U.S. - The Shot Heard Round the World

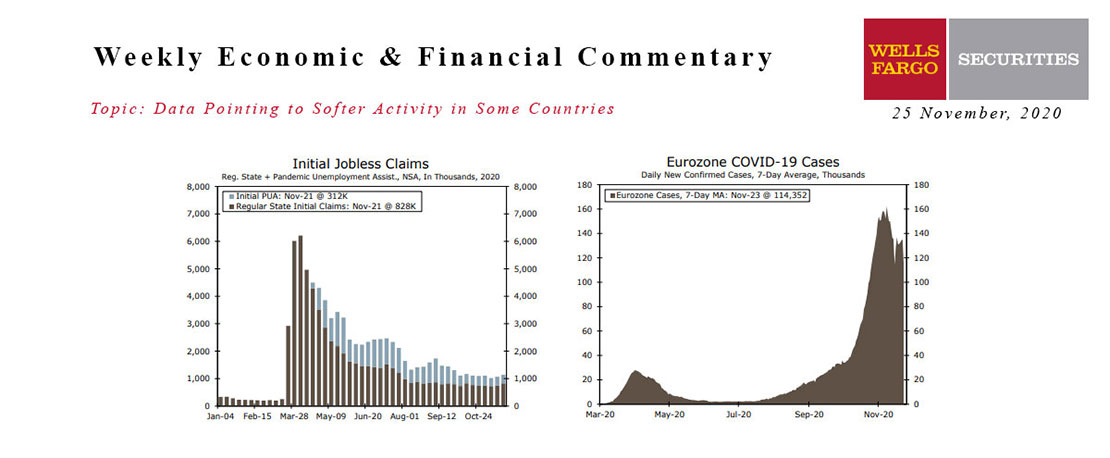

- This week marked the first U.S. COVID vaccinations and the imminent rollout of a second vaccine. But, the resurgence of the virus and increased mobility restrictions further show why fiscal support would help ensure the economic recovery.

- The highest number of individuals since September filed an initial claim for unemployment last week.

- Retail sales missed expectations in November and foreshadow the impending air pocket for durables consumption, which will also have implications for the rebound in manufacturing.

- Housing remains a bright spot with starts up 1.2% last month.

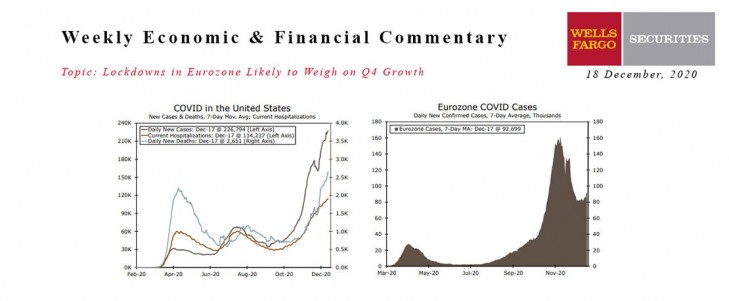

Global - Lockdowns in Eurozone Likely to Weigh on Q4 Growth

- The Eurozone’s manufacturing PMI unexpectedly rose in December, while the services PMI jumped more than expected. Despite the pickup in survey data, the near-term outlook for the Eurozone economy remains negative, given the renewed COVID spread and associated lockdown measures.

- The Norges Bank held its benchmark rate at zero at its monetary policy meeting this week, but the tone of the accompanying statement was somewhat hawkish. The central bank lifted its projected rate path, now projecting a rate hike in early 2022. Meanwhile, the Bank of England also met this week, leaving its policy rate unchanged at 0.10%.

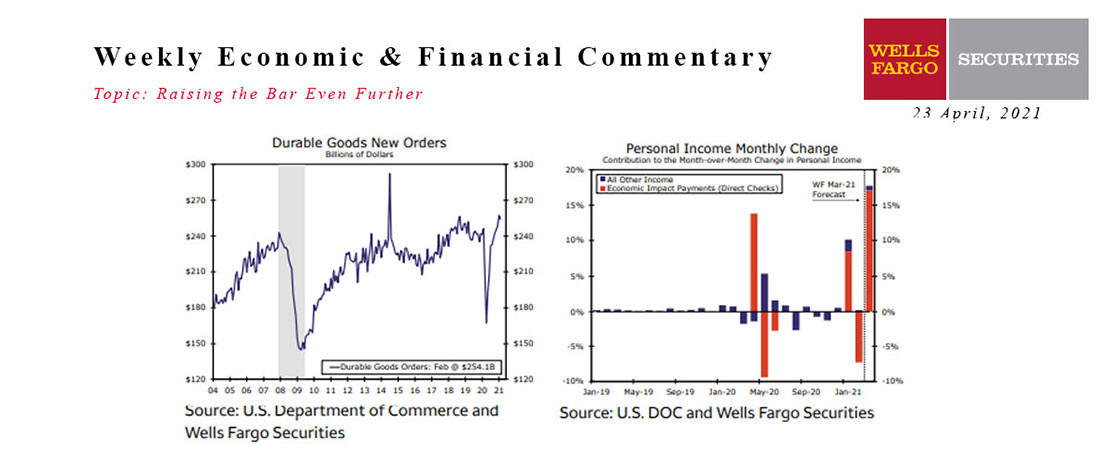

This Week's State Of The Economy - What Is Ahead? - 23 April 2021

Wells Fargo Economics & Financial Report / Apr 26, 2021

This week\'s lighter economic calendar allowed forecasters more time to assess the implications from the prior week\'s blowout retail sales report.

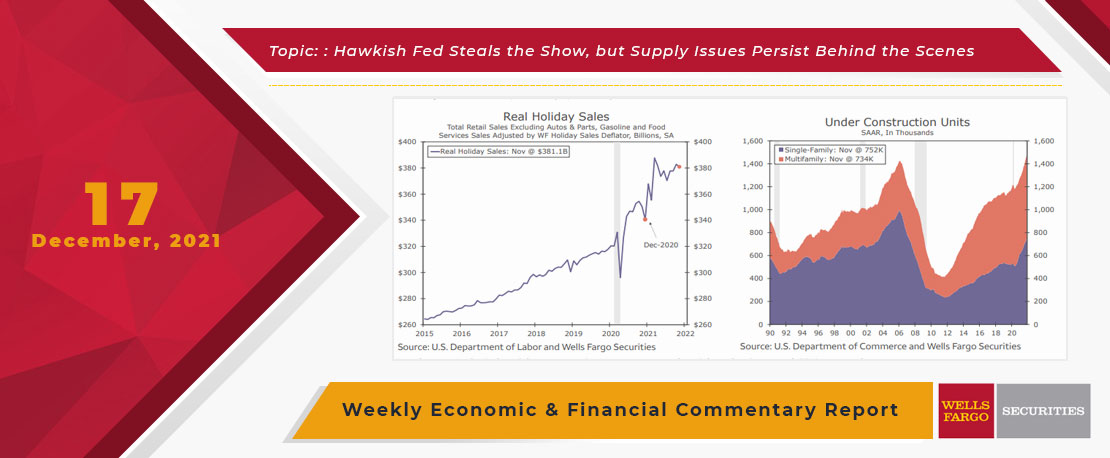

This Week's State Of The Economy - What Is Ahead? - 17 December 2021

Wells Fargo Economics & Financial Report / Dec 21, 2021

7 Interest Rate Watch for more detail. In other news, retail sales data disappointed as higher prices factor into spending and industrial activity continued to recover but remains beset by supply issues.

This Week's State Of The Economy - What Is Ahead? - 09 June 2023

Wells Fargo Economics & Financial Report / Jun 14, 2023

An unexpected spike in jobless claims is a sign that cracks are forming in the labor market. Higher mortgage rates look to be hindering a housing market rebound.

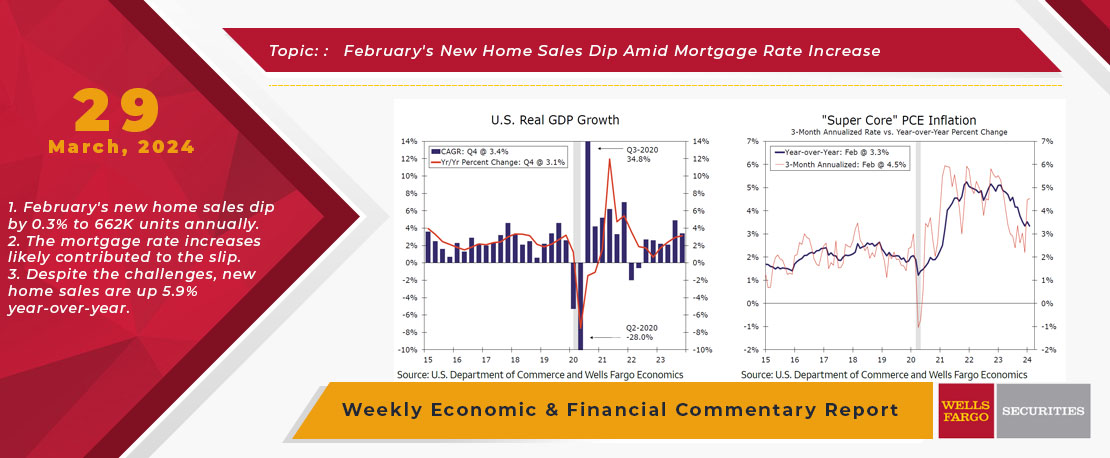

This Week's State Of The Economy - What Is Ahead? - 29 March 2024

Wells Fargo Economics & Financial Report / Apr 03, 2024

Consumer momentum remains largely intact, inflation continues to inch back down, albeit at a slower pace, and rate-sensitive sectors stayed in a holding pattern.

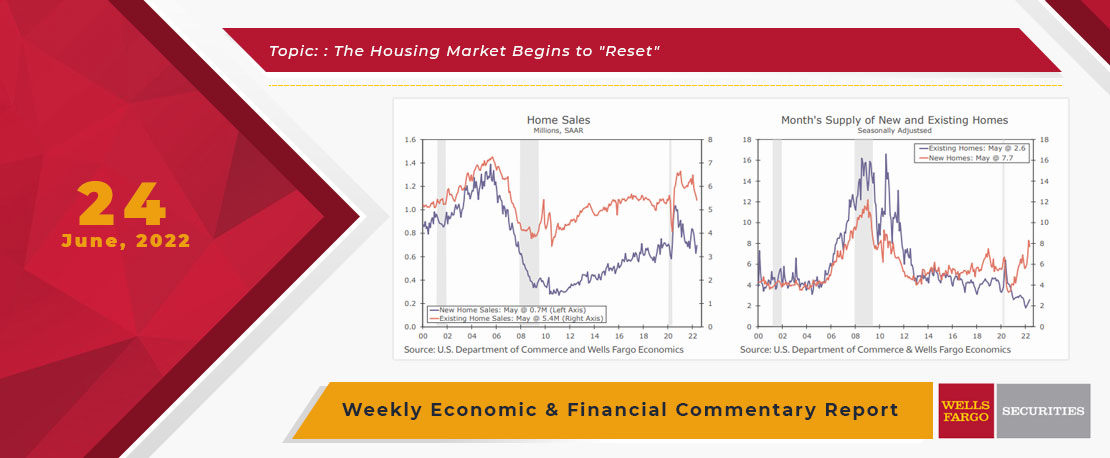

This Week's State Of The Economy - What Is Ahead? - 24 June 2022

Wells Fargo Economics & Financial Report / Jun 25, 2022

The biggest economic news was Fed Chair Powell presenting the Federal Reserve\'s semiannual Monetary Policy report to Congress this week.

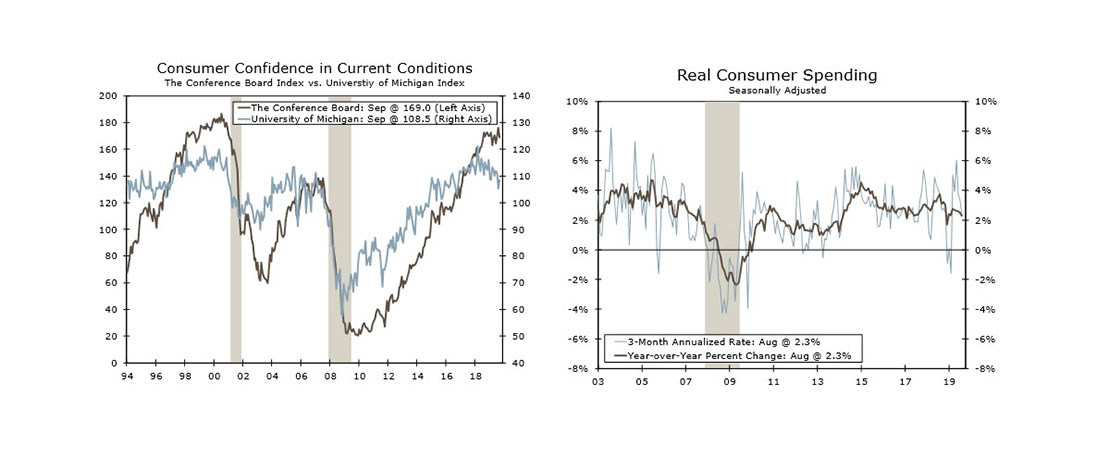

This Week's State Of The Economy - What Is Ahead? - 27 September 2019

Wells Fargo Economics & Financial Report / Sep 28, 2019

The release of the transcript of President Trump\'s phone conversation with Ukraine President Volodymyr Zelenskiy and the whistle blower complaint overshadowed most of this week\'s economic reports and took bond yields modestly lower.

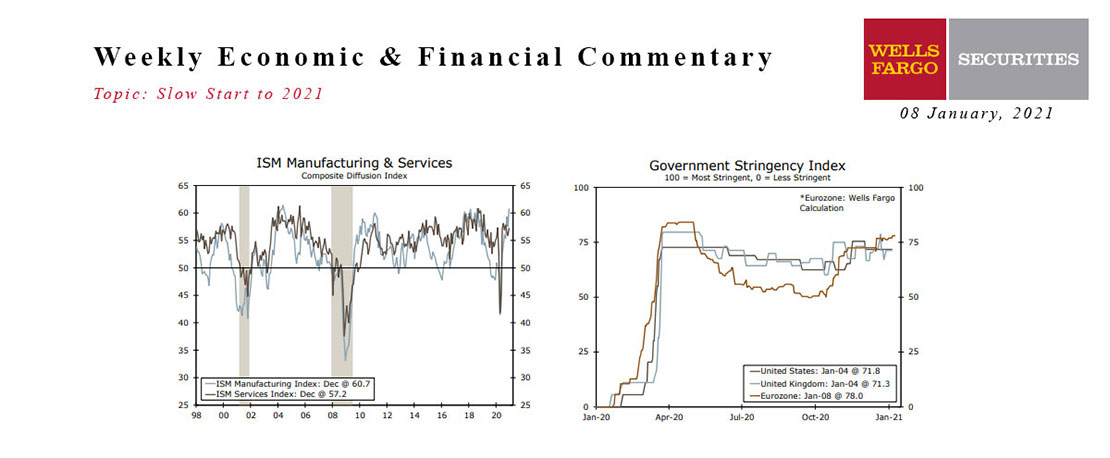

This Week's State Of The Economy - What Is Ahead? - 08 January 2021

Wells Fargo Economics & Financial Report / Jan 12, 2021

The manufacturing sector is showing a great deal of resilience, with the ISM Manufacturing survey exceeding expectations, at 60.7, and factory orders remaining strong.

This Week's State Of The Economy - What Is Ahead? - 25 November 2020

Wells Fargo Economics & Financial Report / Nov 28, 2020

It may be a holiday-shortened week, but there have been as many developments and economic indicators packed into three days as we can recall seeing in any other week this year.

This Week's State Of The Economy - What Is Ahead? - 07 June 2024

Wells Fargo Economics & Financial Report / Jun 11, 2024

The U.S. labor market continues to defy expectations. Employers added 272K net new jobs in May, which was stronger than even the most bullish forecaster among 77 submissions to the Bloomberg survey.

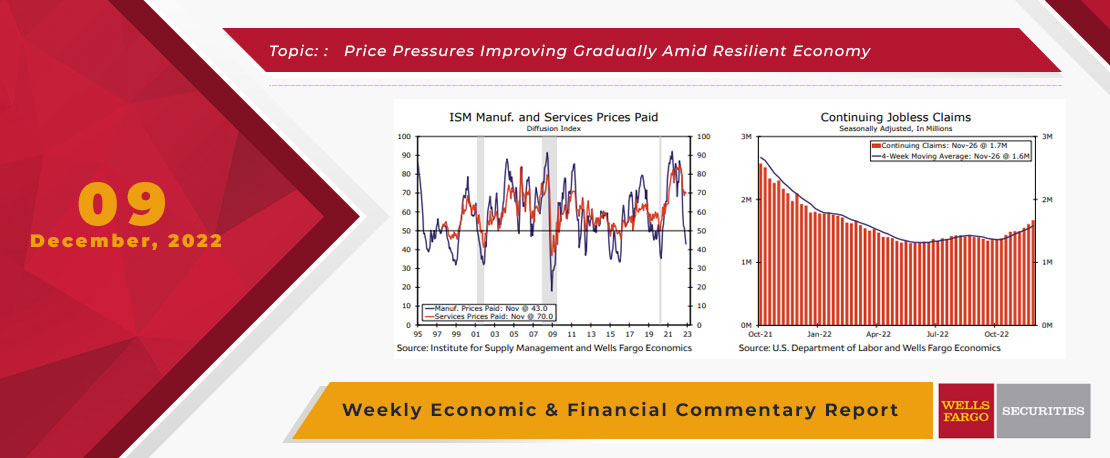

This Week's State Of The Economy - What Is Ahead? - 09 December 2022

Wells Fargo Economics & Financial Report / Dec 15, 2022

Various price metrics released this week showed some continued signs of inflation cooling, but gradually rather than rapidly.