The November release of the ISM services index kicked off the week with a surprisingly strong reading on the U.S. economy. The index rose 2.1 points to 56.5 despite consensus expectations for a roughly one-point decline. The outturn was higher than any of the 60 forecast estimates submitted to Bloomberg. The better-than-expected gain was due almost entirely to a 9.0-point increase in the business activity index. This component is now at its highest reading in almost a year, signaling economic growth in the service sector remained widespread through November. The new orders component fell slightly but remained in solid territory at 56.0.

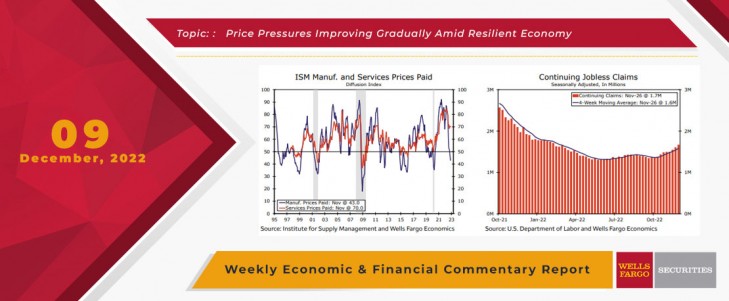

While the slowdown in service sector activity has been more muted than manufacturing, so has the impact on prices. The ISM services prices paid component declined last month, but a reading of 70.0 suggests price pressures still remain elevated. In contrast, the prices paid component in the ISM manufacturing index has fallen to 43.0, the lowest reading since May 2020. This is the largest gap on record for the two price indices and speaks to the different inflation dynamics for service-providers and manufacturers.

This week's producer price index (PPI) data for November was reflective of this divergence between goods and services inflation. The PPI for final demand increased by 0.3% in November. Beneath the headline, prices for final demand services rose 0.4%, while final demand goods prices inched up just 0.1% in the month. Even as we see a reprieve in goods prices, the slow descent in the larger services sector speaks to the fact that it will take time for inflation to return to target and that the Fed still has work to do in its fight against inflation.

Fortunately for the Fed's inflation fight, there was other data this week that suggested some modest improvement in reducing labor cost growth. Revisions to the unit labor cost and productivity figures for the third quarter showed unit labor costs rising at a 2.4% annualized rate in Q3, the slowest pace of growth since Q1-2021. Unit labor costs adjust hourly compensation for labor productivity. Put another way, unit labor costs measure how much it costs a business to produce one unit of output. All else equal, faster unit labor cost growth should be inflationary, and slower growth should be disinflationary. Although the Q3 reading was encouraging, this data can be very volatile on a quarter-to-quarter basis, and over the past year unit labor costs are up 5.3%, roughly triple the average pace in 2019.

Slower labor cost growth could be in the offing if the labor market cools in the year ahead, and this week's unemployment claims data suggest some looser labor market conditions on the margin. Continuing jobless claims increased to 1.67M through the week ending November 26. The above chart shows how continuing claims have been on the rise since bottoming at the beginning of the summer. On an absolute basis, the level of claims is still quite low. For context, continuing claims averaged 1.70M in 2019 in what was a tight labor market. But as we look to 2023, we expect this trend to continue as the labor market rolls over and employment begins to outright contract by the second half of next year. This in turn should help reduce labor cost growth and, by extension, move inflation much closer to the Federal Reserve's 2% target.

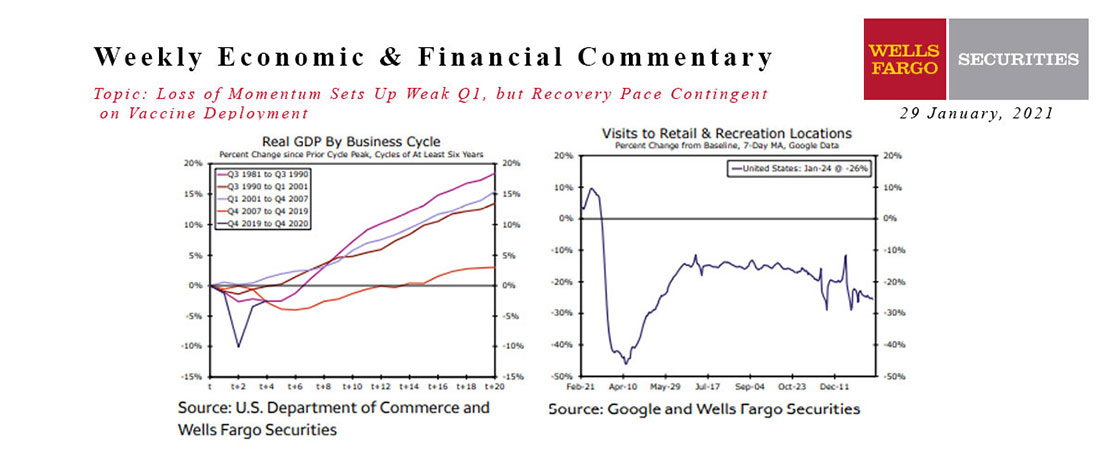

This Week's State Of The Economy - What Is Ahead? - 29 January 2021

Wells Fargo Economics & Financial Report / Feb 09, 2021

Economic data came in largely as expected this week and suggest continued economic recovery.

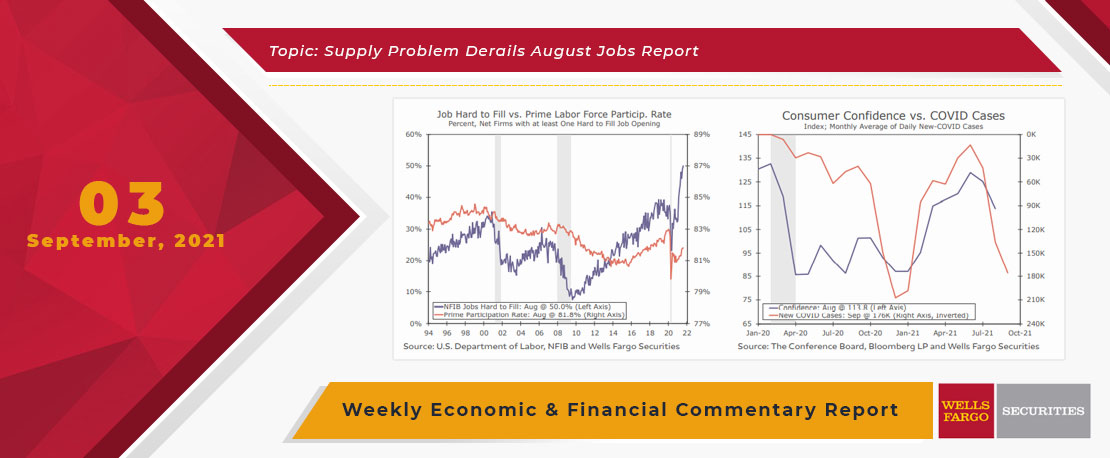

This Week's State Of The Economy - What Is Ahead? - 03 September 2021

Wells Fargo Economics & Financial Report / Sep 10, 2021

e move into the Labor Day weekend celebrating the 235K jobs added in August, while simultaneously lamenting that it was about half a million jobs short of expectations.

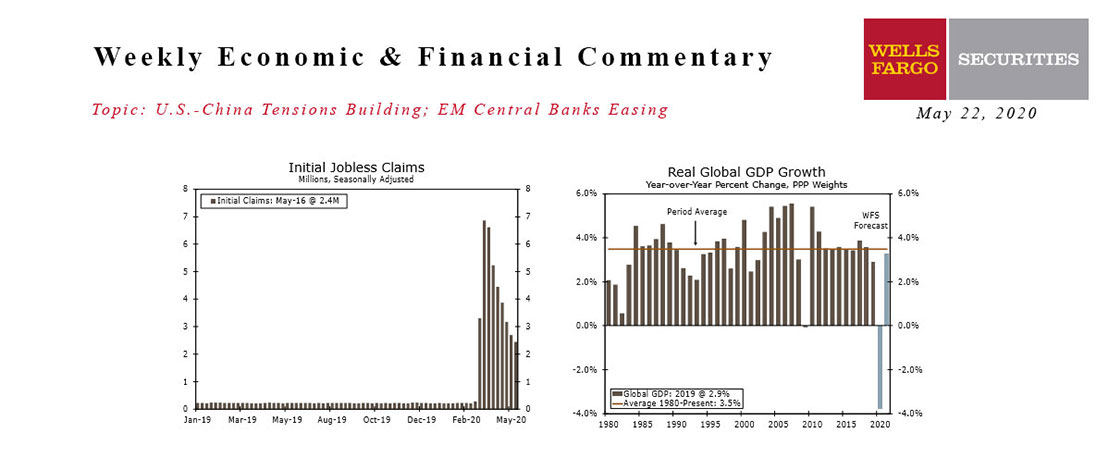

This Week's State Of The Economy - What Is Ahead? - 22 May 2020

Wells Fargo Economics & Financial Report / May 25, 2020

The re-opening of the country is getting underway, with all 50 states starting to roll back restrictions.

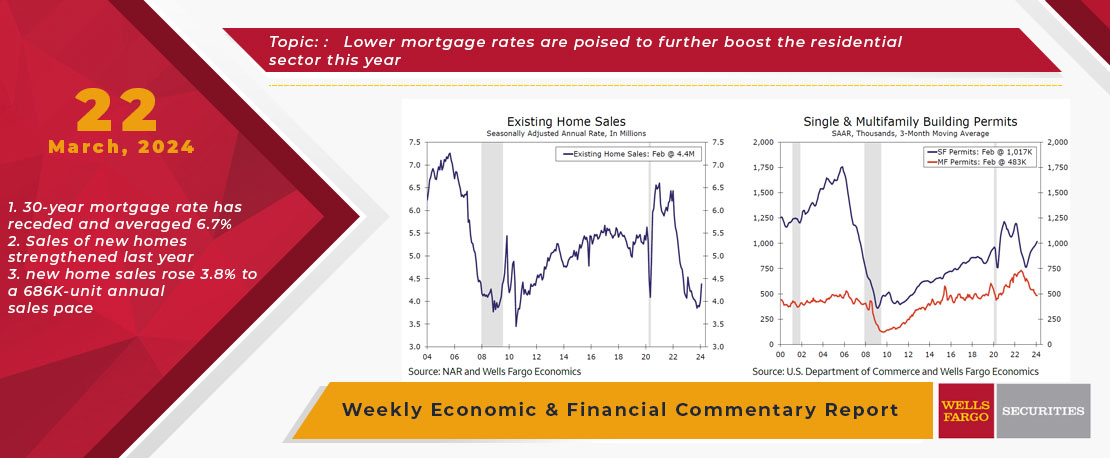

This Week's State Of The Economy - What Is Ahead? - 22 March 2024

Wells Fargo Economics & Financial Report / Mar 25, 2024

During February, existing home sales and housing starts both topped expectations and rose at robust rates. Meanwhile, initial jobless claims have remained subdued so far in March.

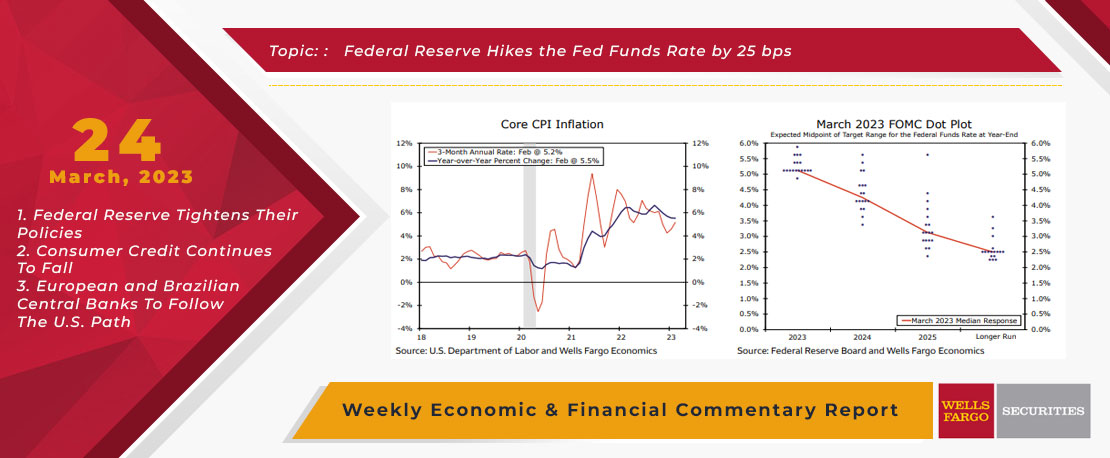

This Week's State Of The Economy - What Is Ahead? - 24 March 2023

Wells Fargo Economics & Financial Report / Mar 29, 2023

The FOMC hiked the federal funds rate by 25 bps on Wednesday amid continued strength in the labor market and elevated inflation.

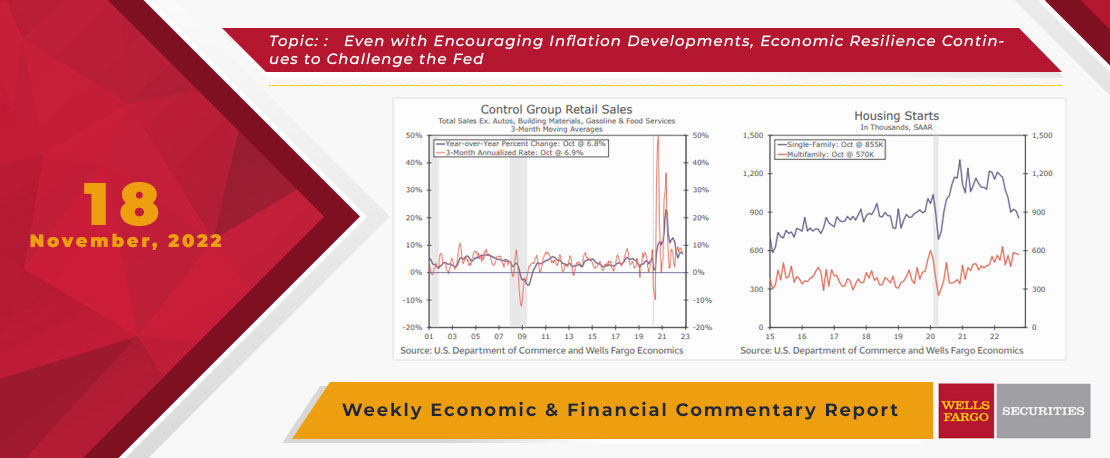

This Week's State Of The Economy - What Is Ahead? - 18 November 2022

Wells Fargo Economics & Financial Report / Nov 21, 2022

The resiliency of the U.S. consumer was also on display, as total retail sales increased a stronger-than-expected 1.3% in October, boosted, in part, by a 1.3% jump in motor vehicles & parts and a 4.1% rise at gasoline stations.

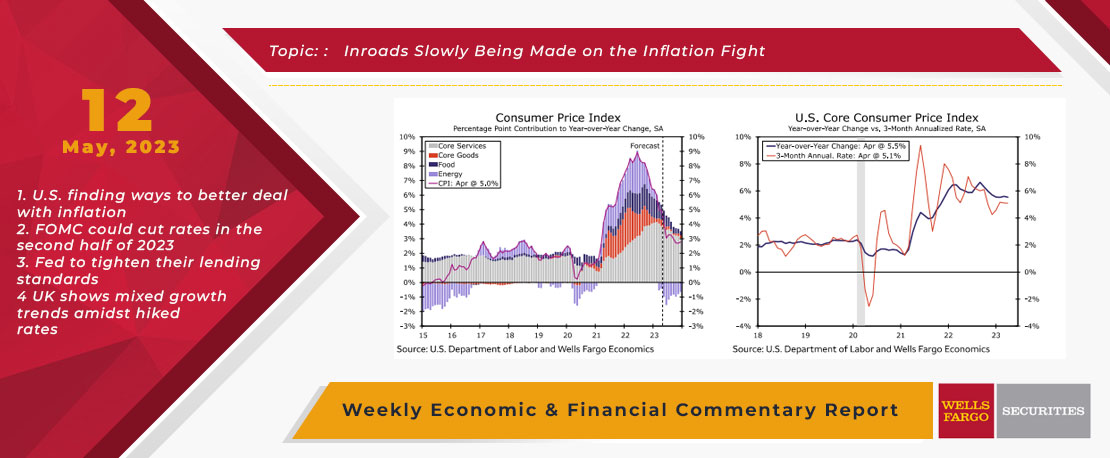

This Week's State Of The Economy - What Is Ahead? - 12 May 2023

Wells Fargo Economics & Financial Report / May 17, 2023

In April, the CPI rose 0.4% on both a headline and core basis, keeping the core running at a 5.1% three-month annualized rate. However, details pointed to price growth easing ahead.

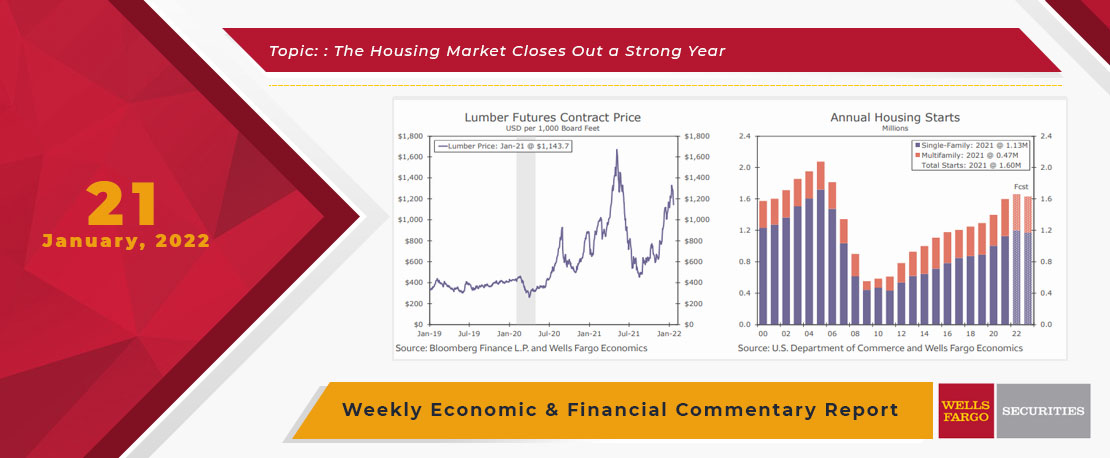

This Week's State Of The Economy - What Is Ahead? - 21 January 2022

Wells Fargo Economics & Financial Report / Jan 24, 2022

The Texans have earned a top draft position yet again, the Cowboys are home again for the remainder of the playoffs, and inflation concerns that continue to mount, along with ongoing supply chain disruptions, are weighing on homebuilder confidence.

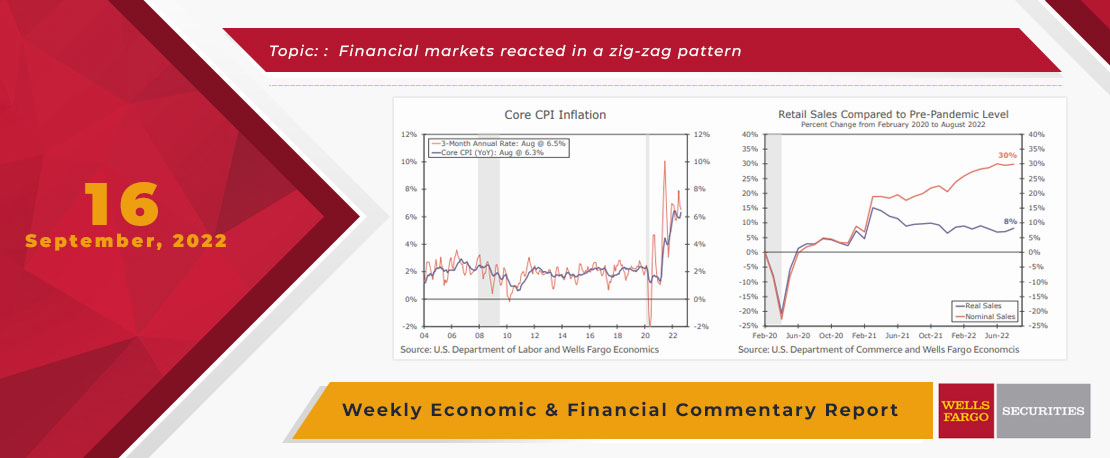

This Week's State Of The Economy - What Is Ahead? - 16 September 2022

Wells Fargo Economics & Financial Report / Sep 20, 2022

Financial markets reacted in a zig-zag pattern to this week\'s economic data ahead of the next FOMC meeting. Price pressure is still not showing the sustained slowdown the Fed needs before it takes its foot off the throttle of tighter policy.

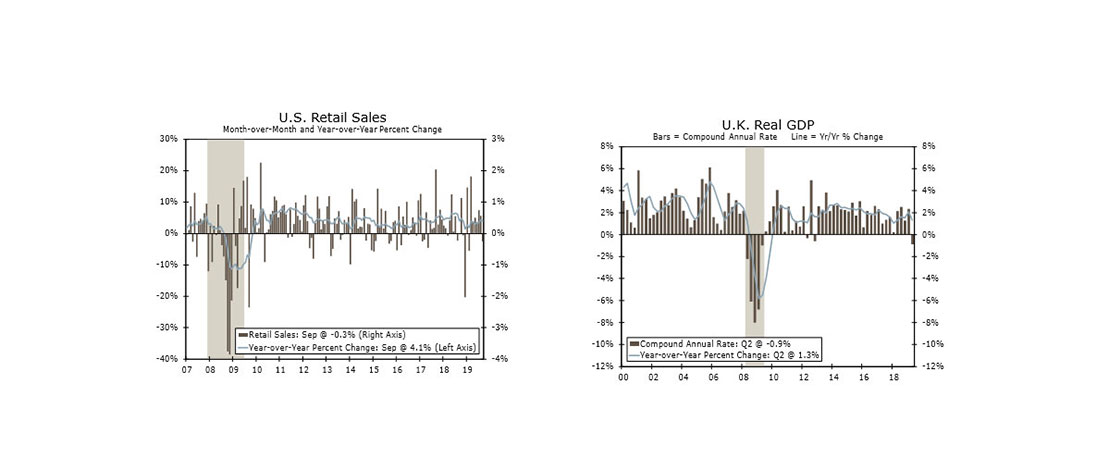

This Week's State Of The Economy - What Is Ahead? - 18 October 2019

Wells Fargo Economics & Financial Report / Oct 19, 2019

Personal consumption is still on track for a solid Q3, but retail sales declined in September for the first time in seven months.