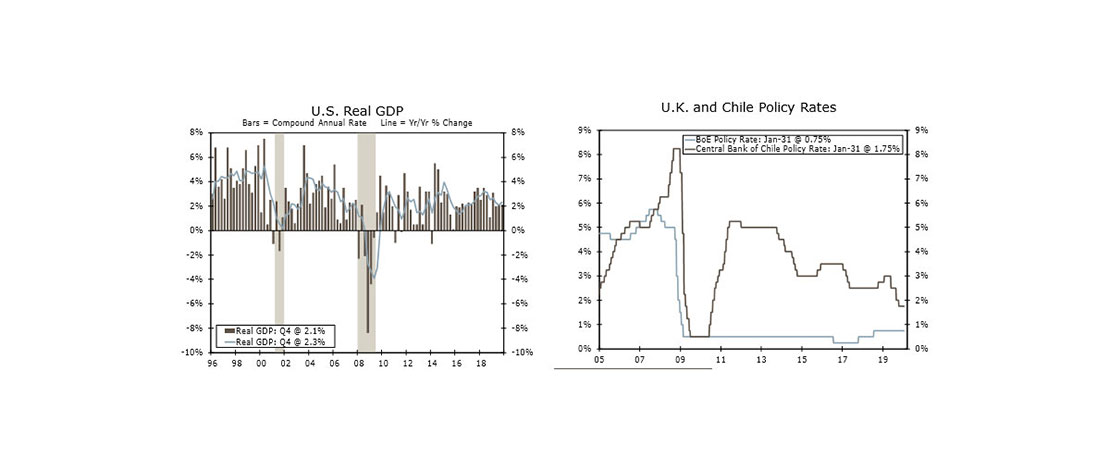

nflation in the U.K. receded for the third straight month in January, with the headline rate coming in lower than expected at 10.1% year-over-year. The biggest upward contributions to the headline rate came from household energy and food prices. Excluding those more volatile factors, core CPI fell to 5.8% year-over-year. Given that headline inflation is still five times the Bank of England's (BoE) 2% target, the central bankraised its policy rate 50 bps to 4.00% at its February meeting and signaled further monetary tightening ahead. Against this backdrop, we forecast a final 25 bps rate increase at the BoE's March meeting. Inflation slowing more sharply than expectations also reinforces the view that an end to BoE rate hikes is in sight, especially against a backdrop of underwhelming U.K. economic activity. We expect the policy rate to remain at 4.25% through late 2023, before the BoE begins cutting rates in Q4 of this year.

Elsewhere, Japan's economy experienced a somewhat uneven growth path in 2022, bouncing back and forth between expansion and contraction. While it ended on a positive note, Japan's Q4 GDP data release showed that the economy grew less than expected. More specifically, GDP rebounded 0.2% quarter-over-quarter in Q4 after a negative print in Q3. The underlying details of the report reflected mixed sector trends, with private consumption rising 0.5% quarter-over-quarter but business spending falling 0.5%. We expect these mixed economic trends to flow through to this year, altogether expecting growth in Japan to average a moderate 1.3% in 2023, essentially unchanged from last year. At the same time, inflation appears to be trending higher. In December, nationwide headline CPI reached 4% year-over-year, and while more contained compared to its global peers, this is quite elevated compared to Japan’s recent history. Only moderate growth combined with rising inflation pressures adds to the Bank of Japan's (BoJ) dilemma of if and when it should begin to tighten monetary policy, especially with a new BoJ governor on the way. While our base case is for no change in policy settings this year, we will be closely watching for any signals that the BoJ is ready to move away from easy monetary policy.

Down under in Australia, labor trends continued to soften in January. The job market failed to regain its footing last month, with employment declining for the second month in a row. Although consensus expectations were for a 20,000-job gain, employment actually fell by 11,500. Notably in contrast to the December jobs report, this drop in employment was completely due to a decline in full-time employment (-43,300), while part-time employment increased (+31,800). Other parts of Australia's economy also experienced some softness late last year, but we believe this soft patch is temporary and do not forecast Australia to fall into recession this year, nor do we expect slower growth to prevent the Reserve Bank of Australia (RBA) from continuing to tighten monetary policy in order to bring down inflation.

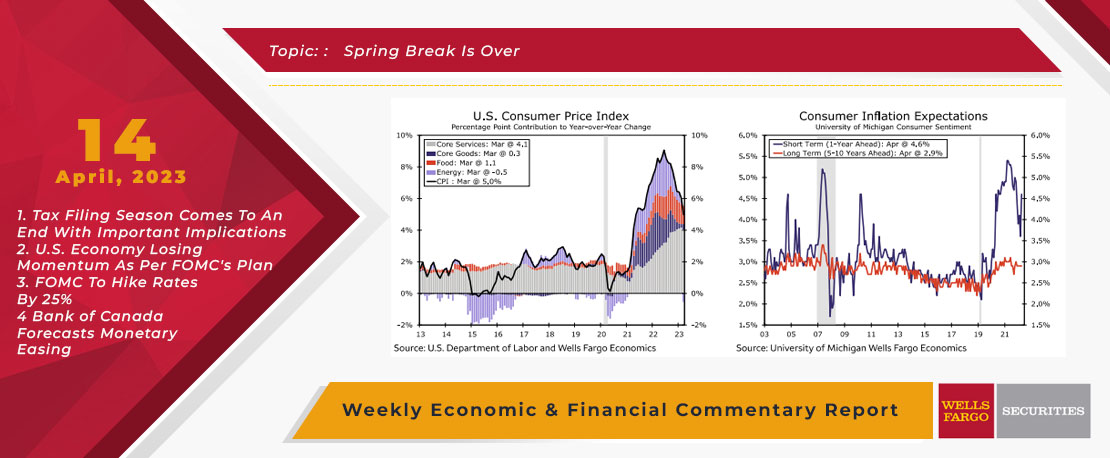

This Week's State Of The Economy - What Is Ahead? - 14 April 2023

Wells Fargo Economics & Financial Report / Apr 20, 2023

In March retail sales fell 1.0%, manufacturing production slipped 0.5% and the consumer price index rose a modest 0.1%.

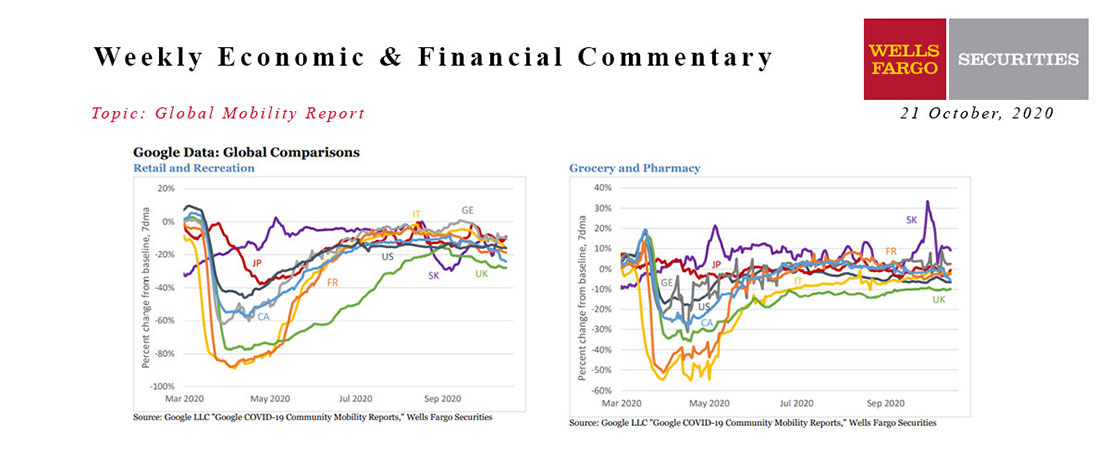

This Week's State Of The Economy - What Is Ahead? - 21 October 2020

Wells Fargo Economics & Financial Report / Oct 21, 2020

Mobility is continuing to trickle lower in several major developed market economies. The U.K., France, Italy and Canada have all seen some further modest declines in retail/recreation visits.

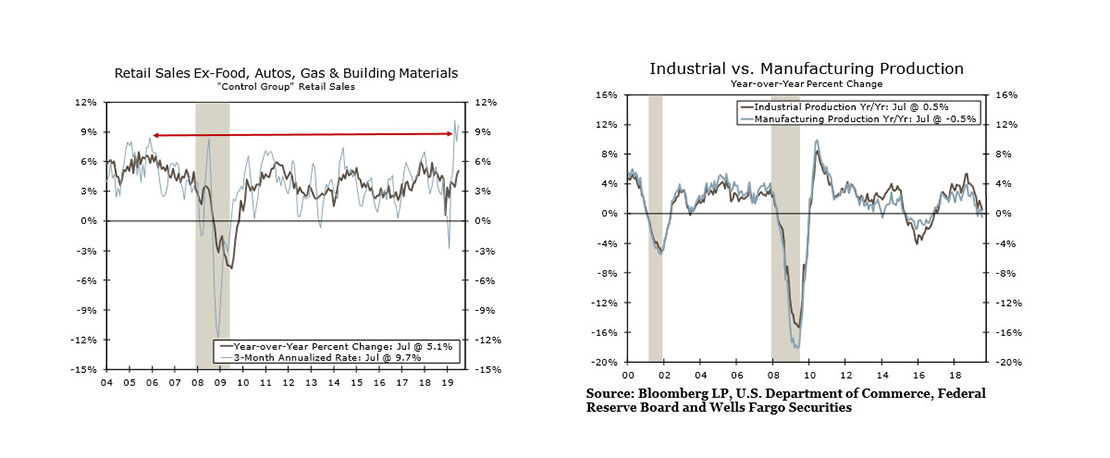

This Week's State Of The Economy - What Is Ahead? - 16 August 2019

Wells Fargo Economics & Financial Report / Aug 17, 2019

Markets gyrated this week as the spread between the ten- and two-year Treasury\'s turned negative for the first time since 2007. Financial markets seem to expect that the sharp slowdown in growth overseas will soon spread to the United States.

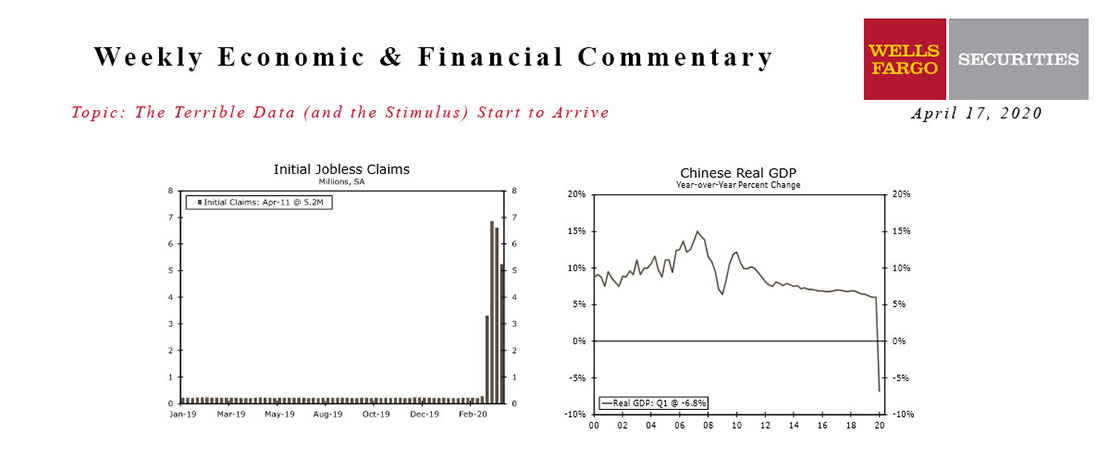

This Week's State Of The Economy - What Is Ahead? - 17 April 2020

Wells Fargo Economics & Financial Report / Apr 18, 2020

Economic data from the early stages of the Great Shutdown have finally arrived, and they are as bad as feared. ‘Worst on record’ is about to become an all too common refrain in our commentary.

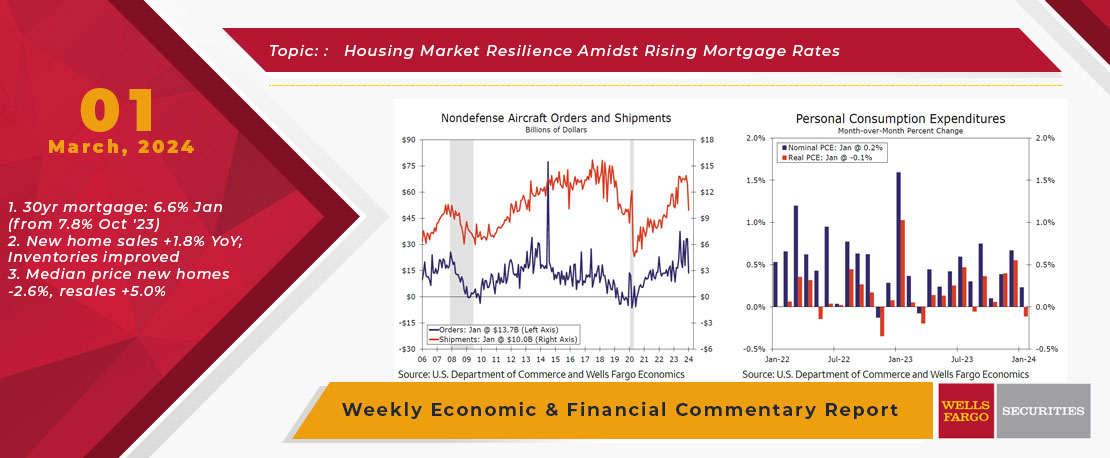

This Week's State Of The Economy - What Is Ahead? - 01 March 2024

Wells Fargo Economics & Financial Report / Mar 05, 2024

Economic data were downbeat this week, as downward revisions took some of the shine out of the marquee headline numbers. Despite the somewhat weak start to Q1, economic growth continues to trek along.

This Week's State Of The Economy - What Is Ahead? - 31 January 2020

Wells Fargo Economics & Financial Report / Feb 01, 2020

Mexico’s economy has slowed notably over the last year, with the economy contracting again in Q4, indicating a full-year contraction for 2019.

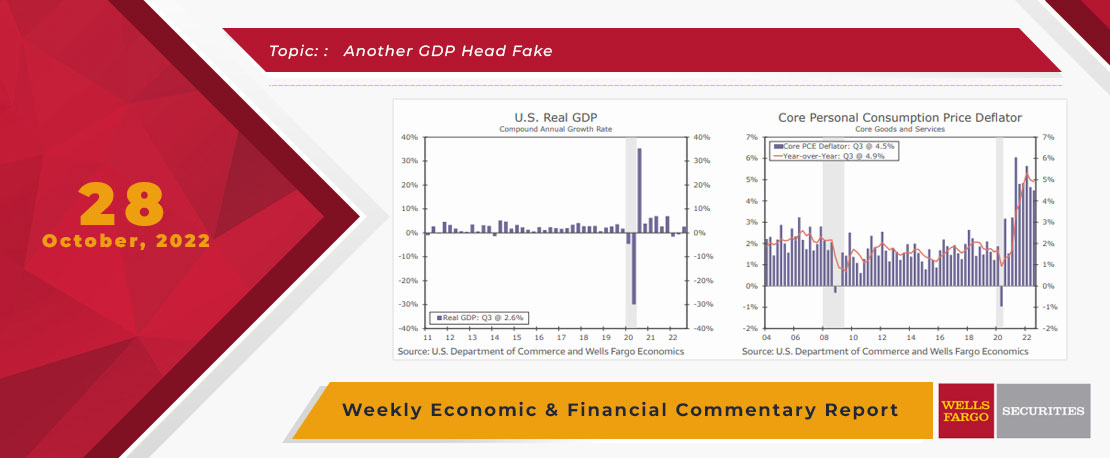

This Week's State Of The Economy - What Is Ahead? - 28 October 2022

Wells Fargo Economics & Financial Report / Oct 31, 2022

Headline GDP continues to send mixed signals on the direction of the U.S. economy. During Q3, real GDP rose at a 2.6% annualized rate, ending the recent string of quarterly declines in growth registered in the first half of 2022.

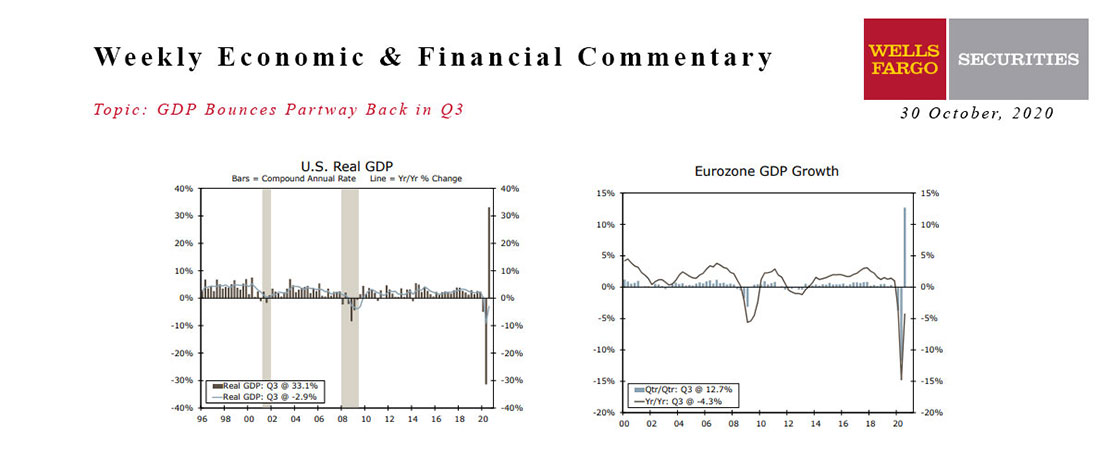

This Week's State Of The Economy - What Is Ahead? - 30 October 2020

Wells Fargo Economics & Financial Report / Oct 27, 2020

Real GDP jumped a record 33.1% during Q3, beating expectations. A 40.7% surge in consumer spending drove the gain.

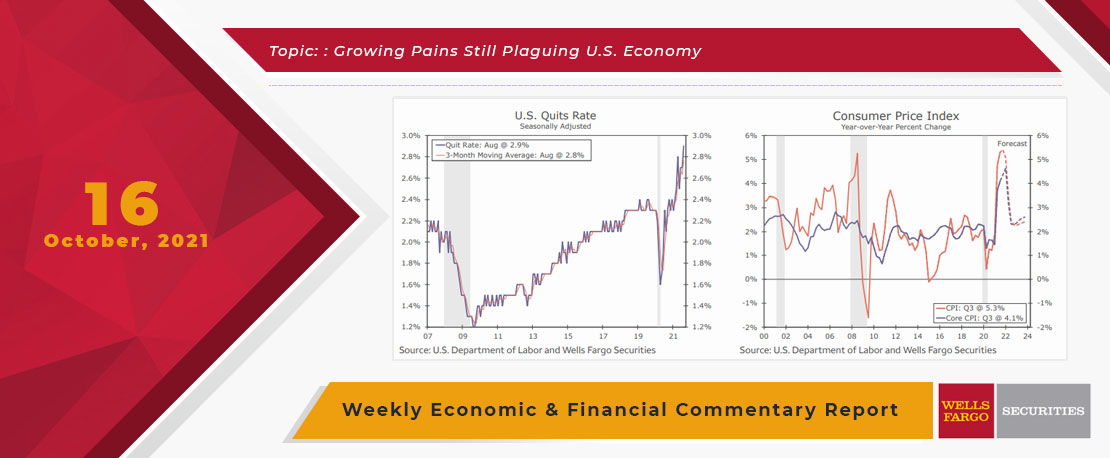

This Week's State Of The Economy - What Is Ahead? - 16 October 2021

Wells Fargo Economics & Financial Report / Oct 22, 2021

The first economic data released this week in the United States reinforced the theme that labor supply and demand are struggling to come into balance.

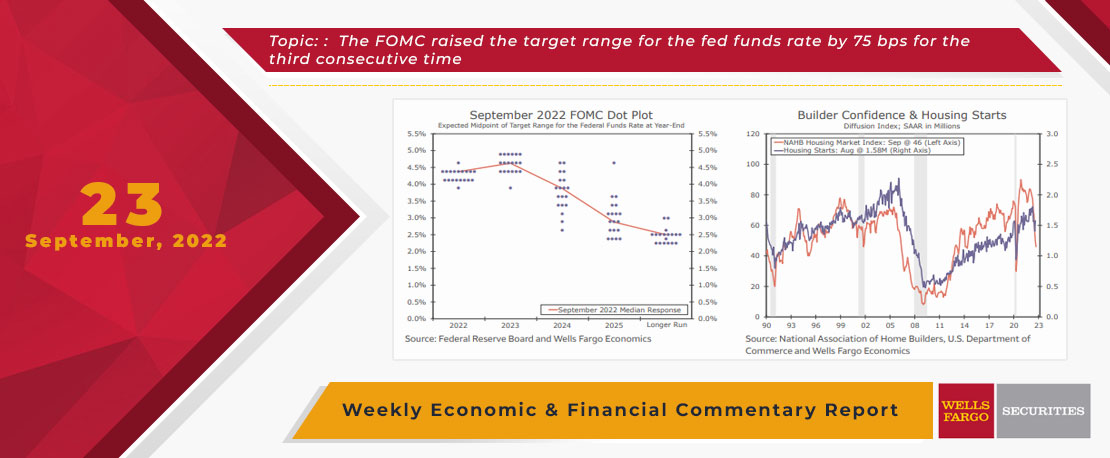

This Week's State Of The Economy - What Is Ahead? - 23 September 2022

Wells Fargo Economics & Financial Report / Sep 27, 2022

The FOMC raised the target range for the fed funds rate by 75 bps for the third consecutive time. The housing market continues to buckle under the pressure of higher mortgage rates.