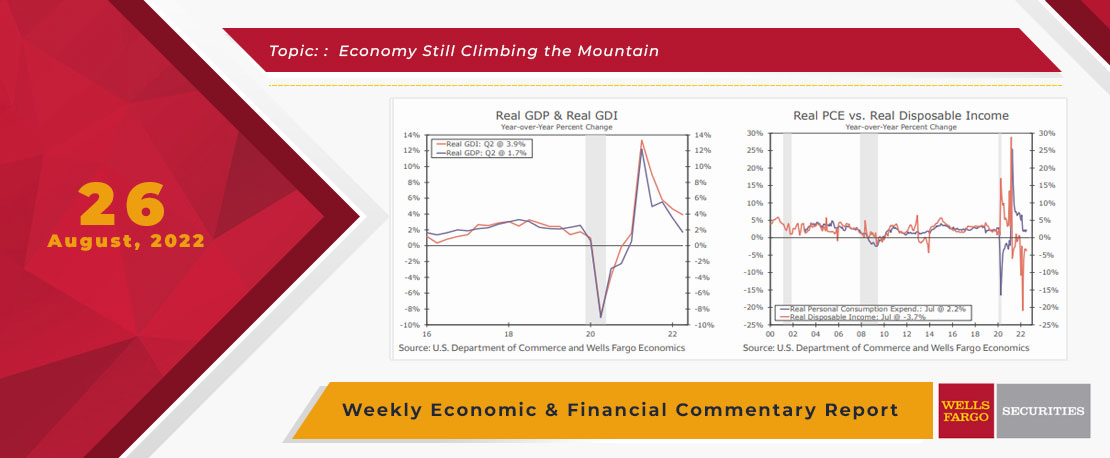

This Week's State Of The Economy - What Is Ahead? - 26August 2022

Wells Fargo Economics & Financial Report / Aug 29, 2022

I can understand how the opportunity to participate in lots of scintillating economic policy discussions could make fishing look exciting in comparison.

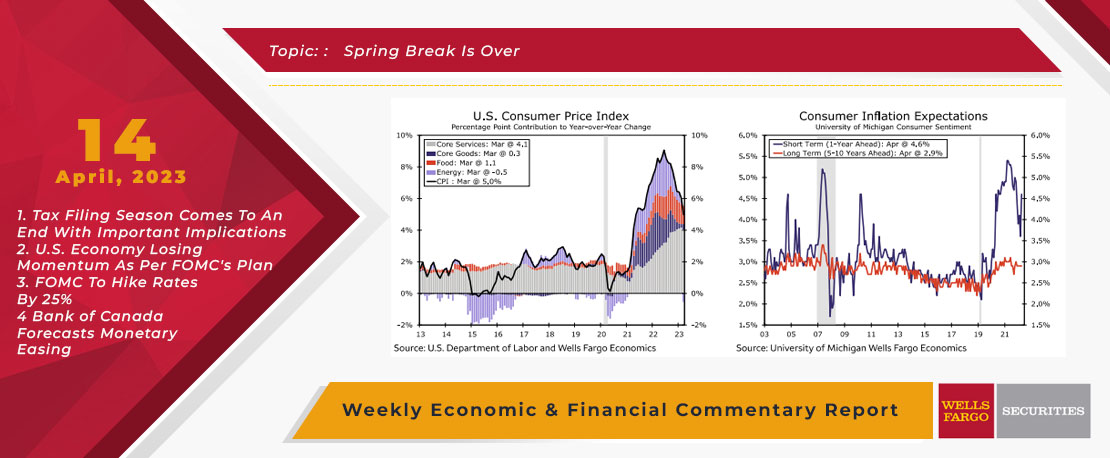

This Week's State Of The Economy - What Is Ahead? - 14 April 2023

Wells Fargo Economics & Financial Report / Apr 20, 2023

In March retail sales fell 1.0%, manufacturing production slipped 0.5% and the consumer price index rose a modest 0.1%.

This Week's State Of The Economy - What Is Ahead? - 18 March 2022

Wells Fargo Economics & Financial Report / Mar 21, 2022

it was a big week for economic news as the Astros allowed the TWINS of all teams to sign Carlos Correa to the type of short-term deal that the Astros have historically been open to.

This Week's State Of The Economy - What Is Ahead? - 11 September 2020

Wells Fargo Economics & Financial Report / Sep 14, 2020

In the holiday-shortened week, analysts’ attention remained on the progress of the labor market. Recent jobless claims data remain stubbornly high and point to a slowing jobs rebound.