U.S. - Wait and See

- The re-opening of the country is getting underway, with all 50 states starting to roll back restrictions.

- It remains too early to assess the effect of the re-opening on corona virus case growth, which continues to slow in a fairly broad-based manner, despite an impressive—albeit late-in-the-game—ramp-up in testing.

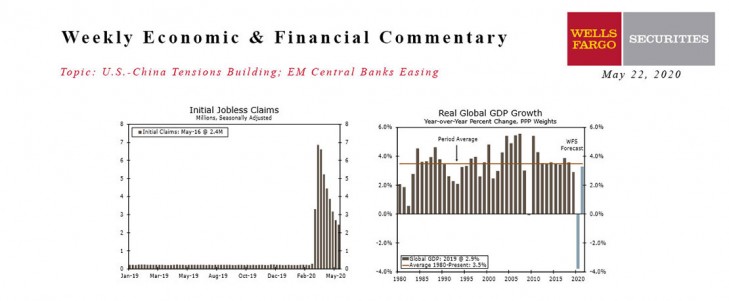

- Nearly 2.5 million Americans filed initial unemployment claims the week ended May 16, bringing the cumulative total over the past nine weeks to more than 38 million.

Global - U.S.-China Tensions Building; EM Central Banks Easing

- Along with the intensification of COVID-19, U.S.-China relations have started to intensify again as well. Heightened rhetoric from the U.S. administration has recently turned to action, and while we are not yet ready to build any material escalations or additional tariffs into our forecasts, we acknowledge U.S.-China trade tensions could be deteriorating.

- Multiple central banks in emerging markets met this week to assess monetary policy with rate cuts occurring across Asia and EMEA. With inflation on a downward trajectory, additional monetary policy space to cut rates has been created and as of now, we believe EM central banks will continue to ease policy.

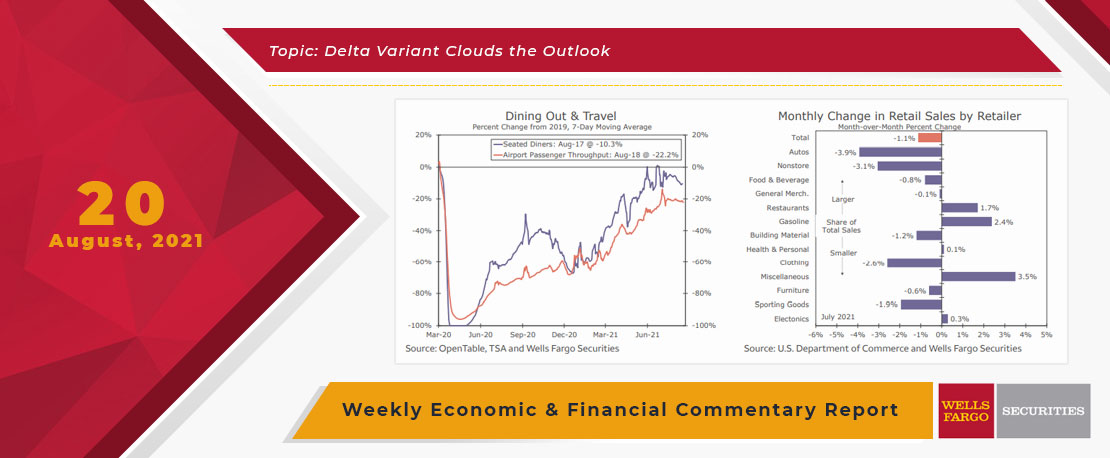

This Week's State Of The Economy - What Is Ahead? - 20 August 2021

Wells Fargo Economics & Financial Report / Aug 24, 2021

The Wells Fargo Economics team notes in the Commentary that new COVID cases in New Zealand disrupted the Reserve Bank of New Zealand\'s plan to tighten monetary policy this week.

This Week's State Of The Economy - What Is Ahead? - 17 May 2024

Wells Fargo Economics & Financial Report / May 23, 2024

The Producer Price Index (PPI) was a bit firm in April, rising 0.5% amid higher services prices, though it did come with slight downward revisions to prior month\'s data.

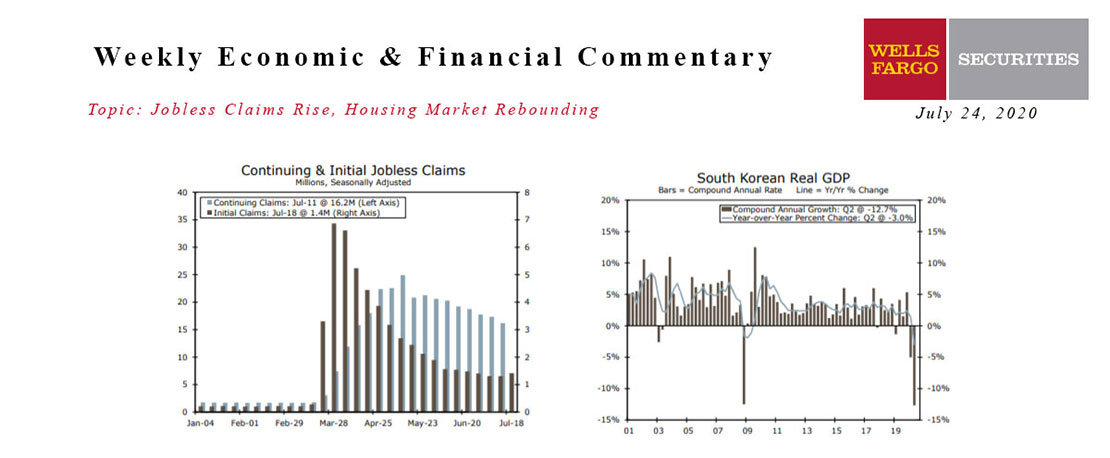

This Week's State Of The Economy - What Is Ahead? - 24 July 2020

Wells Fargo Economics & Financial Report / Jul 25, 2020

Initial jobless claims rose to just over 1.4 million for the week ending July 18. Continuing claims fell to about 16.2 million. Initial claims edging higher suggests that the resurgence of COVID-19 may be taking a toll on the labor market recovery.

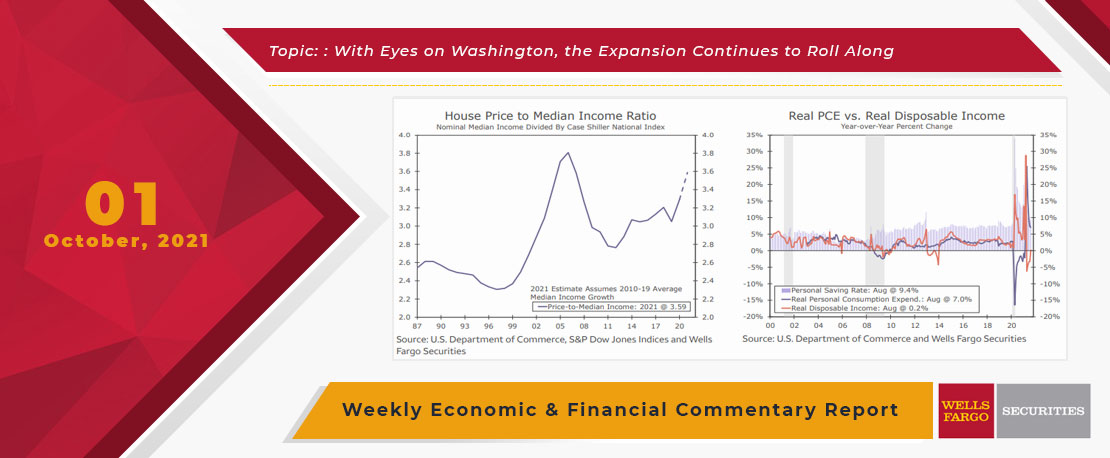

This Week's State Of The Economy - What Is Ahead? - 01 October 2021

Wells Fargo Economics & Financial Report / Oct 10, 2021

Economic data this week indicated that the ongoing expansion still has some momentum despite some familiar headwinds, though this week\'s releases were largely overshadowed by a busy week on Capitol Hill.

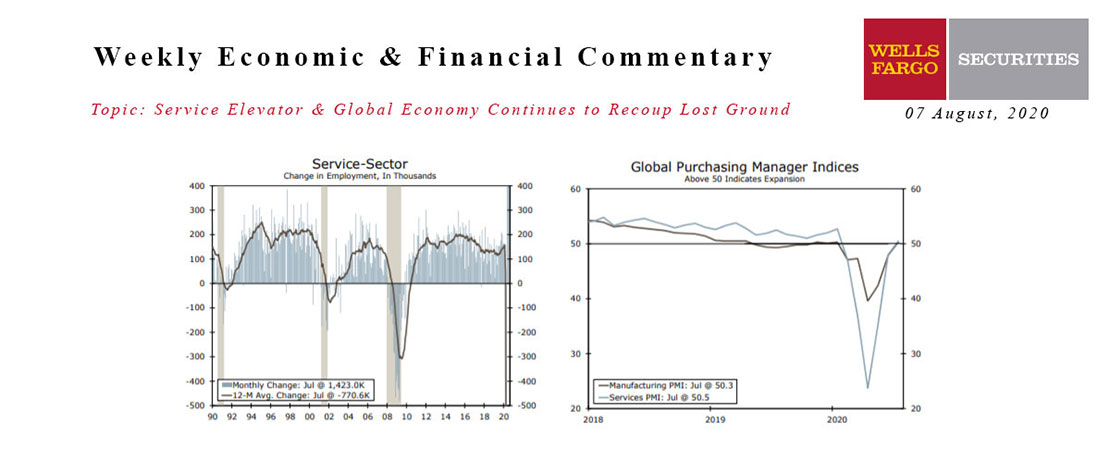

This Week's State Of The Economy - What Is Ahead? - 07 August 2020

Wells Fargo Economics & Financial Report / Aug 11, 2020

There were more signs of global recovery this week and PMI surveys improved further across the world.

This Week's State Of The Economy - What Is Ahead? - 10 November 2022

Wells Fargo Economics & Financial Report / Nov 11, 2022

Relief in October inflation gives the FOMC the ability to slow the pace of rate hikes ahead. But make no mistake, the Fed\'s job of taming inflation remains far from over.

This Week's State Of The Economy - What Is Ahead? - 19 July 2024

Wells Fargo Economics & Financial Report / Jul 22, 2024

Retail sales, housing starts and industrial production all surprised to the upside this week.

This Week's State Of The Economy - What Is Ahead? - 21 February 2020

Wells Fargo Economics & Financial Report / Feb 22, 2020

Minutes from the January 28-29 FOMC meeting indicate the coronavirus will not push the Fed to cut interest rates, and for the most part housing and manufacturing survey data this week supported that view.

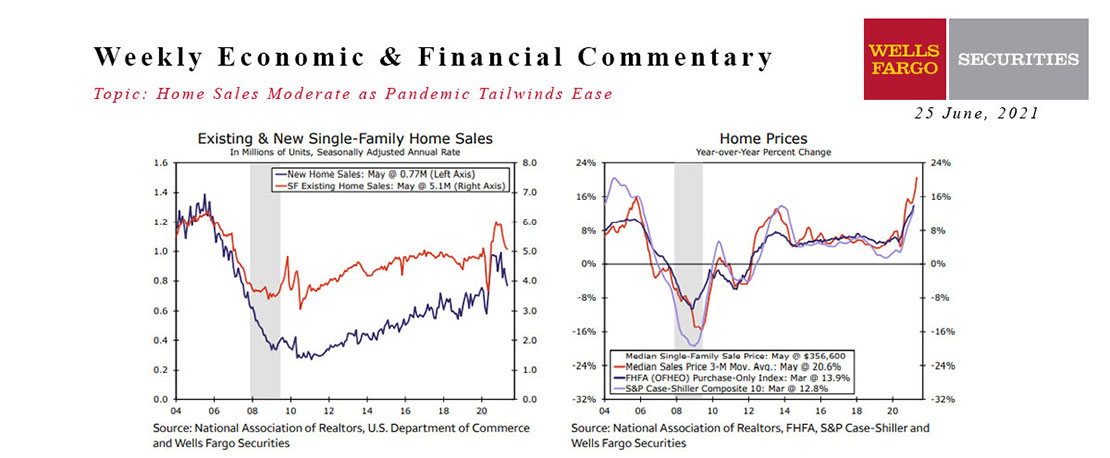

This Week's State Of The Economy - What Is Ahead? - 25 June 2021

Wells Fargo Economics & Financial Report / Jun 26, 2021

Supply chain bottlenecks continue to cause pain-in-the-necks. In spite of all the difficulties, the Economic whizzes in the WF Economics team have upgraded their forecast for full-year 2021 U.S.

This Week's State Of The Economy - What Is Ahead? - 16 September 2022

Wells Fargo Economics & Financial Report / Sep 20, 2022

Financial markets reacted in a zig-zag pattern to this week\'s economic data ahead of the next FOMC meeting. Price pressure is still not showing the sustained slowdown the Fed needs before it takes its foot off the throttle of tighter policy.