Wednesday's FOMC rate decision was the headline economic news this week. As widely expected, the Committee raised the target range for the fed funds rate by 75 bps for the third consecutive time. Updated forecasts were released as well, with inflation expected to remain well above the Fed's 2% target for longer than previously published in June. As such, the median projection for the year-end fed funds rate rose a full percentage point (pp) for 2022 and increased 0.8pp for 2023. Real GDP growth projections were also slashed for this year and next, while unemployment is expected to be higher. On balance, the meeting underpinned the FOMC's firm commitment to do whatever it takes to bring inflation back down to earth. See Interest Rate Watch for more detail.

The rapid rise in the fed funds rate (the upper bound sits at 3.25%) has put pressure on interest-rate sensitive sectors. Housing, in particular, has faltered as mortgage rates have climbed. The NAHB/Wells Fargo Housing Market Index (HMI), a measurement of home builder sentiment, slid three points to 46 in September—the ninth straight monthly decline. Notably, an HMI reading below 50 indicates that more builders report conditions as "poor" than those who see conditions as "good."

The skid in builder sentiment mirrors the trend decline in home construction. Total housing starts surprised to the upside in August, increasing 12.2% over the month. Single-family starts rose 3.4% and multifamily starts increased 28%. Improving supply chain conditions likely increased building material availability during the month, allowing builders to move forward with projects already in the pipeline. Meanwhile, building permits, a forward-looking indicator that leads housing starts by a couple of months, plummeted 10% in August. The drop in permits reflects the ongoing trend of builders tapping the brakes on construction in response to weaker demand and rising financing costs.

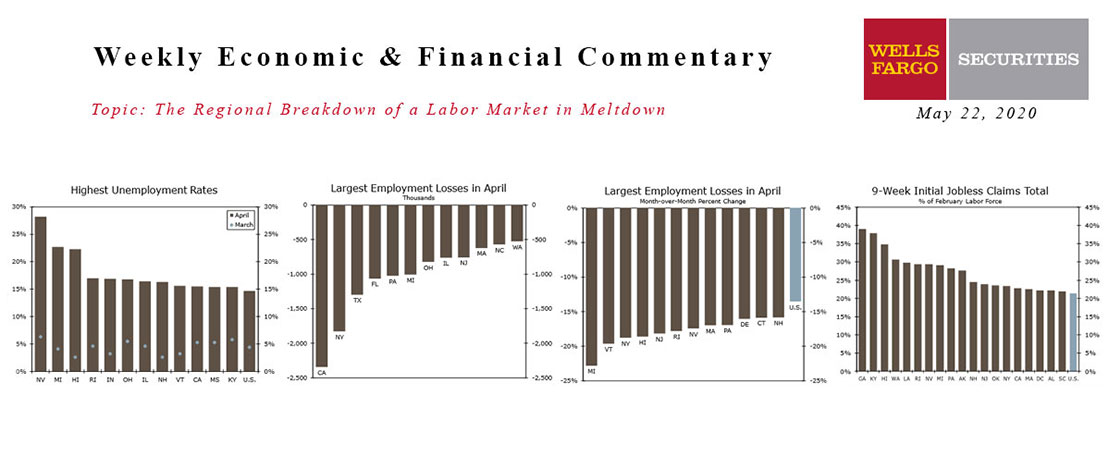

The Regional Breakdown Of A Labor Market In Meltdown

Wells Fargo Economics & Financial Report / May 26, 2020

Employment fell in all 50 states and 43 states saw their unemployment rate rise to a record in April. The damage is already hard to fathom-a 28% unemployment rate in Nevada and still another month of job losses ahead.

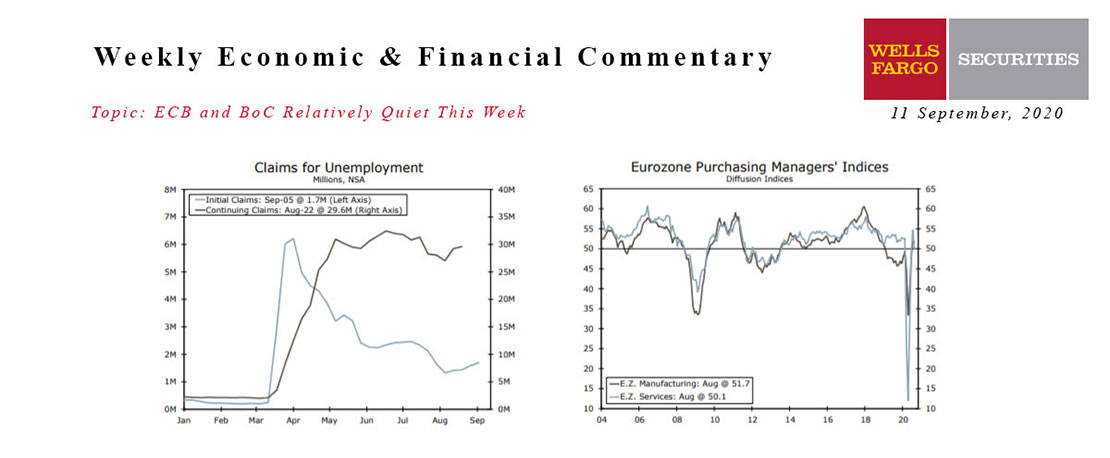

This Week's State Of The Economy - What Is Ahead? - 11 September 2020

Wells Fargo Economics & Financial Report / Sep 14, 2020

In the holiday-shortened week, analysts’ attention remained on the progress of the labor market. Recent jobless claims data remain stubbornly high and point to a slowing jobs rebound.

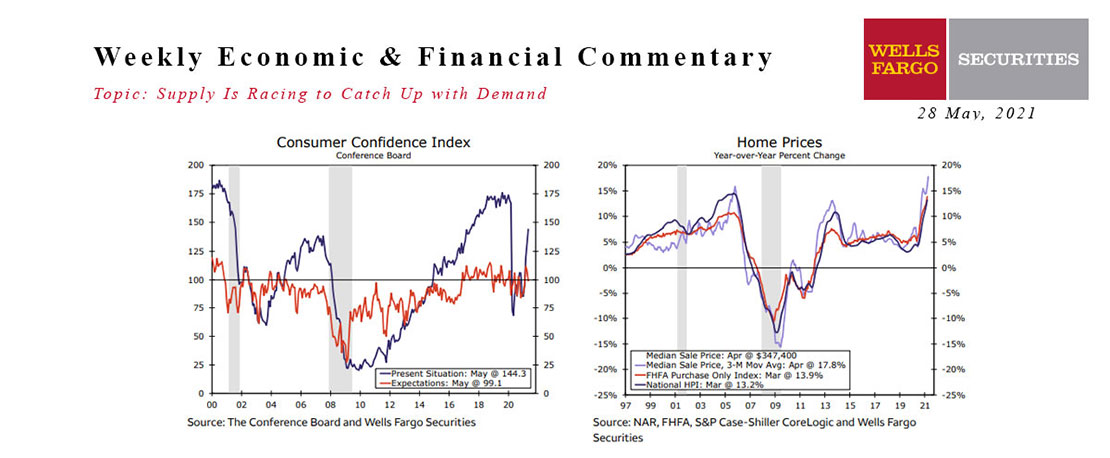

This Week's State Of The Economy - What Is Ahead? - 28 May 2021

Wells Fargo Economics & Financial Report / Jun 08, 2021

This week\'s light calendar of economic reports showed supply chain disruptions tugging a little at economic growth.

This Week's State Of The Economy - What Is Ahead? - 31 May 2024

Wells Fargo Economics & Financial Report / Jun 04, 2024

Markets digested a light lineup of economic data on the holiday-shortened week. The second look at first quarter GDP revealed an economy increasingly pressured by high interest rates as headline growth was revised lower.

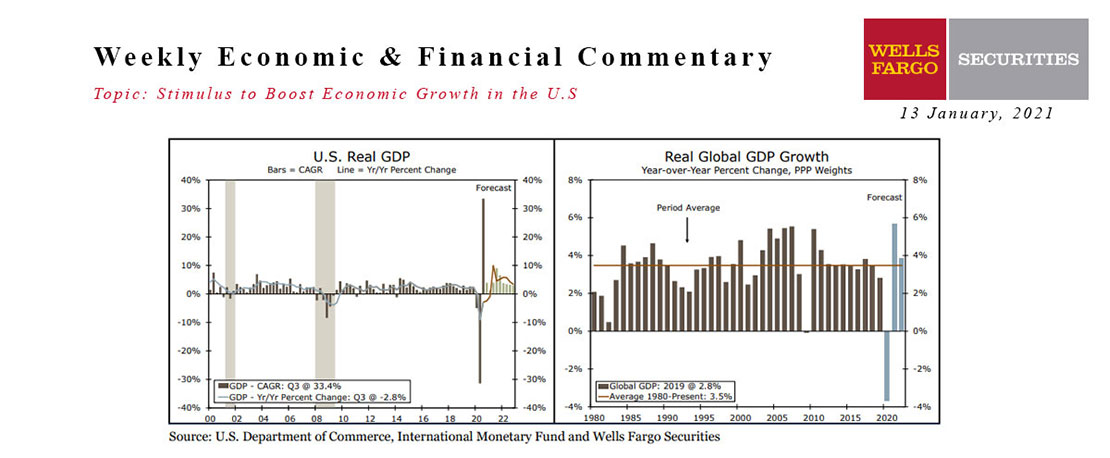

13 January 2021 Monthly Outlook Report

Wells Fargo Economics & Financial Report / Jan 19, 2021

The U.S. economy appears to be losing some momentum as the calendar turns to 2021 and the public health situation continues to deteriorate.

This Week's State Of The Economy - What Is Ahead? - 14 January 2022

Wells Fargo Economics & Financial Report / Jan 18, 2022

As you may have already seen, inflation is running almost as hot as the stock of our favorite bank. The Consumer Price Index (CPI) rose 7.0% year-over-year in December, the fastest increase in nearly 40 years.

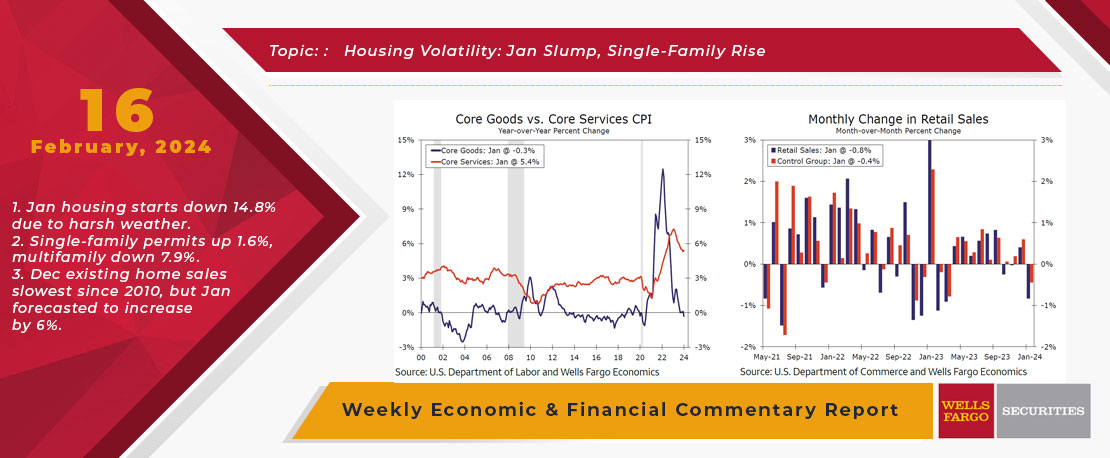

This Week's State Of The Economy - What Is Ahead? - 16 February 2024

Wells Fargo Economics & Financial Report / Feb 20, 2024

The out-of-consensus start to the year for economic data continued with a slip in retail sales and industrial production followed by a startling 14.8% drop in housing starts during January.

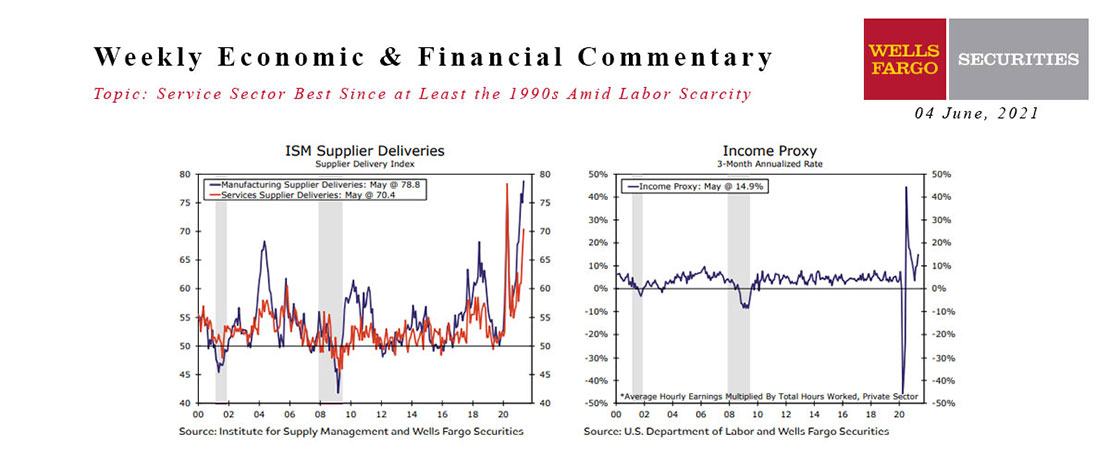

This Week's State Of The Economy - What Is Ahead? - 04 June 2021

Wells Fargo Economics & Financial Report / Jun 08, 2021

The CDC\'s relaxation of its mask mandate occurred mid-May, and as data for that month begins rolling in this week, it is evident there is no lack of demand. Supplies, on the other hand, are a worsening problem.

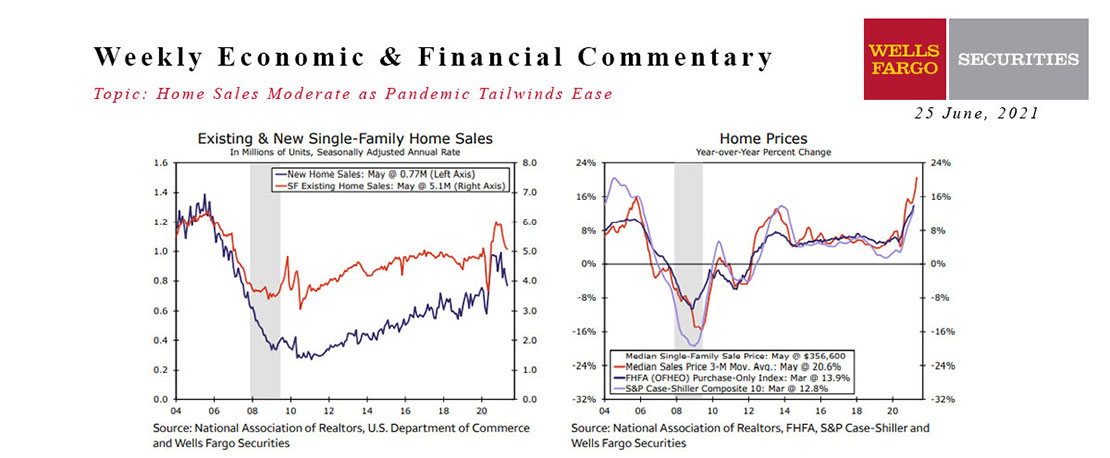

This Week's State Of The Economy - What Is Ahead? - 25 June 2021

Wells Fargo Economics & Financial Report / Jun 26, 2021

Supply chain bottlenecks continue to cause pain-in-the-necks. In spite of all the difficulties, the Economic whizzes in the WF Economics team have upgraded their forecast for full-year 2021 U.S.

This Week's State Of The Economy - What Is Ahead? - 24 January 2020

Wells Fargo Economics & Financial Report / Jan 25, 2020

Fears of an escalating coronavirus outbreak reached the United States this week, as a Washington state man became the first confirmed domestic case and the international total reached more than 800.