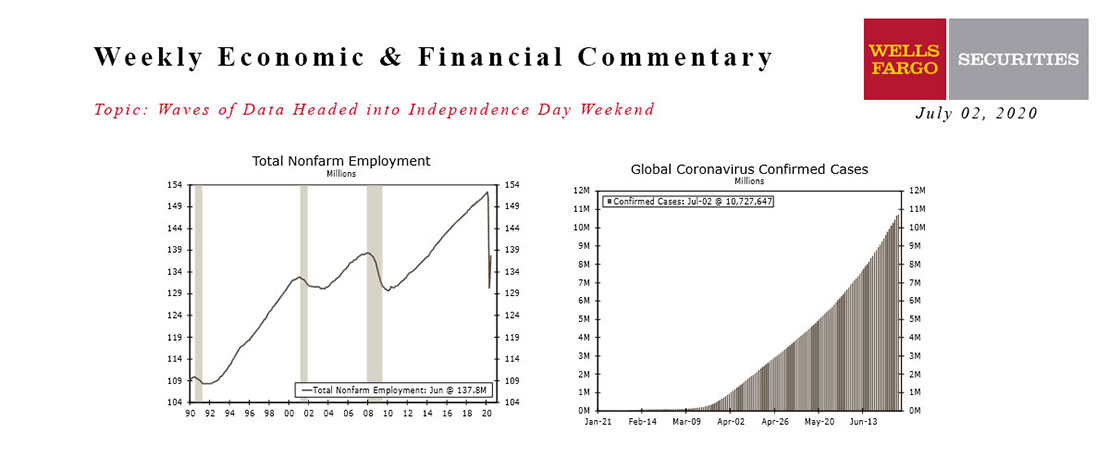

June has now passed and the economic data seems a little mixed. We added 850,00 jobs in June, but much of that was State governments school districts in some parts of the Country reopening just in time for summer break. Subtract that and nonfarm employment increased 620,300, which was below consensus. Both the labor force participation rate (61.6%) and the employment-population ratio (58%) were unchanged in June. It would be nice to see those numbers go up, and logically they should with most States discontinuing participation in expanded Federal unemployment benefits, but June is probably a little too soon to see that reflected.

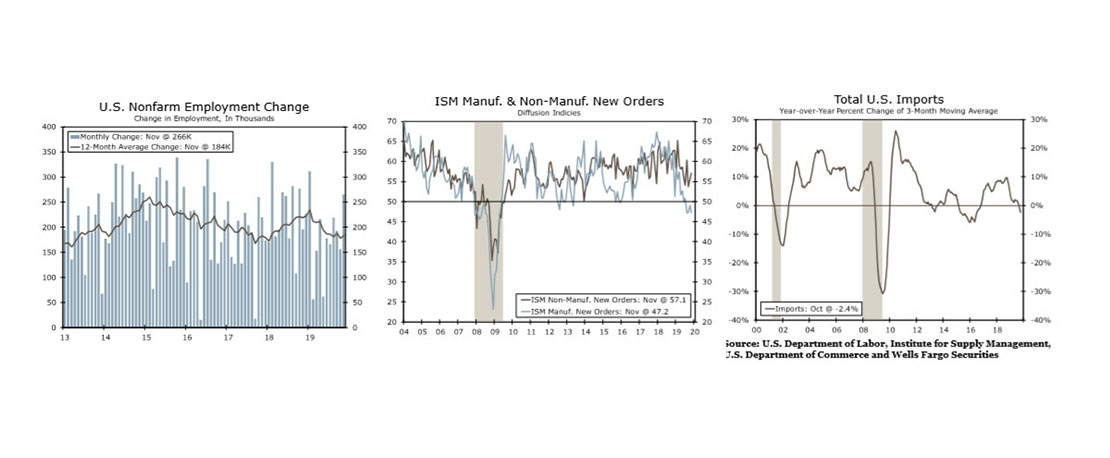

This Week's State Of The Economy - What Is Ahead? - 20 December 2019

Wells Fargo Economics & Financial Report / Dec 21, 2019

President Trump became the third president in U.S. history to be impeached by the House, but removal by the Senate is highly unlikely. The House also passed the USMCA, which should be signed into law in early 2020.

This Week's State Of The Economy - What Is Ahead? - 07 October 2020

Wells Fargo Economics & Financial Report / Oct 10, 2020

In the immediate fallout after the lockdowns in the early stages of this pandemic, there was a lot of discussion about the shape of the recovery.

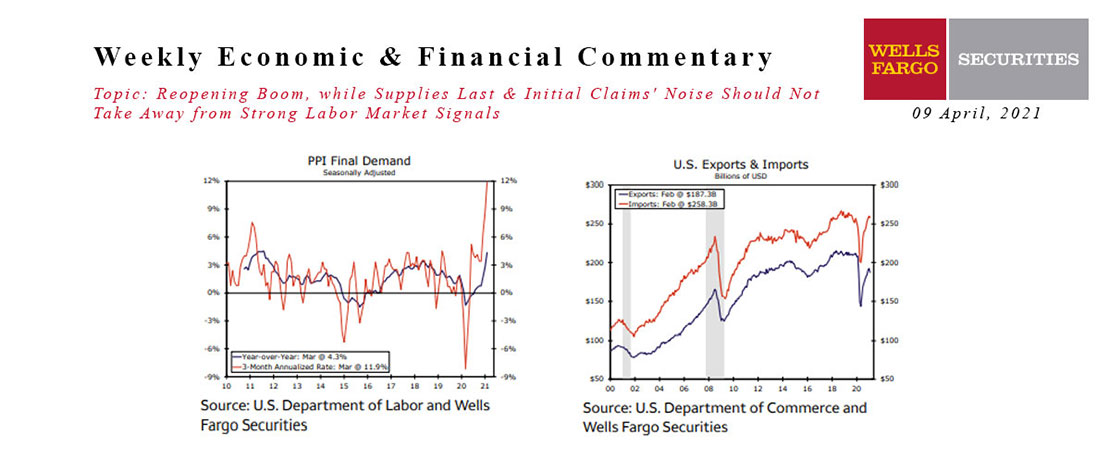

This Week's State Of The Economy - What Is Ahead? - 09 April 2021

Wells Fargo Economics & Financial Report / Apr 10, 2021

This week\'s economic data kicked of with a bang. The ISM Services Index jumped more than eight points to 63.7, signaling the fastest pace of expansion in the index\'s 24-year history.

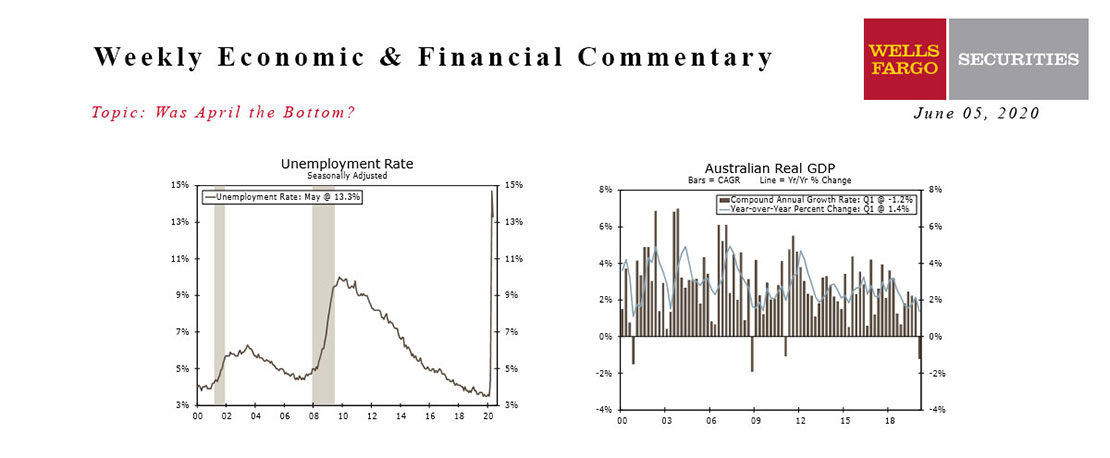

This Week's State Of The Economy - What Is Ahead? - 05 June 2020

Wells Fargo Economics & Financial Report / Jun 09, 2020

Data this week continued to suggest the U.S. economy hit rock bottom in April. Still, it is a long road to recovery and the pickup in economic activity will be gradual.

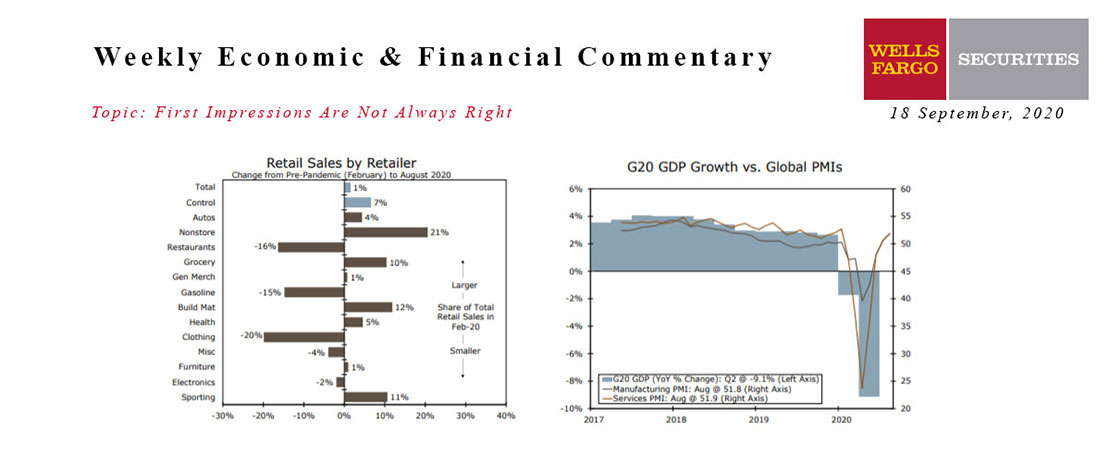

This Week's State Of The Economy - What Is Ahead? - 18 September 2020

Wells Fargo Economics & Financial Report / Sep 15, 2020

The details were generally more favorable. The retail sectors hurt most by the pandemic saw gains in August, factory output is growing and soaring homebuilder confidence suggests soft construction data this week may be transitory.

This Week's State Of The Economy - What Is Ahead? - 24 February 2023

Wells Fargo Economics & Financial Report / Feb 28, 2023

Existing home sales declined 0.7% in January, while new home sales leaped 7.2%. Real personal spending shot higher in January, and solid growth in discretionary spending suggests continued consumer resilience.

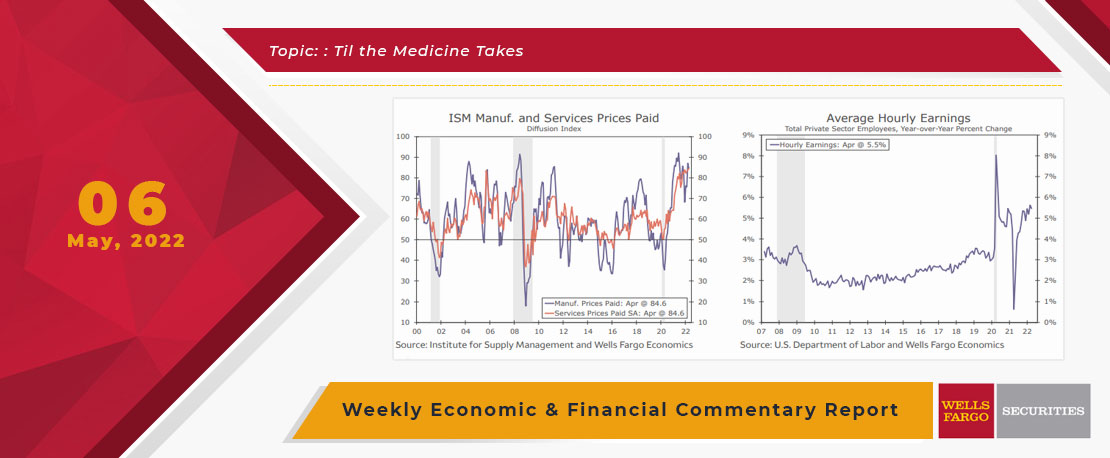

This Week's State Of The Economy - What Is Ahead? - 06 May 2022

Wells Fargo Economics & Financial Report / May 18, 2022

Unlike Yordan Alvarez, no one is expecting the Fed to stand back and admire their handiwork after this weeks 50 basis point increase in the Fed Discount Rate. Similar to Yordan, their effort is more of a single and not a home run.

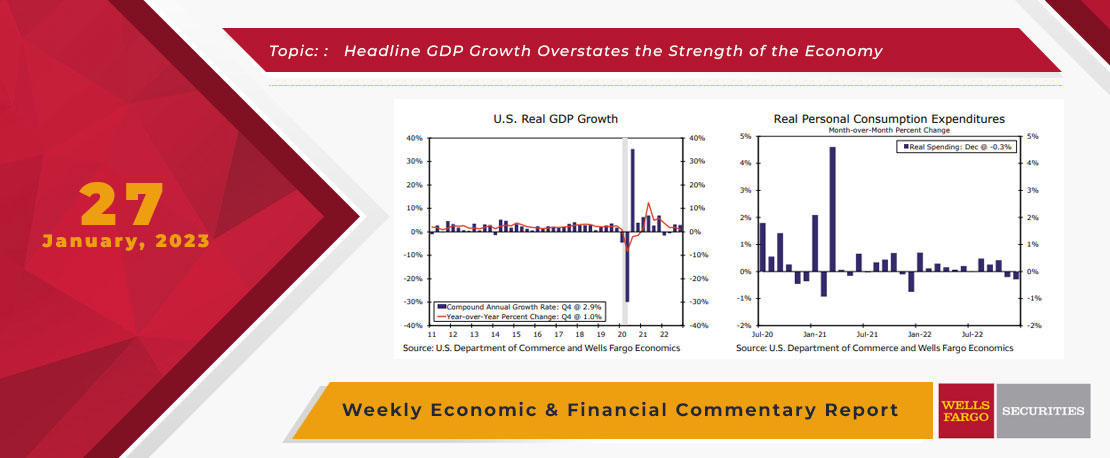

This Week's State Of The Economy - What Is Ahead? - 27 January 2023

Wells Fargo Economics & Financial Report / Jan 28, 2023

Real GDP expanded at a 2.9% annualized pace in Q4. While beating expectations, the underlying details were not as encouraging. Moreover, the weakening monthly indicator performances to end the year suggest the decelerating trend will continue in Q1.

This Week's State Of The Economy - What Is Ahead? - 02 July 2020

Wells Fargo Economics & Financial Report / Jul 04, 2020

It was a mildly busy week for foreign economic data and events, while global COVID-19 cases continued to rise.

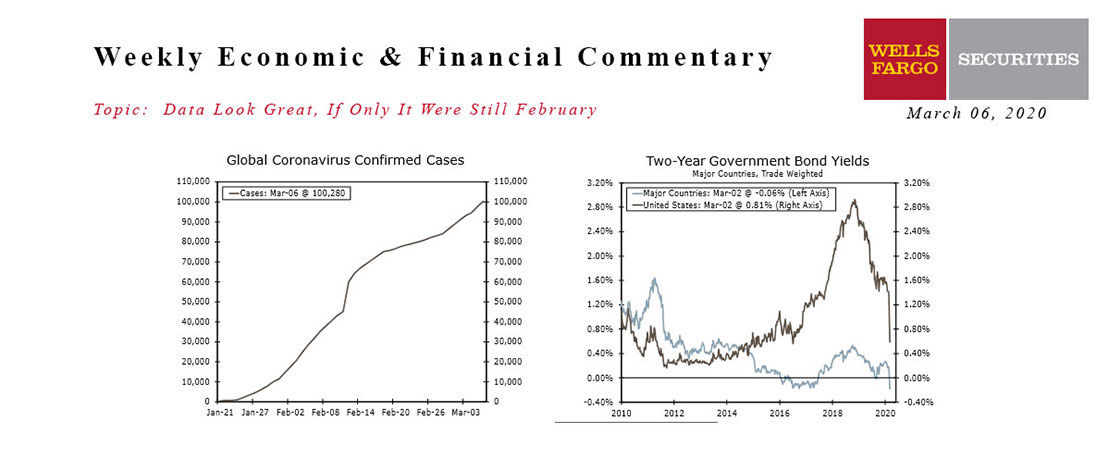

This Week's State Of The Economy - What Is Ahead? - 06 March 2020

Wells Fargo Economics & Financial Report / Mar 07, 2020

An inter-meeting rate cut by the FOMC did little to stem financial market volatility, as the number of confirmed COVID-19 cases continued to climb.