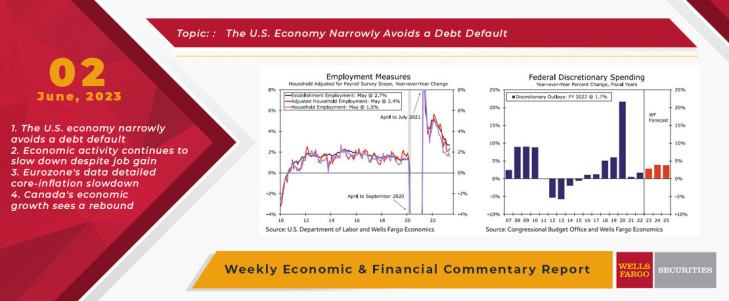

Several developments unfolded over the past few days that carry substantial implications for our economic outlook. This week was chock-full of Fed Speak, showcasing FOMC participants' divided views on their preferred path of policy. Fed Governor Philip Jefferson, President Biden's nominee for vice chair, and Philadelphia Fed President Patrick Harker, another voting member, signaled their preference to "skip" a rate hike at the next meeting. Meanwhile, non-voting members Richmond Fed President Tom Barkin and Cleveland Fed President Loretta Mester voiced their willingness to keep going. Although our base case still assumes that the Fed will hold rates at 5.25% in June, persistent inflation leaves the door open for another rate hike this cycle, especially with a U.S. default now seemingly off the table.

This week, both the House and Senate approved a deal between President Biden and Congressional Republicans to suspend the debt ceiling and avoid what would have been the first default in U.S. history. In exchange for suspending the debt limit through the end of next year (after the election), the legislation set discretionary and nondiscretionary spending caps at $1.65 trillion for FY 2024 and $1.67 trillion for FY 2025, implying a downshift in annual spending growth compared to recent years. The deal would also end the pause on student loan repayments, enact modest permitting

reforms for energy-related projects, and add work requirements for certain SNAP and TANF recipients, while exempting populations like veterans and homeless adults from those requirements. The economic benefits of avoiding default cannot be overstated. That said, we expect the caps on fiscal outlays to shave off a modest 0.1 to 0.2 percentage points from annual real GDP growth over the next few years.

This morning's jobs report blew expectations out of the water. The U.S. economy added 339,000 jobs on net in May, dwarfing expectations of a 195,000 gain. The bewildering nonfarm payroll print came on the heels of upward revisions to the prior two months, suggesting employers are even more resilient to macroeconomic headwinds than previously thought. Not all aspects of the report pointed to a white-hot labor market, however. Monthly average hourly earnings growth decelerated to 0.3% in May from April's downwardly revised 0.4% bump, suggesting more plentiful labor supply is easing wage pressures. The unemployment rate also moved up from 3.4% to 3.7%, revealing the largest decline in employment, as measured in the household survey, since April 2022. Although the enduring strength of the labor market continues to baffle observers, we believe the May report gives the Fed just enough room to justify a pause.

JOLTS also surprised to the upside, as job openings popped back up over 10 million in April. This adds to the evidence that the labor market is far from buckling. We caution against reading too much into one month of data, however. The JOLTS series is highly volatile, and the trend in openings is clearly moving downward. Alternative measures also suggest labor demand is softening. For example, Indeed job openings have steadily inched down since the beginning of the year and small business hiring plans in the NFIB survey continue to wane. Although the labor market remains objectively strong compared to its pre-pandemic normal, signs point to a gradual cooling in labor demand.

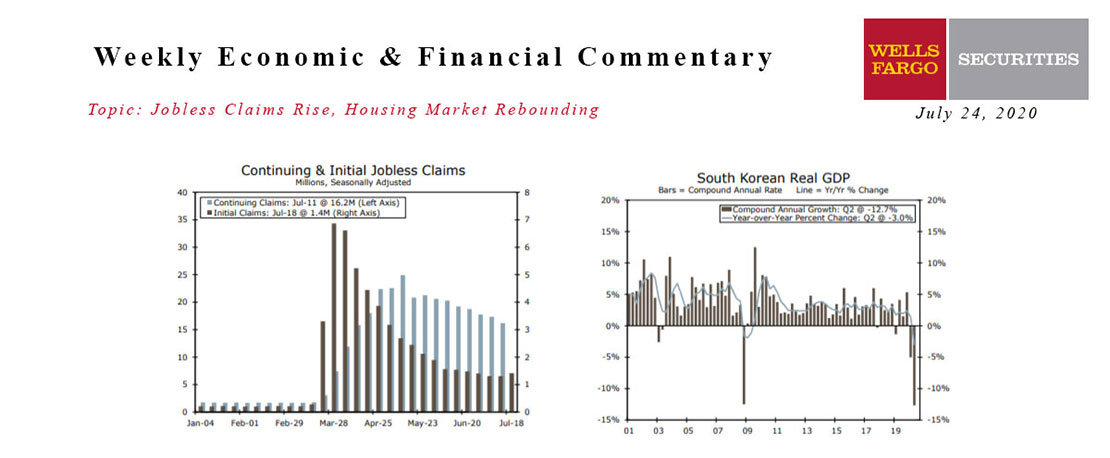

This Week's State Of The Economy - What Is Ahead? - 24 July 2020

Wells Fargo Economics & Financial Report / Jul 25, 2020

Initial jobless claims rose to just over 1.4 million for the week ending July 18. Continuing claims fell to about 16.2 million. Initial claims edging higher suggests that the resurgence of COVID-19 may be taking a toll on the labor market recovery.

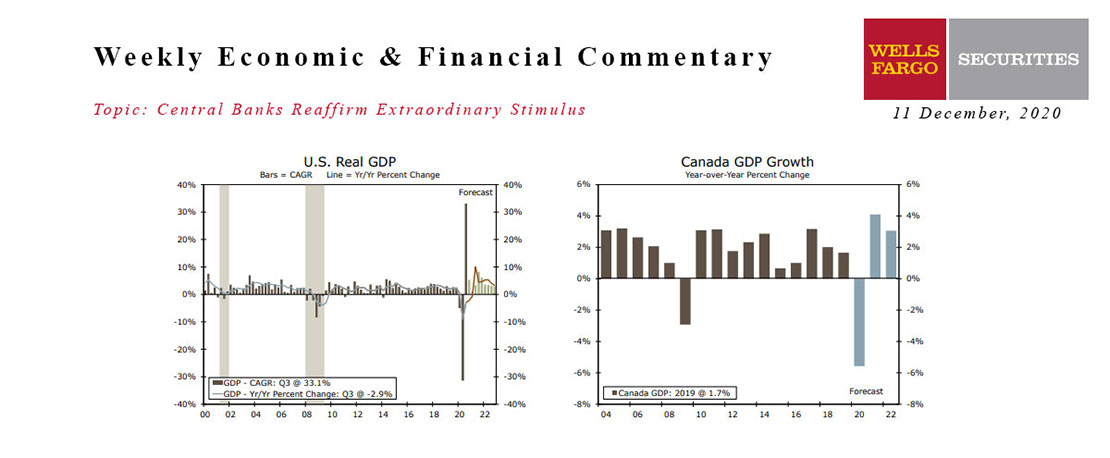

This Week's State Of The Economy - What Is Ahead? - 11 December 2020

Wells Fargo Economics & Financial Report / Dec 14, 2020

Emergency authorization of the Pfizer-BioNTech COVID vaccine appears imminent, but the virus is running rampant across the United States today, pointing to a grim winter.

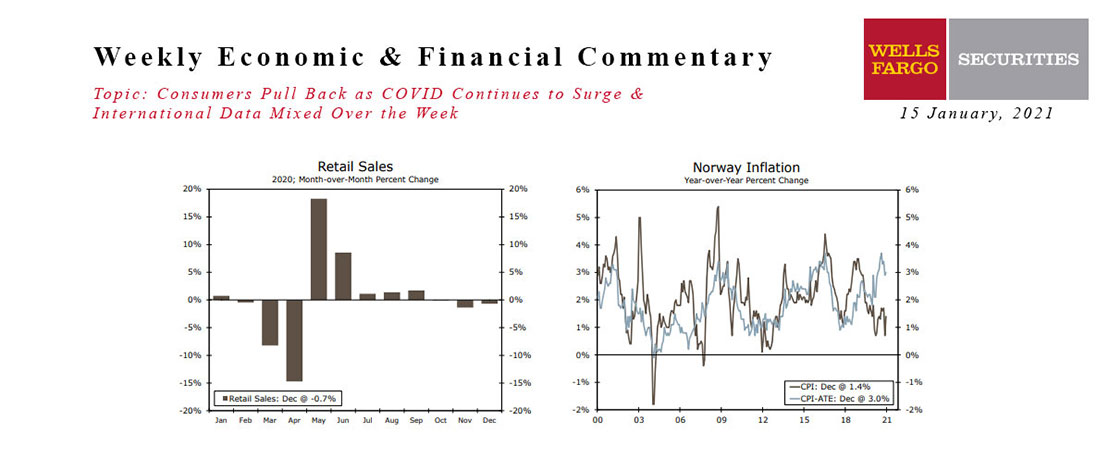

This Week's State Of The Economy - What Is Ahead? - 15 January 2021

Wells Fargo Economics & Financial Report / Jan 18, 2021

Retail sales fell 0.7% in December, the third straight monthly decline. Sales are still up 2.9% over the year, however.

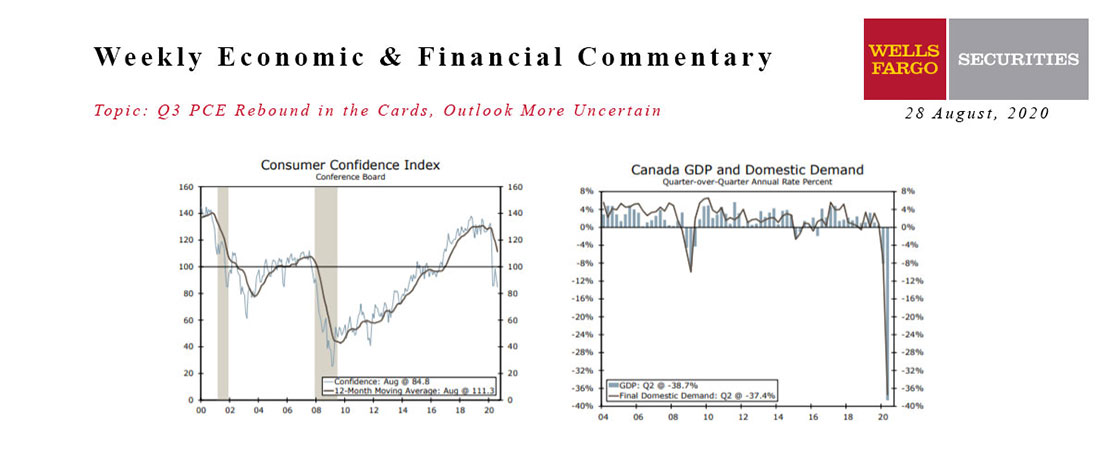

This Week's State Of The Economy - What Is Ahead? - 28 August 2020

Wells Fargo Economics & Financial Report / Aug 26, 2020

After a revised look at GDP this week suggested the second quarter may not have been quite as bad as first estimated, attention shifts to the current quarter.

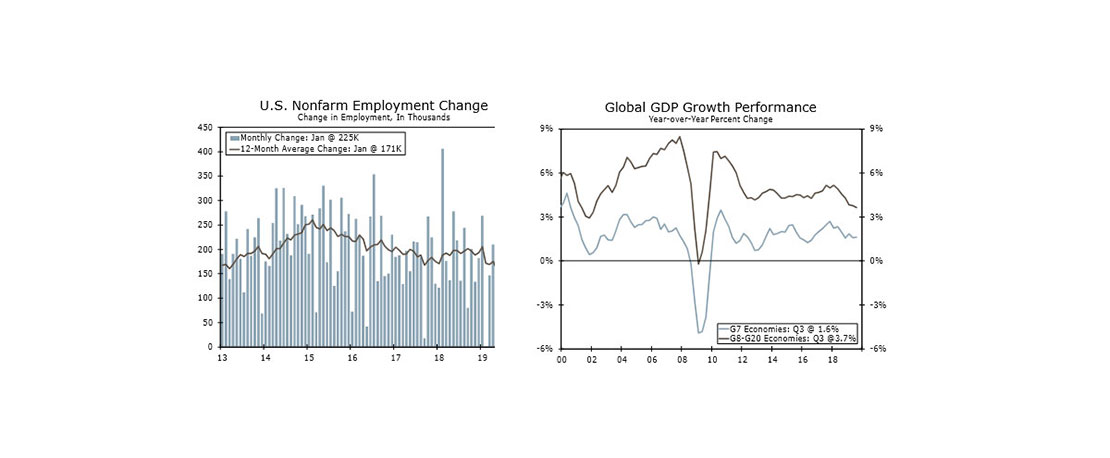

This Week's State Of The Economy - What Is Ahead? - 07 February 2020

Wells Fargo Economics & Financial Report / Feb 08, 2020

U.S. employers added 225K new workers to their payrolls in January, which handily beat expectations. But the factory sector shed jobs for the third time in four months, and net layoffs were reported for finance and retail as well.

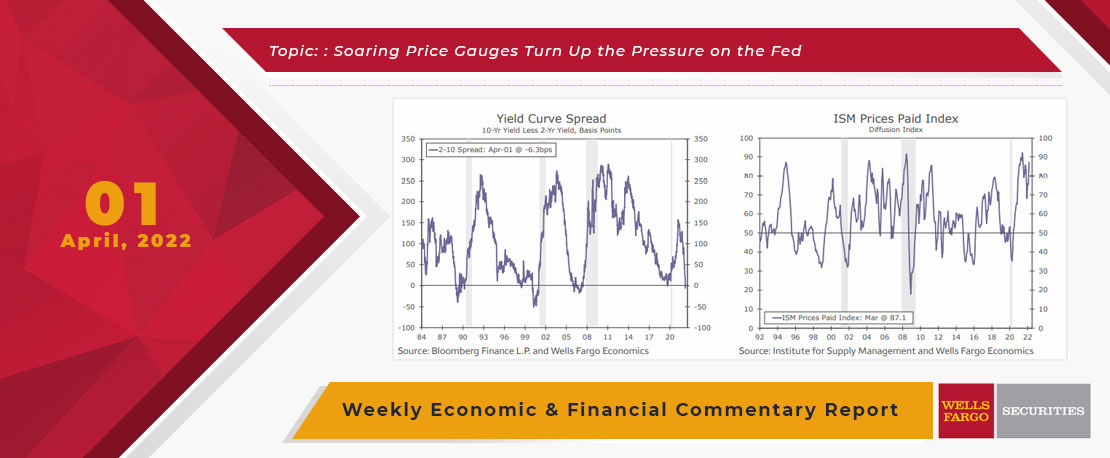

This Week's State Of The Economy - What Is Ahead? - 01 April 2022

Wells Fargo Economics & Financial Report / Apr 05, 2022

The key factor that will drive interest rates is the Fed’s belated effort to rein-in inflation.

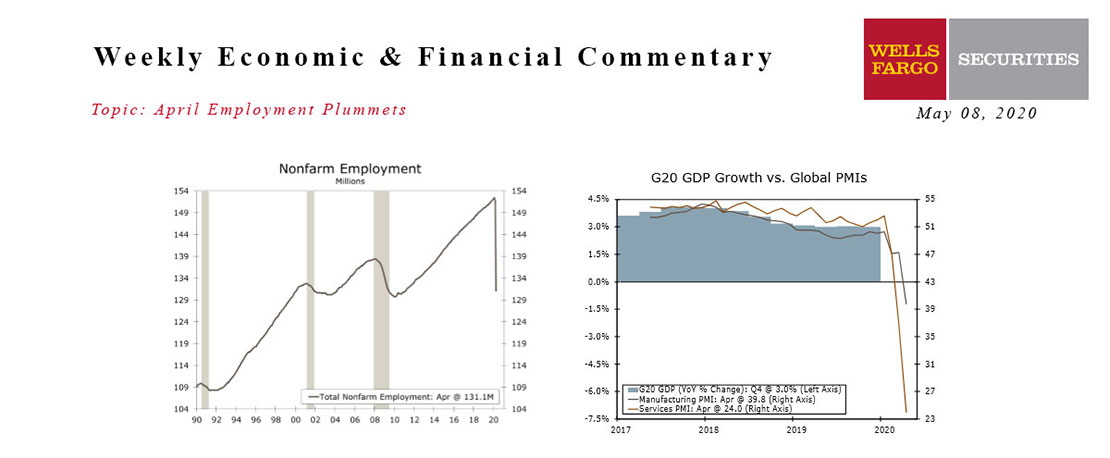

This Week's State Of The Economy - What Is Ahead? - 08 May 2020

Wells Fargo Economics & Financial Report / May 15, 2020

April nonfarm payrolls confirmed what we already knew—the labor market is collapsing. By the survey week of April 12, net employment had fallen by 20,500,000 jobs.

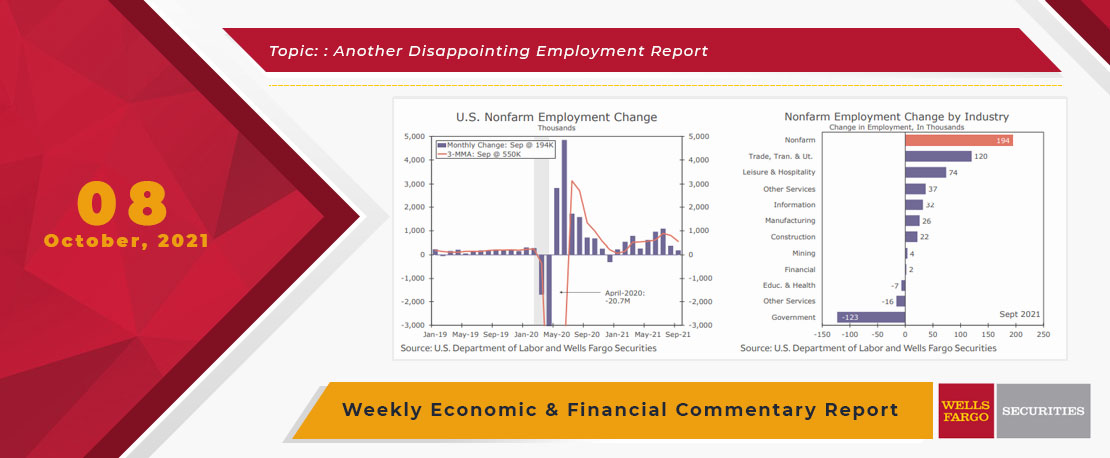

This Week's State Of The Economy - What Is Ahead? - 08 October 2021

Wells Fargo Economics & Financial Report / Oct 15, 2021

September\'s disappointing employment report clearly takes center stage over this week\'s other economic reports. Nonfarm employment rose by just 194,000 jobs, as employers continue to have trouble finding the workers they need.

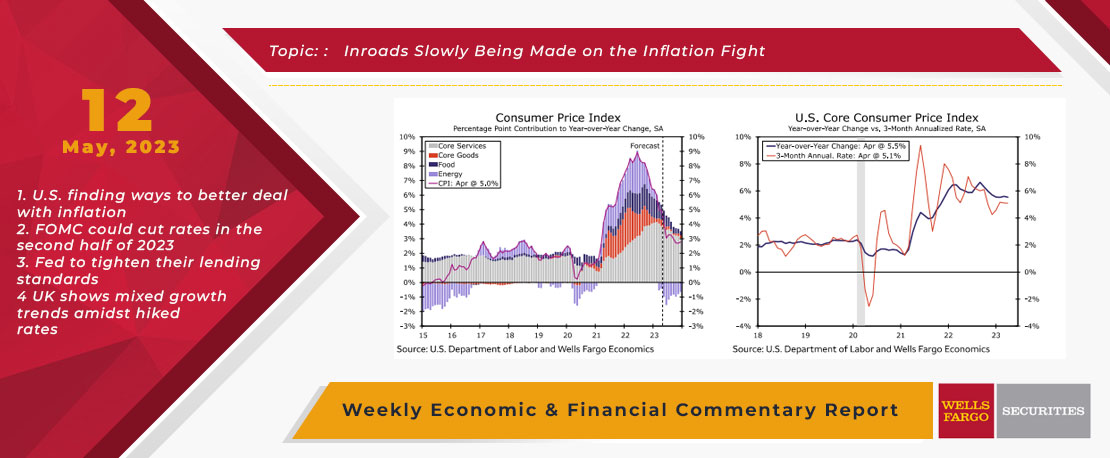

This Week's State Of The Economy - What Is Ahead? - 12 May 2023

Wells Fargo Economics & Financial Report / May 17, 2023

In April, the CPI rose 0.4% on both a headline and core basis, keeping the core running at a 5.1% three-month annualized rate. However, details pointed to price growth easing ahead.

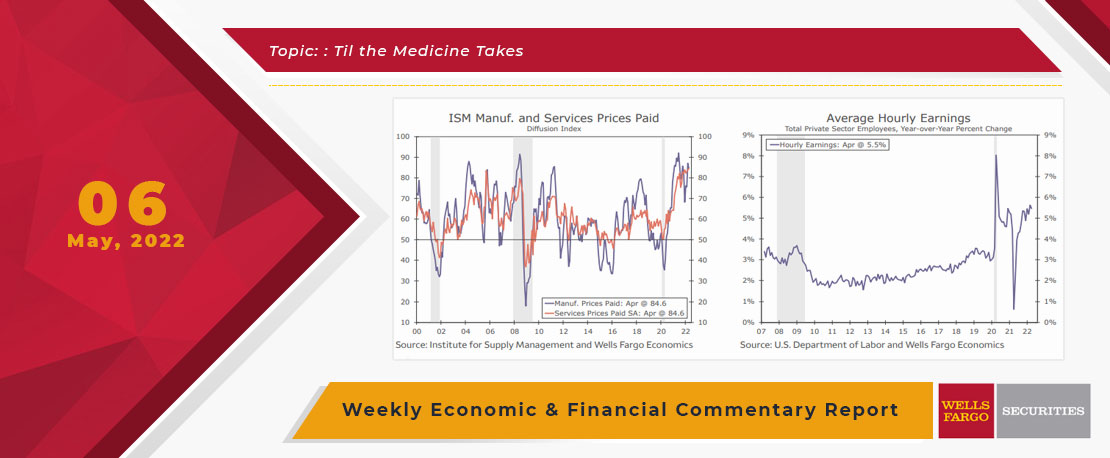

This Week's State Of The Economy - What Is Ahead? - 06 May 2022

Wells Fargo Economics & Financial Report / May 18, 2022

Unlike Yordan Alvarez, no one is expecting the Fed to stand back and admire their handiwork after this weeks 50 basis point increase in the Fed Discount Rate. Similar to Yordan, their effort is more of a single and not a home run.