Gross Domestic Product

U.S. gross domestic product (GDP) grew 7.4 percent, or $1.3 trillion in Q3, adjusted for inflation. The economy benefited from an increase in consumer spending, a restocking of inventories, exports, new investments in building, equipment and inventories, and new home construction.

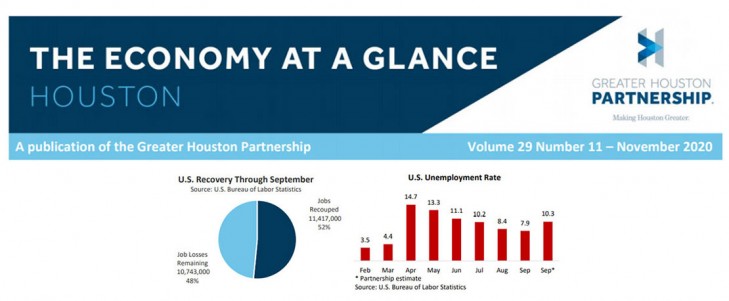

Job Growth

The nation has created 11.4 million jobs since May, recouping over half March and April’s losses. But growth is already slowing. Employers added only 661,000 workers in September, less than half the 1.5 million added in August. The nation remains 10.7 million shy of its February level. The recent spike in COVID cases, the expiration of the federal stimulus packages, and uncertainly over the outcome of the presidential election will further slow job gains.

Unemployment

U.S. unemployment peaked at 14.7 percent in April and has steadily improved, decreasing to 7.9 percent in September. But the headline number belies what’s actually happening in the labor market. Since February, 4.4 million Americans have dropped out of the labor force and are no longer counted as unemployed. Factor them back in and the unemployment rate jumps to 10.3 percent.

Home Sales

Existing-home sales grew for the fourth consecutive month in September, hitting a seasonally-adjusted annual rate of 6.54 million, up 9.4 percent from August and 21 percent from September a year ago. Seven out of every ten homes sold were on the market for less than a month.

Retail

Retail continues to recover. The U.S. Census Bureau reports September sales were up 1.9 percent from August and 5.4 percent from September of last year. Those numbers reflect a shift in consumer buying patterns. Unable to travel, attend concerts, cheer at sporting events, or dine out, consumers have opted to purchase goods rather than services. Through September of this year, consumers spent 20 percent less on dining than they did over the same period in ’19. The data also reflect a significant increase in online purchasing, up 20 percent so far this year.

Perryman's Perspective

Houston’s real gross product (RGP) will shrink 4.8 percent this year (December to December) before rebounding 4.2 percent next year. That’s the latest projections by The Perryman Group, the Waco-based think tank that’s been analyzing and forecasting for U.S., Texas, and Texas metros since the early 1980s.

Houston Employment Update

Metro Houston added 24,400 jobs in September, bringing the total recovered since April to 142,600. Houston re-mains 207,600 jobs short of its pre-pandemic level. The gains put Houston just shy of 3.0 million jobs. The region had topped 3.2 million jobs back in February. In a normal year, the region adds 25,000 to 50,000 in Q4, which would put a considerable dent in the COVID job losses. But this hasn’t been a normal year and job gains through December are likely to be subdued.

Innovation Update

At first glance, tech funding in Houston appears remarkably unscathed by the pandemic. Houston-area startups have raised nearly as much venture capital so far this year as they did last year. VC Investments in the region topped $556 million through Q3/20, down only 4 percent from the same period in ’19, according to a Partnership analysis of PitchBook data.

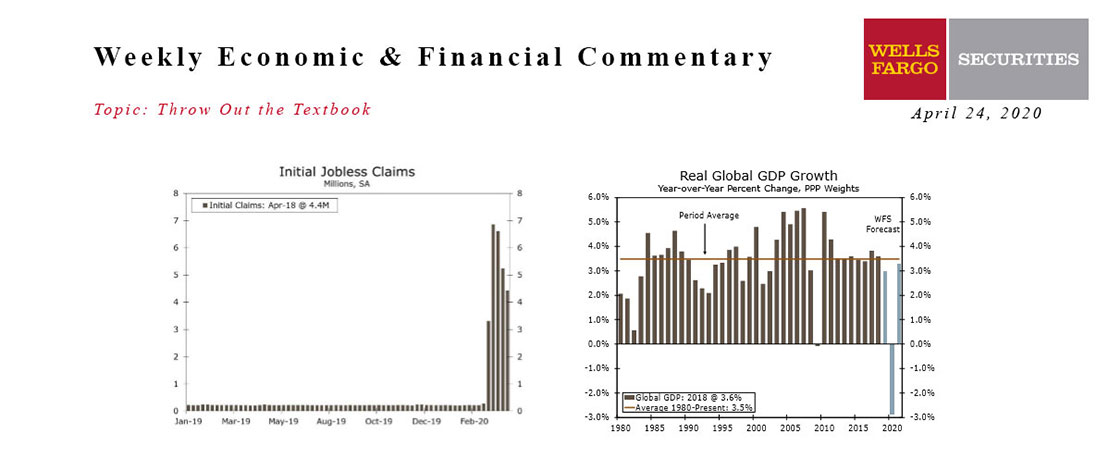

This Week's State Of The Economy - What Is Ahead? - 24 April 2020

Wells Fargo Economics & Financial Report / Apr 27, 2020

Oil prices went negative for the first time in history on Monday as the evaporation of demand collided with a supply glut. In the past five weeks, 26.5 million people have filed for unemployment insurance, or more than one out of every seven workers.

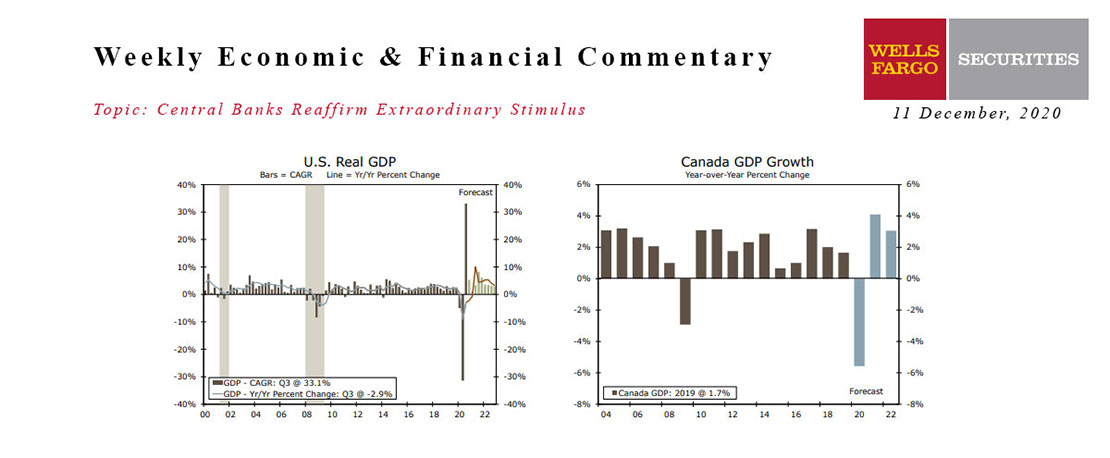

This Week's State Of The Economy - What Is Ahead? - 11 December 2020

Wells Fargo Economics & Financial Report / Dec 14, 2020

Emergency authorization of the Pfizer-BioNTech COVID vaccine appears imminent, but the virus is running rampant across the United States today, pointing to a grim winter.

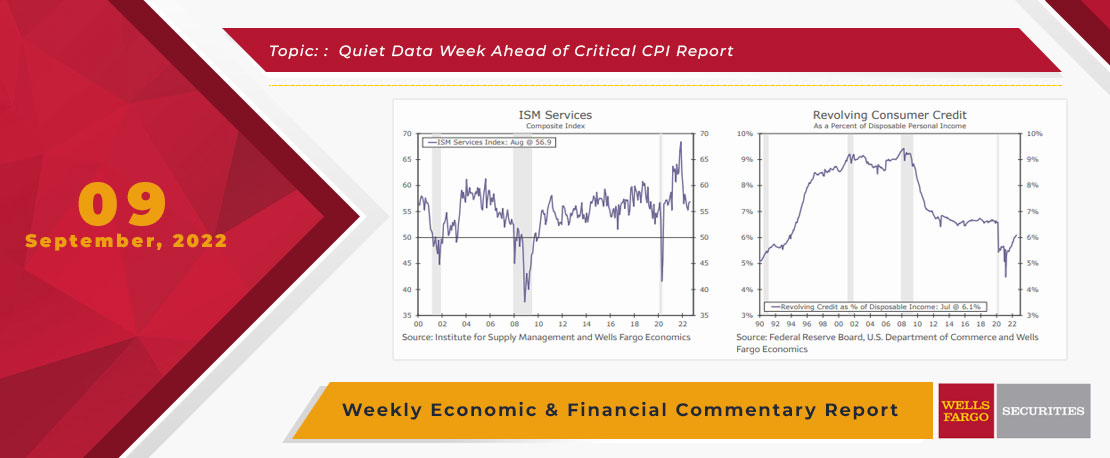

This Week's State Of The Economy - What Is Ahead? - 09 September 2022

Wells Fargo Economics & Financial Report / Sep 10, 2022

The ISM services index came in stronger than expected, and the underlying details pointed to service sector resilience with business activity and new orders notching their highest reading this year.

This Week's State Of The Economy - What Is Ahead? - 24 January 2020

Wells Fargo Economics & Financial Report / Jan 25, 2020

Fears of an escalating coronavirus outbreak reached the United States this week, as a Washington state man became the first confirmed domestic case and the international total reached more than 800.

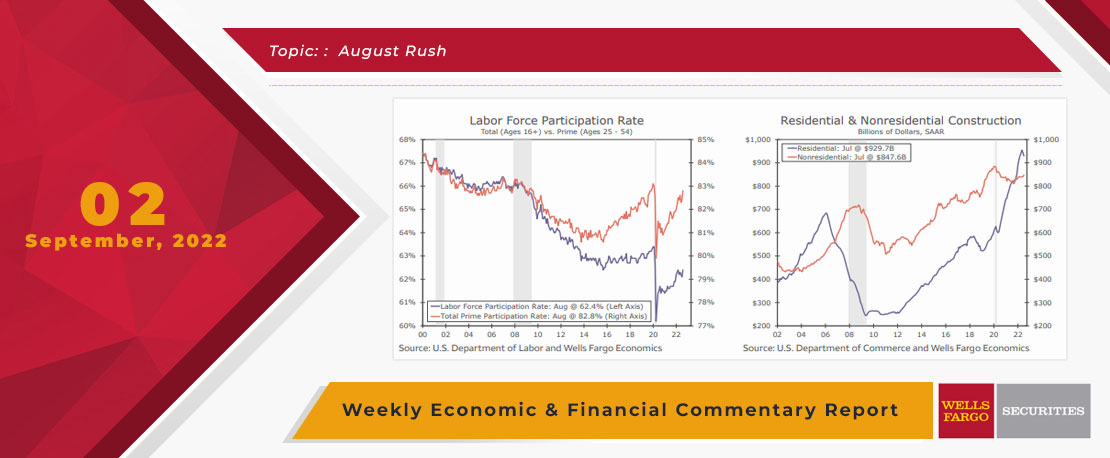

This Week's State Of The Economy - What Is Ahead? - 02 September 2022

Wells Fargo Economics & Financial Report / Sep 05, 2022

More job seekers also lifted the participation rate to 62.4% and thus easing some tightness in the job market even as payrolls expanded.

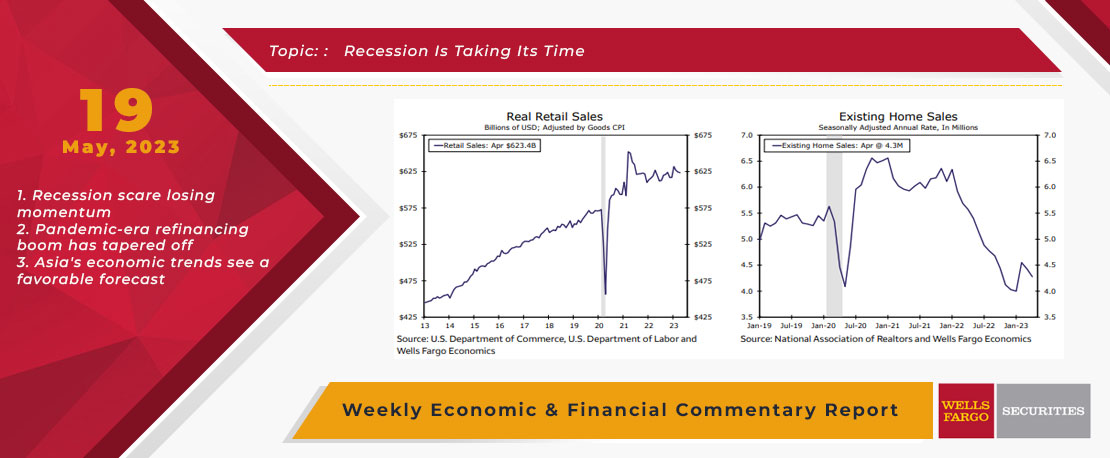

This Week's State Of The Economy - What Is Ahead? - 19 May 2023

Wells Fargo Economics & Financial Report / May 23, 2023

Economic data continue to suggest the U.S. economy is only gradually losing momentum. Consumers continue to spend, and industrial and housing activity are seeing some stabilization.

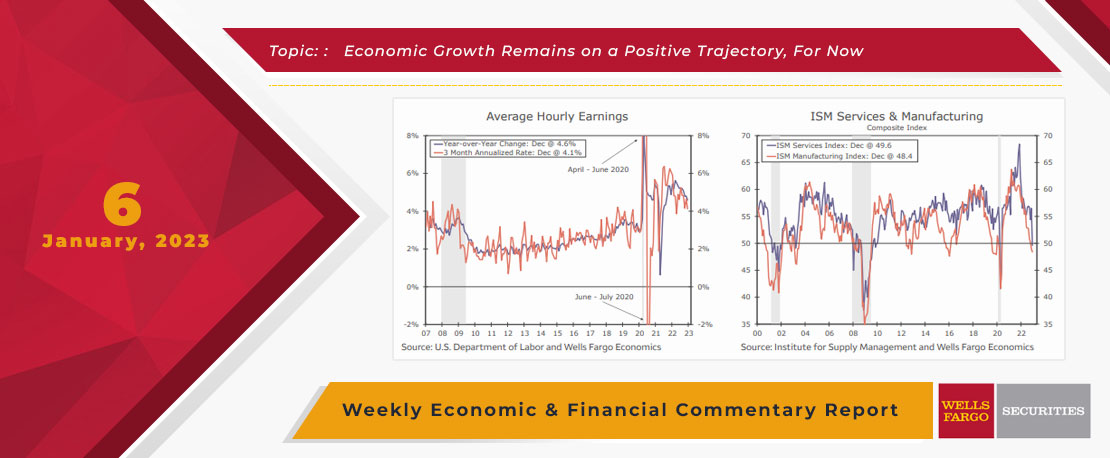

This Week's State Of The Economy - What Is Ahead? - 06 January 2023

Wells Fargo Economics & Financial Report / Jan 12, 2023

During December, payrolls rose by 223K while the unemployment rate fell to 3.5% and average hourly earnings eased 0.3%. Job openings (JOLTS) edged down to 10.46 million in November.

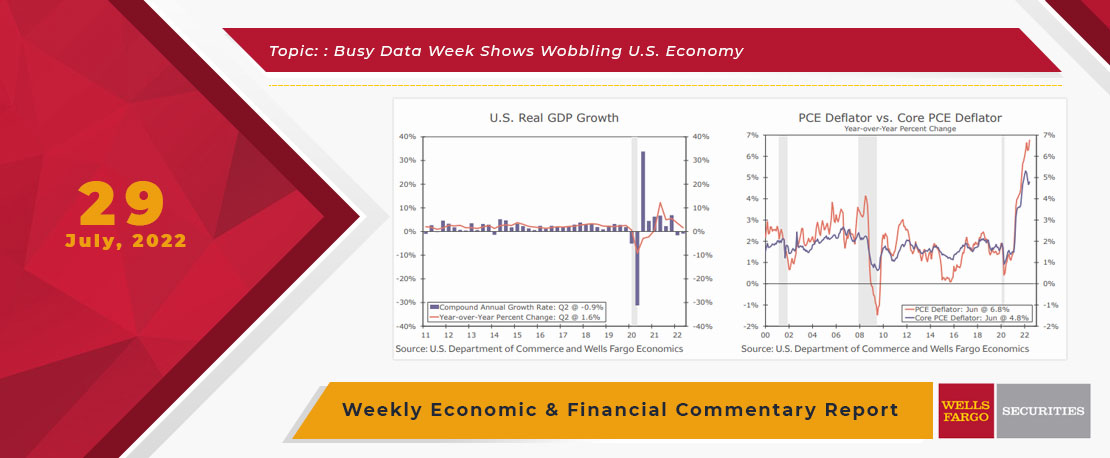

This Week's State Of The Economy - What Is Ahead? - 29 July 2022

Wells Fargo Economics & Financial Report / Jul 31, 2022

Unlike the local temperatures, data released this week showed U.S. economic growth modestly declined in Q2.

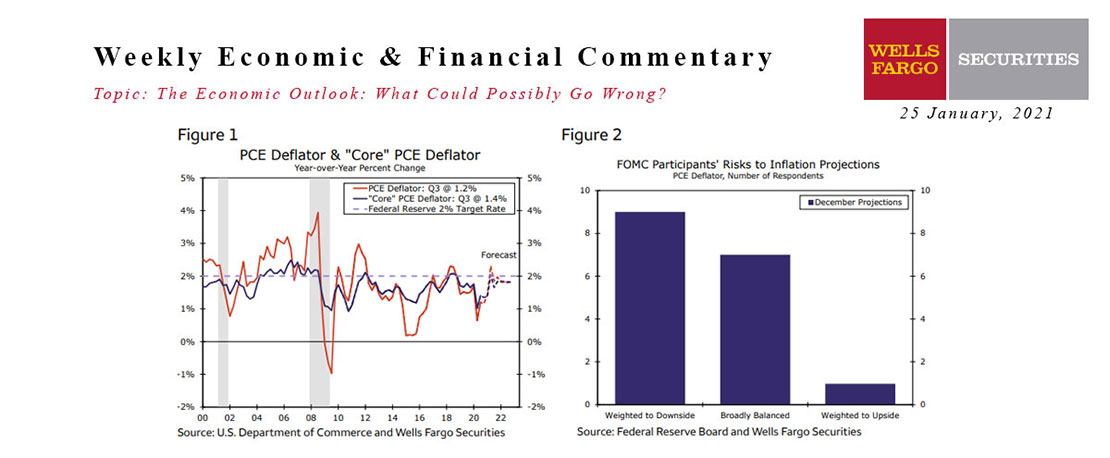

25 January 2021 Economic Outlook Report

Wells Fargo Economics & Financial Report / Jan 30, 2021

In the second installment of our series on economic risks in the foreseeable future, we analyze the potential for higher inflation in coming years stemming from excess demand.

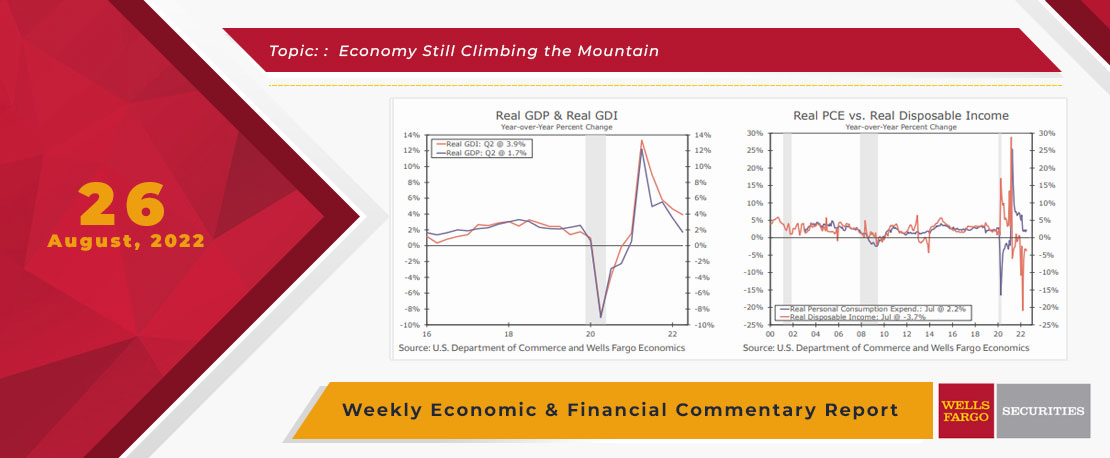

This Week's State Of The Economy - What Is Ahead? - 26August 2022

Wells Fargo Economics & Financial Report / Aug 29, 2022

I can understand how the opportunity to participate in lots of scintillating economic policy discussions could make fishing look exciting in comparison.