This week takes us almost halfway thru the Aug/Sept timeframe that can be especially hot here in Texas. It also brings us to the precipice of that most exciting time of the year…football season. To mark the occasion, this week’s Commentary includes a special seasonal addition that will carry forward through early December…a SPORTS section. Yes you read that correctly. Your favorite weekly economics summary will also bring you a special college football feature each week for the next couple of months, which is appropriate given what a big business it has evolved into. No betting lines are offered, so keep your money in your pocket.

In other economic news, output continues to ramp up across the U.S., even as the resurgence in COVID cases is leading to some pullback in consumer engagement. The need to rebuild inventories should keep production rising, even if consumer spending moderates a bit further. Housing is already beginning to move into better balance, with rising inventories of existing homes beginning to moderate soaring home prices. Inventories of new homes have also increased, although most of the gain is in developed lots and homes under construction.

This Week's State Of The Economy - What Is Ahead? - 02 September 2022

Wells Fargo Economics & Financial Report / Sep 05, 2022

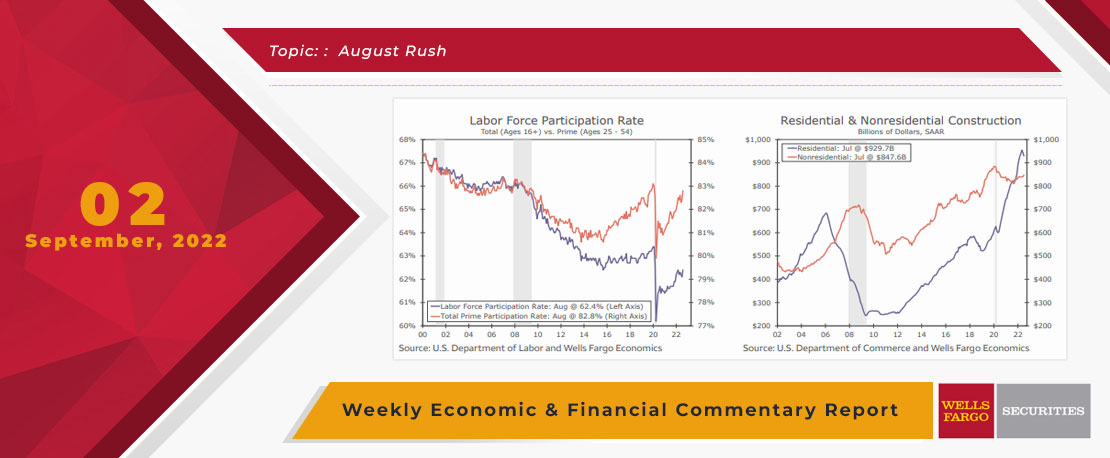

More job seekers also lifted the participation rate to 62.4% and thus easing some tightness in the job market even as payrolls expanded.

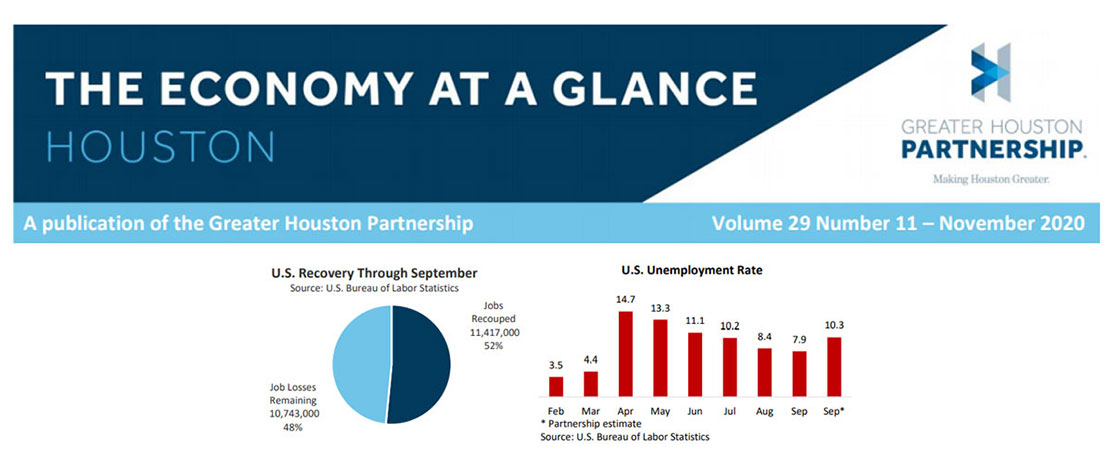

November 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Nov 12, 2020

U.S. gross domestic product (GDP) grew 7.4 percent, or $1.3 trillion in Q3, adjusted for inflation.

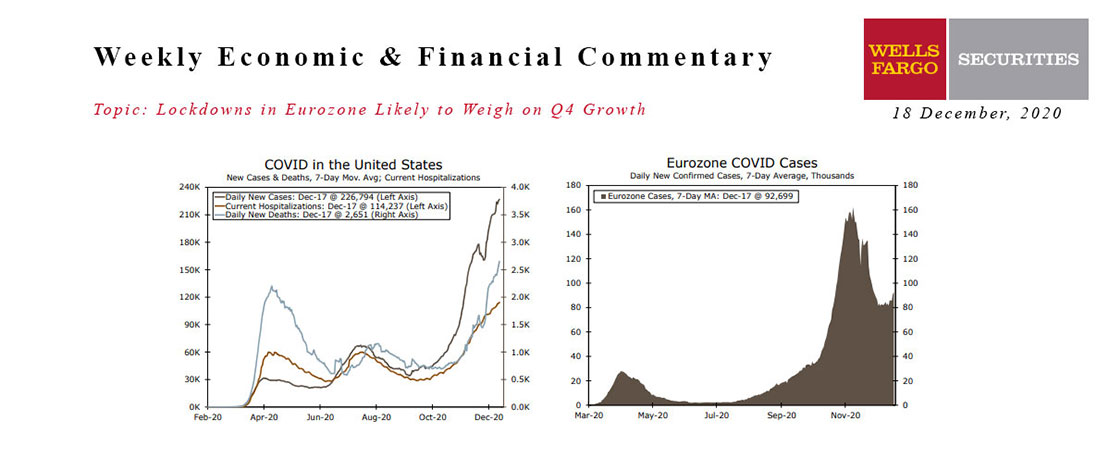

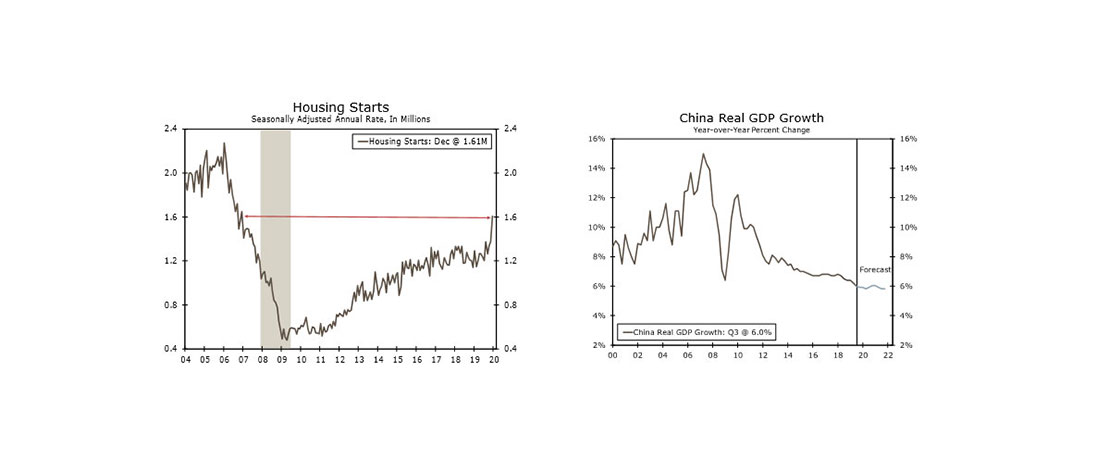

This Week's State Of The Economy - What Is Ahead? - 18 December 2020

Wells Fargo Economics & Financial Report / Dec 21, 2020

This week marked the first U.S. COVID vaccinations and the imminent rollout of a second vaccine.

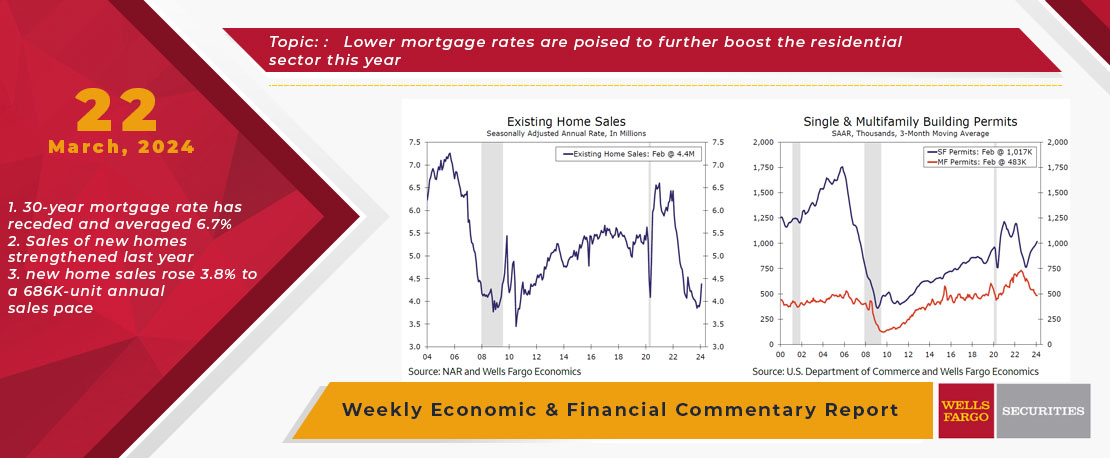

This Week's State Of The Economy - What Is Ahead? - 22 March 2024

Wells Fargo Economics & Financial Report / Mar 25, 2024

During February, existing home sales and housing starts both topped expectations and rose at robust rates. Meanwhile, initial jobless claims have remained subdued so far in March.

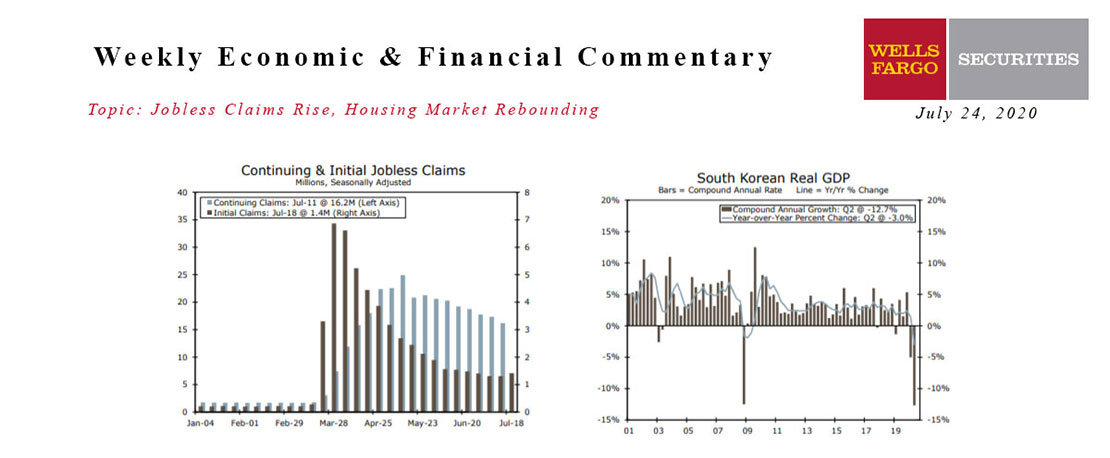

This Week's State Of The Economy - What Is Ahead? - 24 July 2020

Wells Fargo Economics & Financial Report / Jul 25, 2020

Initial jobless claims rose to just over 1.4 million for the week ending July 18. Continuing claims fell to about 16.2 million. Initial claims edging higher suggests that the resurgence of COVID-19 may be taking a toll on the labor market recovery.

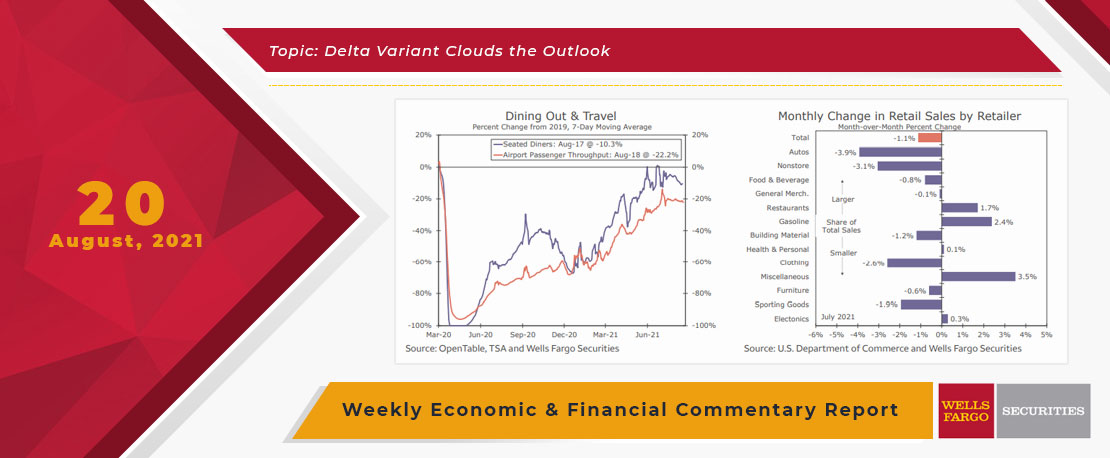

This Week's State Of The Economy - What Is Ahead? - 20 August 2021

Wells Fargo Economics & Financial Report / Aug 24, 2021

The Wells Fargo Economics team notes in the Commentary that new COVID cases in New Zealand disrupted the Reserve Bank of New Zealand\'s plan to tighten monetary policy this week.

This Week's State Of The Economy - What Is Ahead? - 10 January 2020

Wells Fargo Economics & Financial Report / Jan 11, 2020

The week began amid rising tensions carrying over from the U.S. killing of Iranian General Qasem Soleimani last Friday.

This Week's State Of The Economy - What Is Ahead? - 30 April 2021

Wells Fargo Economics & Financial Report / May 18, 2021

The gain in output leaves the level of real GDP just a stone\'s throw below its pre-COVID Q4-2019 level (see chart).

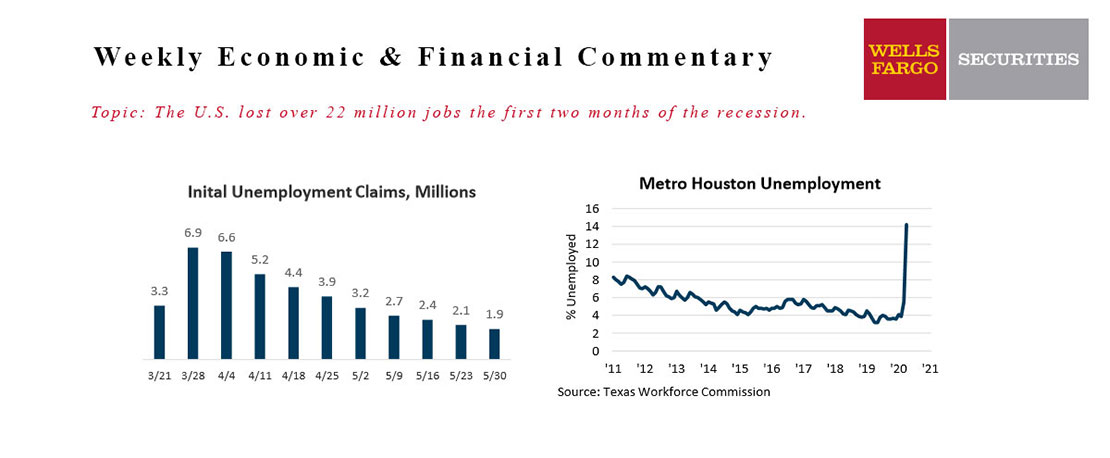

June 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Jun 18, 2020

The Fed expects to hold interest rates near zero through the end of this year, perhaps well into next year, and maybe even into ’22.

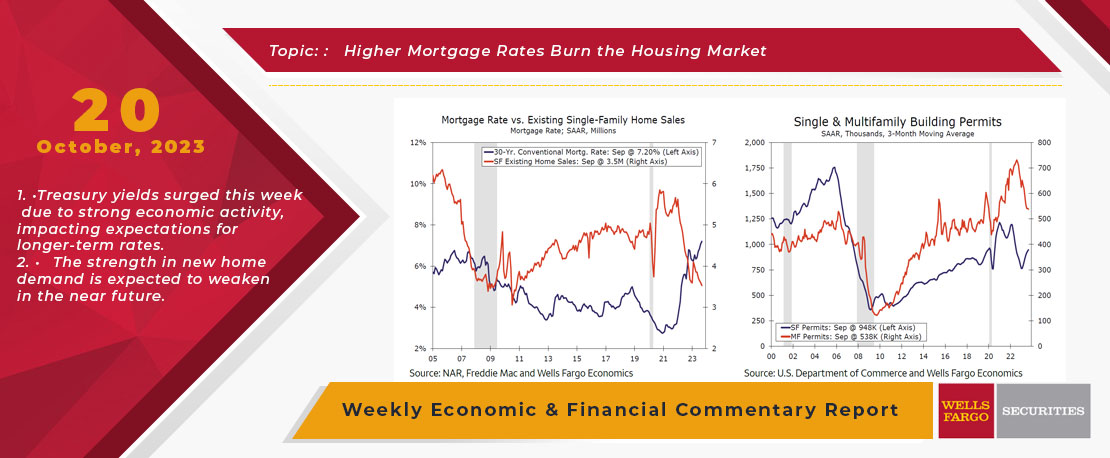

This Week's State Of The Economy - What Is Ahead? - 20 October 2023

Wells Fargo Economics & Financial Report / Oct 27, 2023

Treasury yields surged this week due to strong economic activity, impacting expectations for longer-term rates. New home sales led to a rise in single-family permits, but spiking mortgage rates are testing builder affordability strategies.