Starting with the U.S. Labor Day holiday on Monday, this week was a light data week that ends on a sobering note with the passing yesterday of Queen Elizabeth II and the 9/11 anniversary on Sunday. The ISM services index came in stronger than expected, and the underlying details pointed to service sector resilience with business activity and new orders notching their highest reading this year.

A majority of the selected industry comments from purchasing managers pointed to supply chain challenges affecting business. But the related components of the ISM suggest bottlenecks are improving somewhat, or at least not getting worse. The supplier deliveries component fell 3.3 points last month and that, on top of the 4.1-point drop in July, puts the index at its lowest point in over two years. The easing in delivery times also helped alleviate order backlog, which fell 4.4 points to 53.9 last month.

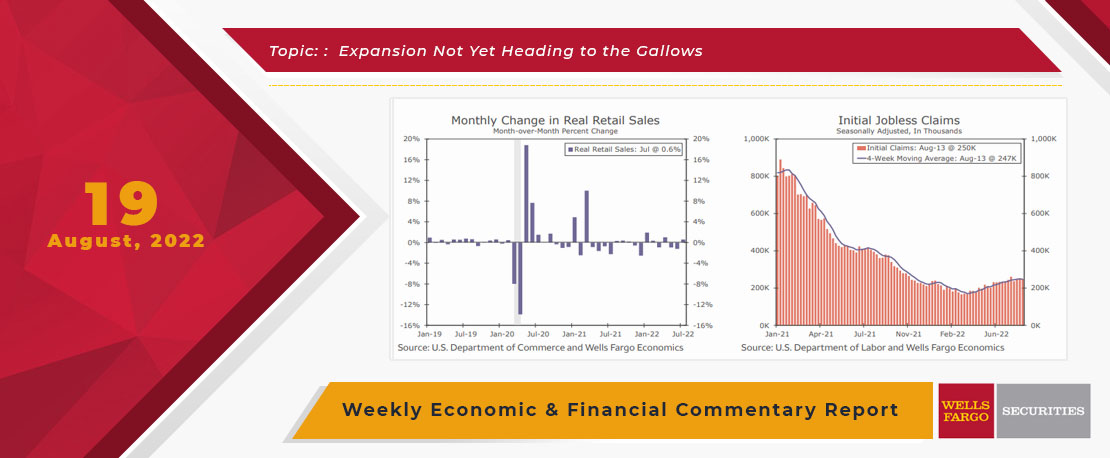

Initial jobless claims came in a bit cooler than expected, although continuing claims were a bit worse than anticipated. As we wrote in a recent report, data on individuals filing for unemployment do not suggest the economy is currently in a recession. Claims have ticked higher, but off of an incredibly low base amid a historically tight labor market. Even with the recent increase in continuing claims, the total number of people collecting unemployment benefits is still roughly 300K below February 2020 levels. For now, the jobless claims data are sending a similar signal to the ISM services index: The U.S. economy is slowing down but not outright contracting.

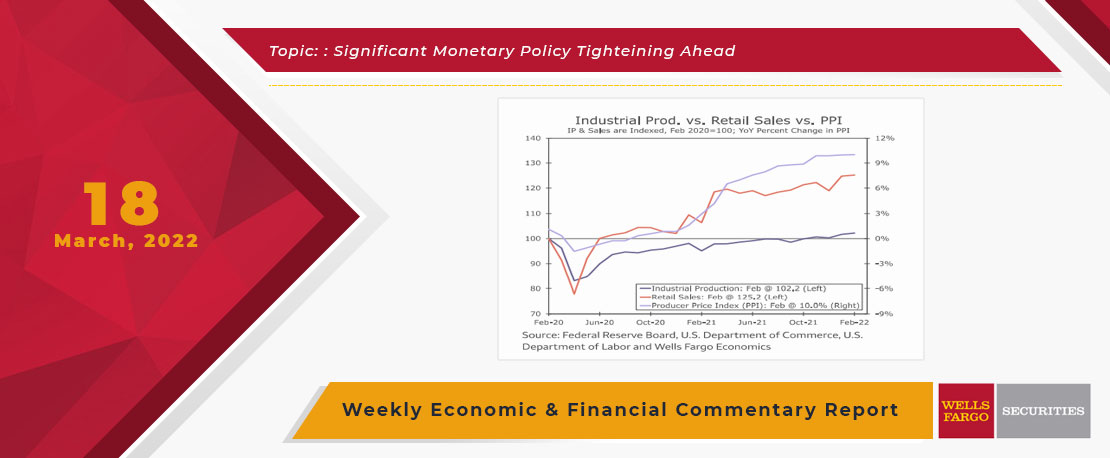

This Week's State Of The Economy - What Is Ahead? - 18 March 2022

Wells Fargo Economics & Financial Report / Mar 21, 2022

it was a big week for economic news as the Astros allowed the TWINS of all teams to sign Carlos Correa to the type of short-term deal that the Astros have historically been open to.

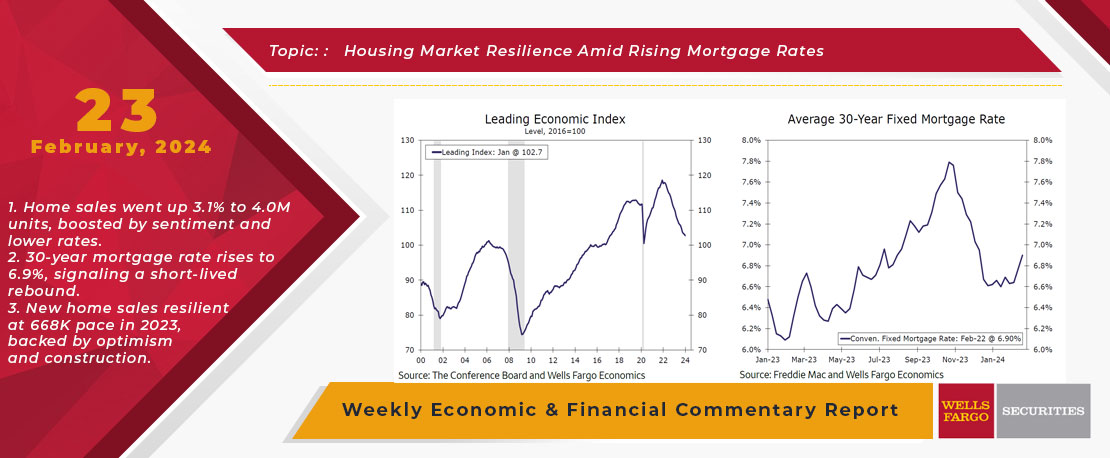

This Week's State Of The Economy - What Is Ahead? - 23 February 2024

Wells Fargo Economics & Financial Report / Feb 27, 2024

Stronger-than-expected inflation, underpinned by the mildly hawkish minutes from the January FOMC meeting, drove a move higher in mortgage rates.

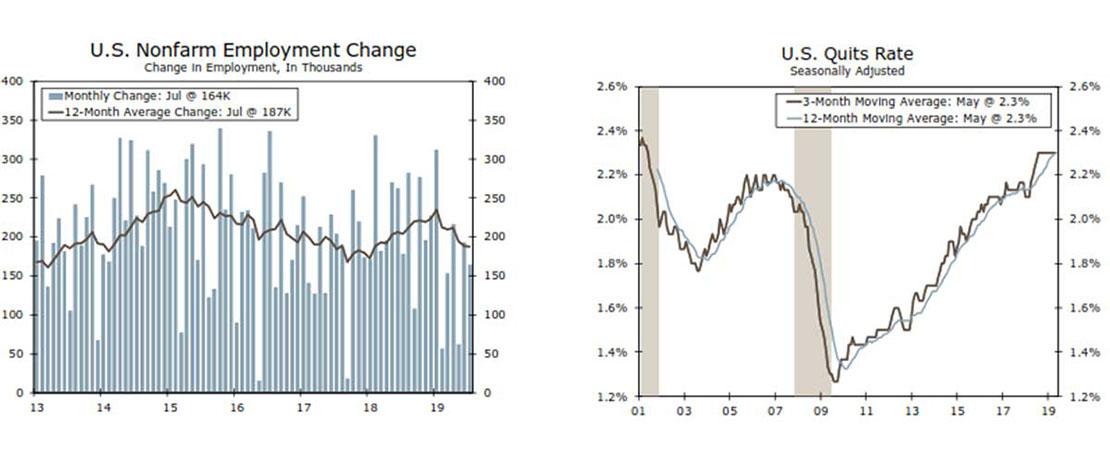

This Week's State Of The Economy-What Is Ahead?

Wells Fargo Economics & Financial Report / Aug 03, 2019

How will Fed rates-cut and Trump 10% tariff on $300 Billion Chinese Goods countered by Chinese currency devaluation against Dollar, affect inflation and economic slowdown in US economy?

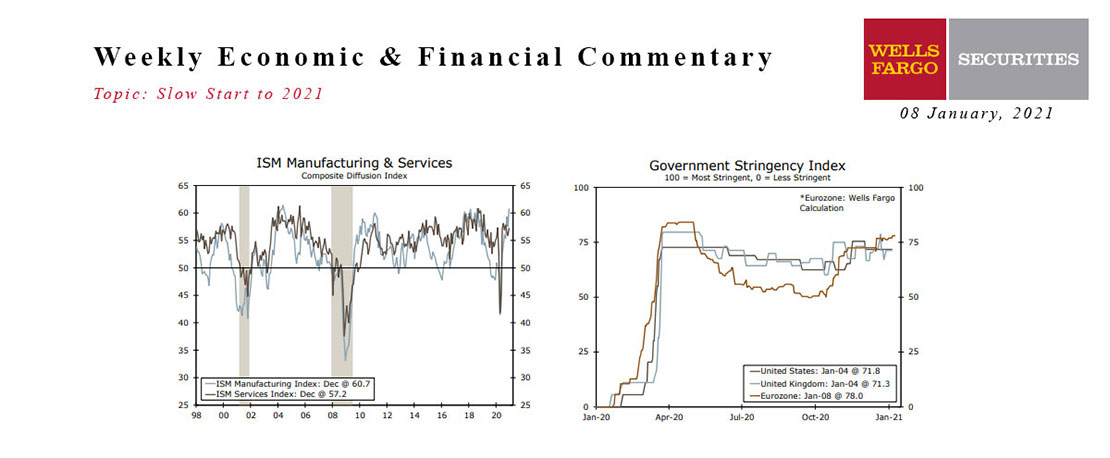

This Week's State Of The Economy - What Is Ahead? - 08 January 2021

Wells Fargo Economics & Financial Report / Jan 12, 2021

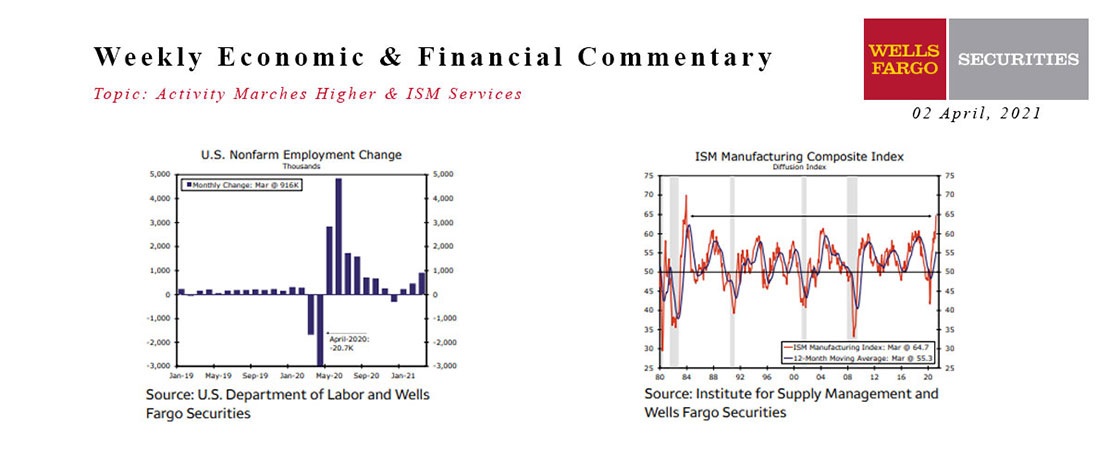

The manufacturing sector is showing a great deal of resilience, with the ISM Manufacturing survey exceeding expectations, at 60.7, and factory orders remaining strong.

This Week's State Of The Economy - What Is Ahead? - 03 September 2021

Wells Fargo Economics & Financial Report / Sep 10, 2021

e move into the Labor Day weekend celebrating the 235K jobs added in August, while simultaneously lamenting that it was about half a million jobs short of expectations.

This Week's State Of The Economy - What Is Ahead? - 19August 2022

Wells Fargo Economics & Financial Report / Aug 23, 2022

July data indicates that we celebrated a decline in gas prices by going shopping, boosting retail sales figures. I’m not sure I get the connection...

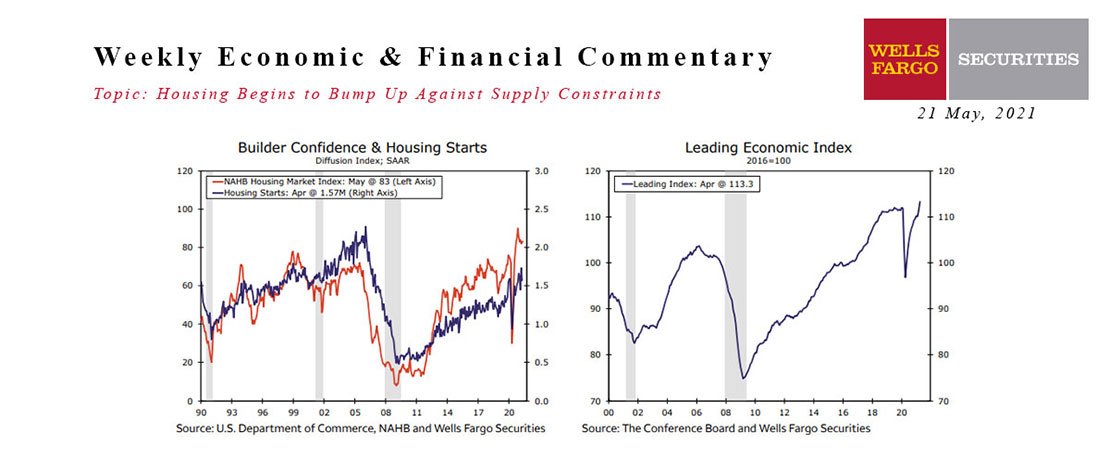

This Week's State Of The Economy - What Is Ahead? - 21 May 2021

Wells Fargo Economics & Financial Report / May 25, 2021

Over the past year, the housing market has become white-hot.

This Week's State Of The Economy - What Is Ahead? - 09 April 2020

Wells Fargo Economics & Financial Report / Apr 10, 2020

The Federal Reserve announced a series of measures this morning that are intended to assist households, businesses and state & local governments as they cope with the economic fallout of the COVID-19 outbreak.

This Week's State Of The Economy - What Is Ahead? - 02 April 2021

Wells Fargo Economics & Financial Report / Apr 08, 2021

Increased vaccinations and an improving public health position led to an easing of restrictions and pickup in activity across the country in March.

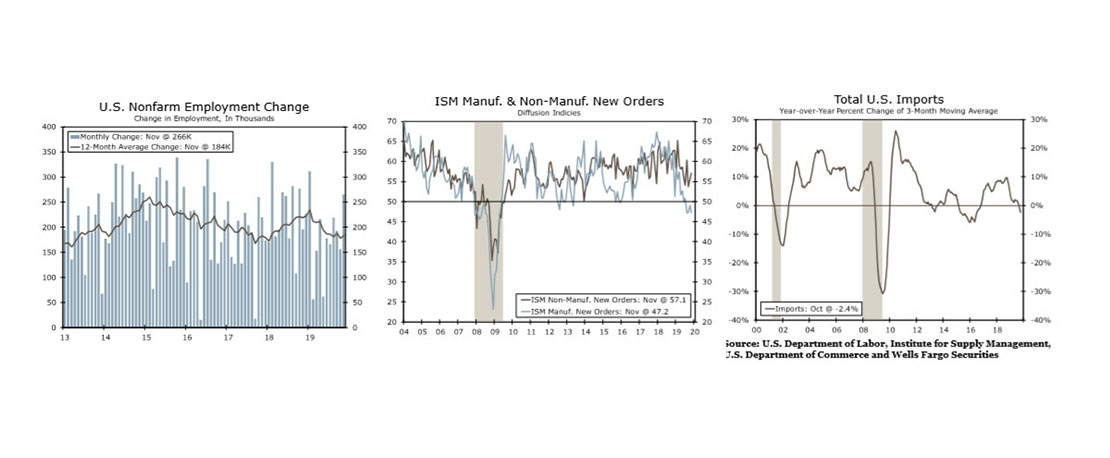

This Week's State Of The Economy - What Is Ahead? - 20 December 2019

Wells Fargo Economics & Financial Report / Dec 21, 2019

President Trump became the third president in U.S. history to be impeached by the House, but removal by the Senate is highly unlikely. The House also passed the USMCA, which should be signed into law in early 2020.