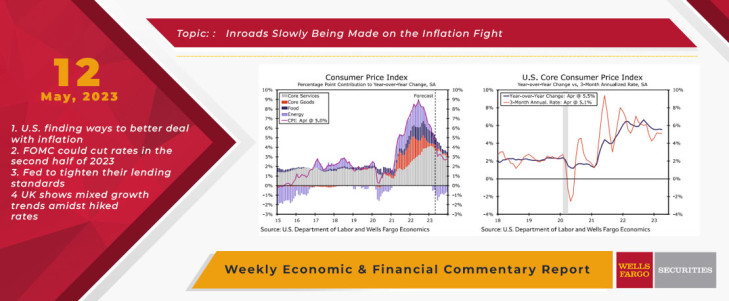

Inflation remains uncomfortably high in the United States. In April, the CPI rose 0.4% on both a headline and core basis, keeping the core running at a 5.1% three-month annualized rate. However, details pointed to price growth easing ahead, while the Producer Price Index and NFIB small business survey also suggested more meaningful disinflation is on its way. Maybe that’s why the bond market is currently priced for 75 bps of Fed easing by the end of the year. One interpretation of that pricing is a 25% probability of 300 bps worth of easing coupled with a 75% probability of no easing. Count me in the 75% and still perplexed why some think this simple return to historically “normal” interest rate levels should somehow lead to any easing back to abnormally lower rates later this year. That said, I’m wrong about so many things, so frequently, that a view contrary to mine may be the safe play.

This Week's State Of The Economy - What Is Ahead? - 04 August 2023

Wells Fargo Economics & Financial Report / Aug 09, 2023

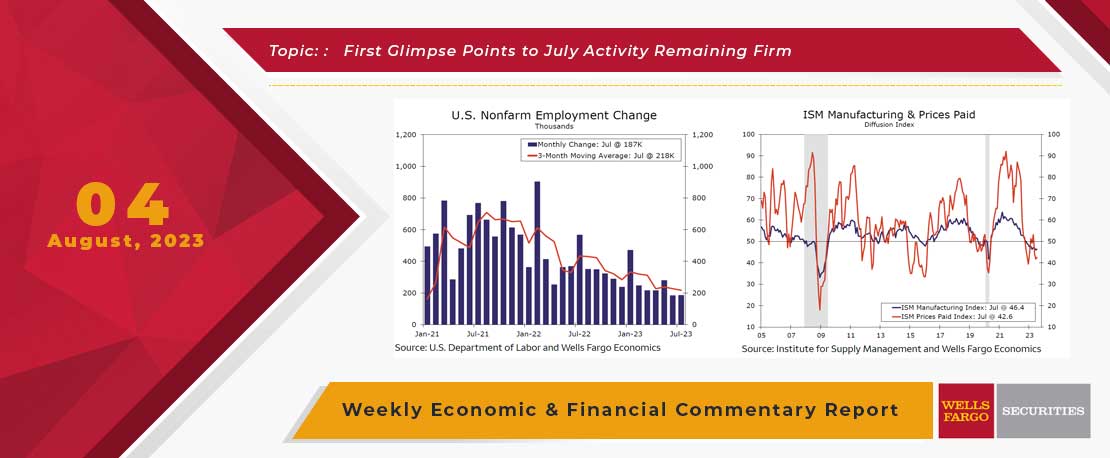

Employment growth was broad-based, though reliant on a 87K gain in health care & social assistance. Modest gains from construction, financial activities and hospitality also contributed to private sector job growth.

This Week's State Of The Economy - What Is Ahead? - 17 April 2020

Wells Fargo Economics & Financial Report / Apr 18, 2020

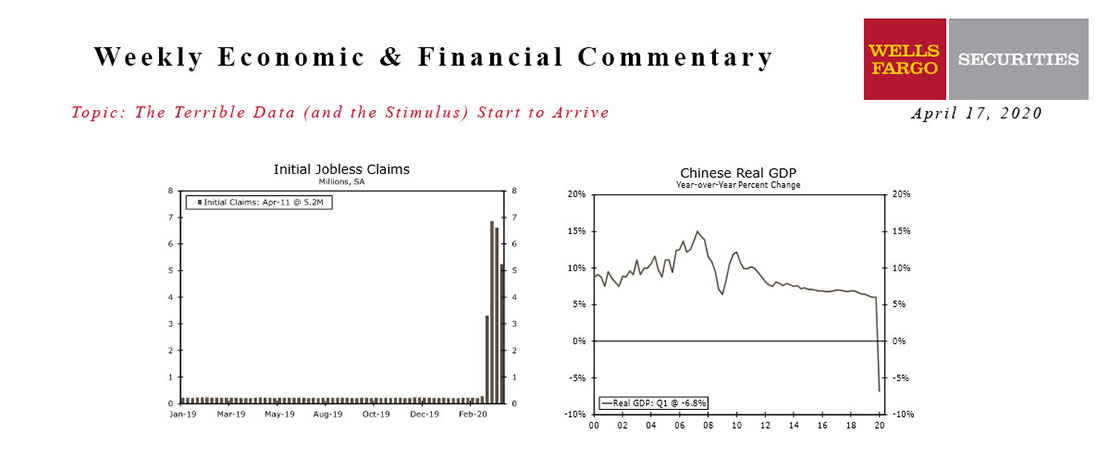

Economic data from the early stages of the Great Shutdown have finally arrived, and they are as bad as feared. ‘Worst on record’ is about to become an all too common refrain in our commentary.

This Week's State Of The Economy - What Is Ahead? - 05 August 2022

Wells Fargo Economics & Financial Report / Aug 08, 2022

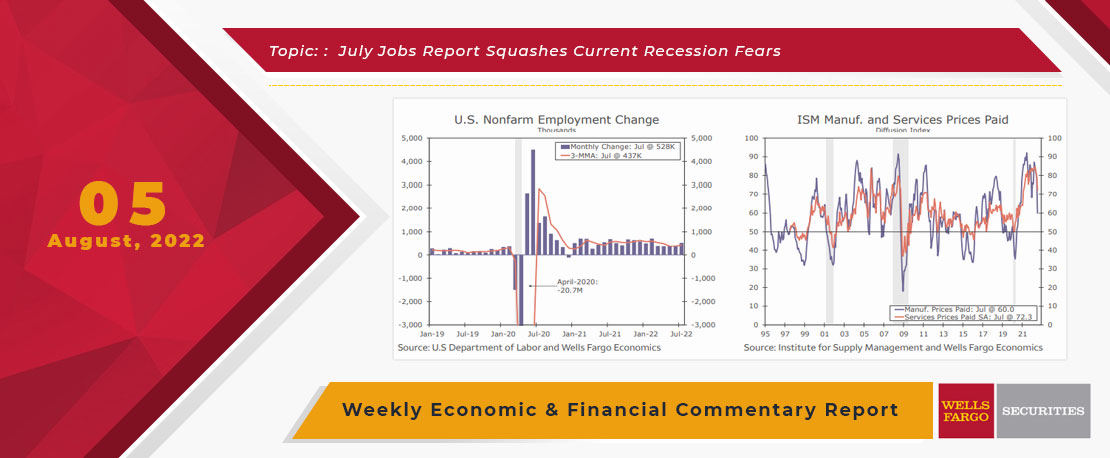

The Bureau of Labor Statistics reported this morning that nonfarm payrolls increased 528,000 for the month of July, easily topping estimates, lowering the unemployment rate to 3.5%.

September 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Sep 19, 2020

A March survey by the Federal Reserve Bank of Dallas found most exploration firms need West Texas Inter-mediate (WTI) at $49 per barrel or higher to profitably drill a well.

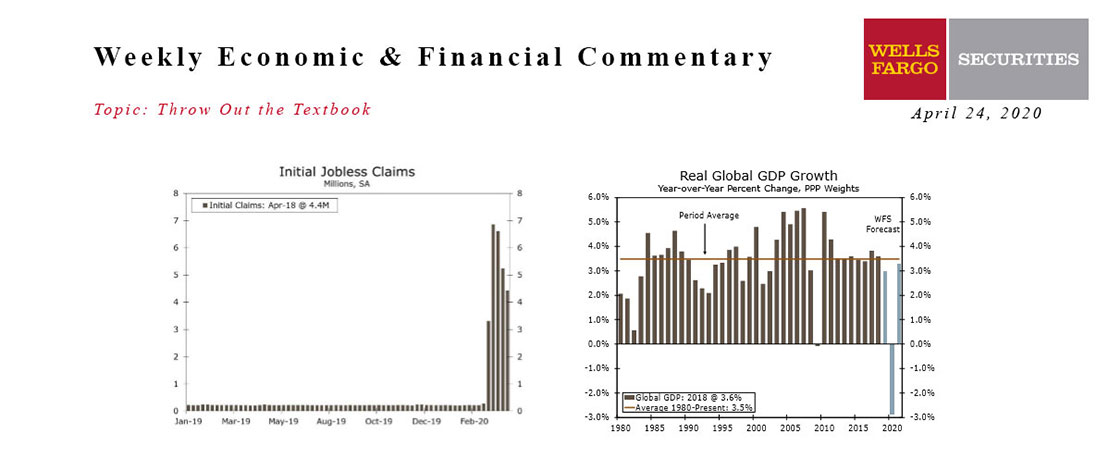

This Week's State Of The Economy - What Is Ahead? - 24 April 2020

Wells Fargo Economics & Financial Report / Apr 27, 2020

Oil prices went negative for the first time in history on Monday as the evaporation of demand collided with a supply glut. In the past five weeks, 26.5 million people have filed for unemployment insurance, or more than one out of every seven workers.

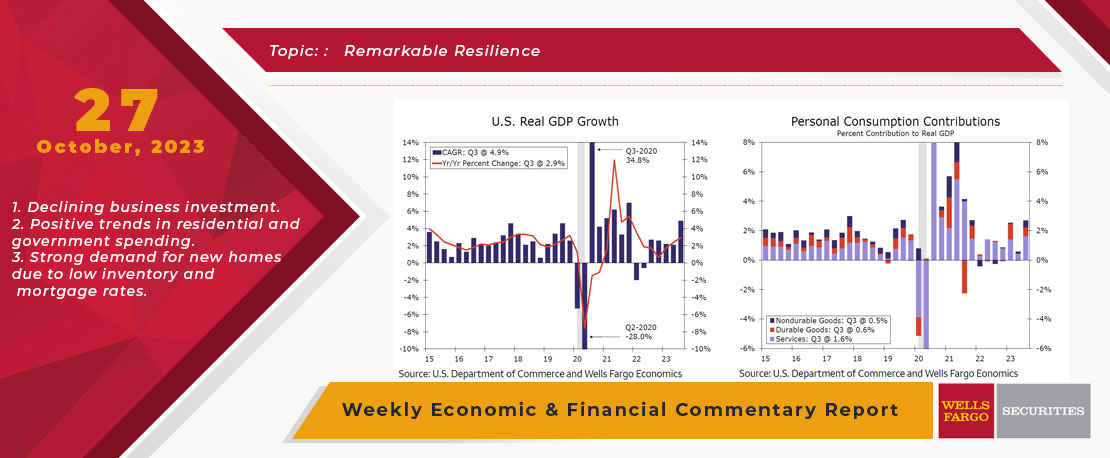

This Week's State Of The Economy - What Is Ahead? - 27 October 2023

Wells Fargo Economics & Financial Report / Nov 02, 2023

The U.S. economy expanded at a stronger-than-expected pace in Q3, with real GDP increasing at a robust 4.9% annualized rate.

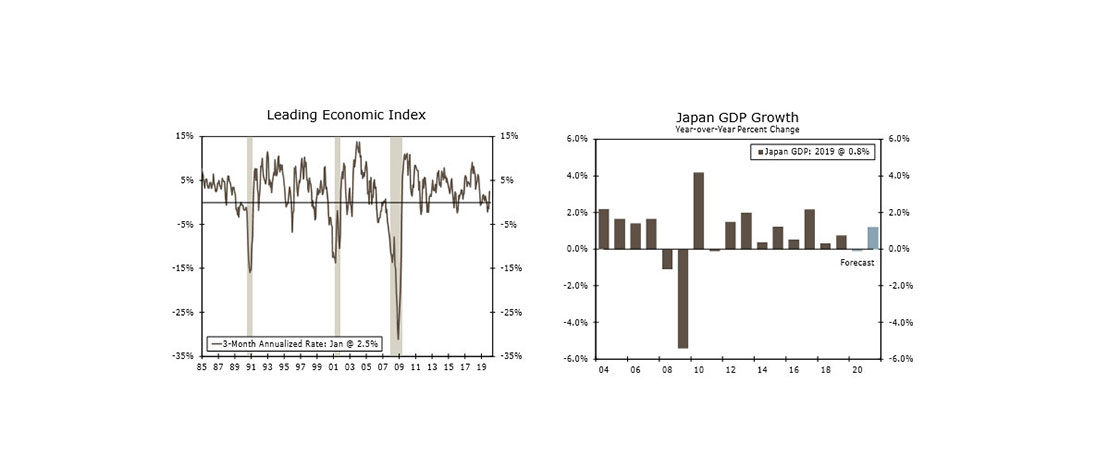

This Week's State Of The Economy - What Is Ahead? - 21 February 2020

Wells Fargo Economics & Financial Report / Feb 22, 2020

Minutes from the January 28-29 FOMC meeting indicate the coronavirus will not push the Fed to cut interest rates, and for the most part housing and manufacturing survey data this week supported that view.

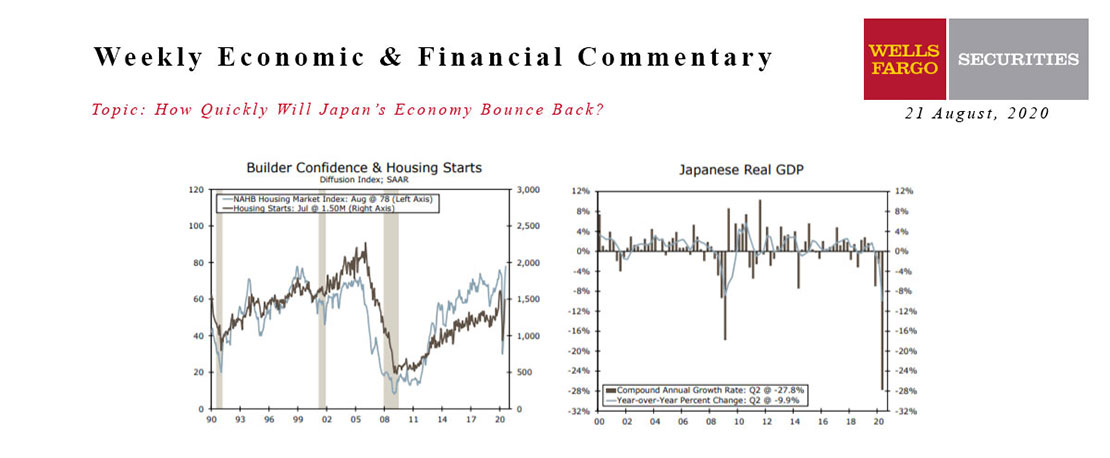

This Week's State Of The Economy - What Is Ahead? - 21 August 2020

Wells Fargo Economics & Financial Report / Aug 18, 2020

Despite indications of lost momentum elsewhere, residential construction activity is picking up steam.

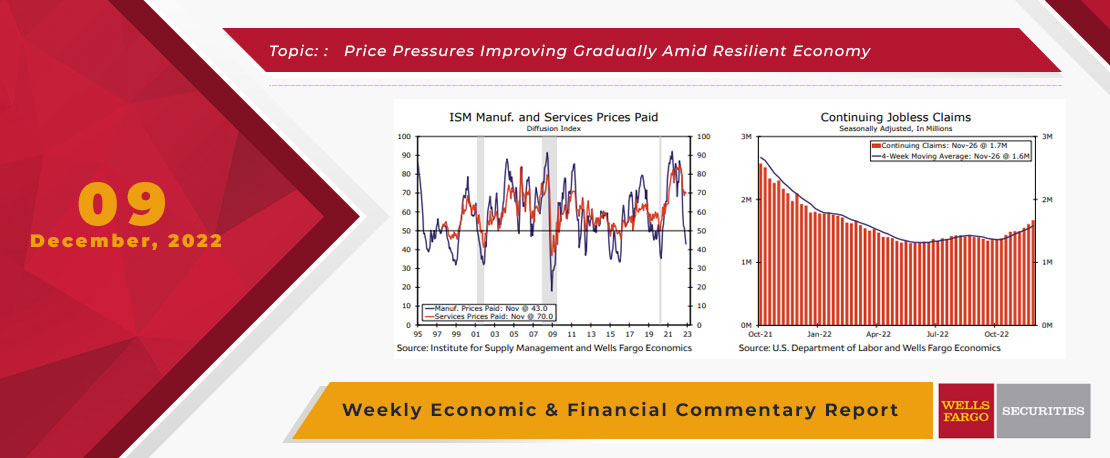

This Week's State Of The Economy - What Is Ahead? - 09 December 2022

Wells Fargo Economics & Financial Report / Dec 15, 2022

Various price metrics released this week showed some continued signs of inflation cooling, but gradually rather than rapidly.

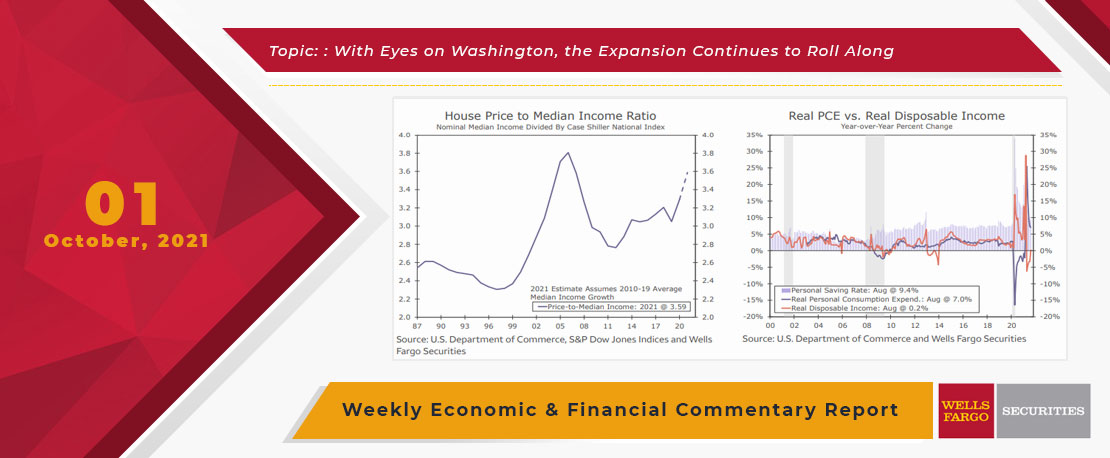

This Week's State Of The Economy - What Is Ahead? - 01 October 2021

Wells Fargo Economics & Financial Report / Oct 10, 2021

Economic data this week indicated that the ongoing expansion still has some momentum despite some familiar headwinds, though this week\'s releases were largely overshadowed by a busy week on Capitol Hill.