Following last week's data, which brought some encouraging updates showing ongoing strong growth and easing inflation, this week continued with the first look at key July indicators, including more evidence that the labor market continues to gradually cool.

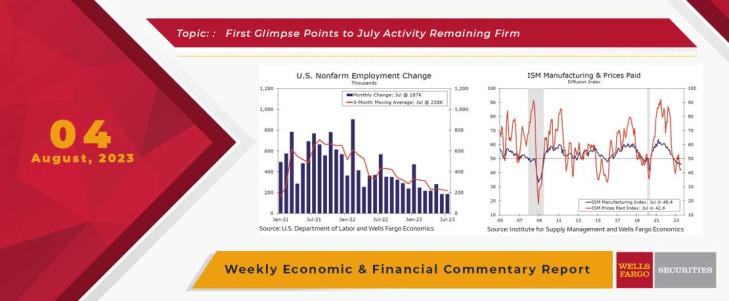

The big release of the week was the July nonfarm payroll report, which showed employers adding 187K net new jobs last month. A downside miss to the consensus expectation of 200K, July's performance marks the second straight month below 200K, the weakest two-month performance in two and a half years, and marks the sixth consecutive month of downward revisions to the previous month's estimate. Employment growth was broad-based, though reliant on a 87K gain in health care & social assistance. Modest gains from construction, financial activities and hospitality also contributed to private sector job growth. Weakness was also evident with job losses in professional & business services, manufacturing, information and temporary help, a reminder that the Fed's monetary policy tightening efforts are having a cooling effect on some of the more cyclical parts of the economy. The unemployment rate fell for the second straight month to 3.5%, a tick above the 53-year low in January and April of this year and a reminder that the labor market remains tight even with the lower-than-expected headline payroll readings. Average hourly earnings beat expectations and rose 0.4% month-over-month in July. The three-month annualized pace of 4.9% stands above the year-over-year pace of 4.4%, indicating upward pressures are still evident, according to this measure of wages. That said, the more comprehensive Employment Cost Index showed that labor costs rose at the slowest pace in two years during the past quarter, which should temper FOMC concerns about the stronger-than-expected average hourly earnings performance.

Continued cooling in the labor market was evident elsewhere. Job openings declined in June to more than a two-year low to 9.58 million from a downwardly revised 9.62 million in May. The job openings rate remained unchanged in June at 5.8% with the downward trend extending in many of the sectors where vacancy rates remain the highest, including leisure & hospitality. The ratio of job openings per unemployed person held broadly steady at a still-historically elevated 1.61. Although lower than at the start of the year at 1.9, the ratio remains well above its pre-pandemic average of 1.2. On balance, while labor demand remains elevated, the JOLTS data suggest there is an incremental slowing in demand as compared to the prior month.

Beyond the labor market, there were some instructive updates with business sentiment in the manufacturing and services sectors. The ISM manufacturing index improved in July, though remained in contractionary territory for the ninth straight month at a level of 46.4. The modestly positive July gain reflects mixed results across components, with firmer readings in inventories, new orders, production and supplier deliveries more than offsetting a sharp deterioration in the employment index. The improvement in new orders was apparently driven by domestic demand, with new export orders falling to a seven-month low. Encouragement was seen on the prices front, as the prices paid index remained in contractionary territory for the fifth time in the past seven months. The downward performance remains consistent with deflationary pressures for goods and is consistent with survey respondents' comments of softening input cost pressures. On balance, the headline ISM manufacturing index remains in a range that is historically consistent with declines in factory output, though still well short of the low-40 readings typically seen in a recession.

The headline ISM services index fell in July to a level of 52.7, albeit remaining consistent with moderate service sector activity gains. The underlying composition was weak with the business activity, new orders and employment components all decreasing. Nonetheless, July's headline index remains above the series of lackluster readings from March to May, suggesting that service sector activity remains on somewhat stronger footing as compared to that period. The prices paid index reversed course in July following months of declines, suggesting that disinflationary momentum in the services sector is diminishing. Overall, the ISM services performance remains consistent with muted economic growth and continued disinflation at the start of Q3, which the Fed will consider as it meets again in late September.

This Week's State Of The Economy - What Is Ahead? - 14 January 2022

Wells Fargo Economics & Financial Report / Jan 18, 2022

As you may have already seen, inflation is running almost as hot as the stock of our favorite bank. The Consumer Price Index (CPI) rose 7.0% year-over-year in December, the fastest increase in nearly 40 years.

This Week's State Of The Economy - What Is Ahead? - 28 February 2020

Wells Fargo Economics & Financial Report / Feb 29, 2020

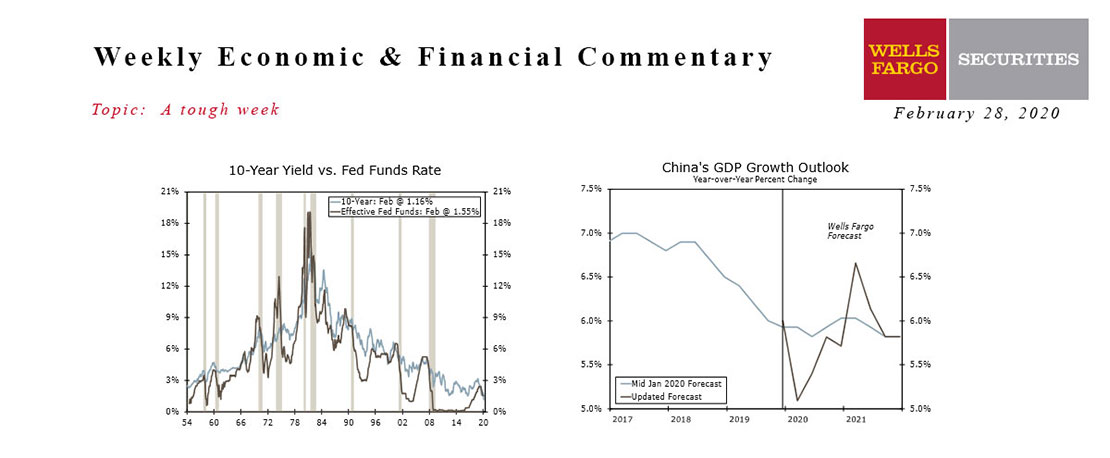

The COVID-19 coronavirus hammered financial markets this week and rapidly raised the perceived likelihood and magnitude of additional Fed accommodation.

This Week's State Of The Economy - What Is Ahead? - 04 March 2022

Wells Fargo Economics & Financial Report / Mar 08, 2022

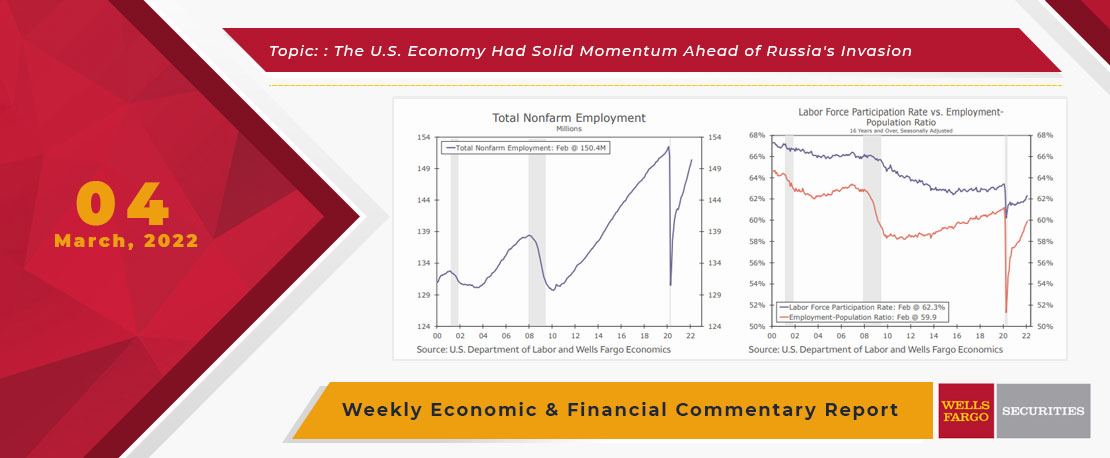

February\'s employment data showed the economy had strong momentum, but that seems pretty dated now with Russia\'s invasion of Ukraine and the Fed\'s shift to a more hawkish tone on monetary policy.

This Week's State Of The Economy - What Is Ahead? - 13 March 2020

Wells Fargo Economics & Financial Report / Mar 14, 2020

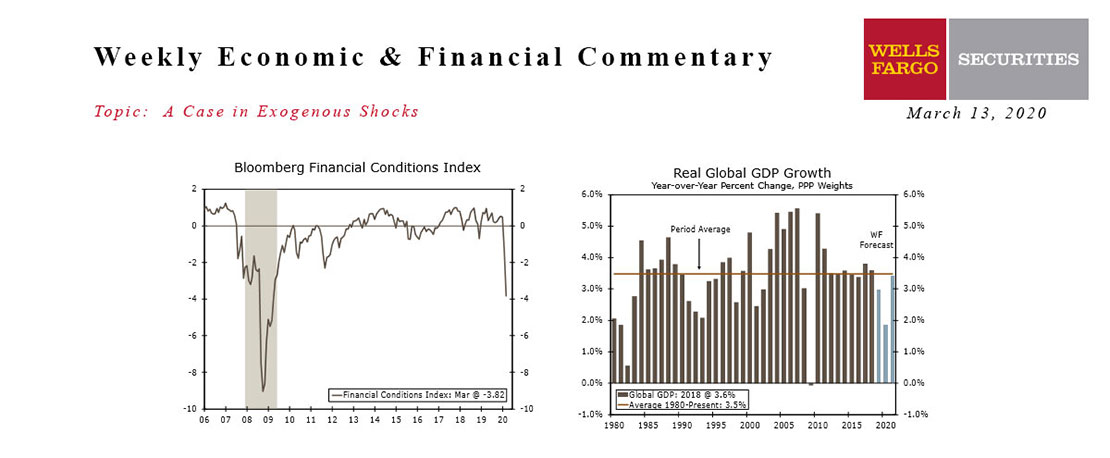

Financial conditions tightened sharply this week as concerns over the coronavirus and the economic fallout of containment efforts mounted.

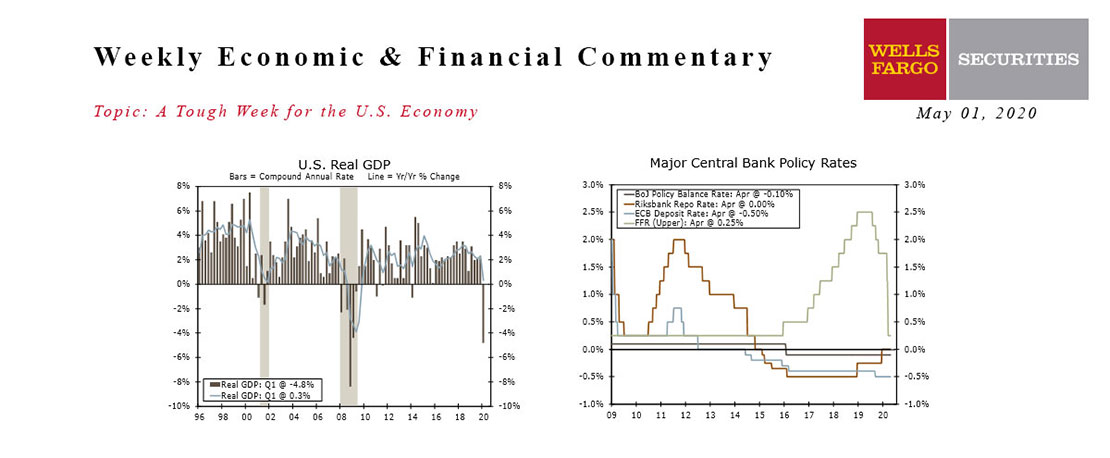

This Week's State Of The Economy - What Is Ahead? - 01 May 2020

Wells Fargo Economics & Financial Report / May 04, 2020

U.S. GDP declined at an annualized rate of 4.8% in the first quarter, only a hint of what is to come in the second quarter.

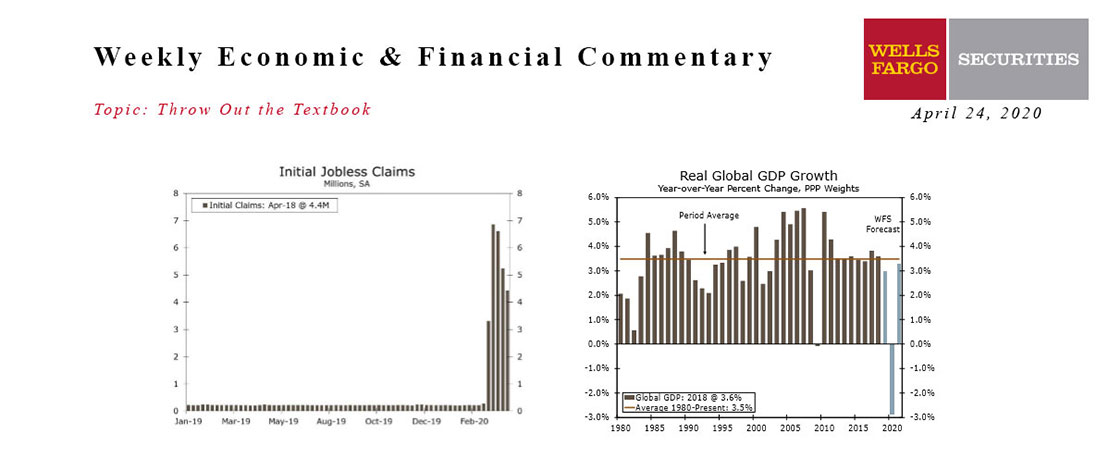

This Week's State Of The Economy - What Is Ahead? - 24 April 2020

Wells Fargo Economics & Financial Report / Apr 27, 2020

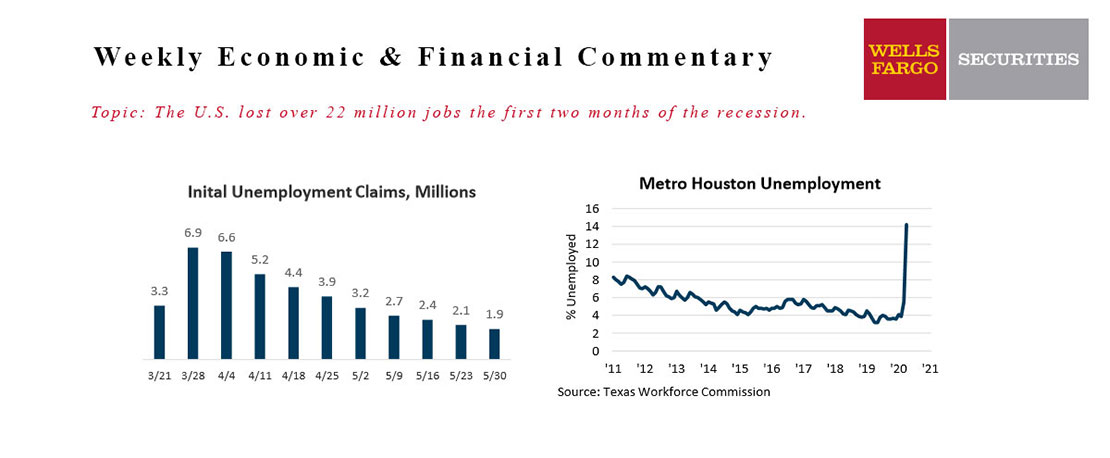

Oil prices went negative for the first time in history on Monday as the evaporation of demand collided with a supply glut. In the past five weeks, 26.5 million people have filed for unemployment insurance, or more than one out of every seven workers.

June 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Jun 18, 2020

The Fed expects to hold interest rates near zero through the end of this year, perhaps well into next year, and maybe even into ’22.

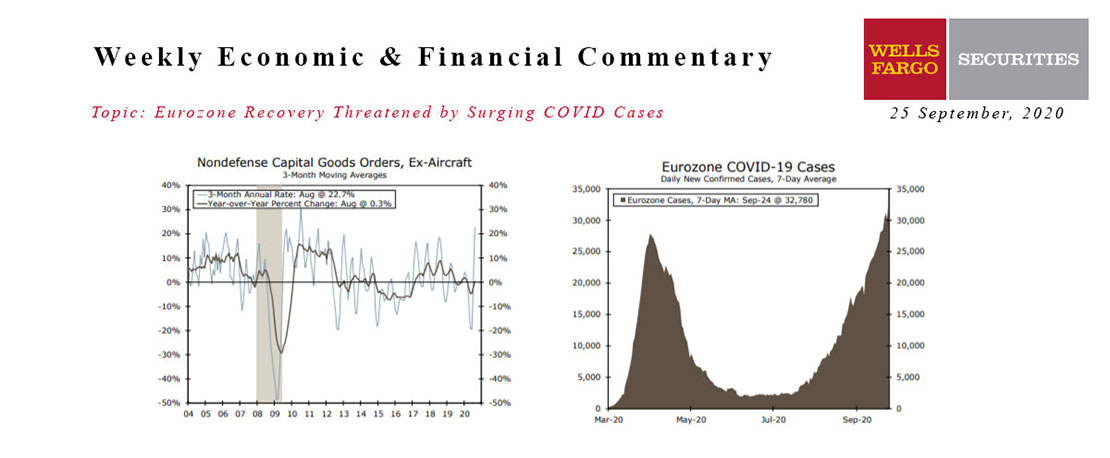

This Week's State Of The Economy - What Is Ahead? - 25 September 2020

Wells Fargo Economics & Financial Report / Sep 28, 2020

Existing home sales rose 2.4% to a 6.0-million unit annual pace. The surge in sales further depleted inventories and pushed prices sharply higher.

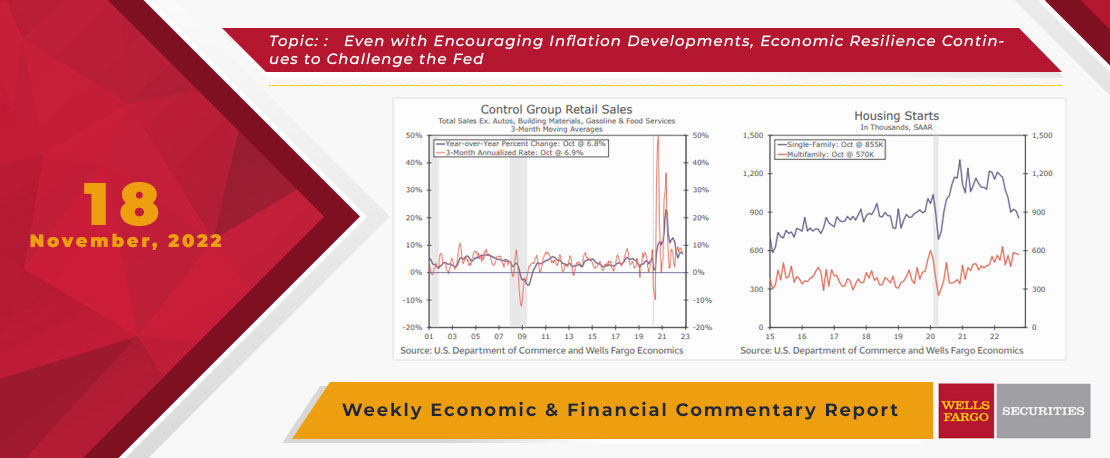

This Week's State Of The Economy - What Is Ahead? - 18 November 2022

Wells Fargo Economics & Financial Report / Nov 21, 2022

The resiliency of the U.S. consumer was also on display, as total retail sales increased a stronger-than-expected 1.3% in October, boosted, in part, by a 1.3% jump in motor vehicles & parts and a 4.1% rise at gasoline stations.

September 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Sep 19, 2020

A March survey by the Federal Reserve Bank of Dallas found most exploration firms need West Texas Inter-mediate (WTI) at $49 per barrel or higher to profitably drill a well.