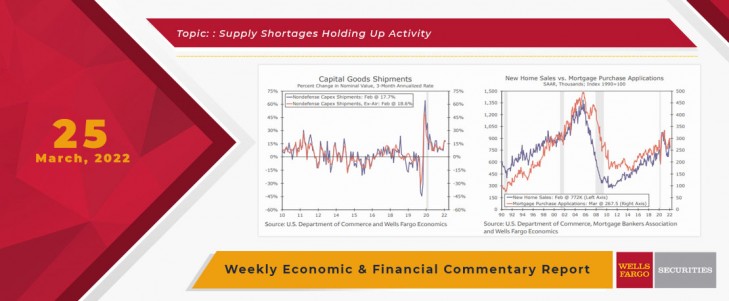

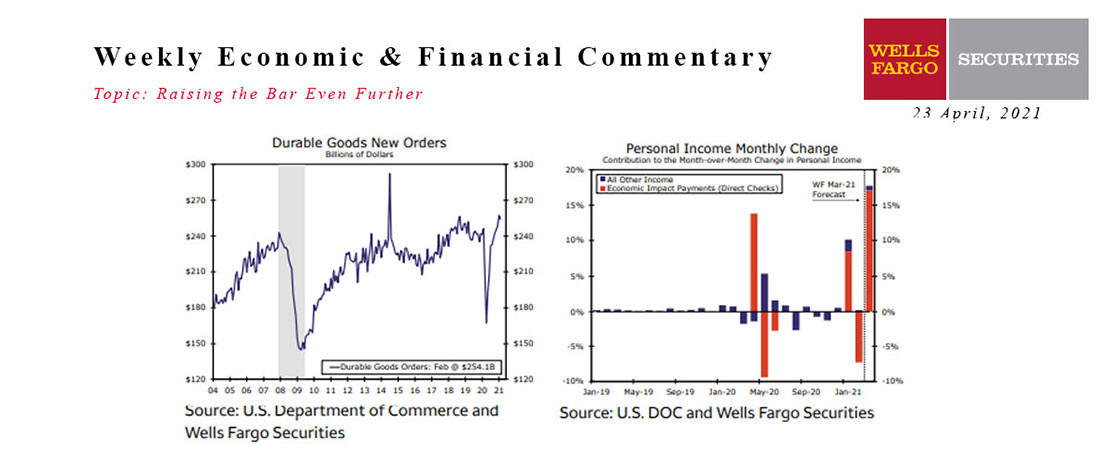

This week's durable goods report was largely disappointing with the 2.2% headline decline, partly the result of a sharp drop in civilian aircraft orders. Excluding the transportation sector, orders still fell 0.6%. With some upward revisions to prior data and a better-than-expected outturn for shipments of core capital goods, equipment spending is still tracking with our Q1 forecast for a 5.7% annualized growth rate.

The fact that capital goods shipments surprised on the upside was one of the few things that went right in this week's durable goods report. Stripping out the volatile defense and aircraft components tends to reveal the underlying trend in activity, and revisions to core orders and shipments were fairly positive. But core capital goods orders declined 0.3% during the month after a 1.3% gain to start the year, suggesting some stalling in activity in February.

Since the GDP account counts bookings once shipped, shipments are the more important indicator when considering the impact on rst quarter growth. Core capital goods shipments (including aircraft) rose a more modest 0.2% in February after near 2% gains in the prior two consecutive months. Despite the step down in growth, the solid start to the quarter still leaves equipment spending in a decent position

This Week's State Of The Economy - What Is Ahead? - 18 November 2022

Wells Fargo Economics & Financial Report / Nov 21, 2022

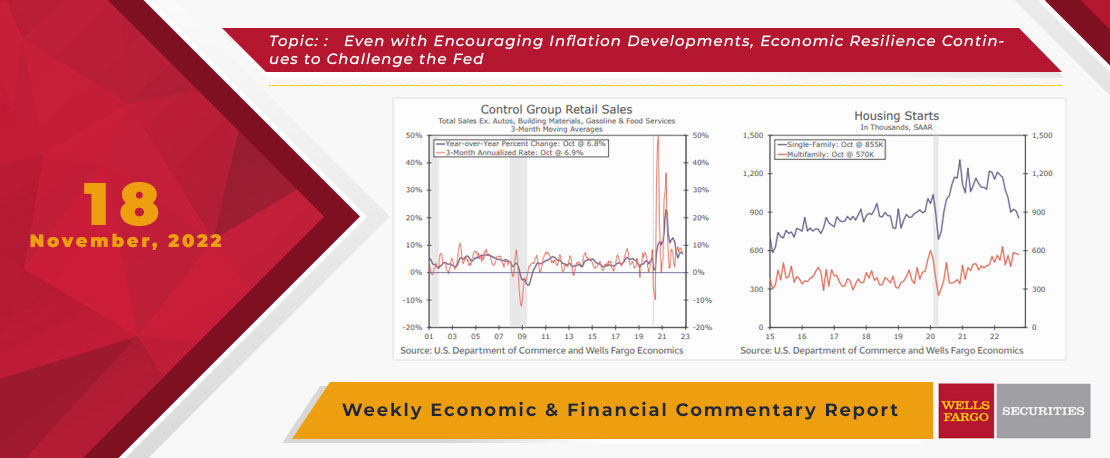

The resiliency of the U.S. consumer was also on display, as total retail sales increased a stronger-than-expected 1.3% in October, boosted, in part, by a 1.3% jump in motor vehicles & parts and a 4.1% rise at gasoline stations.

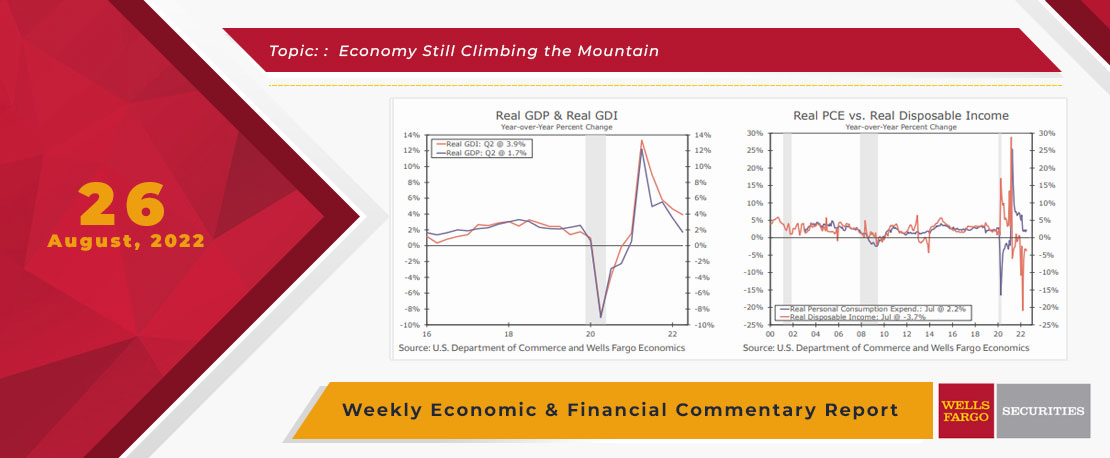

This Week's State Of The Economy - What Is Ahead? - 26August 2022

Wells Fargo Economics & Financial Report / Aug 29, 2022

I can understand how the opportunity to participate in lots of scintillating economic policy discussions could make fishing look exciting in comparison.

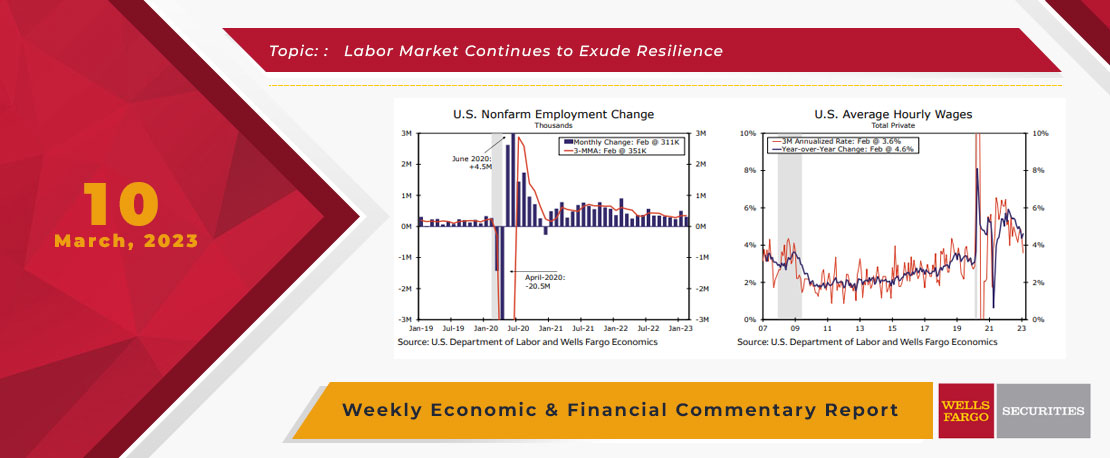

This Week's State Of The Economy - What Is Ahead? - 10 March 2023

Wells Fargo Economics & Financial Report / Mar 14, 2023

Financial markets were looking for validation that January\'s unexpected strength was not a fluke and that the downward slide in economic momentum experienced late last year had stabilized.

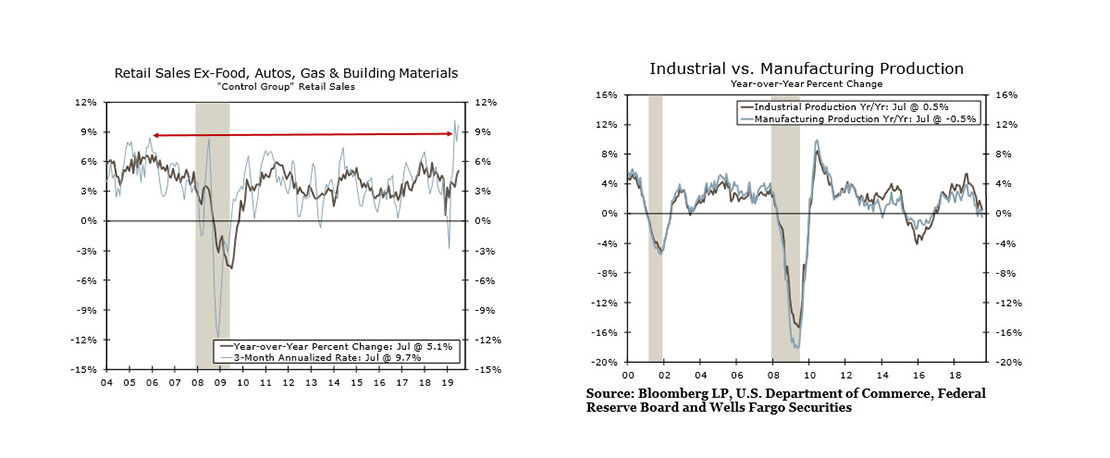

This Week's State Of The Economy - What Is Ahead? - 16 August 2019

Wells Fargo Economics & Financial Report / Aug 17, 2019

Markets gyrated this week as the spread between the ten- and two-year Treasury\'s turned negative for the first time since 2007. Financial markets seem to expect that the sharp slowdown in growth overseas will soon spread to the United States.

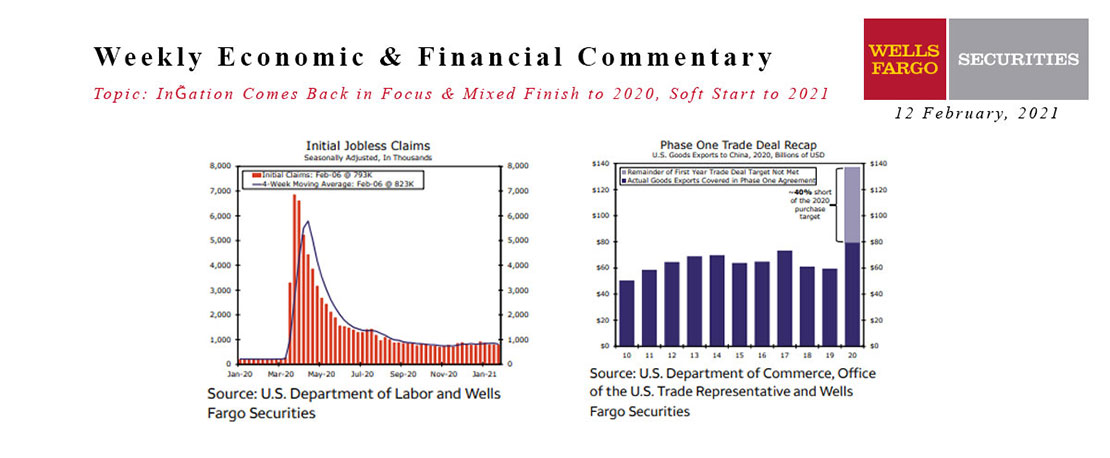

This Week's State Of The Economy - What Is Ahead? - 12 February 2021

Wells Fargo Economics & Financial Report / Feb 19, 2021

Market attention was concentrated on the January consumer price data, as inflation has come back into focus.

This Week's State Of The Economy - What Is Ahead? - 23 April 2021

Wells Fargo Economics & Financial Report / Apr 26, 2021

This week\'s lighter economic calendar allowed forecasters more time to assess the implications from the prior week\'s blowout retail sales report.

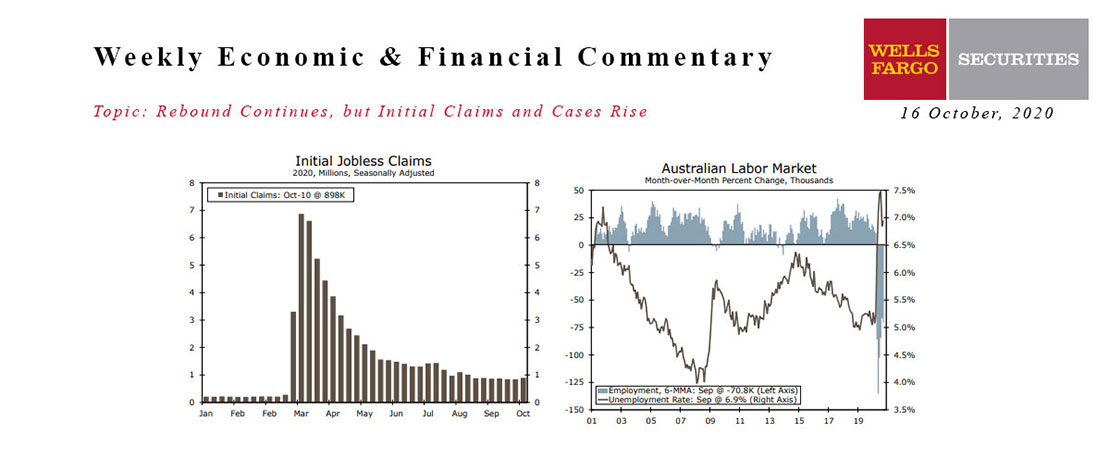

This Week's State Of The Economy - What Is Ahead? - 16 October 2020

Wells Fargo Economics & Financial Report / Oct 20, 2020

Data continue to reflect an economy digging itself out of the lockdown-induced slump.

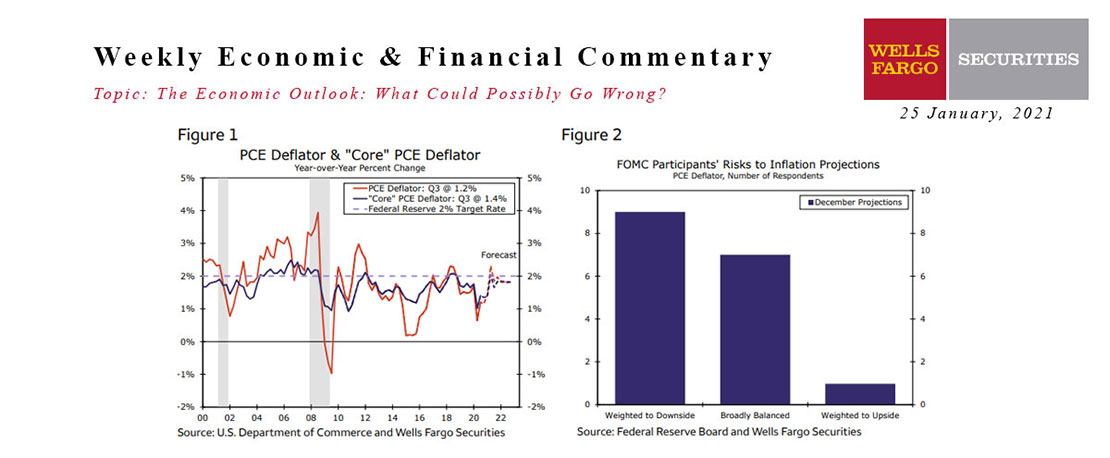

25 January 2021 Economic Outlook Report

Wells Fargo Economics & Financial Report / Jan 30, 2021

In the second installment of our series on economic risks in the foreseeable future, we analyze the potential for higher inflation in coming years stemming from excess demand.

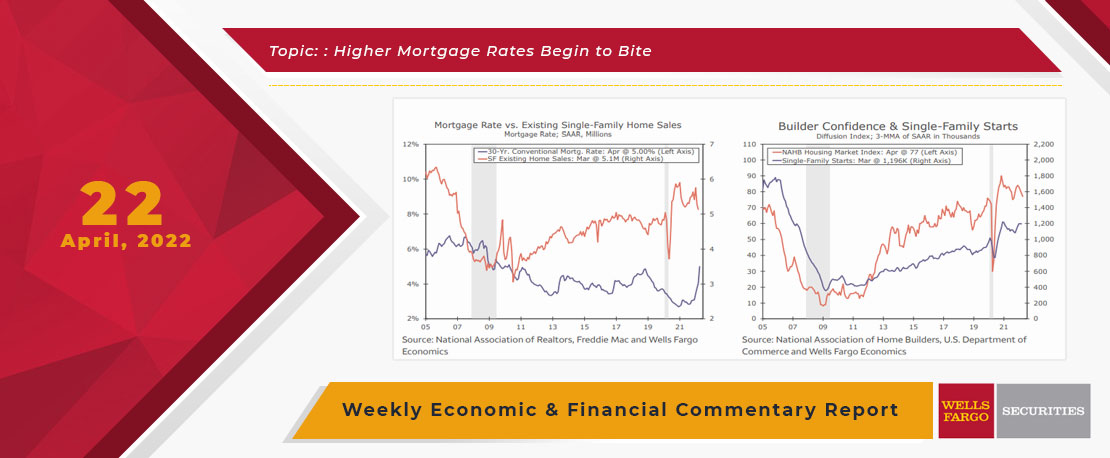

This Week's State Of The Economy - What Is Ahead? - 22 April 2022

Wells Fargo Economics & Financial Report / Apr 27, 2022

I’ll wish you a Happy Earth Day anyway. Don’t expect a card this year. While the Earth continues to thankfully revolve at a steady rate, rising mortgage rates appear to be slowing residential activity

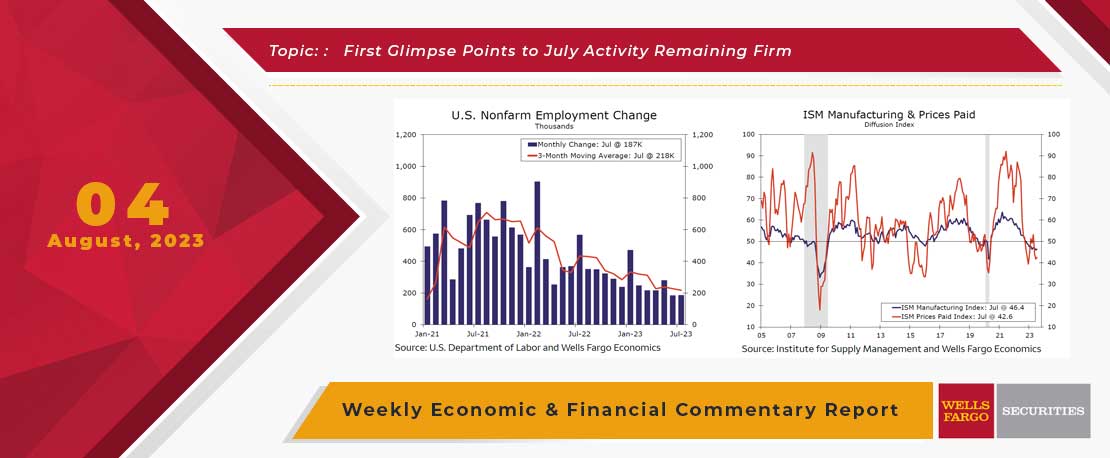

This Week's State Of The Economy - What Is Ahead? - 04 August 2023

Wells Fargo Economics & Financial Report / Aug 09, 2023

Employment growth was broad-based, though reliant on a 87K gain in health care & social assistance. Modest gains from construction, financial activities and hospitality also contributed to private sector job growth.