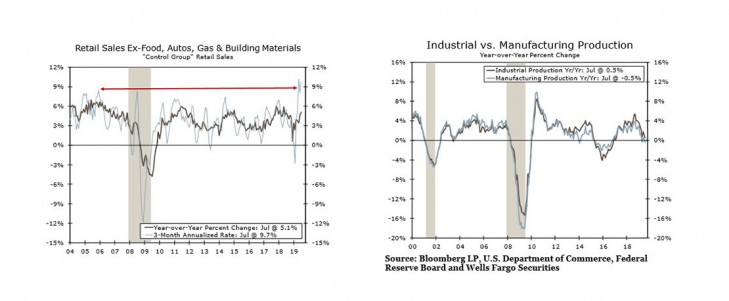

Markets gyrated this week as the spread between the ten- and two-year Treasury's turned negative for the first time since 2007. Financial markets seem to expect that the sharp slowdown in growth overseas will soon spread to the United States. Economic data this week, however, continued to say otherwise. Retail sales again beat expectations, rising 0.7% in July. Sales were boosted by the 2.8% surge at non-store retailers (read: Amazon Prime Day,) but were broad-based. Ten of 13 categories posted increases, while core sales jumped 1.0%. Consumer confidence may get another boost heading into the holiday season on news Tuesday that the administration will delay the imposition of 10% tariffs on approximately $155 billion of imports from China that were scheduled to go into effect September 1. The exempted products electronics, toys, etc... suggest the delay is intended to shield consumers from a tariff-related surge in prices just before the gift-giving season and to shield the administration from political blowback. The consumer which comprises roughly 70% of the economy has been carrying the weight the past few quarters, and to a large extent has avoided much of a spill over from all the trade uncertainty.

This Week's State Of The Economy - What Is Ahead? - 20 March 2020

Wells Fargo Economics & Financial Report / Mar 21, 2020

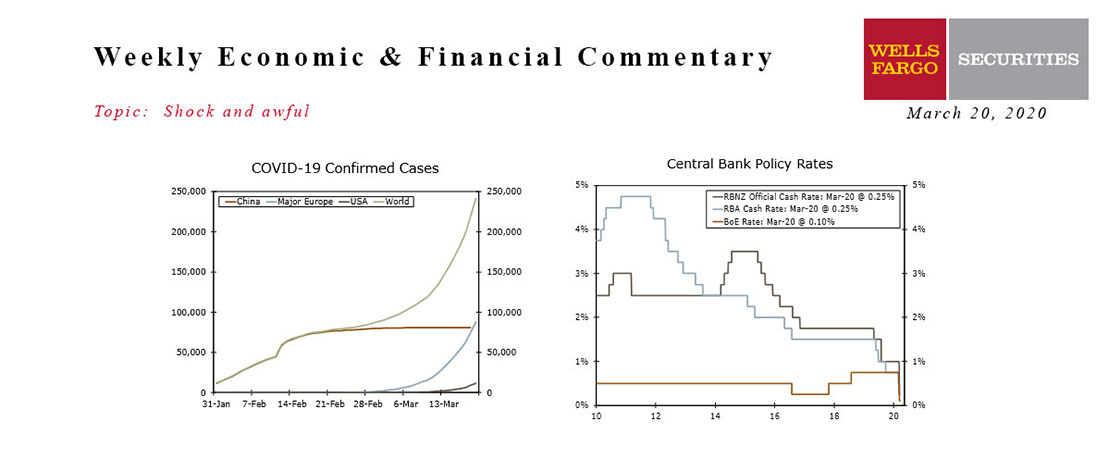

Daily life came to a screeching halt this week as governments, businesses and consumers took drastic steps to halt the COVID-19 pandemic.

This Week's State Of The Economy - What Is Ahead? - 28 June 2024

Wells Fargo Economics & Financial Report / Jul 04, 2024

According to the Federal Reserve\'s preferred gauge, core inflation cooled to its softest pace in more than three years in May against a backdrop of measured consumer spending and still-strong personal income.

This Week's State Of The Economy - What Is Ahead? - 06 August 2021

Wells Fargo Economics & Financial Report / Aug 16, 2021

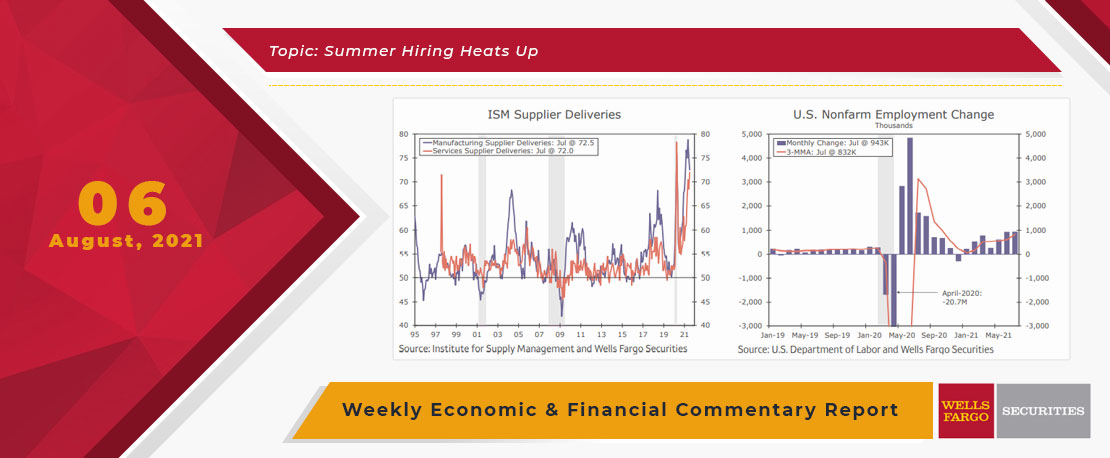

Back to the economy, issues with supply constraints remains a broken-record reference, but data this week highlighted the economy\'s resilience in spite of those continuing problems.

This Week's State Of The Economy - What Is Ahead? - 08 October 2021

Wells Fargo Economics & Financial Report / Oct 15, 2021

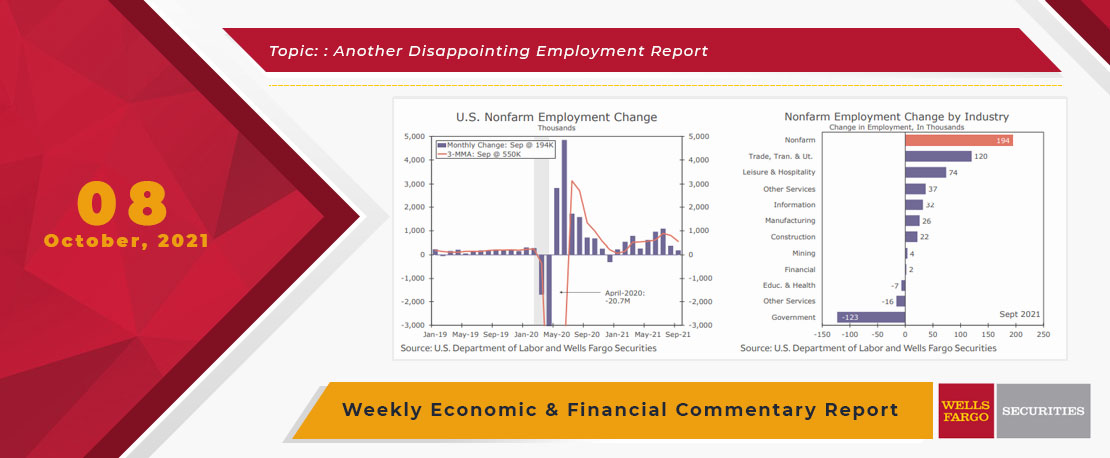

September\'s disappointing employment report clearly takes center stage over this week\'s other economic reports. Nonfarm employment rose by just 194,000 jobs, as employers continue to have trouble finding the workers they need.

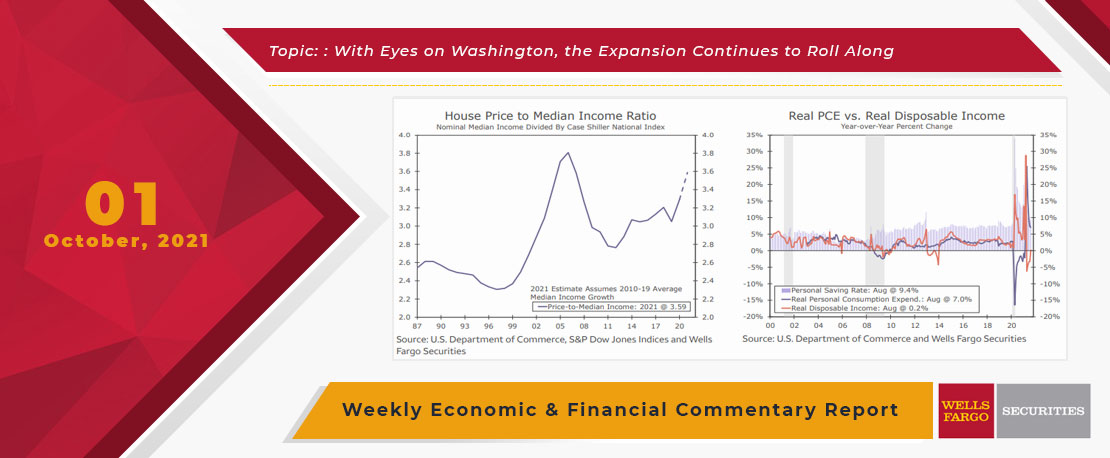

This Week's State Of The Economy - What Is Ahead? - 01 October 2021

Wells Fargo Economics & Financial Report / Oct 10, 2021

Economic data this week indicated that the ongoing expansion still has some momentum despite some familiar headwinds, though this week\'s releases were largely overshadowed by a busy week on Capitol Hill.

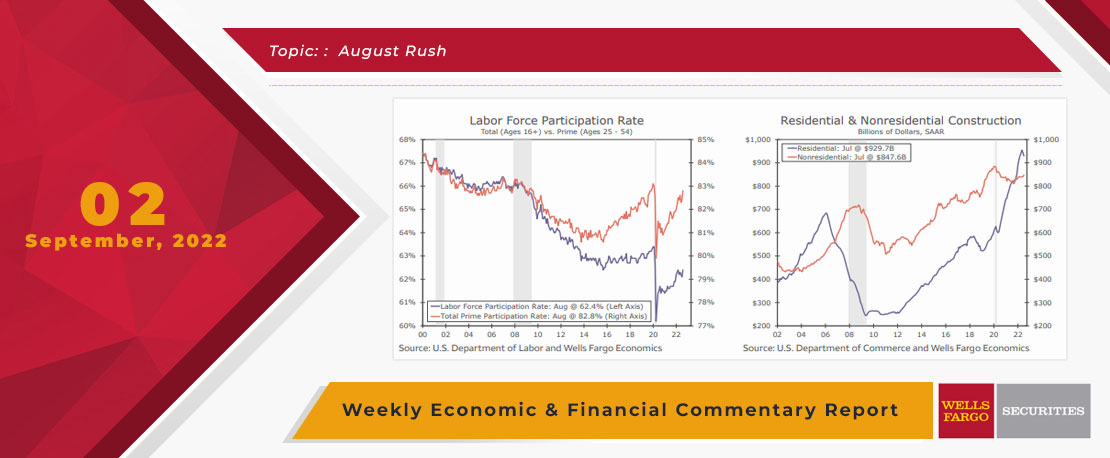

This Week's State Of The Economy - What Is Ahead? - 02 September 2022

Wells Fargo Economics & Financial Report / Sep 05, 2022

More job seekers also lifted the participation rate to 62.4% and thus easing some tightness in the job market even as payrolls expanded.

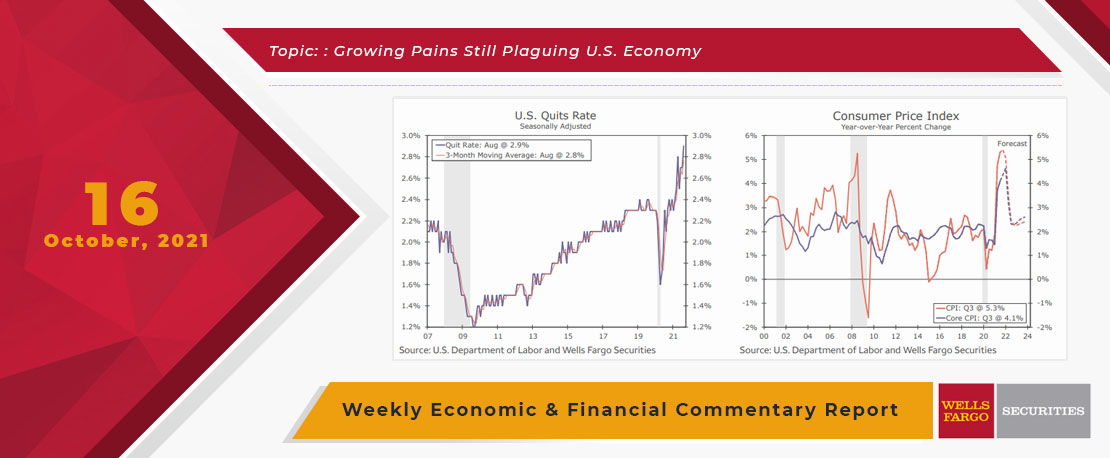

This Week's State Of The Economy - What Is Ahead? - 16 October 2021

Wells Fargo Economics & Financial Report / Oct 22, 2021

The first economic data released this week in the United States reinforced the theme that labor supply and demand are struggling to come into balance.

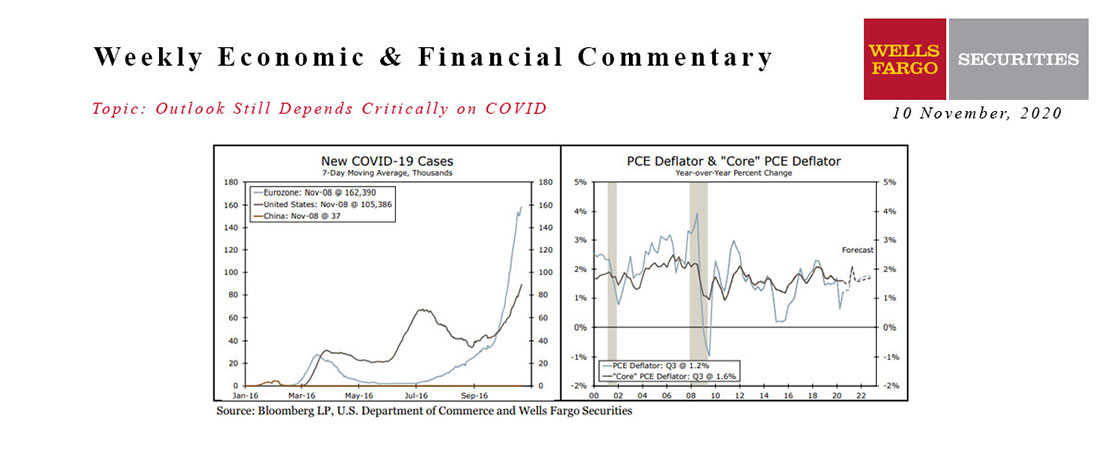

This Week's State Of The Economy - What Is Ahead? - 10 November 2020

Wells Fargo Economics & Financial Report / Nov 17, 2020

The U.S. election has come and gone, but we have not made any meaningful changes to our economic outlook, which continues to look for further expansion in the U.S. economy in coming quarters.

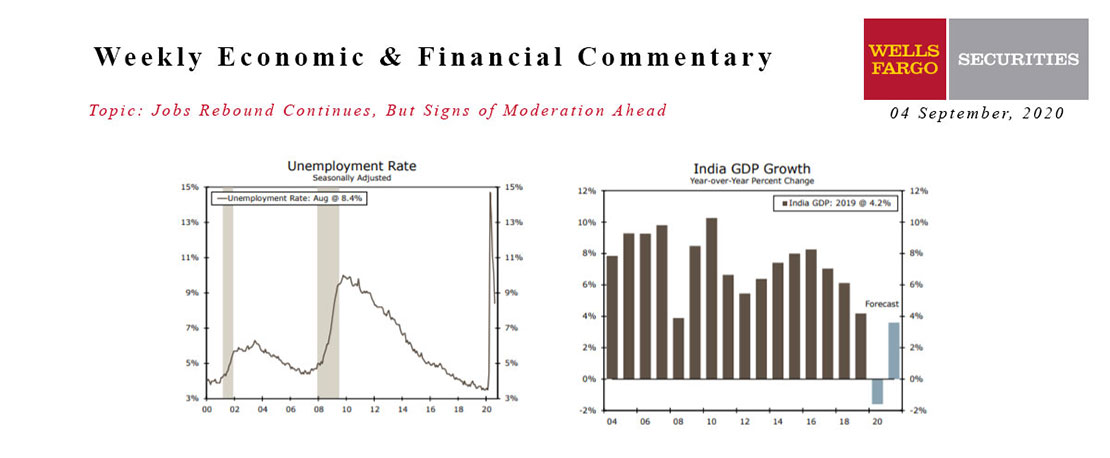

This Week's State Of The Economy - What Is Ahead? - 04 September 2020

Wells Fargo Economics & Financial Report / Aug 29, 2020

Employers added jobs for the fourth consecutive month in August, bringing the total number of jobs recovered from the virus-related low to 10.5 million.

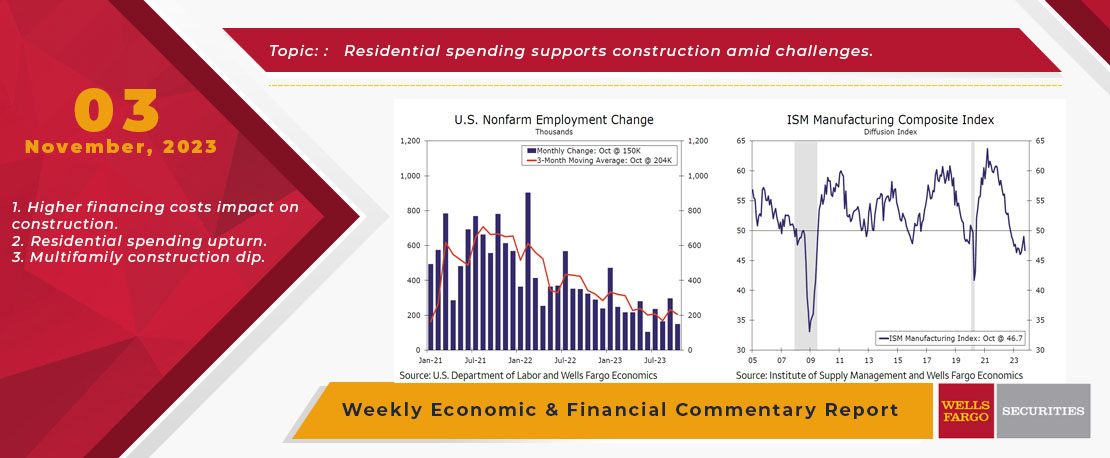

This Week's State Of The Economy - What Is Ahead? - 03 November 2023

Wells Fargo Economics & Financial Report / Nov 08, 2023

Although payroll growth is easing, the labor market remains relatively tight. The unemployment rate inched up to 3.9% in October, slightly higher than the cycle low of 3.4% first hit in January 2023, but still low compared to historical averages.