The Federal Reserve doesn't expect a quick rebound.

The Fed expects to hold interest rates near zero through the end of this year, perhaps well into next year, and maybe even into ’22.

The World Bank is less optimistic than the Fed.

The bank expects the global economy to shrink 5.2 percent this year, making it one of the most severe downturns in the past 150 years. Never before have so many countries entered a recession at the same time.

Many economists expect the recovery to begin in Q3.

In a recent survey of 60 prominent academic and business economists, The Wall Street Journal found 68.4 percent expect the recovery to begin Q3/20. Just over a fifth, 22.8%, said it had already begun in Q2/20.

The spot price for West Texas Intermediate, the U.S. benchmark for light, sweet crude, averaged $37.32 per barrel the first week of June, up from $15.71 the first week of May.

Baker Hughes reports that the North American rig count fell to 279 the week ending June 5, the lowest level on record. During the Fracking Bust of ’14 – ’17, the rig count bottomed out at 404.

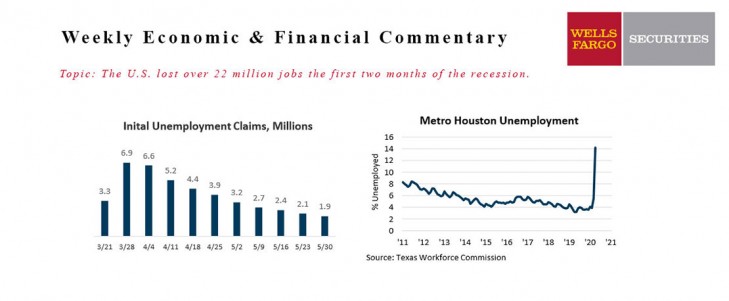

HOUSTON EMPLOYMENT UPDATE

The nine-county Metro Houston area has lost 330,100 jobs since the economy shut down due to the COVID-19 pandemic, according to Partnership calculations based on Texas Workforce Commission (TWC) data.

Today's Losses in Perspective

The region lost 221,000 jobs during the ’80s energy bust, or one in every seven jobs. Houston’s economy is significantly larger now, so the 330,100 jobs lost in the COVID-19 recession represents a smaller share of employment, about one in ten jobs in the region.

UNEMPLOYMENT

The region’s unemployment rate, as low as 3.9 percent in February, rose to 14.2 percent in April. The rates are not seasonally adjusted. Again, TWC has likely understated local unemployment.

POPULATION TRENDS

Houston reached a milestone last year. The nine-county metro area topped 7.0 million residents, according to data released this spring by the U.S. Census Bureau. The announcement went largely unnoticed because the nation’s attention was focused on the COVID-19 pandemic.

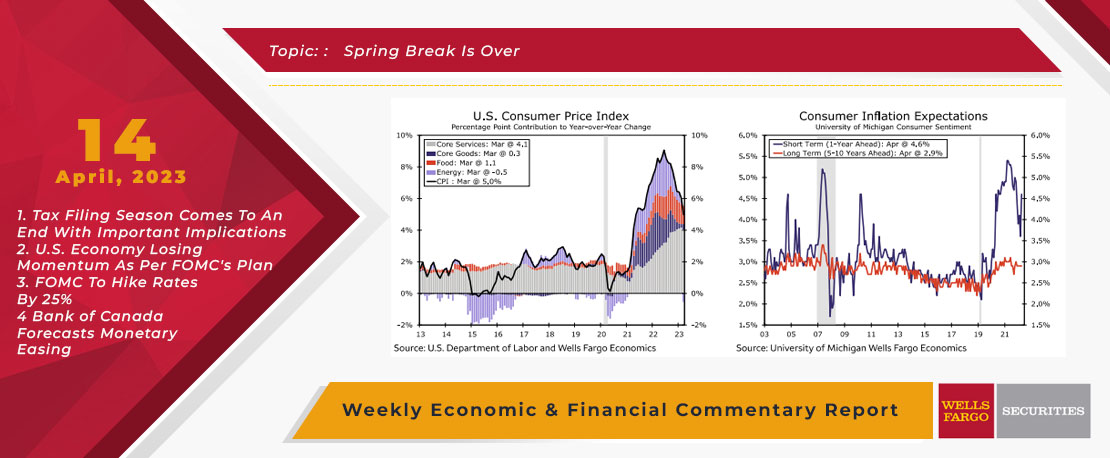

This Week's State Of The Economy - What Is Ahead? - 14 April 2023

Wells Fargo Economics & Financial Report / Apr 20, 2023

In March retail sales fell 1.0%, manufacturing production slipped 0.5% and the consumer price index rose a modest 0.1%.

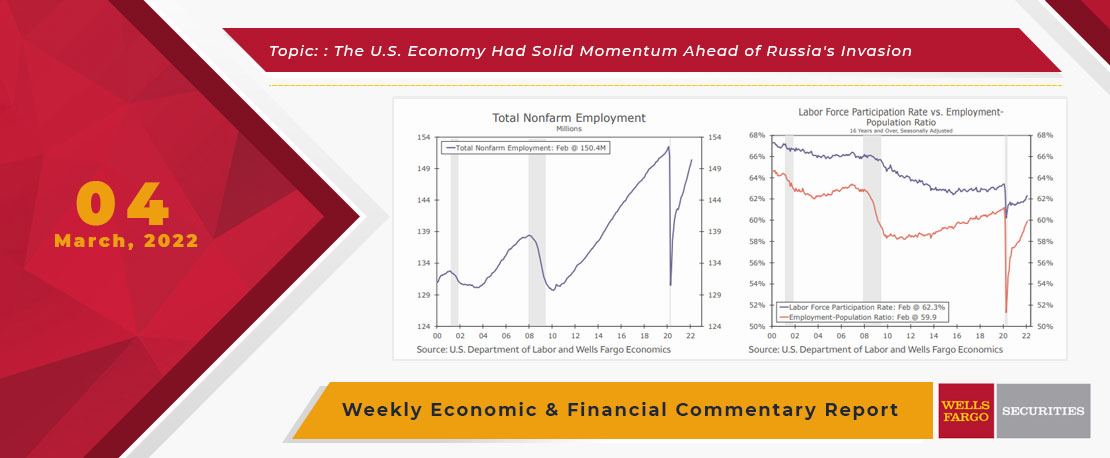

This Week's State Of The Economy - What Is Ahead? - 04 March 2022

Wells Fargo Economics & Financial Report / Mar 08, 2022

February\'s employment data showed the economy had strong momentum, but that seems pretty dated now with Russia\'s invasion of Ukraine and the Fed\'s shift to a more hawkish tone on monetary policy.

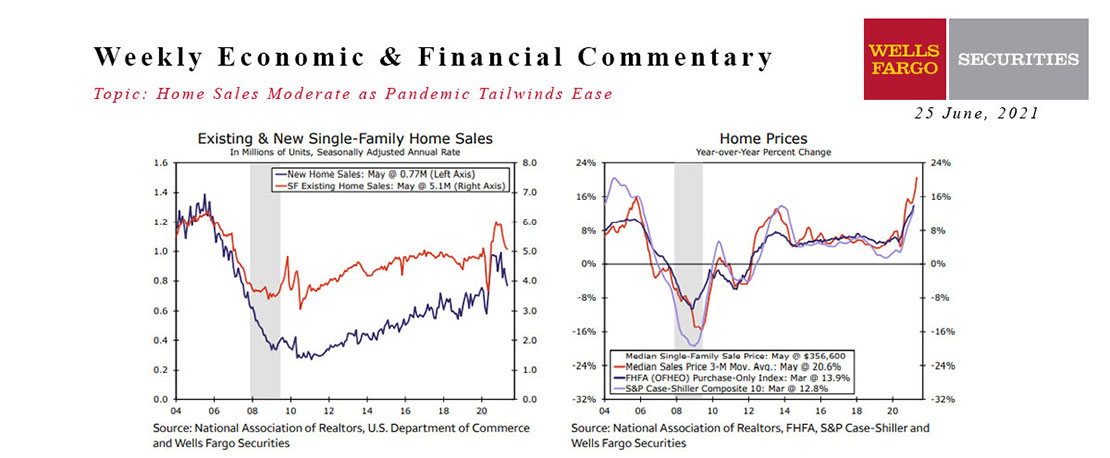

This Week's State Of The Economy - What Is Ahead? - 25 June 2021

Wells Fargo Economics & Financial Report / Jun 26, 2021

Supply chain bottlenecks continue to cause pain-in-the-necks. In spite of all the difficulties, the Economic whizzes in the WF Economics team have upgraded their forecast for full-year 2021 U.S.

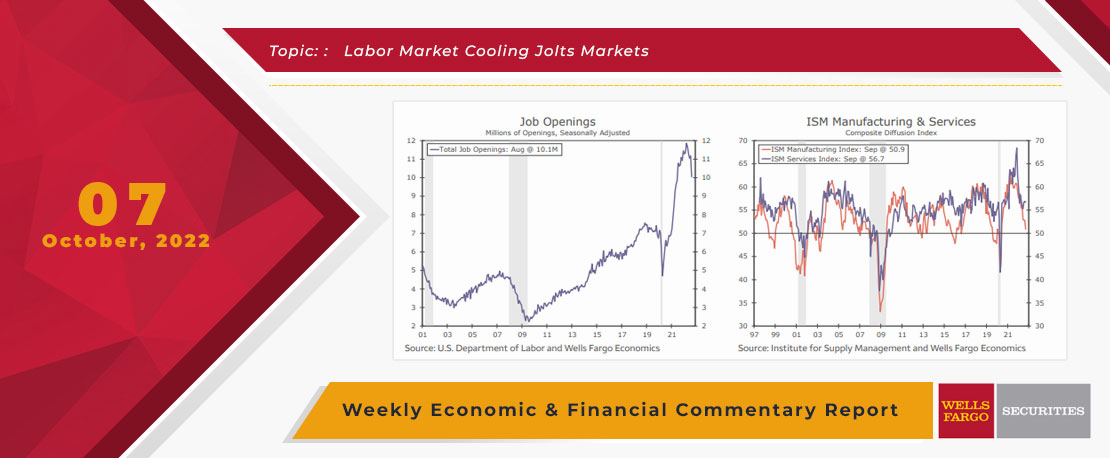

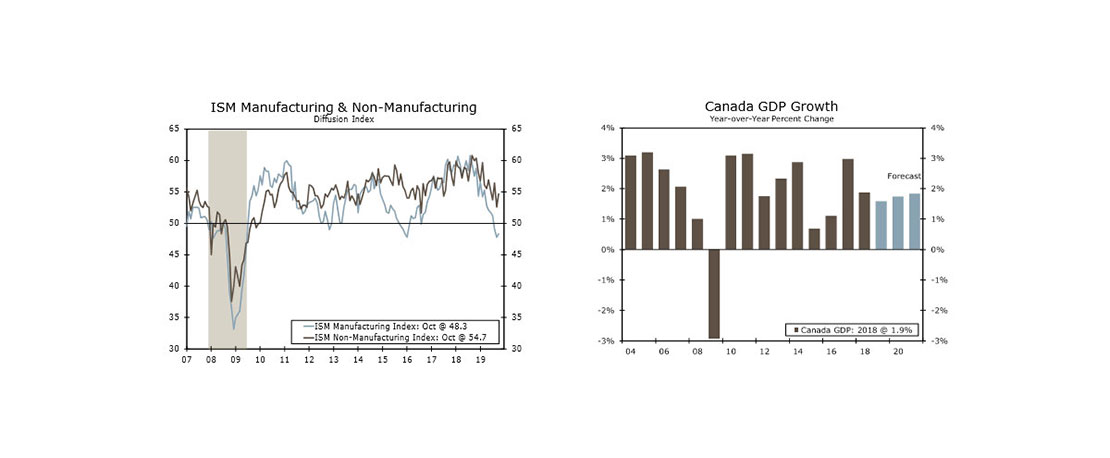

This Week's State Of The Economy - What Is Ahead? - 07 October 2022

Wells Fargo Economics & Financial Report / Oct 10, 2022

higher interest rates and inflation appear to be weighing on manufacturing and construction, yet service sector activity remains fairly resilient.

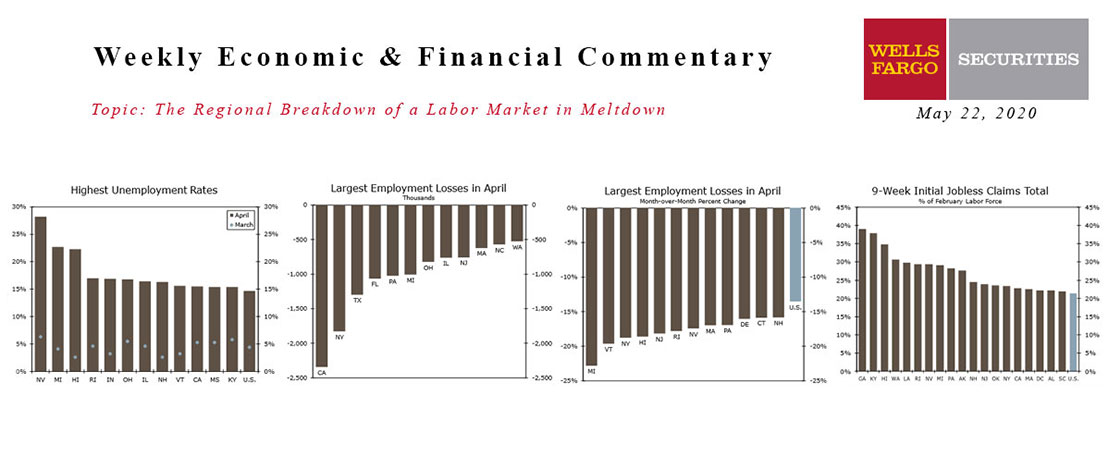

The Regional Breakdown Of A Labor Market In Meltdown

Wells Fargo Economics & Financial Report / May 26, 2020

Employment fell in all 50 states and 43 states saw their unemployment rate rise to a record in April. The damage is already hard to fathom-a 28% unemployment rate in Nevada and still another month of job losses ahead.

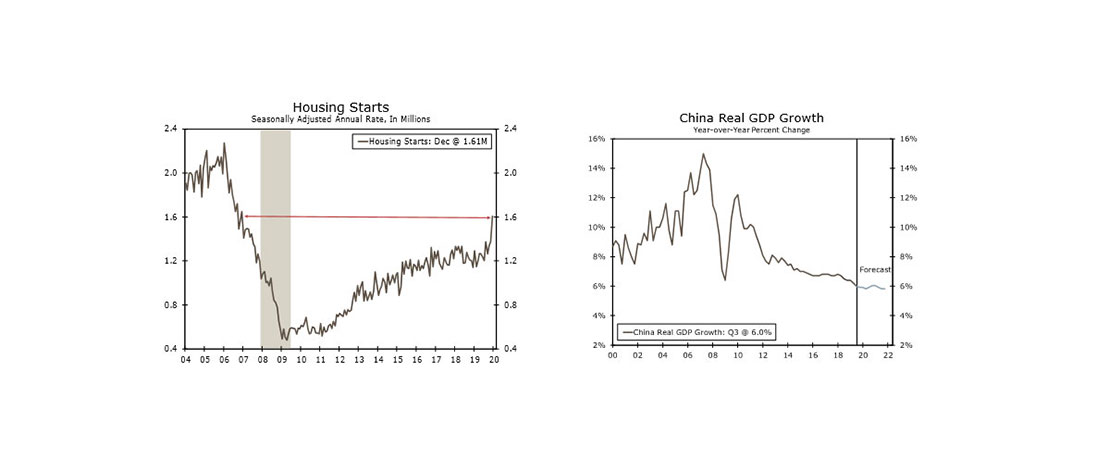

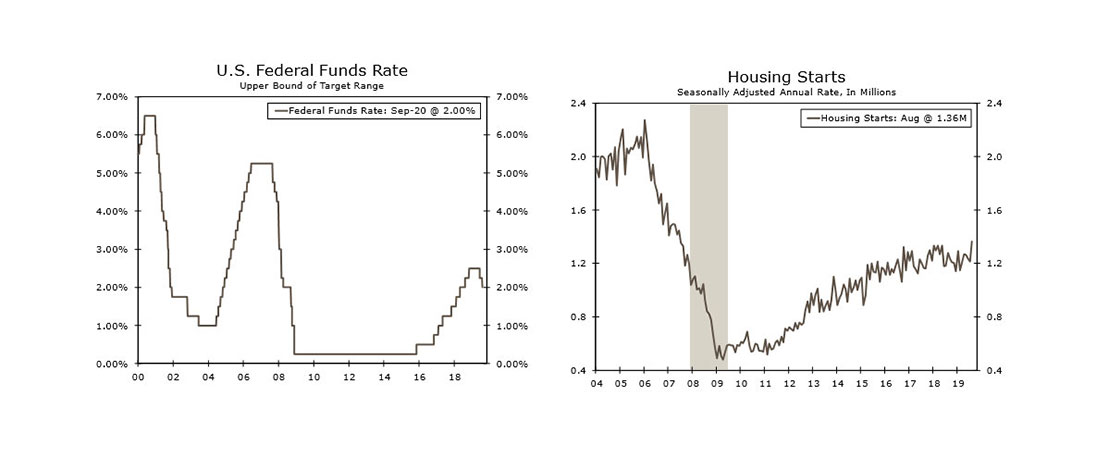

This Week's State Of The Economy - What Is Ahead? - 17 January 2020

Wells Fargo Economics & Financial Report / Jan 18, 2020

Mild weather helped housing starts surge 16.9% in December to a 1.61 million-unit pace, the highest in 13 years. Manufacturing surveys from the New York Fed and Philadelphia Fed both rose more than expected in December.

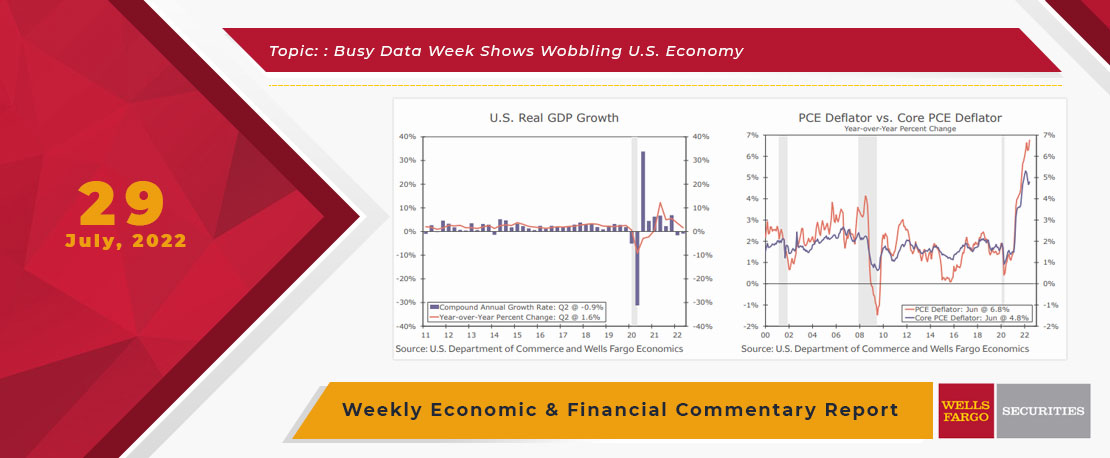

This Week's State Of The Economy - What Is Ahead? - 29 July 2022

Wells Fargo Economics & Financial Report / Jul 31, 2022

Unlike the local temperatures, data released this week showed U.S. economic growth modestly declined in Q2.

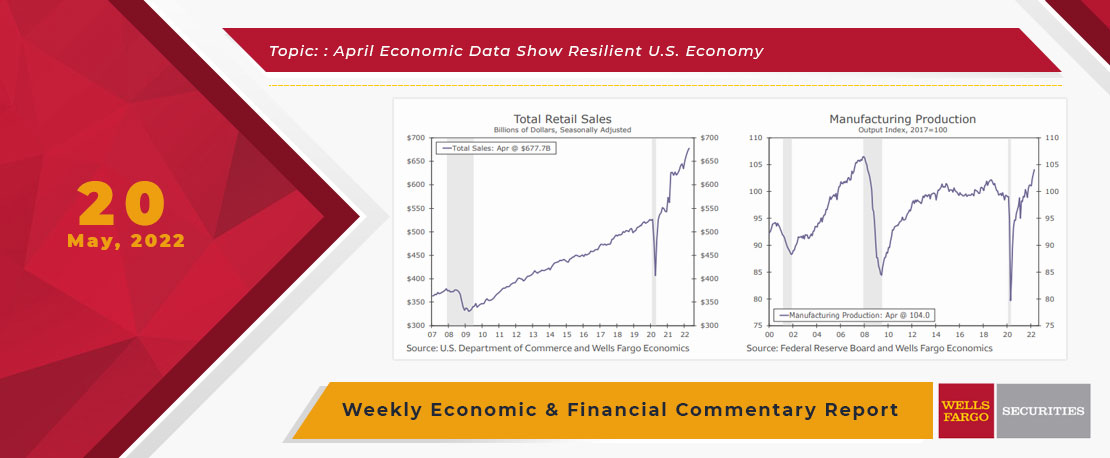

This Week's State Of The Economy - What Is Ahead? - 20 May 2022

Wells Fargo Economics & Financial Report / May 29, 2022

U.S. retail sales topped expectations in April, while industrial production also grew more rapidly than economists expected. Data on housing starts, home sales and homebuilder sentiment, however, showed tentative signs of cooling.

This Week's State Of The Economy - What Is Ahead? - 20 September 2019

Wells Fargo Economics & Financial Report / Sep 21, 2019

The Federal Reserve reduced the fed funds rate 25 bps this week, continuing to cite economic weakness overseas and muted inflation pressures.

This Week's State Of The Economy - What Is Ahead? - 08 November 2019

Wells Fargo Economics & Financial Report / Nov 09, 2019

Optimism soared this week on hopes of a forthcoming trade deal, as equity markets hit all-time highs and the yield curve steepened.