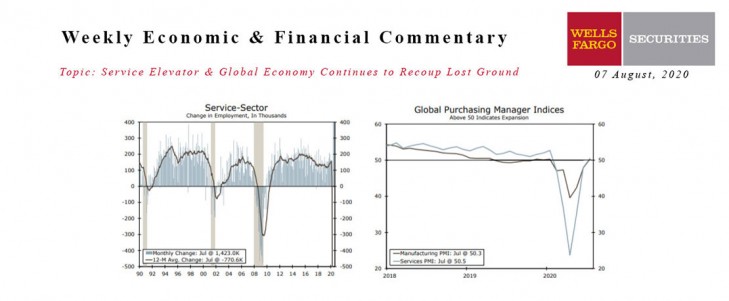

Global - Global Economy Continues to Recoup Lost Ground

- There were more signs of global recovery this week and PMI surveys improved further across the world. Indeed, the global manufacturing and services PMIs rose above the break even 50 level, suggesting the global economy has returned to positive growth in Q3.

- The Euro zone economy showed increased momentum in June as retail sales returned to pre-pandemic level and industrial output rose for the region’s four largest economies. We expect that improved Euro zone momentum carried into Q3. Meanwhile, the recovery is slower in Latin America, where Brazil and Mexico both still appear to be contracting.

U.S. - Service Elevator

- Despite rising virus case counts in July, unexpected strength in the service sector was evident in the economic data this week.

- The better-than-expected July jobs report was driven primarily by hiring in the service sector, which accounted for 1.42 million of the overall 1.76 million jobs added in the month.

- The ISM index for the service sector was arguably the biggest economic surprise of the week climbing to 58.1 with some sub components reaching multi-year highs.

- It remains a long road to recovery and the virus still sets the timetable, but numbers moved in the right direction this week.

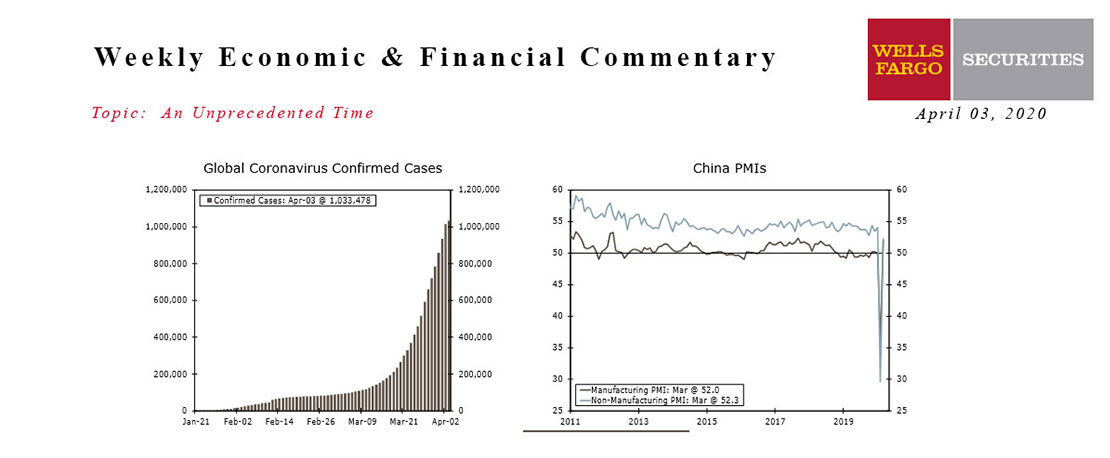

This Week's State Of The Economy - What Is Ahead? - 03 April 2020

Wells Fargo Economics & Financial Report / Apr 04, 2020

Efforts to contain the virus are leading to millions of job losses and it’s likely only a matter of time before a majority of economic data reveal unprecedented declines.

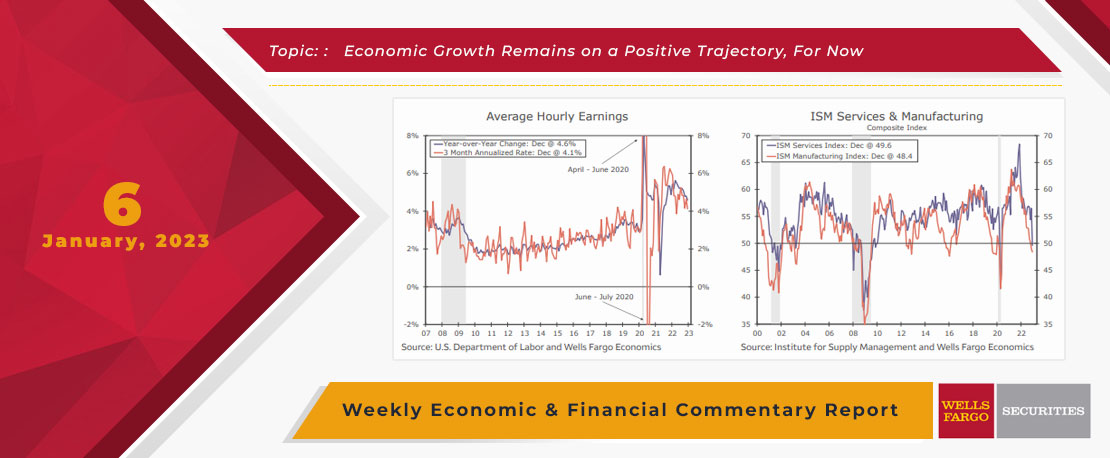

This Week's State Of The Economy - What Is Ahead? - 06 January 2023

Wells Fargo Economics & Financial Report / Jan 12, 2023

During December, payrolls rose by 223K while the unemployment rate fell to 3.5% and average hourly earnings eased 0.3%. Job openings (JOLTS) edged down to 10.46 million in November.

This Week's State Of The Economy - What Is Ahead? - 14 June 2024

Wells Fargo Economics & Financial Report / Jun 20, 2024

On Wednesday, the May CPI data showed that consumer prices were unchanged in the month, the first flat reading for the CPI since July 2022.

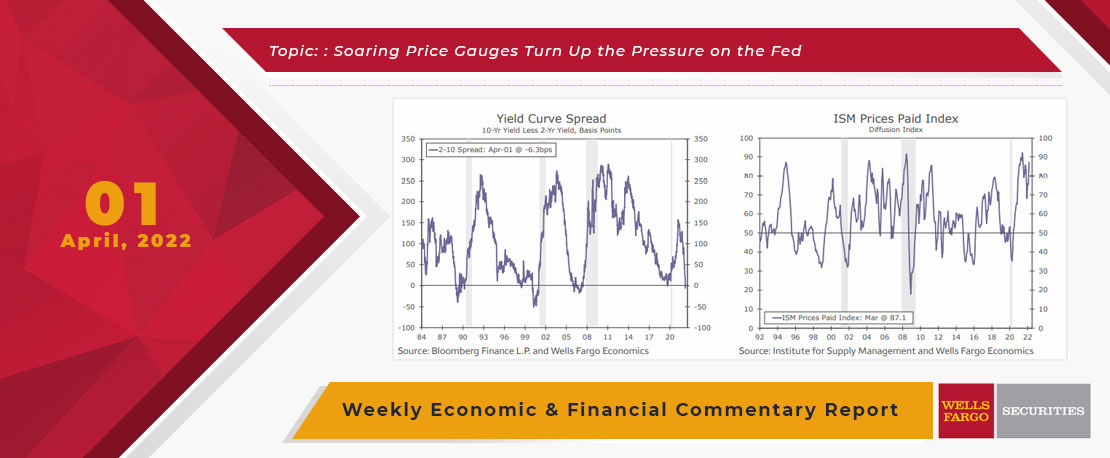

This Week's State Of The Economy - What Is Ahead? - 01 April 2022

Wells Fargo Economics & Financial Report / Apr 05, 2022

The key factor that will drive interest rates is the Fed’s belated effort to rein-in inflation.

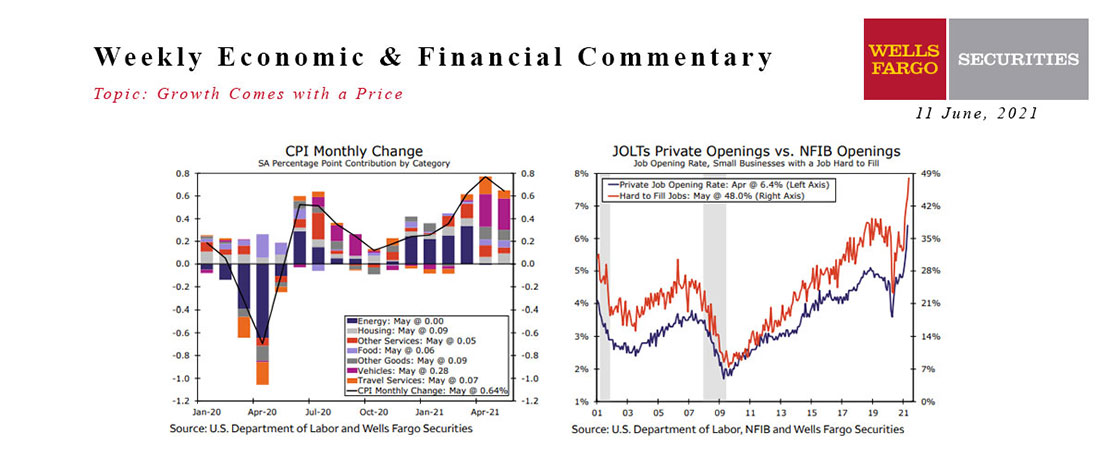

This Week's State Of The Economy - What Is Ahead? - 11 June 2021

Wells Fargo Economics & Financial Report / Jun 26, 2021

Okay, so I’ve gotten about half a dozen calls since Wednesday asking if I saw the May CPI numbers that came out this week.

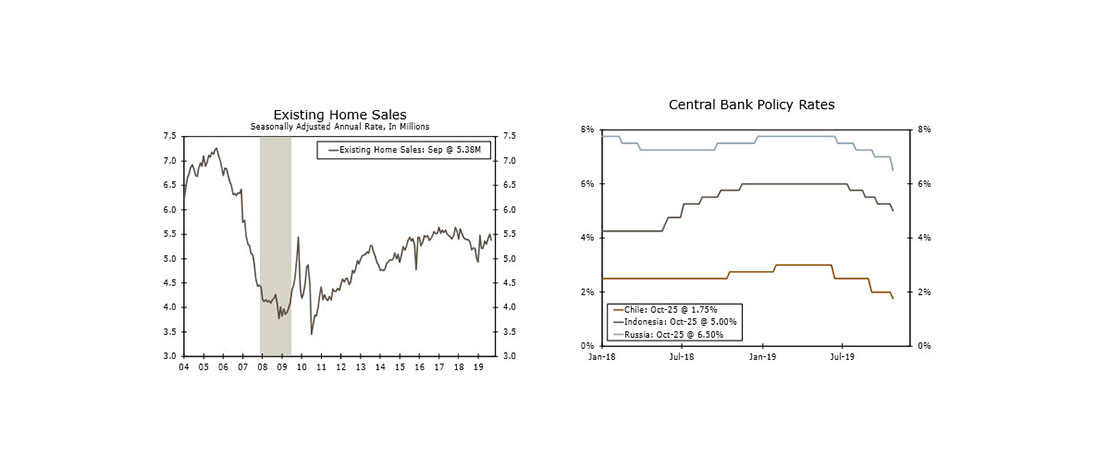

This Week's State Of The Economy - What Is Ahead? - 25 October 2019

Wells Fargo Economics & Financial Report / Oct 26, 2019

Sales of existing homes fell 2.2% to a 5.38 million-unit pace in September, but sales and prices were still up enough in the quarter that they will add solidly to Q3 GDP growth.

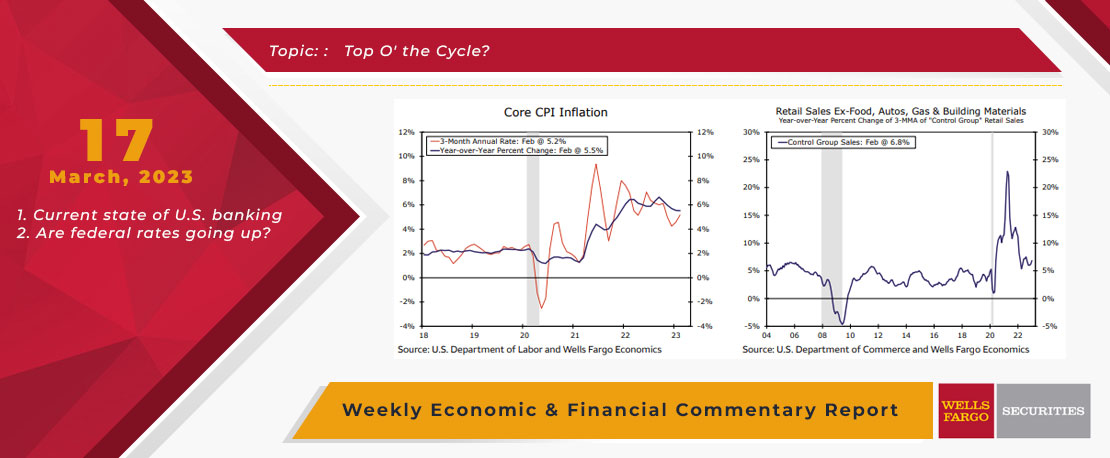

This Week's State Of The Economy - What Is Ahead? - 17 March 2023

Wells Fargo Economics & Financial Report / Mar 21, 2023

Retail sales declined 0.4% during February, while industrial production was flat (0.0%). Housing starts and permits jumped 9.8% and 13.8%, respectively.

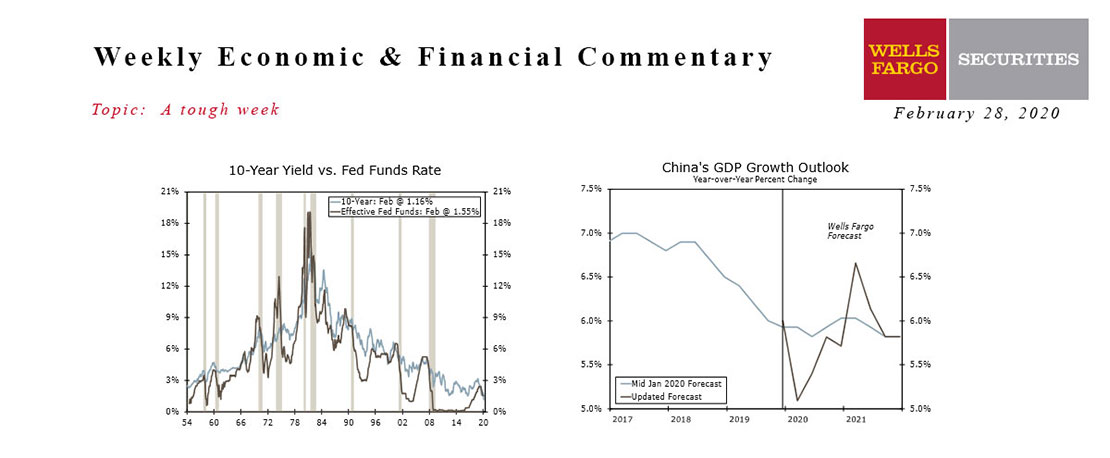

This Week's State Of The Economy - What Is Ahead? - 28 February 2020

Wells Fargo Economics & Financial Report / Feb 29, 2020

The COVID-19 coronavirus hammered financial markets this week and rapidly raised the perceived likelihood and magnitude of additional Fed accommodation.

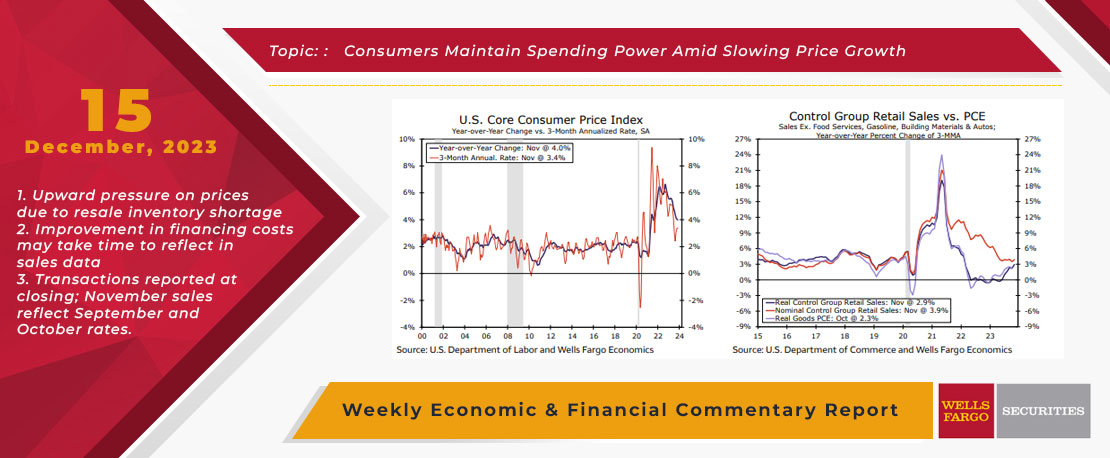

This Week's State Of The Economy - What Is Ahead? - 15 December 2023

Wells Fargo Economics & Financial Report / Dec 21, 2023

core CPI remained elevated in November at a 4.0% annual rate, a string of slower monthly prints suggests that disinflation has more room to run.

This Week's State Of The Economy - What Is Ahead? - 21 June 2024

Wells Fargo Economics & Financial Report / Jun 25, 2024

Retail sales rose just 0.1% over the month, falling short of consensus and suggesting that consumers may finally be feeling some spending fatigue.