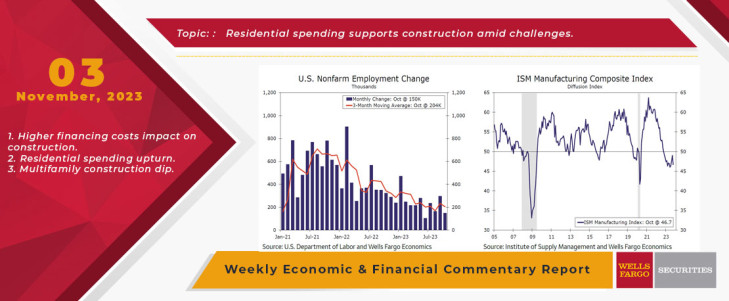

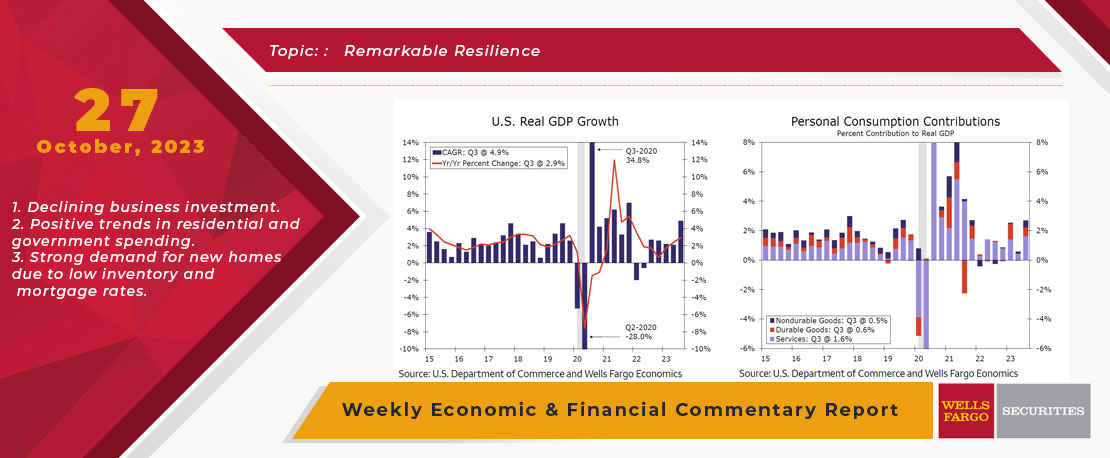

This week delivered an onslaught of economic indicators that provided a first glimpse of economic activity during Q4. In short, the remarkable strength on display during Q3 looks to be fading as the year begins to wind to a close. The labor market was front and center. After September's surprising surge, nonfarm payrolls advanced at a more moderate pace in October, rising by 150,000 net new jobs during the month. Strike activity, in particular the UAW strike, looks to have suppressed overall hiring during the month. Through the monthly volatility, however, a trend of labor market cooling remains in place. Total payrolls rose 1.9% year-over-year in October, the slowest annual change since early 2021. The number of payrolls added over the prior two months was also revised down by a hefty 101,000.

Although payroll growth is easing, the labor market remains relatively tight. The unemployment rate inched up to 3.9% in October, slightly higher than the cycle low of 3.4% first hit in January 2023, butstill low compared to historical averages. The slight upturn in the jobless rate this year reflects labor supply and demand becoming more balanced. The labor force participation rate slipped a tick to 62.7% in October but is still 0.5 percentage points higher than a year ago. The improvement in labor supply amid a cooler pace of hiring has yielded a more moderate pace of wage growth. Average hourly earnings rose 0.2% in October, the slowest monthly pace in more than a year.

A host of other indicators released this week provided additional evidence that the labor market is moving back to pre-pandemic form. During September, the count of job openings as measured by the Job Openings and Labor Turnover Survey (JOLTS) edged up to 9.55 million. While the number of job vacancies remains highly elevated, both the hiring and quits rate—which were both unchanged during the month at 3.7% and 2.3%, respectively—more or less have returned to 2019 averages. What's more, the Employment Cost Index (ECI) rose 1.1% in Q3, a touch higher than the consensus. Yet, the 4.3% not seasonally adjusted ECI figure marks the lowest reading since 2021. On top of that, the Q3 nonfarm productivity report published this week showed that unit labor costs declined at a 0.8% annualized pace in Q3, solidifying a downward trend since 2022. The decline in labor unit costs has occurred against a backdrop of improving productivity. Overall nonfarm labor productivity grew at a robust 4.7% annualized rate in the third quarter, bringing the four-quarter moving average of growth in employee output per hour back to pre-COVID norms.

A pick-up in productivity alongside slowing nominal wage growth is an encouraging sign that inflation is still on the path back to the Federal Reserve's 2% target. As we write in the Interest Rate Watchsection, the FOMC unanimously agreed to keep its target range for the federal funds rate unchanged at 5.25%-5.50% at the conclusion of the Nov. 1 meeting this week. Although monetary policy is likely to remain restrictive in the months ahead, additional rate hikes are not likely to be forthcoming, given that the labor market and inflation both look to be charting a course for calmer waters.

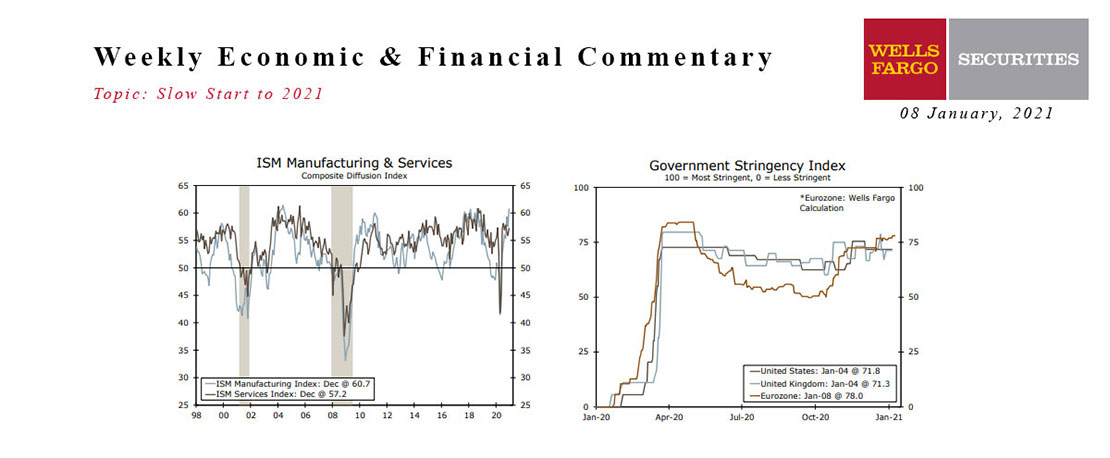

This Week's State Of The Economy - What Is Ahead? - 08 January 2021

Wells Fargo Economics & Financial Report / Jan 12, 2021

The manufacturing sector is showing a great deal of resilience, with the ISM Manufacturing survey exceeding expectations, at 60.7, and factory orders remaining strong.

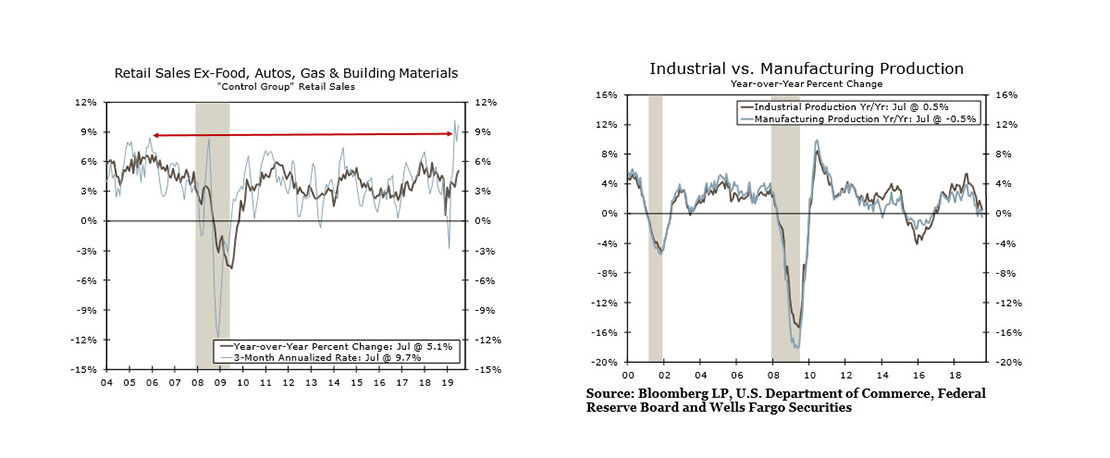

This Week's State Of The Economy - What Is Ahead? - 16 August 2019

Wells Fargo Economics & Financial Report / Aug 17, 2019

Markets gyrated this week as the spread between the ten- and two-year Treasury\'s turned negative for the first time since 2007. Financial markets seem to expect that the sharp slowdown in growth overseas will soon spread to the United States.

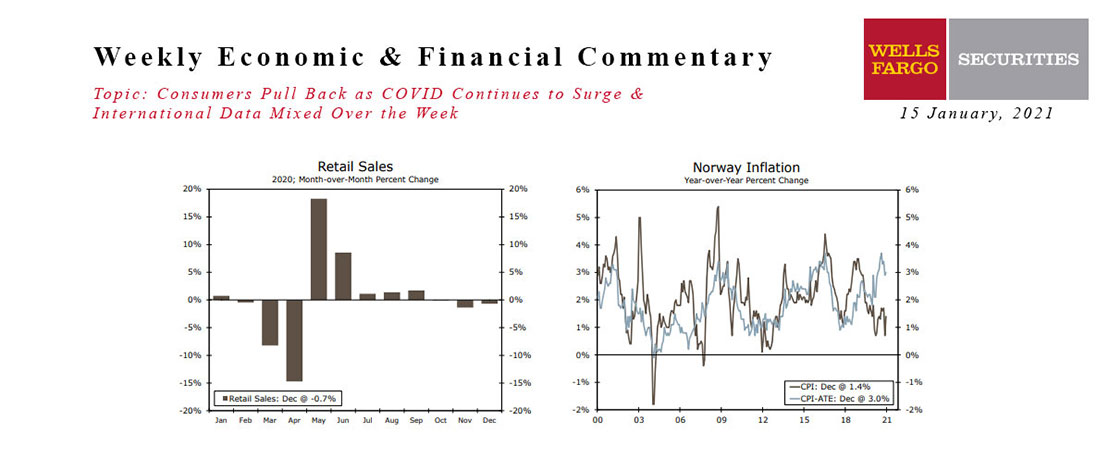

This Week's State Of The Economy - What Is Ahead? - 15 January 2021

Wells Fargo Economics & Financial Report / Jan 18, 2021

Retail sales fell 0.7% in December, the third straight monthly decline. Sales are still up 2.9% over the year, however.

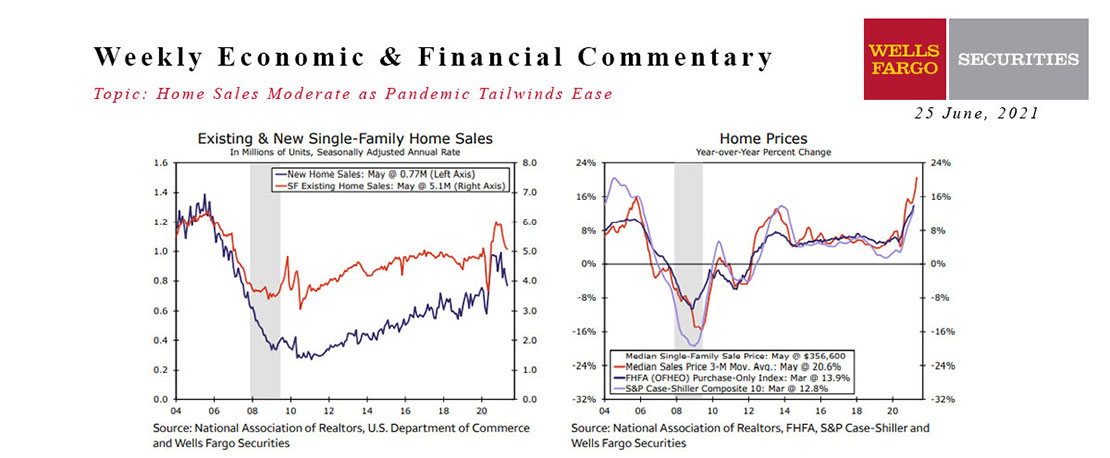

This Week's State Of The Economy - What Is Ahead? - 25 June 2021

Wells Fargo Economics & Financial Report / Jun 26, 2021

Supply chain bottlenecks continue to cause pain-in-the-necks. In spite of all the difficulties, the Economic whizzes in the WF Economics team have upgraded their forecast for full-year 2021 U.S.

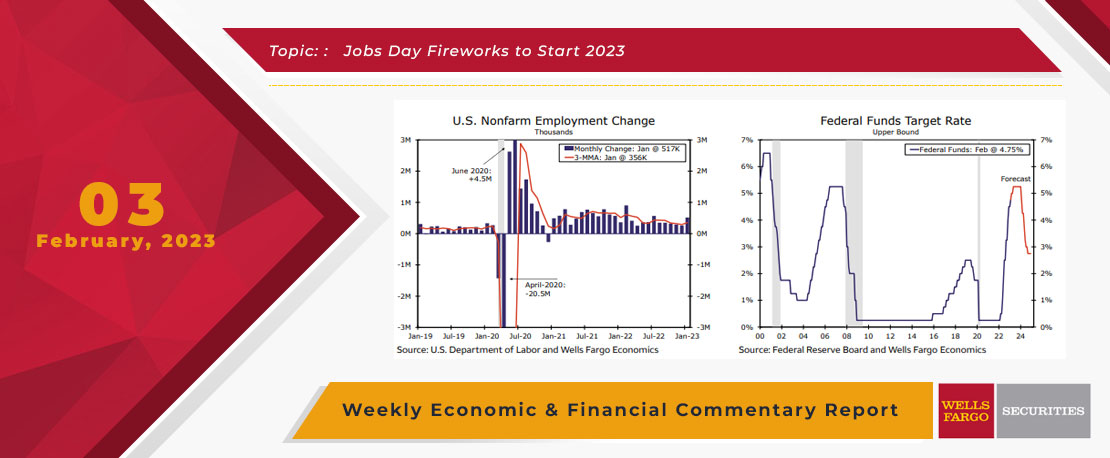

This Week's State Of The Economy - What Is Ahead? - 03 February 2023

Wells Fargo Economics & Financial Report / Feb 04, 2023

During January, payrolls jumped by 517K, the unemployment rate fell to 3.4% and average hourly earnings rose by 0.3%. The FOMC raised the fed funds target range by 25 bps to 4.5%-4.75% this week.

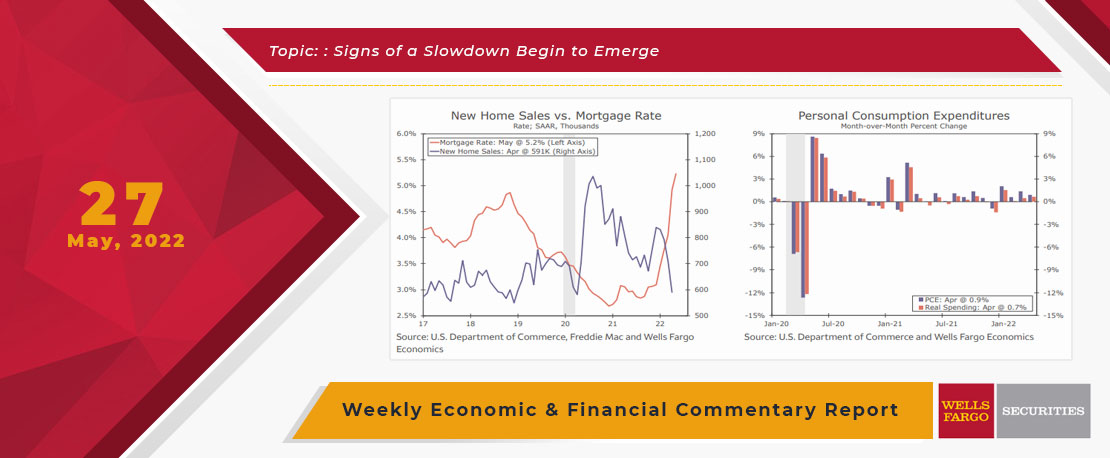

This Week's State Of The Economy - What Is Ahead? - 27 May 2022

Wells Fargo Economics & Financial Report / May 29, 2022

it looks like higher mortgage rates are starting to have some effect on the housing market as April...

This Week's State Of The Economy - What Is Ahead? - 30 April 2021

Wells Fargo Economics & Financial Report / May 18, 2021

The gain in output leaves the level of real GDP just a stone\'s throw below its pre-COVID Q4-2019 level (see chart).

This Week's State Of The Economy - What Is Ahead? - 27 October 2023

Wells Fargo Economics & Financial Report / Nov 02, 2023

The U.S. economy expanded at a stronger-than-expected pace in Q3, with real GDP increasing at a robust 4.9% annualized rate.

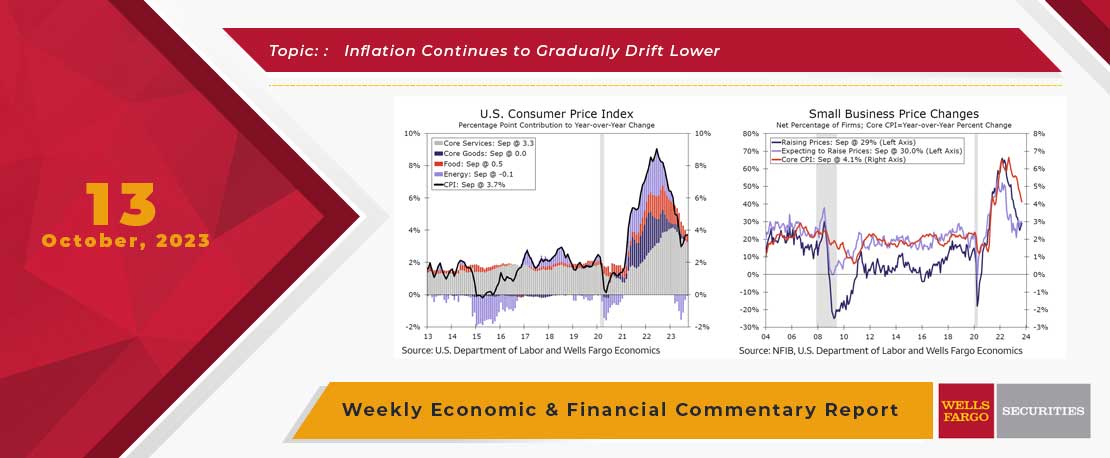

This Week's State Of The Economy - What Is Ahead? - 13 October 2023

Wells Fargo Economics & Financial Report / Oct 13, 2023

The Consumer Price Index (CPI) rose 0.4% in September, a monthly change that was a bit softer than the 0.6% increase registered in August. The core CPI rose 0.3% during the month, a pace unchanged from the month prior.

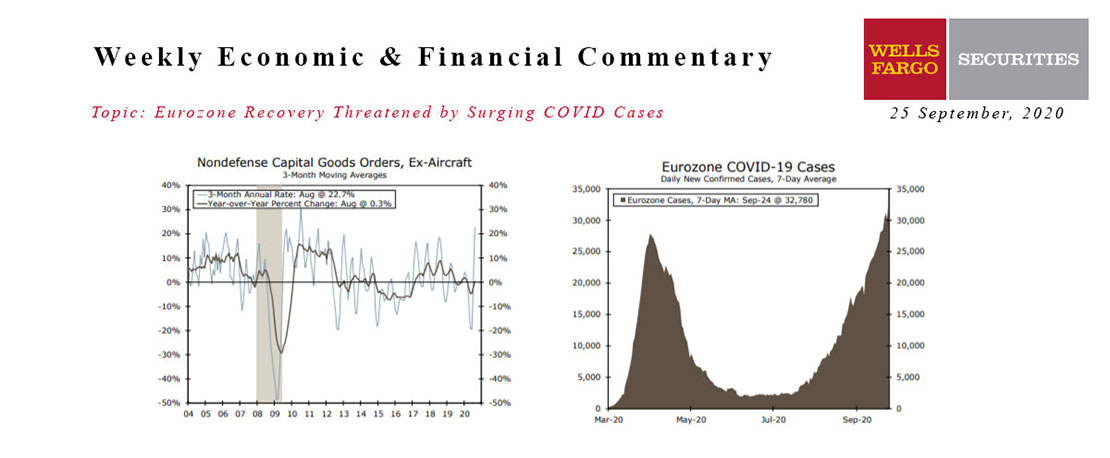

This Week's State Of The Economy - What Is Ahead? - 25 September 2020

Wells Fargo Economics & Financial Report / Sep 28, 2020

Existing home sales rose 2.4% to a 6.0-million unit annual pace. The surge in sales further depleted inventories and pushed prices sharply higher.