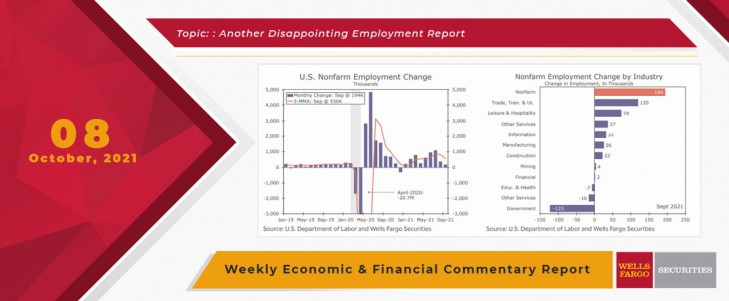

September's disappointing employment report clearly takes center stage over this week's other economic reports. Nonfarm employment rose by just 194,000 jobs, as employers continue to have trouble finding the workers they need. While the equity markets sold off and bonds initially rallied on the news, the report was not quite as weak as it first appeared. Data for the prior two months were revised higher by a combined 169,000 jobs.

The household employment data do not show anywhere near the deceleration that the establishment survey does. The household survey showed civilian employment rising by 526,000 in September, following a 509,000 increase the prior month.

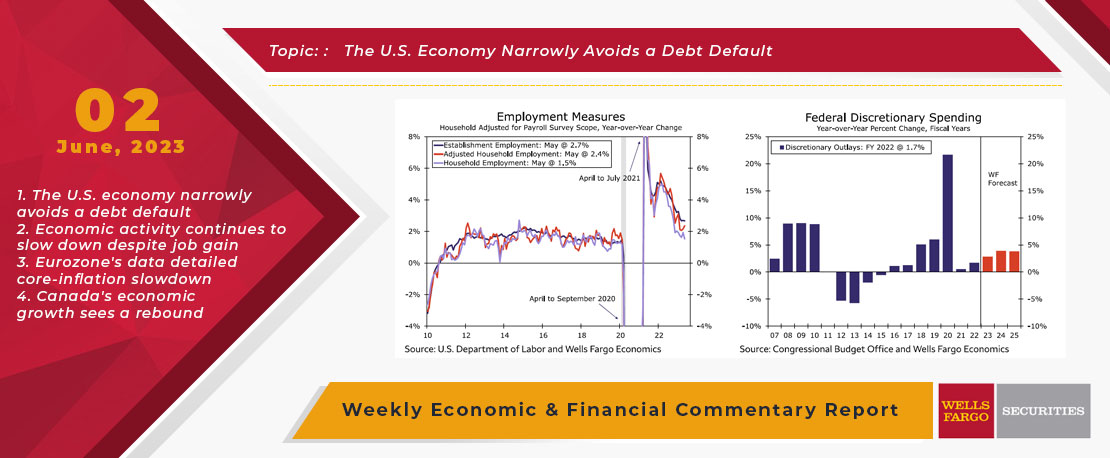

This Week's State Of The Economy - What Is Ahead? - 02 June 2023

Wells Fargo Economics & Financial Report / Jun 06, 2023

This week, Congress and the president prevented what would have been the first default in U.S. history by agreeing to suspend the debt ceiling through the end of 2024.

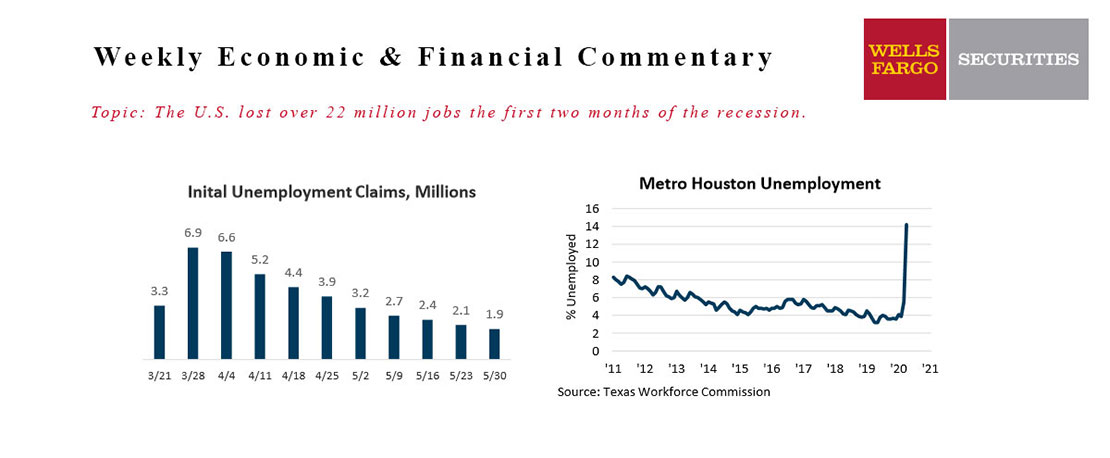

June 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Jun 18, 2020

The Fed expects to hold interest rates near zero through the end of this year, perhaps well into next year, and maybe even into ’22.

This Week's State Of The Economy - What Is Ahead? - 03 May 2024

Wells Fargo Economics & Financial Report / May 10, 2024

The Federal Reserve can afford patience thanks to a resilient labor market. During April, total nonfarm payrolls rose by 175,000 net jobs, continuing a string of solid monthly payroll additions.

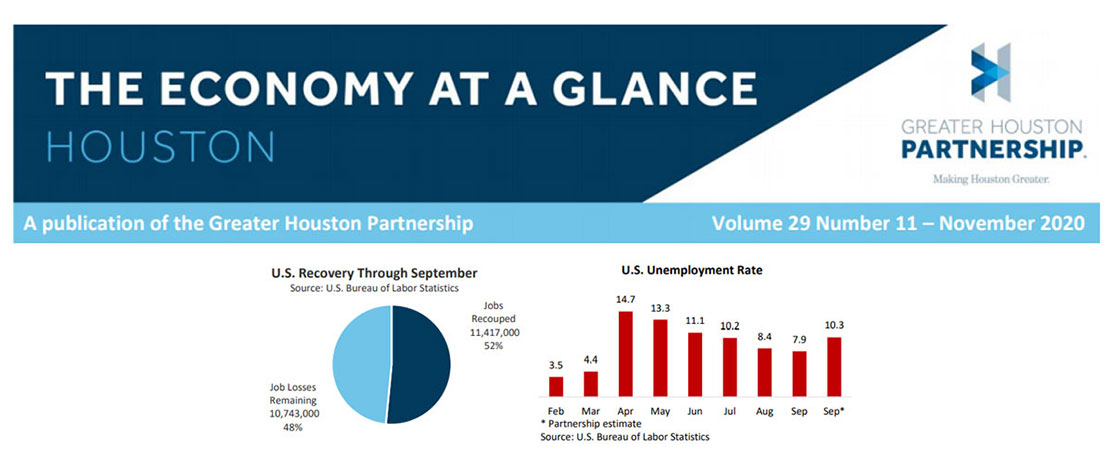

November 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Nov 12, 2020

U.S. gross domestic product (GDP) grew 7.4 percent, or $1.3 trillion in Q3, adjusted for inflation.

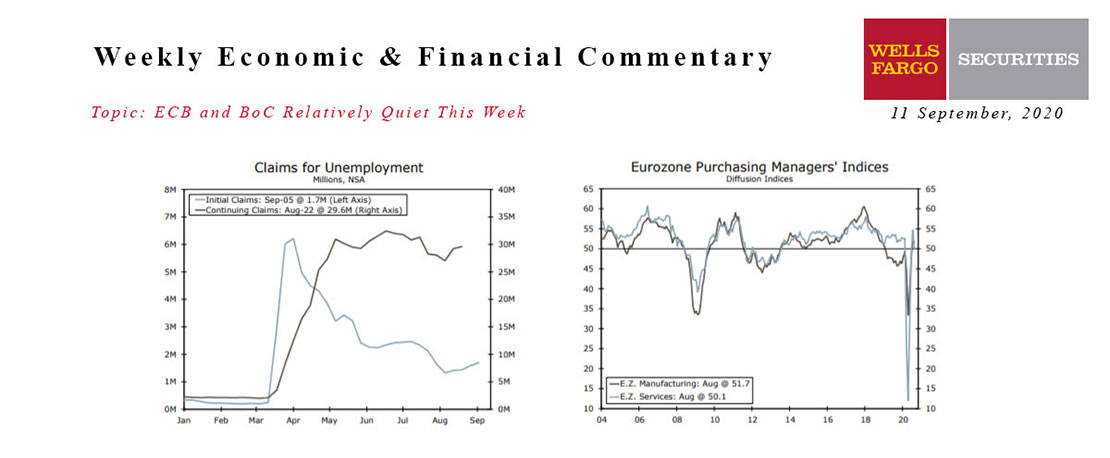

This Week's State Of The Economy - What Is Ahead? - 11 September 2020

Wells Fargo Economics & Financial Report / Sep 14, 2020

In the holiday-shortened week, analysts’ attention remained on the progress of the labor market. Recent jobless claims data remain stubbornly high and point to a slowing jobs rebound.

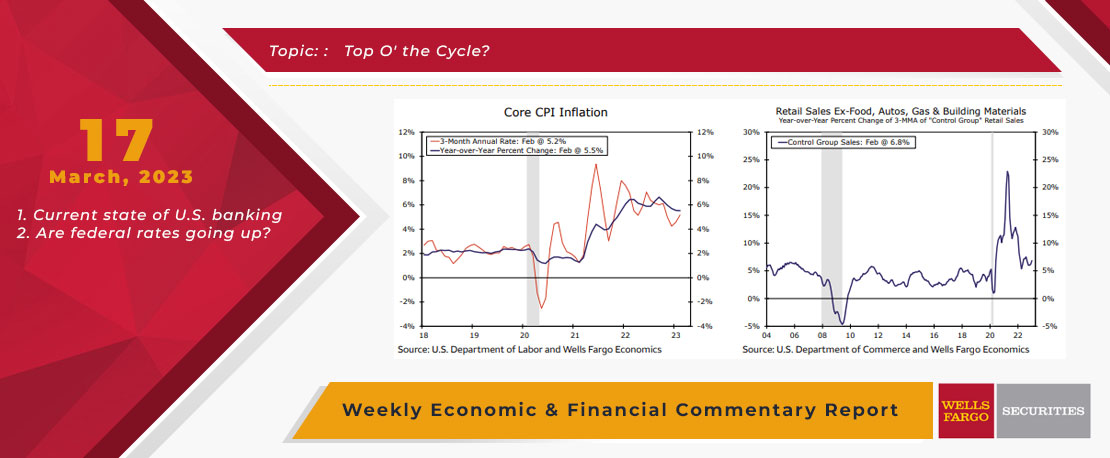

This Week's State Of The Economy - What Is Ahead? - 17 March 2023

Wells Fargo Economics & Financial Report / Mar 21, 2023

Retail sales declined 0.4% during February, while industrial production was flat (0.0%). Housing starts and permits jumped 9.8% and 13.8%, respectively.

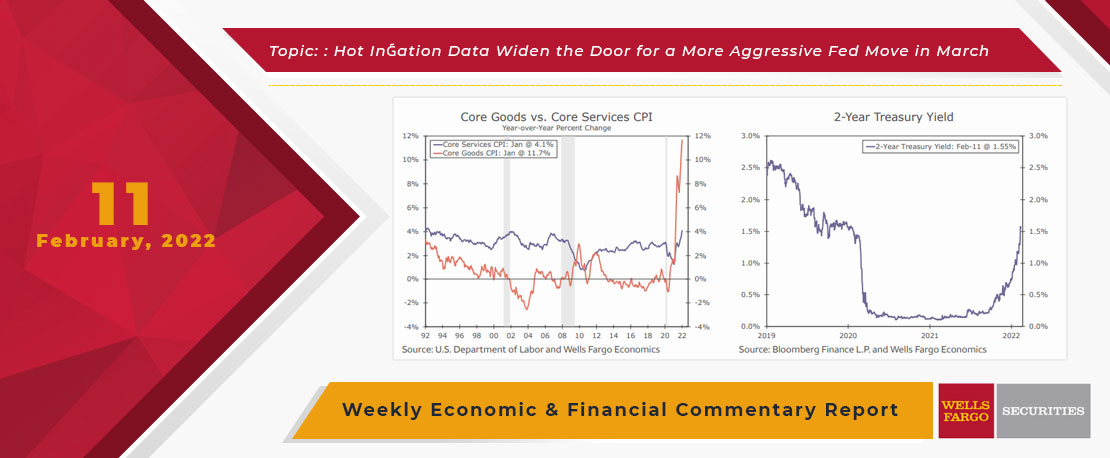

This Week's State Of The Economy - What Is Ahead? - 11 February 2022

Wells Fargo Economics & Financial Report / Feb 14, 2022

Deep thought for the week, if a tree falls in the forest, or an Olympics occurs, and no one is there to hear it or see it, did it really occur?

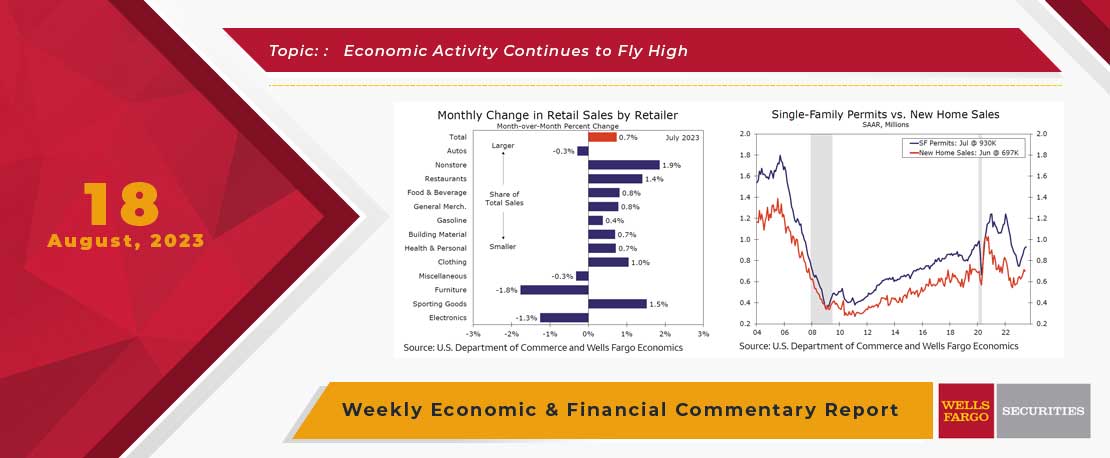

This Week's State Of The Economy - What Is Ahead? - 18 August 2023

Wells Fargo Economics & Financial Report / Aug 23, 2023

The FOMC meeting minutes acknowledged the economy\'s resilience and continued to stress the Committee\'s resolve to bring inflation back down toward its 2% goal.

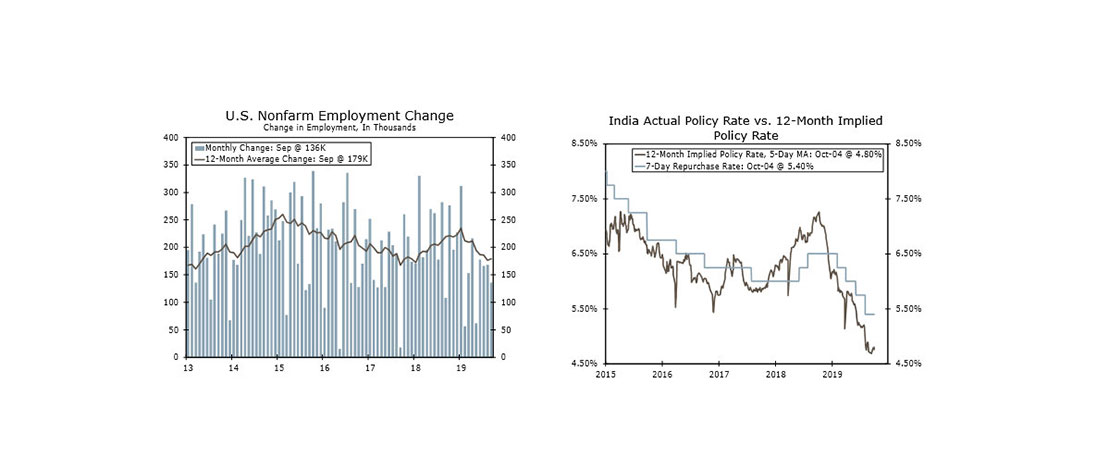

This Week's State Of The Economy - What Is Ahead? - 4 October 2019

Wells Fargo Economics & Financial Report / Oct 05, 2019

Survey evidence flashed signs of contraction in the manufacturing sector and indicated weakness spreading to the services side of the economy, while employers added a less-than-expected 136K jobs in September.

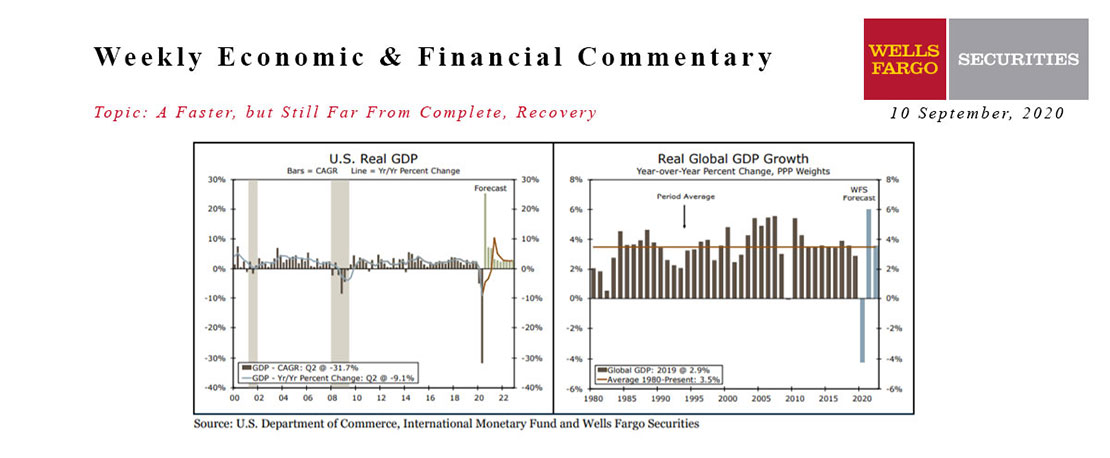

This Week's State Of The Economy - What Is Ahead? - 10 September 2020

Wells Fargo Economics & Financial Report / Sep 12, 2020

Although the recovery from the COVID recession is still far from over, the U.S. economy is bouncing back faster than many expected.