U.S. - Hiring Report Telling You Be of Good Cheer

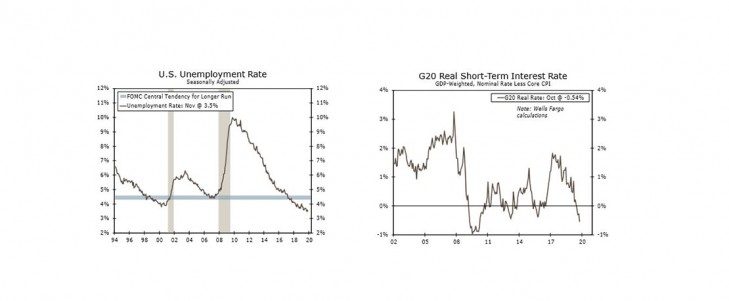

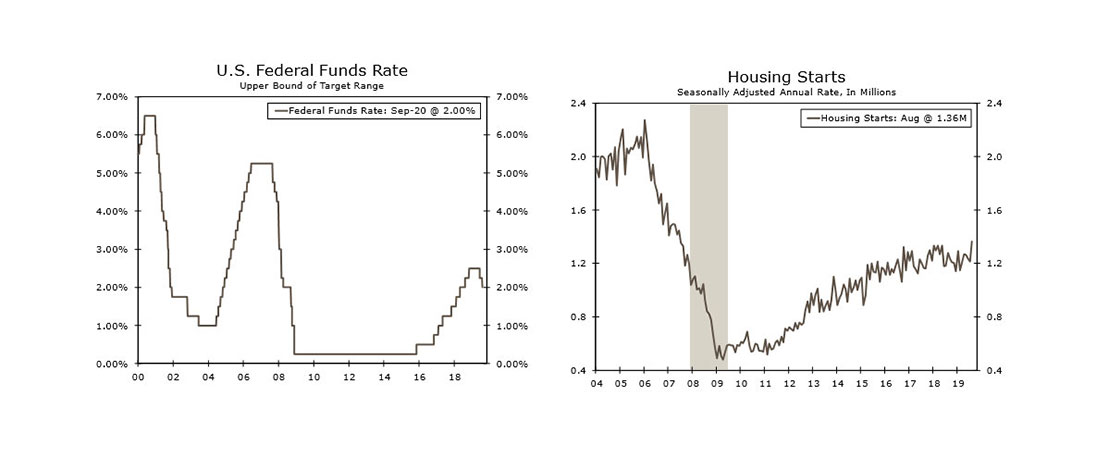

- The latest hiring data are an encouraging sign that the U.S. economy is withstanding the global slowdown and continued trade-related uncertainty. Solid labor market conditions echo the Fed’s assessment that the current stance of monetary policy remains appropriate. The FOMC will be on hold next week.

- Despite encouraging signals from the labor market, the trade war remains a headwind. Murmurs of a possible “Phase I” trade deal flooded news headlines this week, but continue to be void of details. Trade uncertainty continues to weigh on manufacturing and has permeated into the service sector, though not nearly to the same extent.

Global Review - Are We There Yet?

- While the global bias remains towards easier monetary policy, there are some hints we may be getting closer to the end of this global easing cycle. Among the several announcements this past week, central banks in Australia, Canada, India and Chile all held rates steady, while Canada and Chile also hinted at rates remaining on hold for the foreseeable future.

- The news from the Eurozone was mixed this week. The Q3 GDP details showed a reasonably solid domestic economy as underlying final domestic demand rose 0.4% quarter-overquarter, but Eurozone retail sales and German industrial output both registered large declines in October.

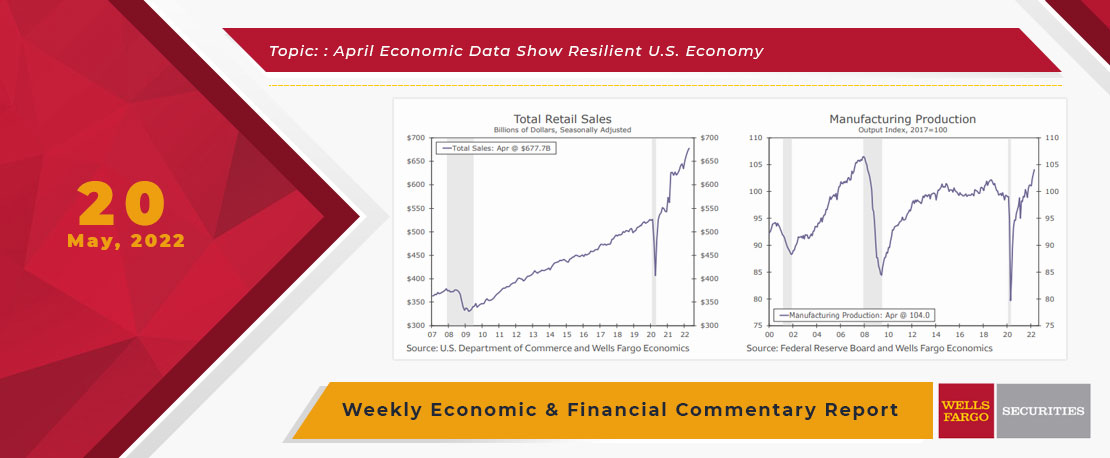

This Week's State Of The Economy - What Is Ahead? - 20 May 2022

Wells Fargo Economics & Financial Report / May 29, 2022

U.S. retail sales topped expectations in April, while industrial production also grew more rapidly than economists expected. Data on housing starts, home sales and homebuilder sentiment, however, showed tentative signs of cooling.

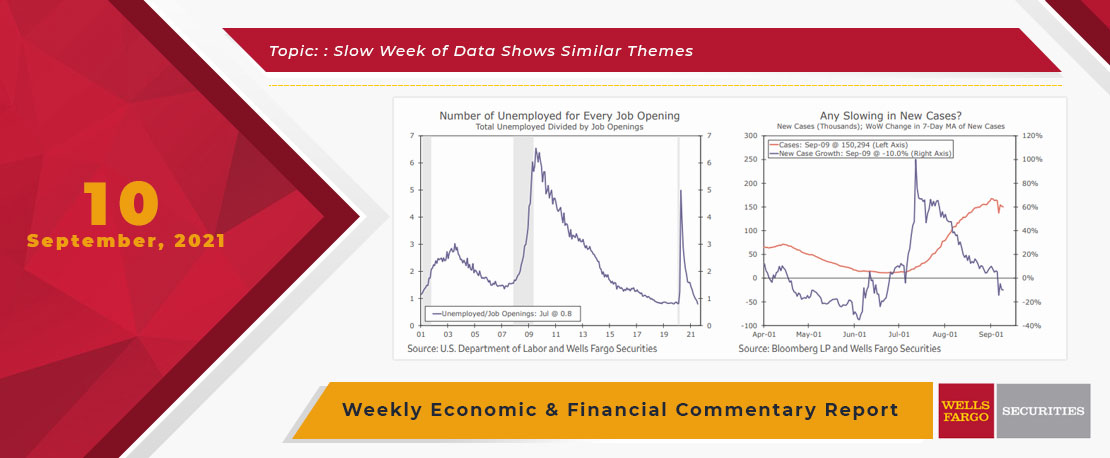

This Week's State Of The Economy - What Is Ahead? - 10 September 2021

Wells Fargo Economics & Financial Report / Sep 13, 2021

Data from the opening weekend of College Football indicates that we will have to endure another season of Nick Saban deification.

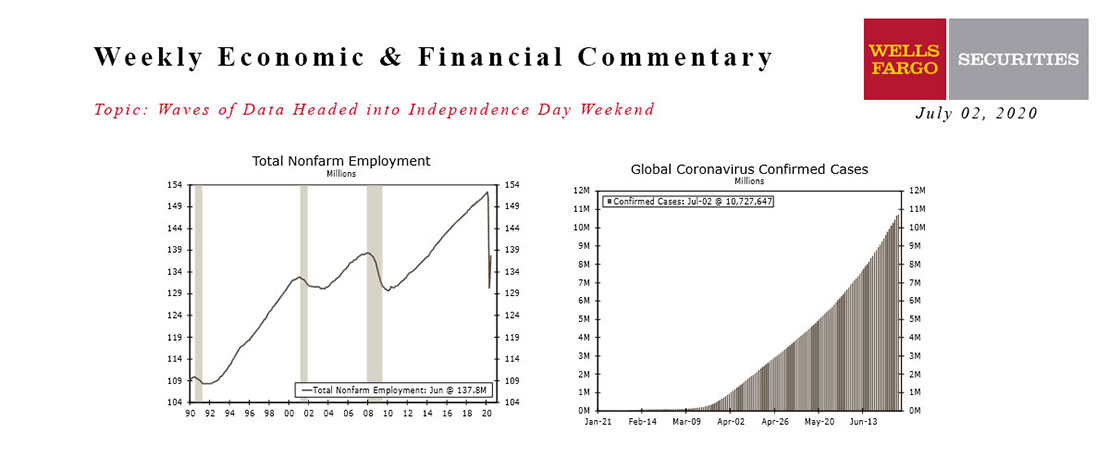

This Week's State Of The Economy - What Is Ahead? - 02 July 2020

Wells Fargo Economics & Financial Report / Jul 04, 2020

It was a mildly busy week for foreign economic data and events, while global COVID-19 cases continued to rise.

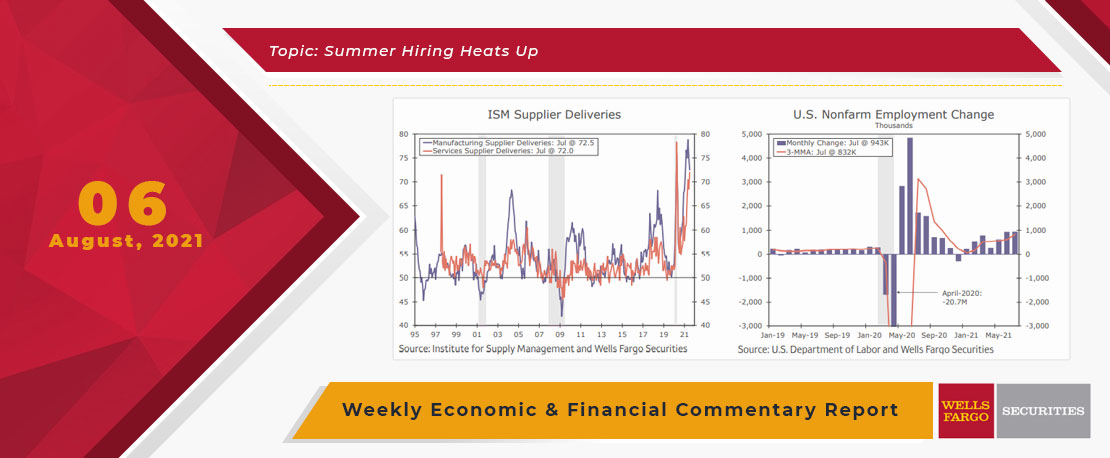

This Week's State Of The Economy - What Is Ahead? - 06 August 2021

Wells Fargo Economics & Financial Report / Aug 16, 2021

Back to the economy, issues with supply constraints remains a broken-record reference, but data this week highlighted the economy\'s resilience in spite of those continuing problems.

This Week's State Of The Economy - What Is Ahead? - 20 September 2019

Wells Fargo Economics & Financial Report / Sep 21, 2019

The Federal Reserve reduced the fed funds rate 25 bps this week, continuing to cite economic weakness overseas and muted inflation pressures.

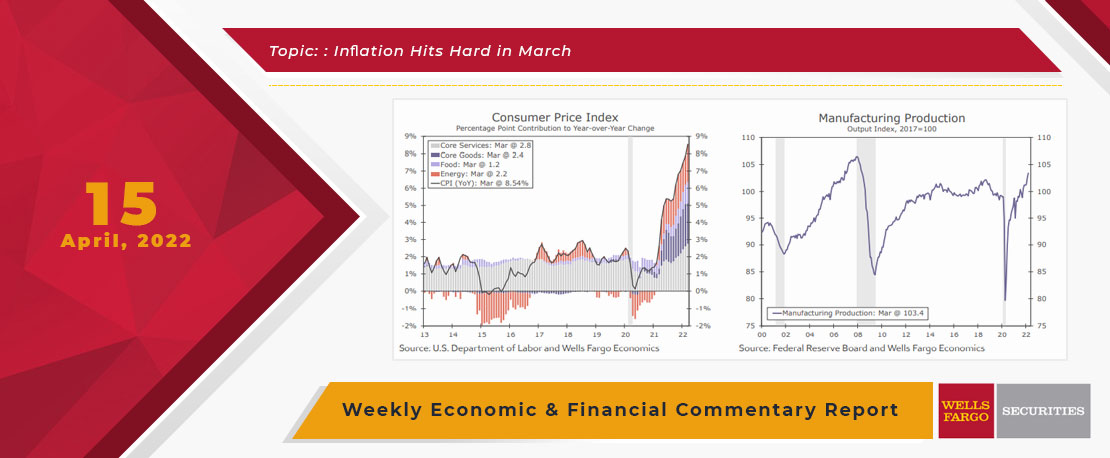

This Week's State Of The Economy - What Is Ahead? - 15 April 2022

Wells Fargo Economics & Financial Report / Apr 18, 2022

What do pollen and the Consumer Price Index (CPI) have in common? Answer; both are hitting new highs. This week’s U.S. economic data was led by the largest month monthly increase in the Consumer Price Index (CPI) since September 2005.

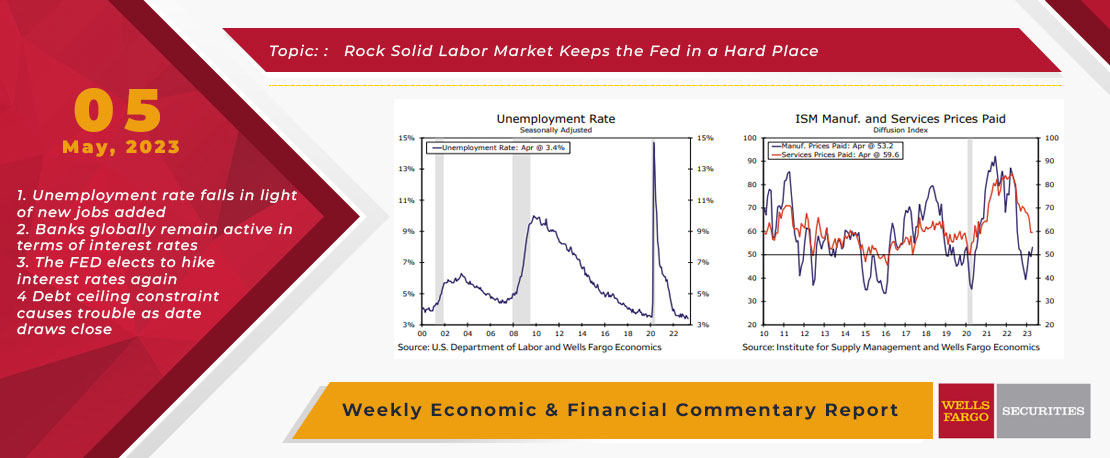

This Week's State Of The Economy - What Is Ahead? - 05 May 2023

Wells Fargo Economics & Financial Report / May 11, 2023

In April, employers added 253K jobs and the unemployment rate fell to 3.4%. During the same month, the ISM services index edged up to 51.9, while the ISM manufacturing index improved to 47.1.

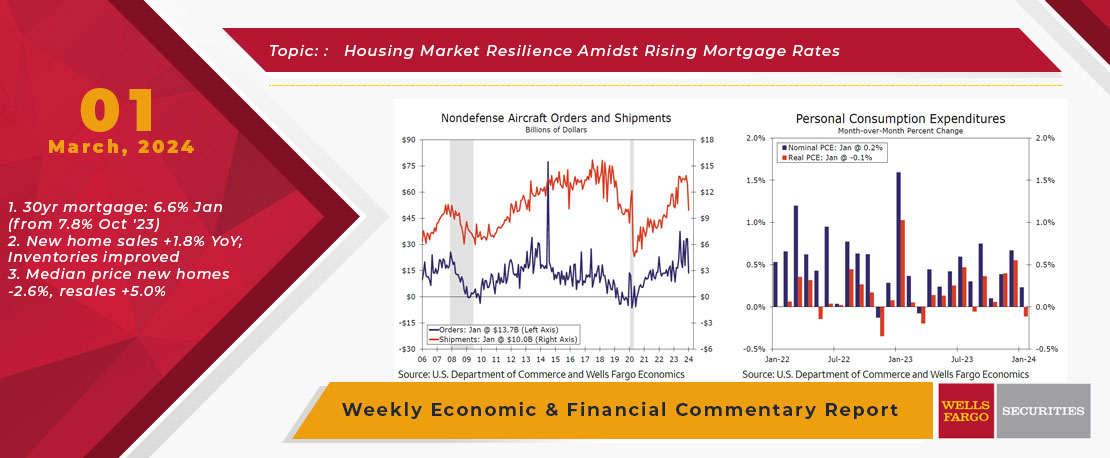

This Week's State Of The Economy - What Is Ahead? - 01 March 2024

Wells Fargo Economics & Financial Report / Mar 05, 2024

Economic data were downbeat this week, as downward revisions took some of the shine out of the marquee headline numbers. Despite the somewhat weak start to Q1, economic growth continues to trek along.

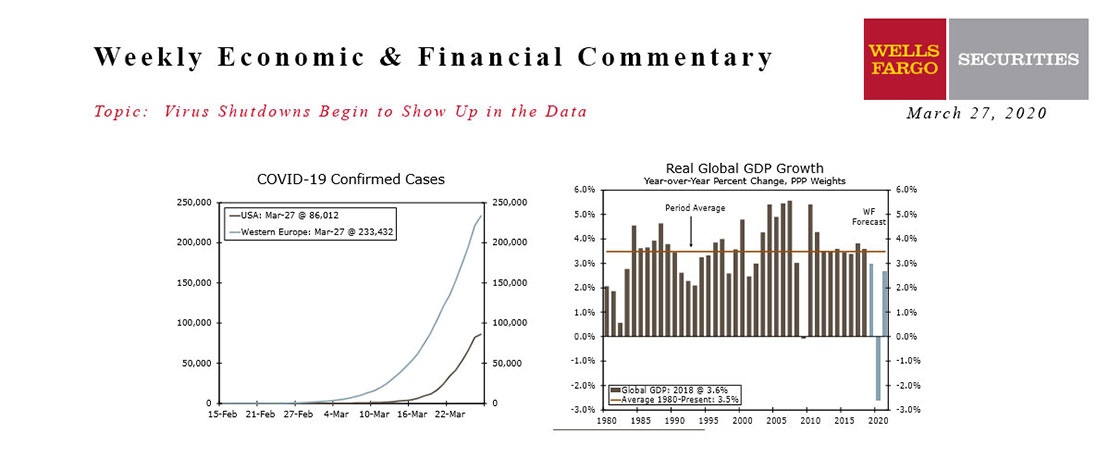

This Week's State Of The Economy - What Is Ahead? - 27 March 2020

Wells Fargo Economics & Financial Report / Mar 28, 2020

The U.S. surpassed Italy and China with the most confirmed cases of COVID-19. Europe is still the center of the storm, with the total cases in Europe’s five largest economies topping 230,000.

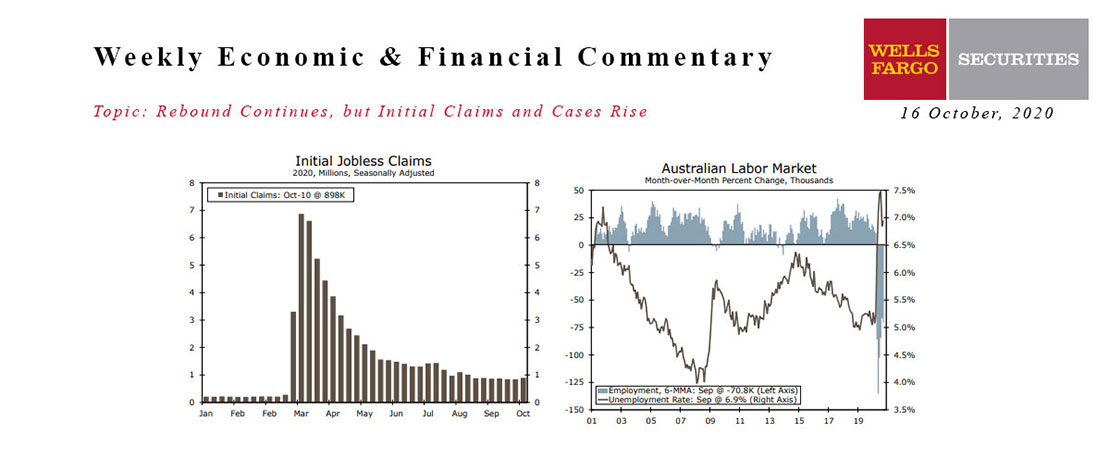

This Week's State Of The Economy - What Is Ahead? - 16 October 2020

Wells Fargo Economics & Financial Report / Oct 20, 2020

Data continue to reflect an economy digging itself out of the lockdown-induced slump.