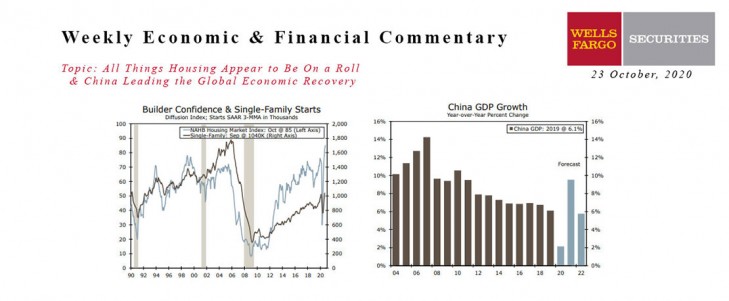

U.S. - All Things Housing Appear to Be On a Roll

- A recent strong report from the National Association of Homebuilders set the tone for another round of strong housing data. The NAHB index rose two points to a record high 85.

- A drop in new apartment construction led to a below consensus housing starts report but single-family starts rose solidly.

- Existing home sales easily topped expectations, with sales jumping 9.4% to a 6.54-million unit pace.

- Weekly first-time unemployment claims declined more than expected and continuing claims fell by more than one million.

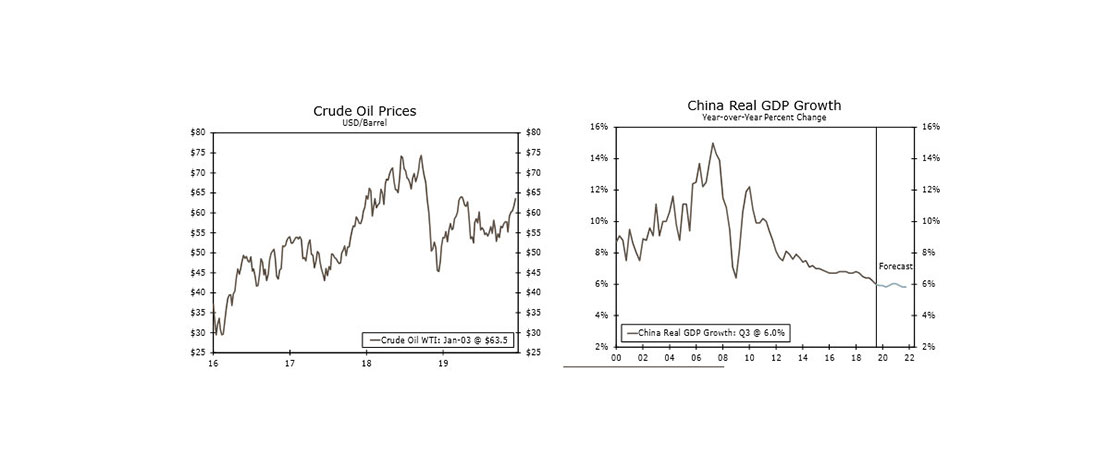

Global - China Leading the Global Economic Recovery

- Q3 GDP data revealed China is still leading the global economic recovery from the COVID induced downturn. In addition, leading indicators of activity beat expectations in September, giving us slightly more optimism around the health of China’s economy heading into the end of the year.

- As Eurozone countries grapple with a second wave of COVID cases and new localized lockdown protocol, activity and sentiment data could start to deteriorate. In that context, the services PMI declined more than expected in October; however, the manufacturing PMI beat expectations and surprised to the upside.

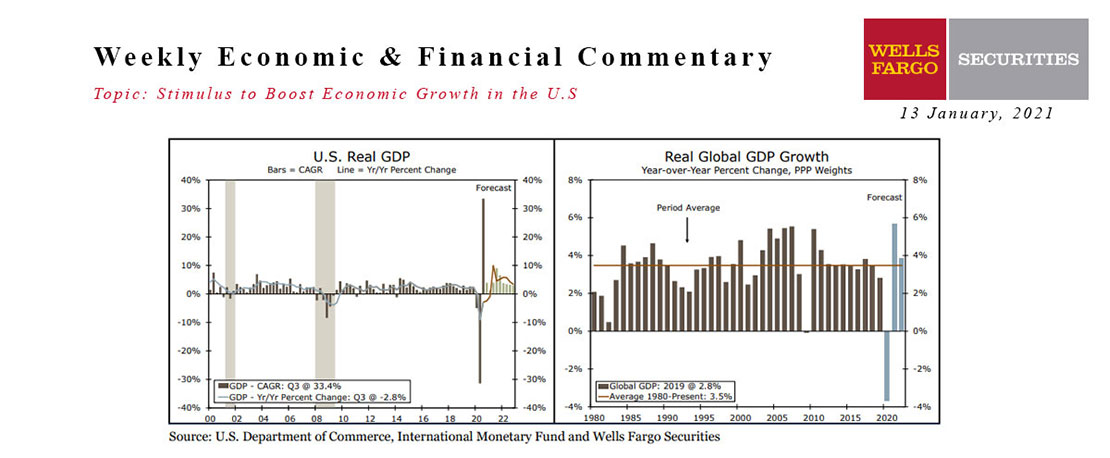

13 January 2021 Monthly Outlook Report

Wells Fargo Economics & Financial Report / Jan 19, 2021

The U.S. economy appears to be losing some momentum as the calendar turns to 2021 and the public health situation continues to deteriorate.

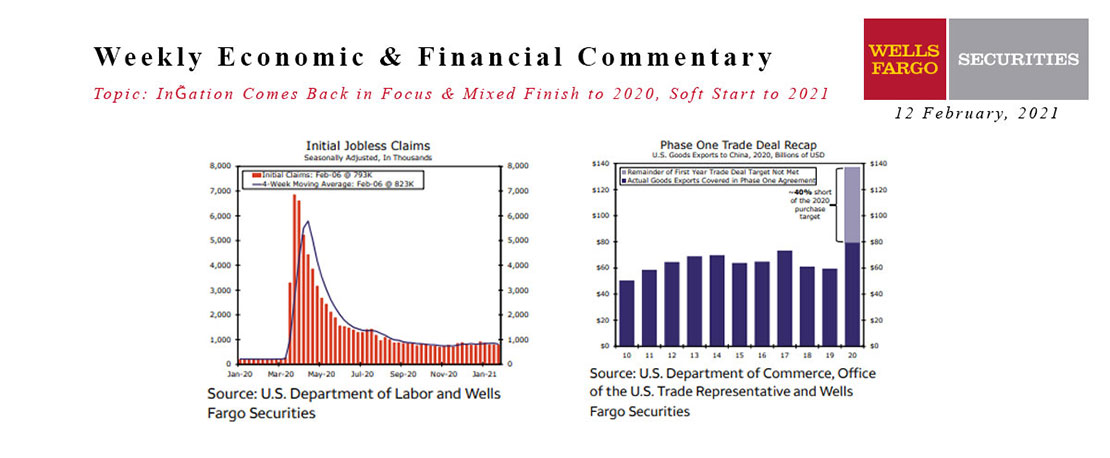

This Week's State Of The Economy - What Is Ahead? - 12 February 2021

Wells Fargo Economics & Financial Report / Feb 19, 2021

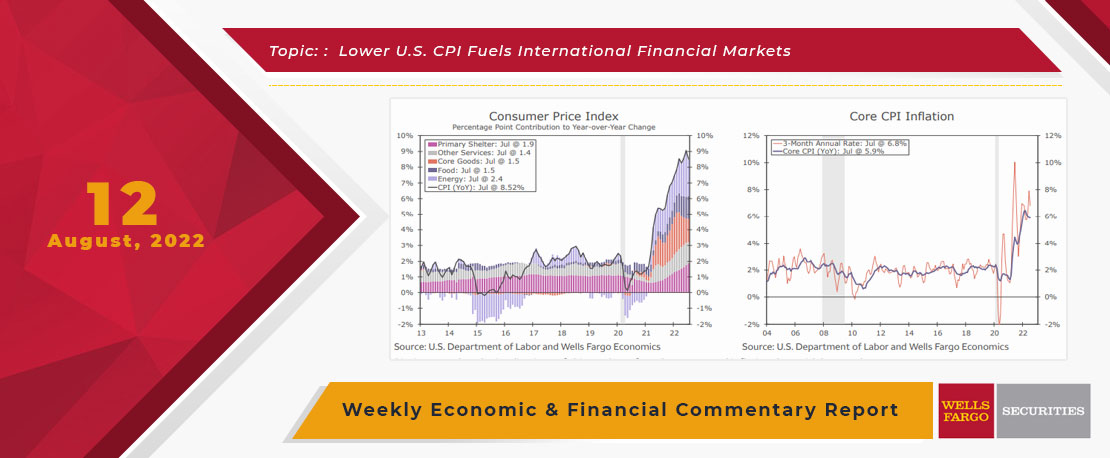

Market attention was concentrated on the January consumer price data, as inflation has come back into focus.

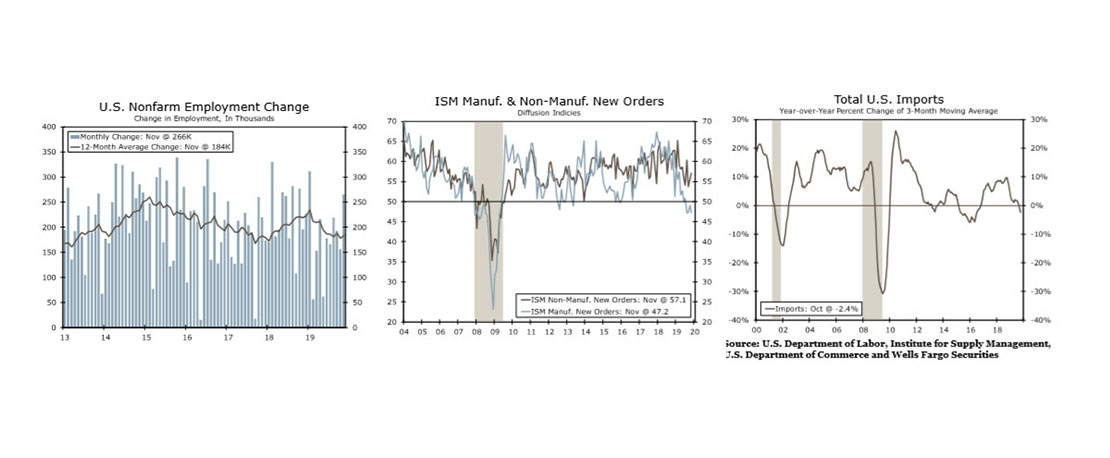

This Week's State Of The Economy - What Is Ahead? - 20 December 2019

Wells Fargo Economics & Financial Report / Dec 21, 2019

President Trump became the third president in U.S. history to be impeached by the House, but removal by the Senate is highly unlikely. The House also passed the USMCA, which should be signed into law in early 2020.

This Week's State Of The Economy - What Is Ahead? - 03 January 2020

Wells Fargo Economics & Financial Report / Jan 04, 2020

Markets were also pressured from the latest ISM manufacturing report, which signaled further deterioration in the sector with the index falling to its lowest level since 2009.

This Week's State Of The Economy - What Is Ahead? - 22 November 2019

Wells Fargo Economics & Financial Report / Nov 23, 2019

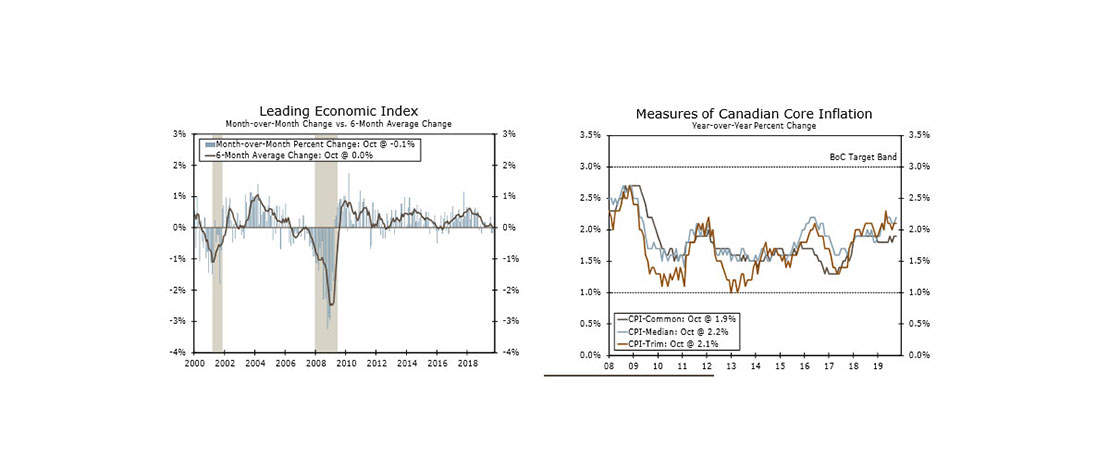

Minutes from the October FOMC meeting indicated the Fed is content to remain on the sidelines for the rest of this year as the looser financial conditions resulting from rate cuts at three consecutive meetings feed through to the economy.

This Week's State Of The Economy - What Is Ahead? - 09 April 2020

Wells Fargo Economics & Financial Report / Apr 10, 2020

The Federal Reserve announced a series of measures this morning that are intended to assist households, businesses and state & local governments as they cope with the economic fallout of the COVID-19 outbreak.

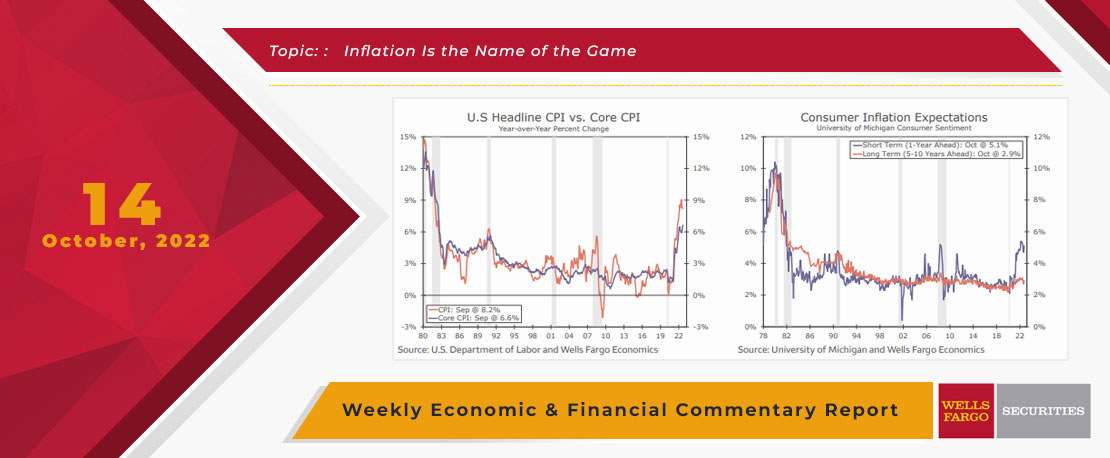

This Week's State Of The Economy - What Is Ahead? - 14 October 2022

Wells Fargo Economics & Financial Report / Oct 18, 2022

Highly anticipated Consumer Price Index report surprised to the upside. Headline CPI rose 0.4% in September, and core CPI increased 0.6%.

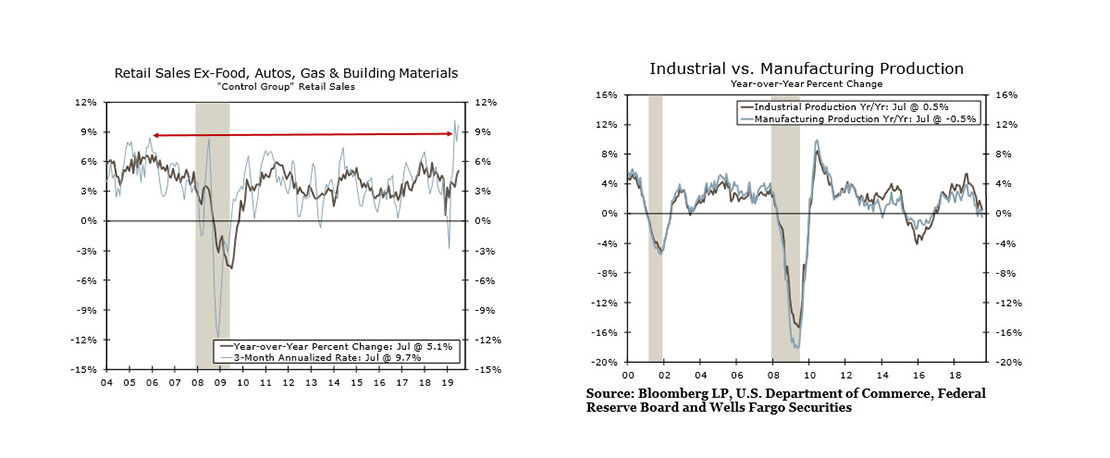

This Week's State Of The Economy - What Is Ahead? - 12 August 2022

Wells Fargo Economics & Financial Report / Aug 13, 2022

The FOMC has made it clear that it needs to see inflation slowing on a sustained basis before pivoting from its current stance. The data seems to be going in multiple directions all at once.

This Week's State Of The Economy - What Is Ahead? - 14 June 2024

Wells Fargo Economics & Financial Report / Jun 20, 2024

On Wednesday, the May CPI data showed that consumer prices were unchanged in the month, the first flat reading for the CPI since July 2022.

This Week's State Of The Economy - What Is Ahead? - 16 August 2019

Wells Fargo Economics & Financial Report / Aug 17, 2019

Markets gyrated this week as the spread between the ten- and two-year Treasury\'s turned negative for the first time since 2007. Financial markets seem to expect that the sharp slowdown in growth overseas will soon spread to the United States.