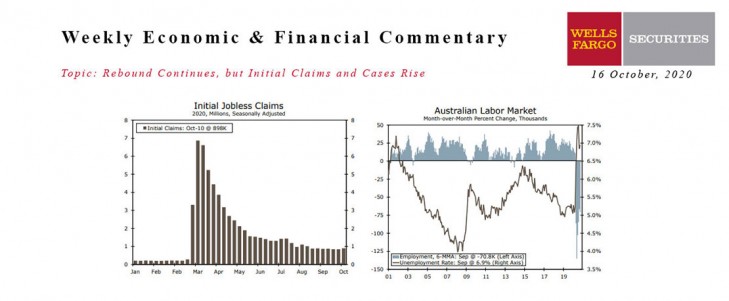

U.S. - Rebound Continues, but Initial Claims and Cases Rise

- Data continue to reflect an economy digging itself out of the lockdown-induced slump.

- Consumer prices and retail sales rose in September as activity continued to pick up, but a rise in initial claims for state unemployment benefits last week points to continued churn in the labor market.

- Stimulus talks regarding an additional fiscal relief package continued this week, but an agreement remained elusive.

- COVID-19 case counts are on the rise in the Midwest, presenting renewed concern of localized setbacks.

Global - Data Underwhelming This Week

- Swedish inflation slid more than expected in September, with headline and core CPIF remaining well-below the Riksbank’s 2% target inflation rate.

- Australia’s employment declined by 29,500 in September, the first decline since May, while the unemployment rate edged higher to 6.9%. The slump in the labor market in part reflects the Stage 4 restrictions in Victoria put in place to contain the spread of COVID-19.

- Chile’s central bank held its policy interest rate at 0.50% at this week’s meeting, and did not announce any new quantitative easing measures.

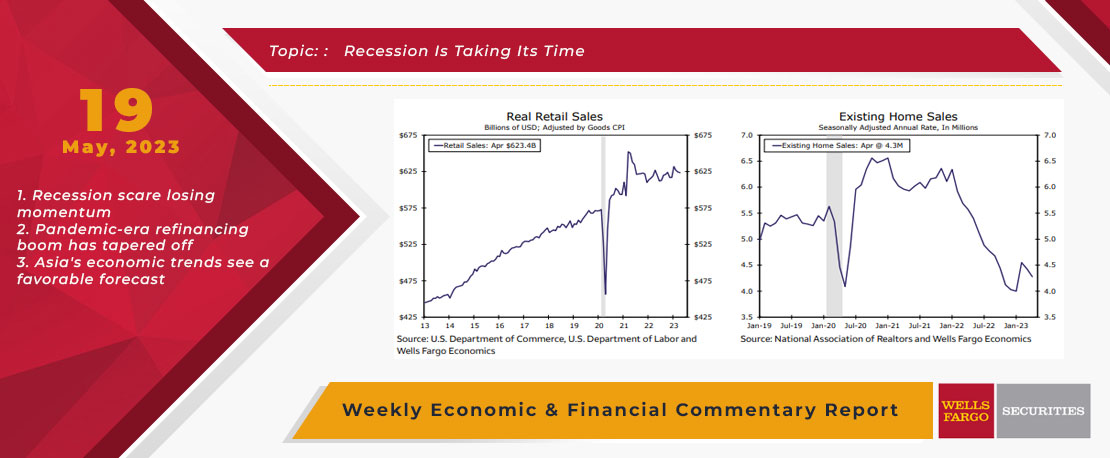

This Week's State Of The Economy - What Is Ahead? - 19 May 2023

Wells Fargo Economics & Financial Report / May 23, 2023

Economic data continue to suggest the U.S. economy is only gradually losing momentum. Consumers continue to spend, and industrial and housing activity are seeing some stabilization.

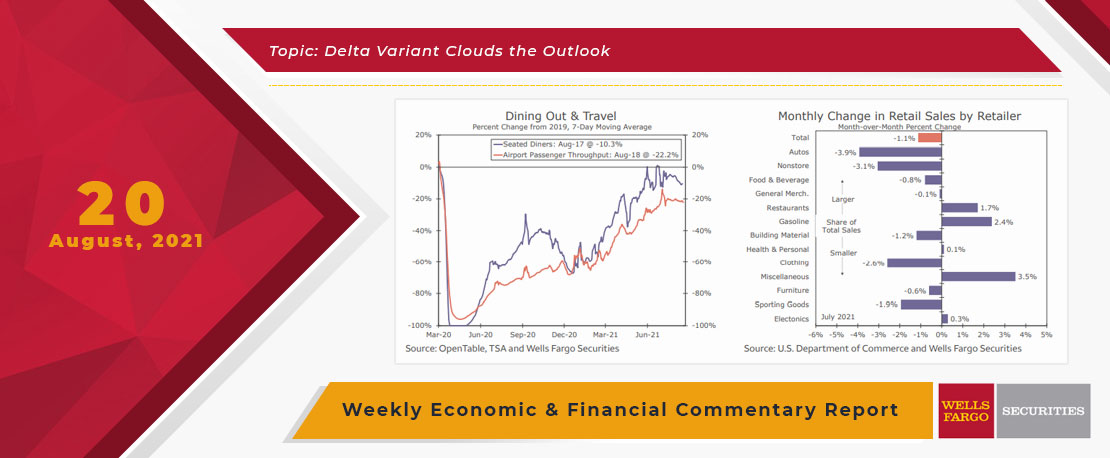

This Week's State Of The Economy - What Is Ahead? - 20 August 2021

Wells Fargo Economics & Financial Report / Aug 24, 2021

The Wells Fargo Economics team notes in the Commentary that new COVID cases in New Zealand disrupted the Reserve Bank of New Zealand\'s plan to tighten monetary policy this week.

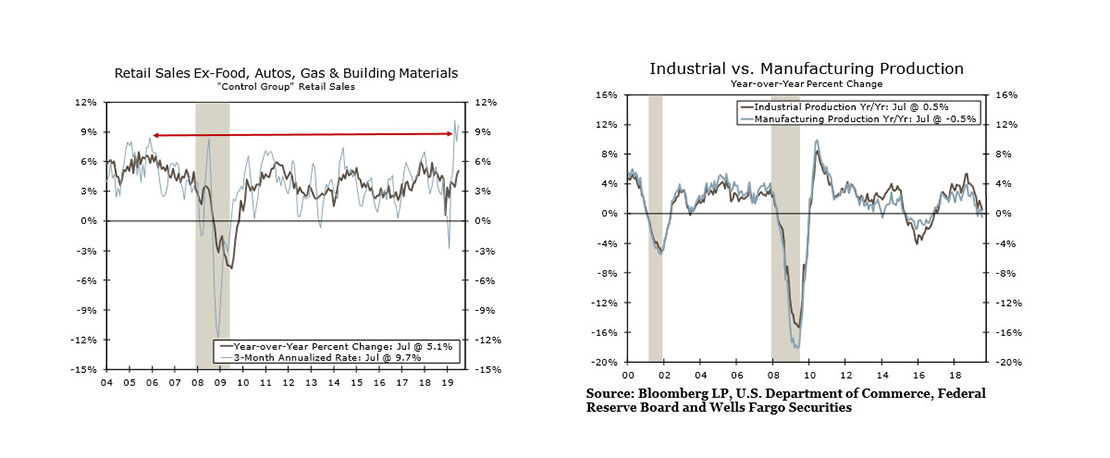

This Week's State Of The Economy - What Is Ahead? - 16 August 2019

Wells Fargo Economics & Financial Report / Aug 17, 2019

Markets gyrated this week as the spread between the ten- and two-year Treasury\'s turned negative for the first time since 2007. Financial markets seem to expect that the sharp slowdown in growth overseas will soon spread to the United States.

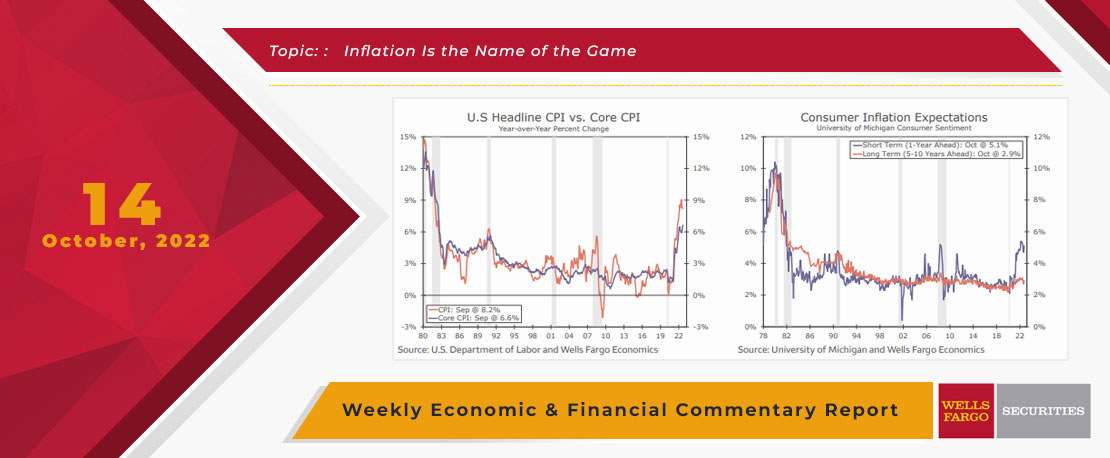

This Week's State Of The Economy - What Is Ahead? - 14 October 2022

Wells Fargo Economics & Financial Report / Oct 18, 2022

Highly anticipated Consumer Price Index report surprised to the upside. Headline CPI rose 0.4% in September, and core CPI increased 0.6%.

This Week's State Of The Economy - What Is Ahead? - 21 January 2022

Wells Fargo Economics & Financial Report / Jan 24, 2022

The Texans have earned a top draft position yet again, the Cowboys are home again for the remainder of the playoffs, and inflation concerns that continue to mount, along with ongoing supply chain disruptions, are weighing on homebuilder confidence.

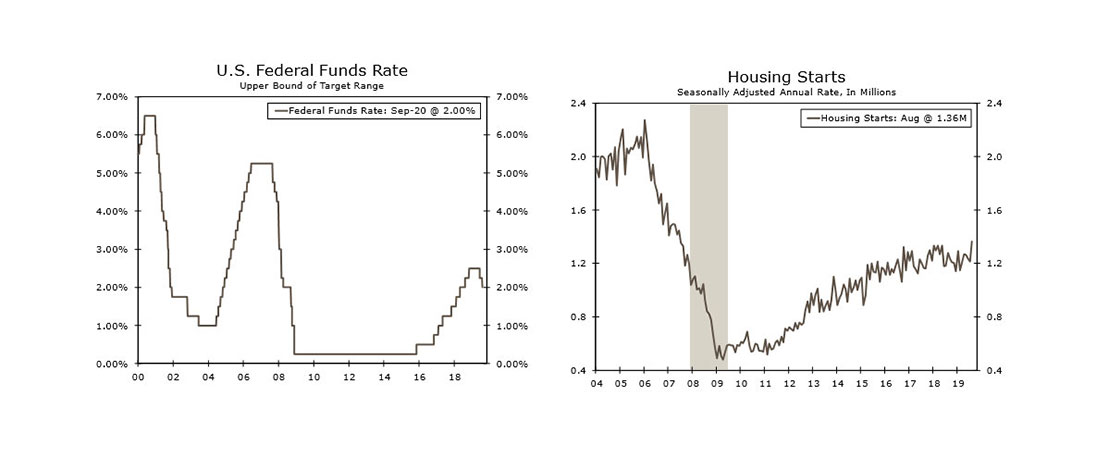

This Week's State Of The Economy - What Is Ahead? - 20 September 2019

Wells Fargo Economics & Financial Report / Sep 21, 2019

The Federal Reserve reduced the fed funds rate 25 bps this week, continuing to cite economic weakness overseas and muted inflation pressures.

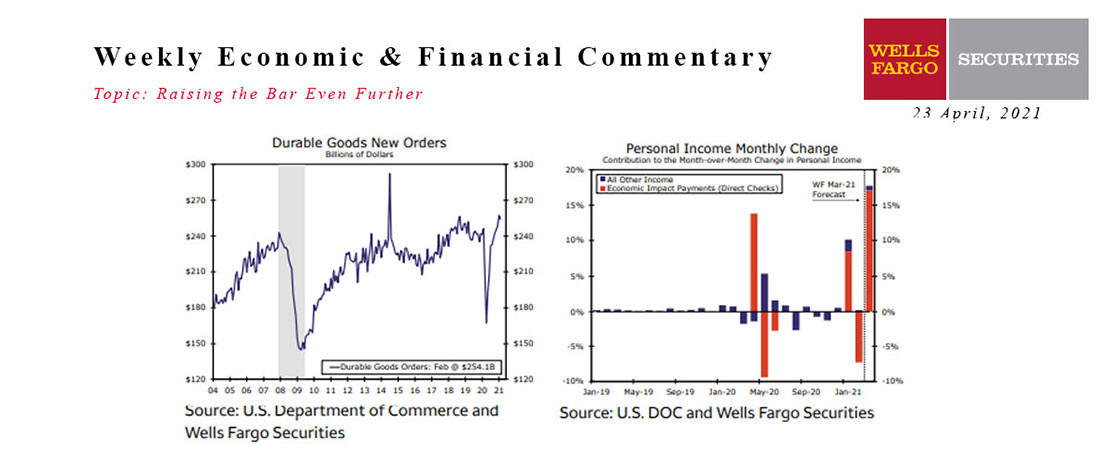

This Week's State Of The Economy - What Is Ahead? - 23 April 2021

Wells Fargo Economics & Financial Report / Apr 26, 2021

This week\'s lighter economic calendar allowed forecasters more time to assess the implications from the prior week\'s blowout retail sales report.

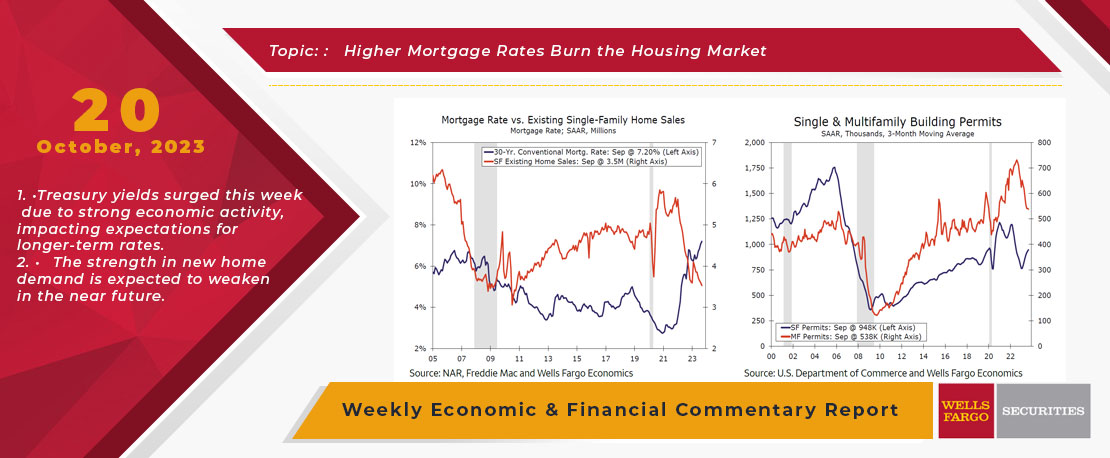

This Week's State Of The Economy - What Is Ahead? - 20 October 2023

Wells Fargo Economics & Financial Report / Oct 27, 2023

Treasury yields surged this week due to strong economic activity, impacting expectations for longer-term rates. New home sales led to a rise in single-family permits, but spiking mortgage rates are testing builder affordability strategies.

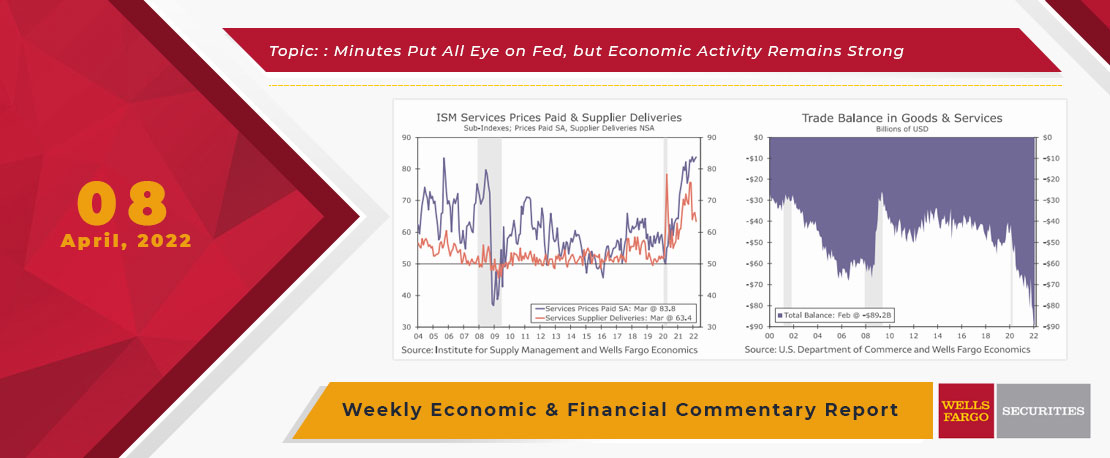

This Week's State Of The Economy - What Is Ahead? - 08 April 2022

Wells Fargo Economics & Financial Report / Apr 11, 2022

Wednesday\'s release of the FOMC minutes stirred things up as comments showed committee members agreeing that elevated inflation and the tight labor market at present warrant balance sheet reduction to begin soon.

This Week's State Of The Economy - What Is Ahead? - 30 September 2022

Wells Fargo Economics & Financial Report / Oct 03, 2022

Just as I know the folks in Florida are resilient and will recover in time, incoming data indicate a slowing yet resilient economy.