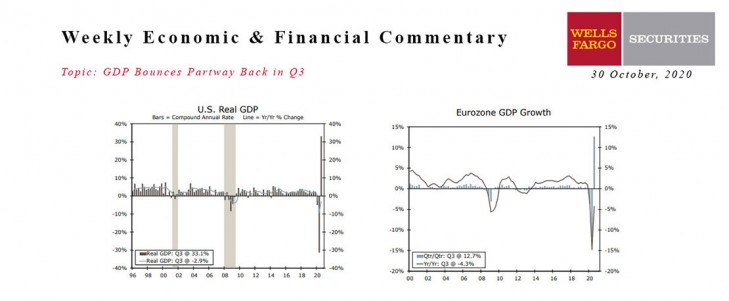

U.S. - GDP Bounces Partway Back in Q3

- Real GDP jumped a record 33.1% during Q3, beating expectations. A 40.7% surge in consumer spending drove the gain. However, real GDP is still 3.5% below pre-pandemic levels.

- Initial jobless claims dropped to 751k for the week ending October 24, the lowest level since mid-March.

- Durable goods orders rose 1.9% in September, well above consensus estimates. In addition, new home sales fell 3.5% to a still-blistering 959K-unit pace.

- Consumer confidence edged down to 100.9 in October. Rising COVID cases may weigh on confidence in the months ahead.

Global - Renewed Questions Surrounding Global Recovery

- Eurozone Q3 GDP jumped more than 12% quarter-over-quarter, although that bounce did not fully recover declines from earlier this year. More concerning going forward is the renewed spread of COVID and clear signs of softening in service sector activity. Thus while the European Central Bank held monetary policy steady this week, it gave a clear signal further easing should be expected in December.

- In Canada an encouraging economic rebound continues, in turn prompting the central bank to stay on hold. Mexico’s Q3 GDP jumped after a large Q2 fall, while South Korea’s Q3 GDP gain was led in large part by export growth.

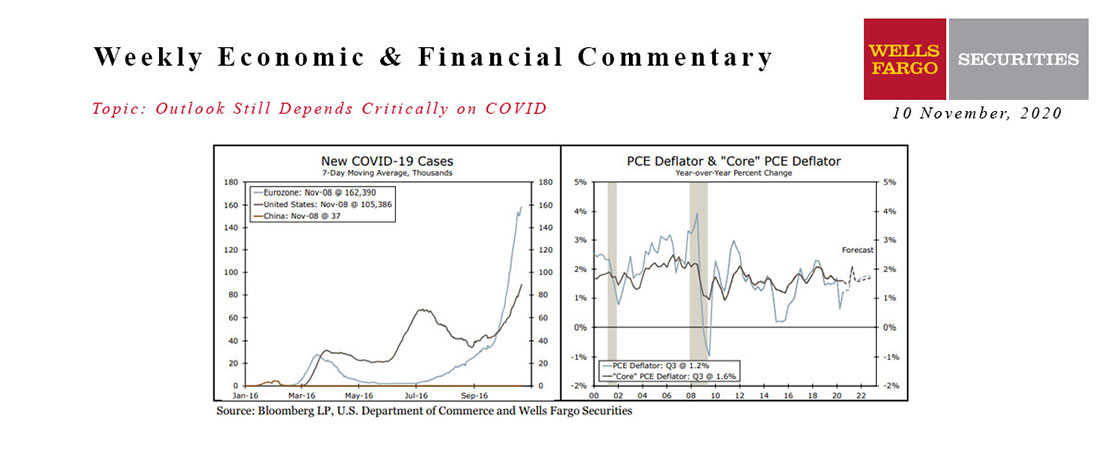

This Week's State Of The Economy - What Is Ahead? - 10 November 2020

Wells Fargo Economics & Financial Report / Nov 17, 2020

The U.S. election has come and gone, but we have not made any meaningful changes to our economic outlook, which continues to look for further expansion in the U.S. economy in coming quarters.

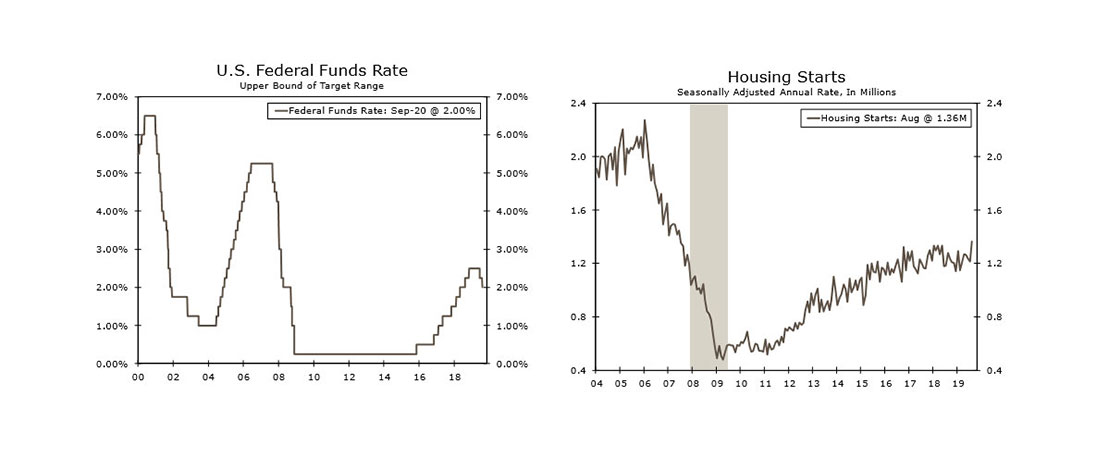

This Week's State Of The Economy - What Is Ahead? - 20 September 2019

Wells Fargo Economics & Financial Report / Sep 21, 2019

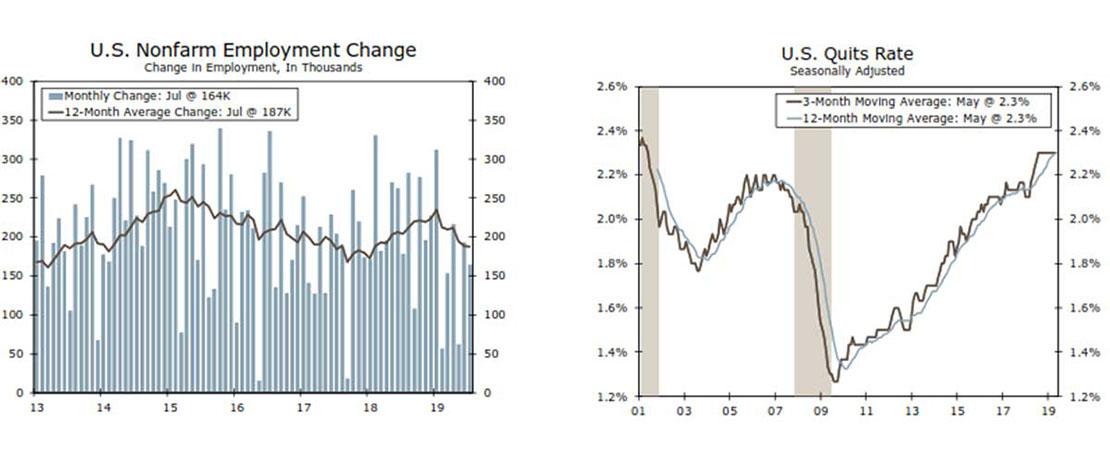

The Federal Reserve reduced the fed funds rate 25 bps this week, continuing to cite economic weakness overseas and muted inflation pressures.

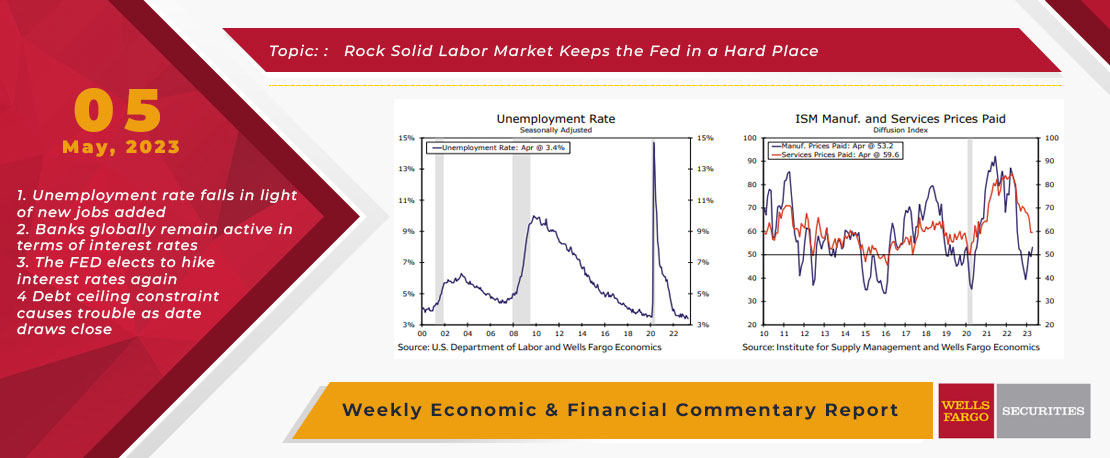

This Week's State Of The Economy - What Is Ahead? - 05 May 2023

Wells Fargo Economics & Financial Report / May 11, 2023

In April, employers added 253K jobs and the unemployment rate fell to 3.4%. During the same month, the ISM services index edged up to 51.9, while the ISM manufacturing index improved to 47.1.

This Week's State Of The Economy-What Is Ahead?

Wells Fargo Economics & Financial Report / Aug 03, 2019

How will Fed rates-cut and Trump 10% tariff on $300 Billion Chinese Goods countered by Chinese currency devaluation against Dollar, affect inflation and economic slowdown in US economy?

This Week's State Of The Economy - What Is Ahead? - 23 September 2020

Wells Fargo Economics & Financial Report / Sep 22, 2020

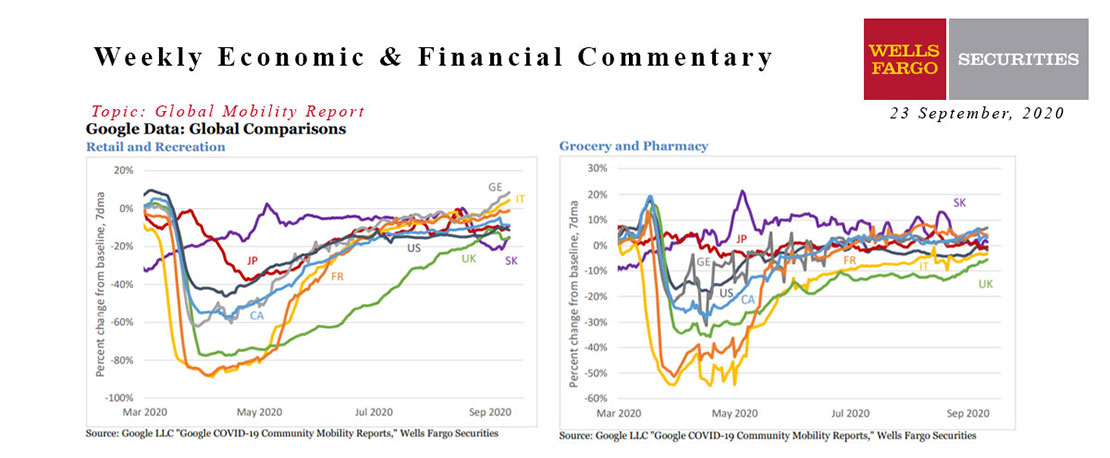

European activity is surging. Germany and Italy are leading the way, but France is close behind despite an ongoing rise in cases. The Google data are a bit outdated, but are hard to reconcile with today’s weak Eurozone services PMI figures.

This Week's State Of The Economy - What Is Ahead? - 21 February 2020

Wells Fargo Economics & Financial Report / Feb 22, 2020

Minutes from the January 28-29 FOMC meeting indicate the coronavirus will not push the Fed to cut interest rates, and for the most part housing and manufacturing survey data this week supported that view.

This Week's State Of The Economy - What Is Ahead? - 14 October 2020

Wells Fargo Economics & Financial Report / Oct 14, 2020

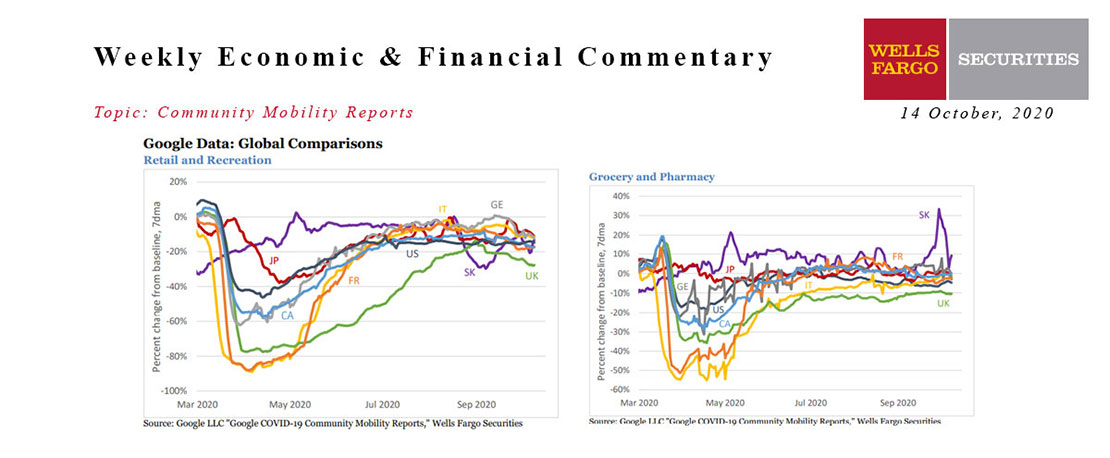

The global mobility playing field is equalizing. Major European countries such as Germany and France have seen a slowdown in recent weeks, leaving them right in line with the United States relative to the January baseline.

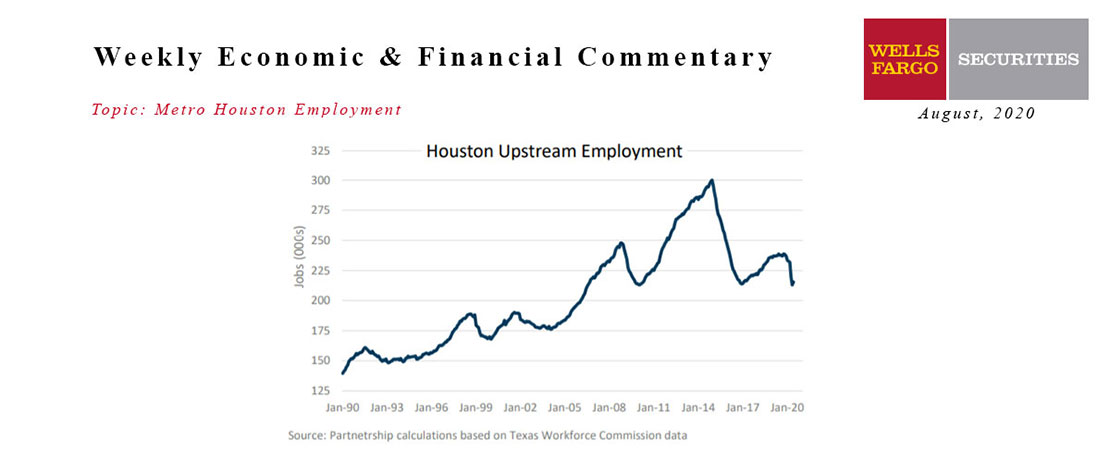

August 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Aug 22, 2020

Downstream involves the refining and processing of oil and natural gas into fuels, chemicals, and plastics. All three sectors are well-represented in Houston.

This Week's State Of The Economy - What Is Ahead? - 30 April 2021

Wells Fargo Economics & Financial Report / May 18, 2021

The gain in output leaves the level of real GDP just a stone\'s throw below its pre-COVID Q4-2019 level (see chart).

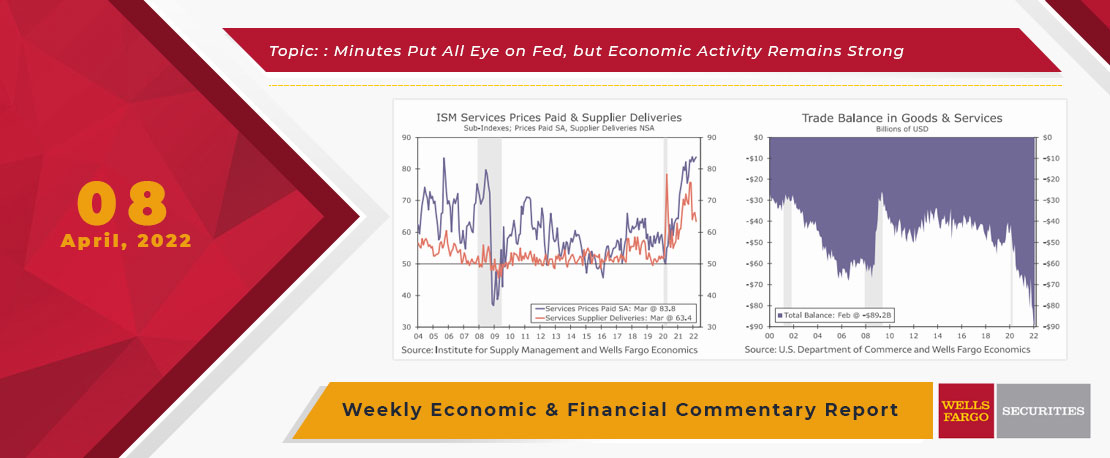

This Week's State Of The Economy - What Is Ahead? - 08 April 2022

Wells Fargo Economics & Financial Report / Apr 11, 2022

Wednesday\'s release of the FOMC minutes stirred things up as comments showed committee members agreeing that elevated inflation and the tight labor market at present warrant balance sheet reduction to begin soon.