COVID-19 UPDATE

The recent surge in COVID-19 cases indicates that elected officials re-opened the economy too soon, that too many Americans are flaunting social distancing guidelines, and that the virus is likely to be around longer than we’d hoped. On July 14, the U.S. recorded nearly 59,000 new cases, up from 22,000 cases on June 14. Texas logged 10,745 cases that day, Houston nearly 2,600 cases. That’s a five fold increase over the month for the state and the metro area.

Business Closures

The popular website Yelp.com publishes crowd-sourced reviews on local restaurants, retailers, entertainment venues and personal services. Yelp reports that 177,000 U.S. business on its site were closed between March 1 and April 19. As of June 15, only 37,000 had reopened. In Houston, the pandemic forced the closure of 3,518 Yelp businesses, of which only 578 had re-opened by mid-June.

The Outlook

The current recession can no longer be seen as a brief shutdown in which Congress passes enough safety nets and stimulus packages to bridge the gap. The number of active business owners in the U.S. plummeted by 3.3 million or 22 percent in March and April.

Though the nation has recouped some of the jobs lost in March and April, there are still 16.6 million unemployed workers in the U.S.

HOUSTON EMPLOYMENT UPDATE

Metro Houston added 73,800 jobs in May, a record for any month. The jump came as Governor Greg Abbott issued orders reopening the state’s economy early in the month. Despite the surge, local employment remains 276,400 jobs below its February pre-COVID level. The largest job gains occurred in accommodation and food services, retail and health care. Mining and logging (energy), professional, scientific and technical services, other services, and government continued to lose jobs. Only finance and insurance has returned to its pre-COVID employment level.

Crude Oil

The closing spot price for West Texas Inter-mediate (WTI), the U.S. benchmark for light, sweet crude, averaged $39.22 per barrel the last week of June ’20, down 32.8 percent from $58.38 for the same period in ’19.

Home Sales

Houston realtors sold 9,238 single-family homes in June ’20, up 15.7 percent from 8,063 in June ’19. The average price for a single-family home sold in June was $319,881, down 0.6 percent from $321,884 a year earlier. The month ended with 11,610 pending sales, a 39.3 percent increase over June ’19.

Rig Count

Baker Hughes reports 258 drilling rigs working in the U.S. during the first week of July ’20. That’s down 700 rigs, or 73.1 percent, from the same week in July ’19.

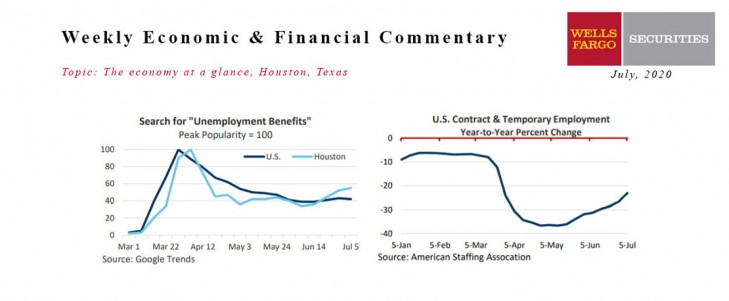

Unemployment

Houston’s unemployment rate fell from 14.2 in April to 13.9 in May. It had been as low as 3.9 percent in February.

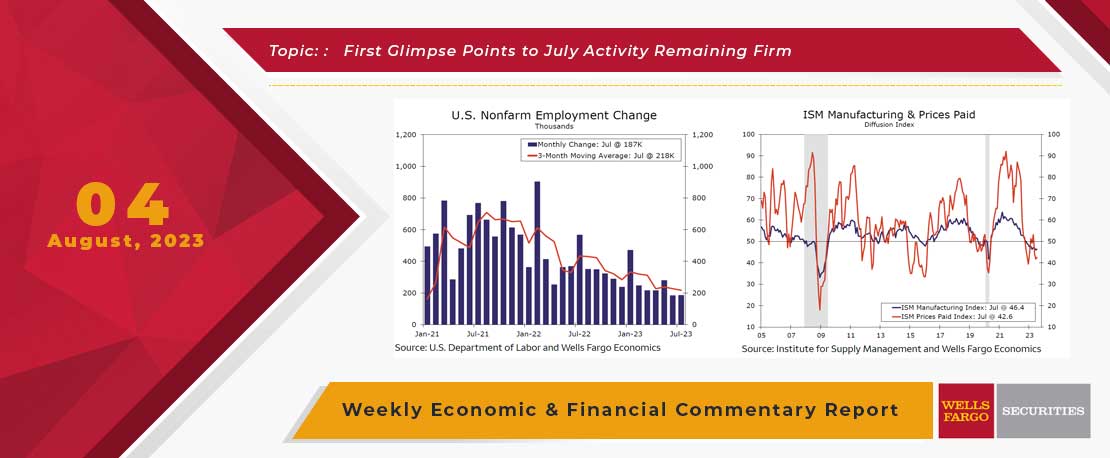

This Week's State Of The Economy - What Is Ahead? - 04 August 2023

Wells Fargo Economics & Financial Report / Aug 09, 2023

Employment growth was broad-based, though reliant on a 87K gain in health care & social assistance. Modest gains from construction, financial activities and hospitality also contributed to private sector job growth.

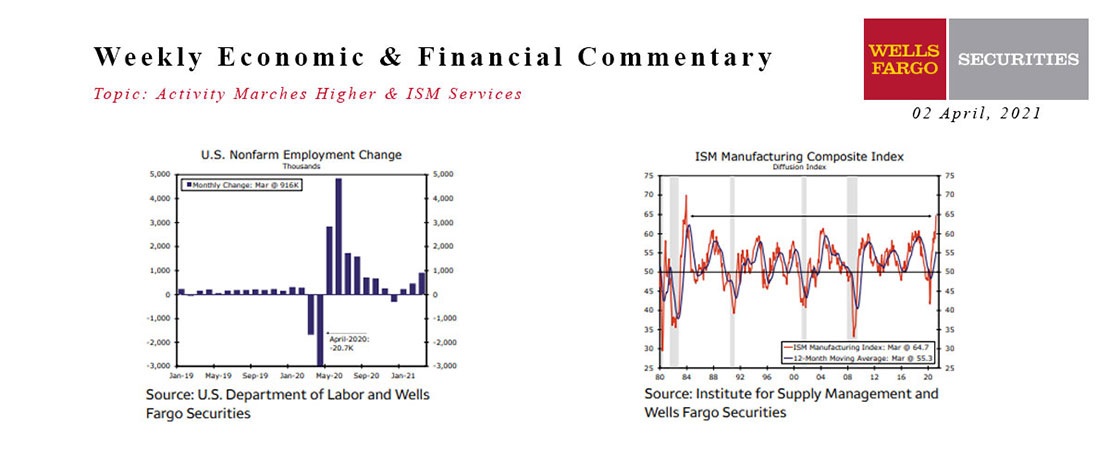

This Week's State Of The Economy - What Is Ahead? - 02 April 2021

Wells Fargo Economics & Financial Report / Apr 08, 2021

Increased vaccinations and an improving public health position led to an easing of restrictions and pickup in activity across the country in March.

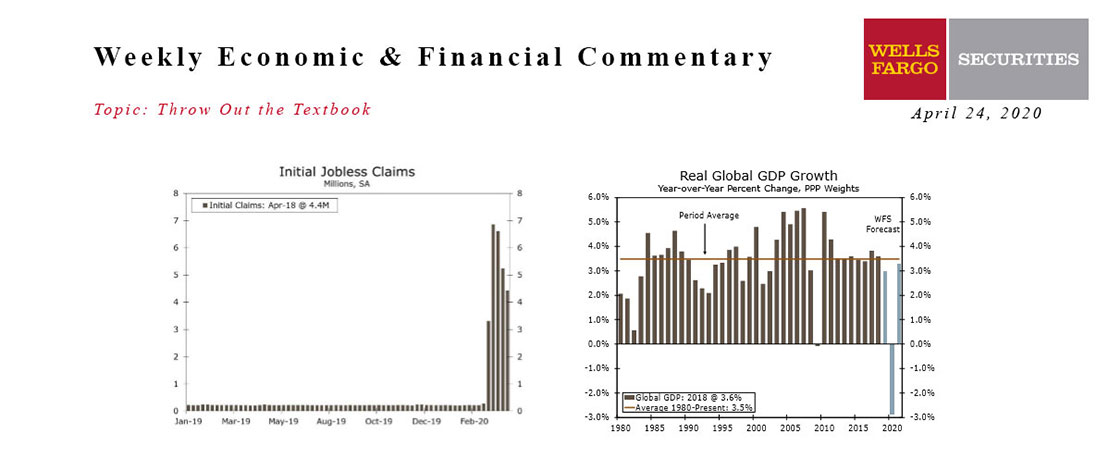

This Week's State Of The Economy - What Is Ahead? - 24 April 2020

Wells Fargo Economics & Financial Report / Apr 27, 2020

Oil prices went negative for the first time in history on Monday as the evaporation of demand collided with a supply glut. In the past five weeks, 26.5 million people have filed for unemployment insurance, or more than one out of every seven workers.

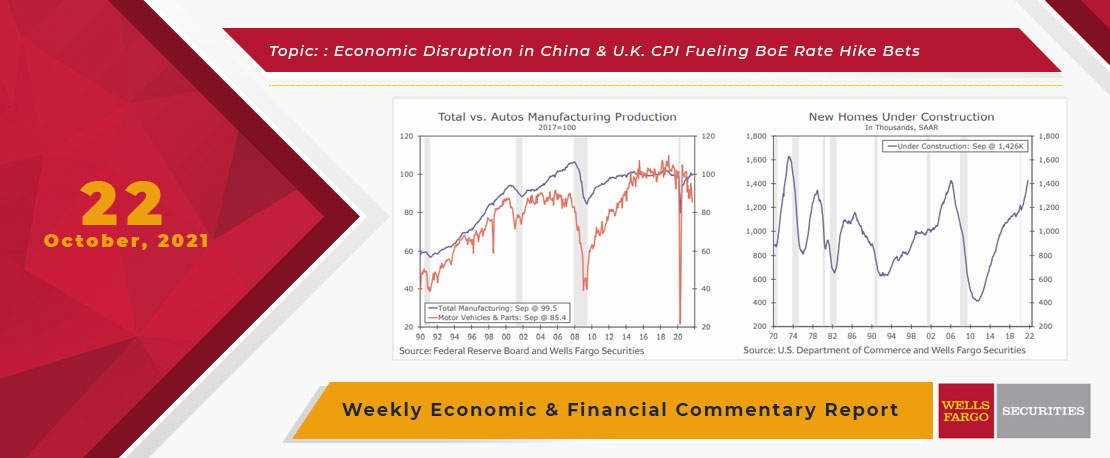

This Week's State Of The Economy - What Is Ahead? - 22 October 2021

Wells Fargo Economics & Financial Report / Oct 25, 2021

Restrictions from a renewed COVID outbreak in China, regulatory changes weighing on local financial markets and a potential collapse of Evergrande have all contributed to a slowdown in Chinese economic activity.

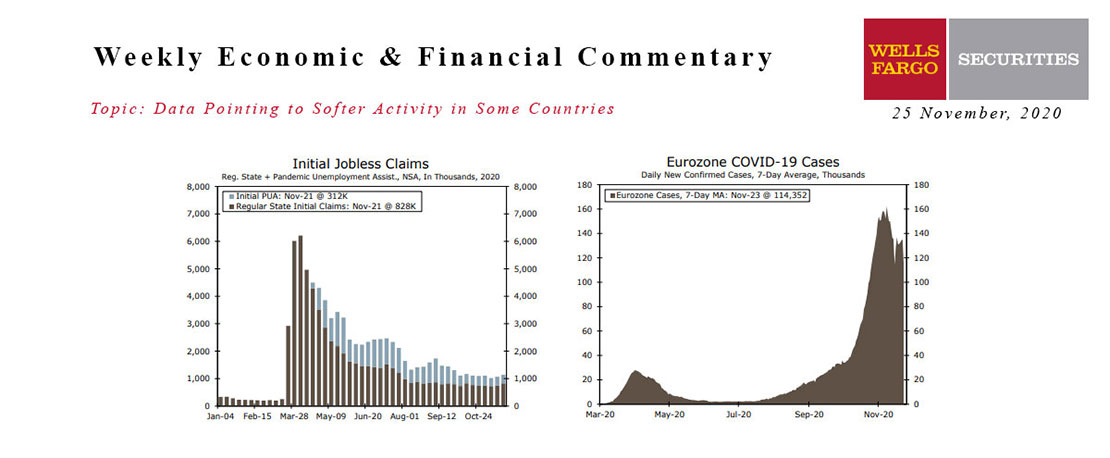

This Week's State Of The Economy - What Is Ahead? - 25 November 2020

Wells Fargo Economics & Financial Report / Nov 28, 2020

It may be a holiday-shortened week, but there have been as many developments and economic indicators packed into three days as we can recall seeing in any other week this year.

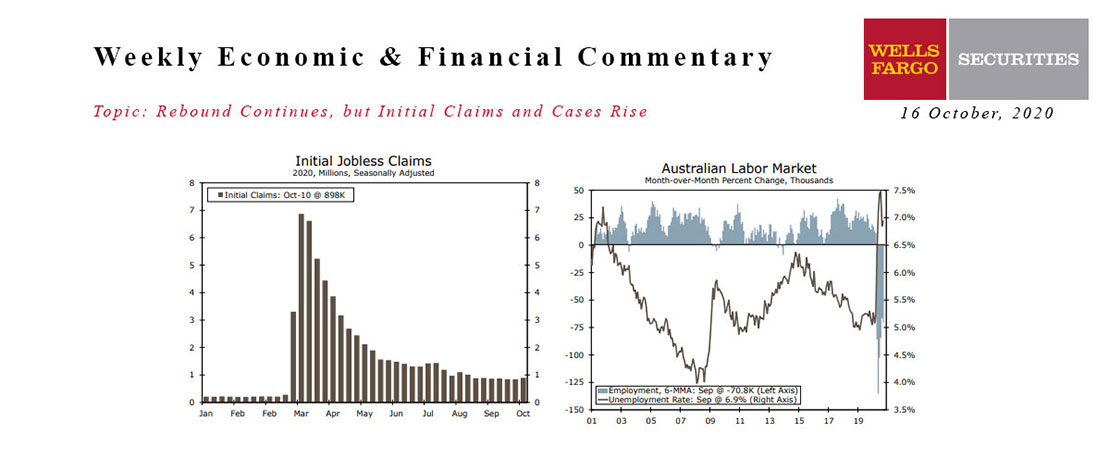

This Week's State Of The Economy - What Is Ahead? - 16 October 2020

Wells Fargo Economics & Financial Report / Oct 20, 2020

Data continue to reflect an economy digging itself out of the lockdown-induced slump.

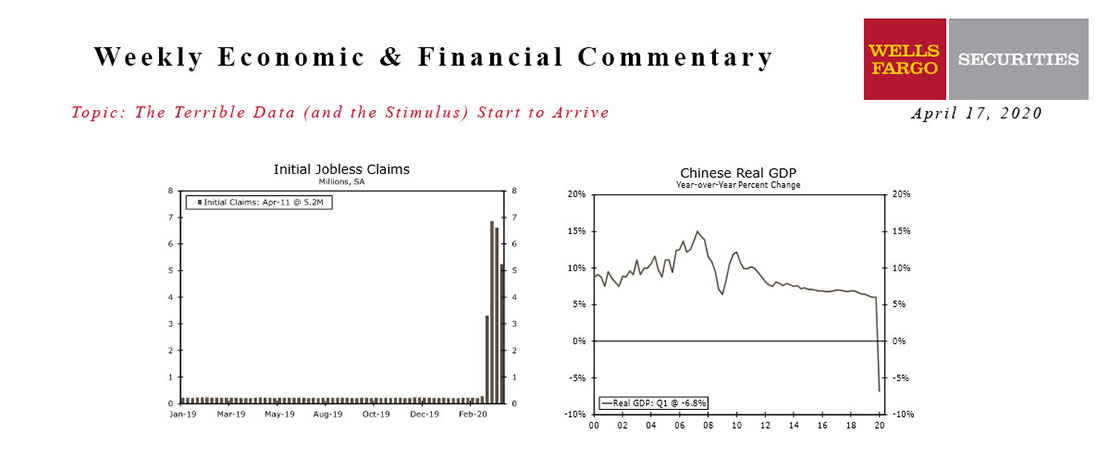

This Week's State Of The Economy - What Is Ahead? - 17 April 2020

Wells Fargo Economics & Financial Report / Apr 18, 2020

Economic data from the early stages of the Great Shutdown have finally arrived, and they are as bad as feared. ‘Worst on record’ is about to become an all too common refrain in our commentary.

This Week's State Of The Economy - What Is Ahead? - 12 August 2020

Wells Fargo Economics & Financial Report / Aug 15, 2020

The consumer has been a bright spot in the recovery so far, but with jobless benefits in flux and no clear path for the long-awaited stimulus bill, the support here could fade.

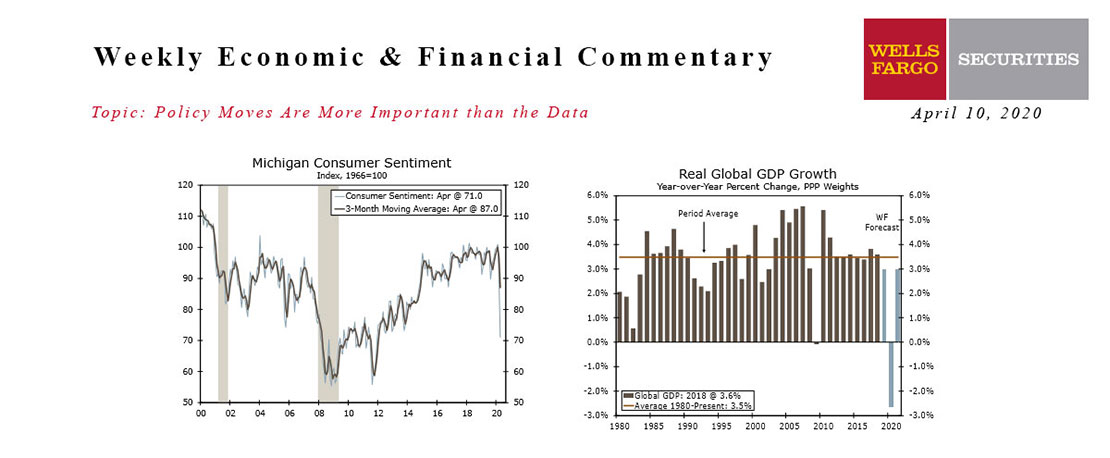

This Week's State Of The Economy - What Is Ahead? - 10 April 2020

Wells Fargo Economics & Financial Report / Apr 11, 2020

The Federal Reserve greatly expanded the collateral that it is willing to buy, further easing pressures in financial markets.

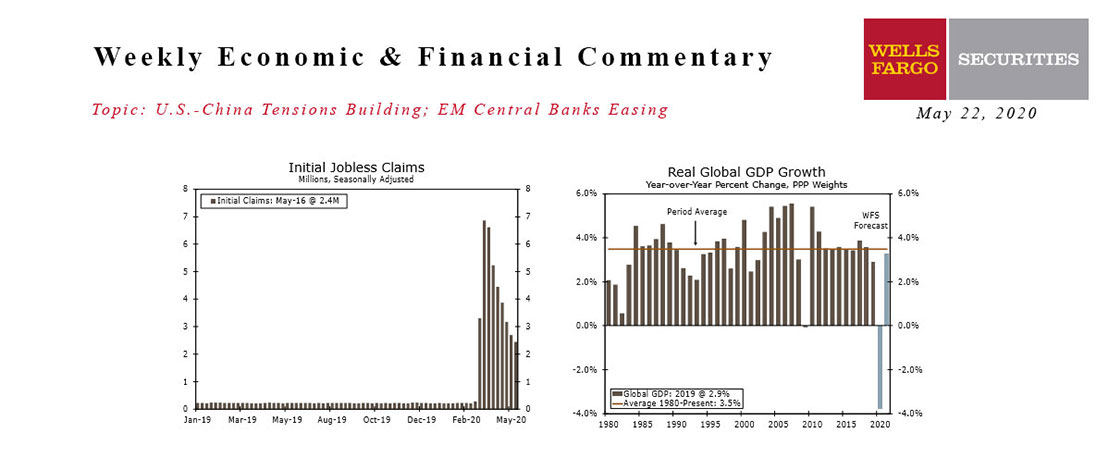

This Week's State Of The Economy - What Is Ahead? - 22 May 2020

Wells Fargo Economics & Financial Report / May 25, 2020

The re-opening of the country is getting underway, with all 50 states starting to roll back restrictions.