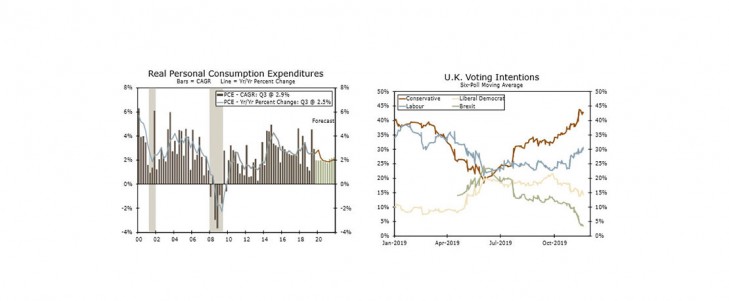

U.S. - Fundamentals Continue to Support Festive Holiday Spending

- Despite easing for the fourth consecutive month, confidence still remains near its cycle high in November as consumers continue to focus on their own economic prospects, while discounting political drama out of Washington D.C. and concerns from abroad.

- The health of the labor market, low gasoline prices and a stock market near record highs continue to underpin our expectations for solid consumer spending growth in the fourth quarter, albeit at a substantially slower pace than the robust rates seen in the prior two quarters.

Global Review - Boris Johnson Commands Lead in U.K. Polls

- A series of U.K. general election polls released this week continue to show Boris Johnson’s Conservative Party with a significant lead over the opposition Labor Party. The current margin of support points to a parliamentary majority for the Conservatives, although much can still change over the next two weeks leading into the election.

- It was a quiet start to the week for international data releases. Sentiment figures from Germany rebounded very slightly but still point to especially sluggish economic growth, while revisions to Mexican GDP figures showed the economy contracted for three straight quarters starting in Q4-2018.

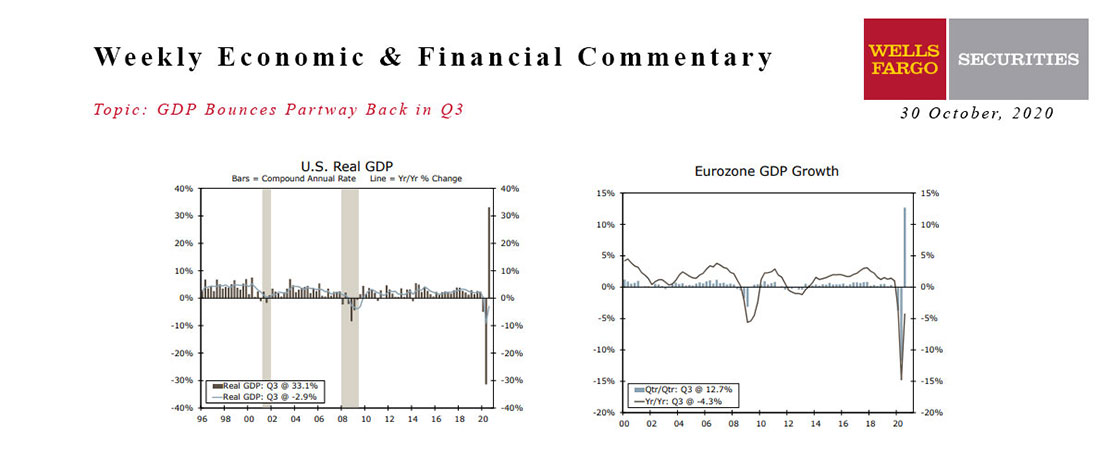

This Week's State Of The Economy - What Is Ahead? - 30 October 2020

Wells Fargo Economics & Financial Report / Oct 27, 2020

Real GDP jumped a record 33.1% during Q3, beating expectations. A 40.7% surge in consumer spending drove the gain.

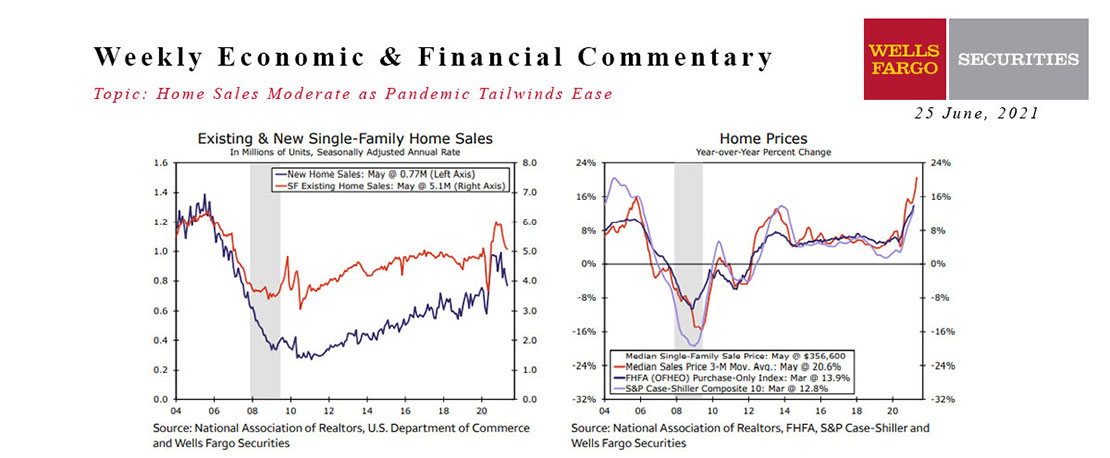

This Week's State Of The Economy - What Is Ahead? - 25 June 2021

Wells Fargo Economics & Financial Report / Jun 26, 2021

Supply chain bottlenecks continue to cause pain-in-the-necks. In spite of all the difficulties, the Economic whizzes in the WF Economics team have upgraded their forecast for full-year 2021 U.S.

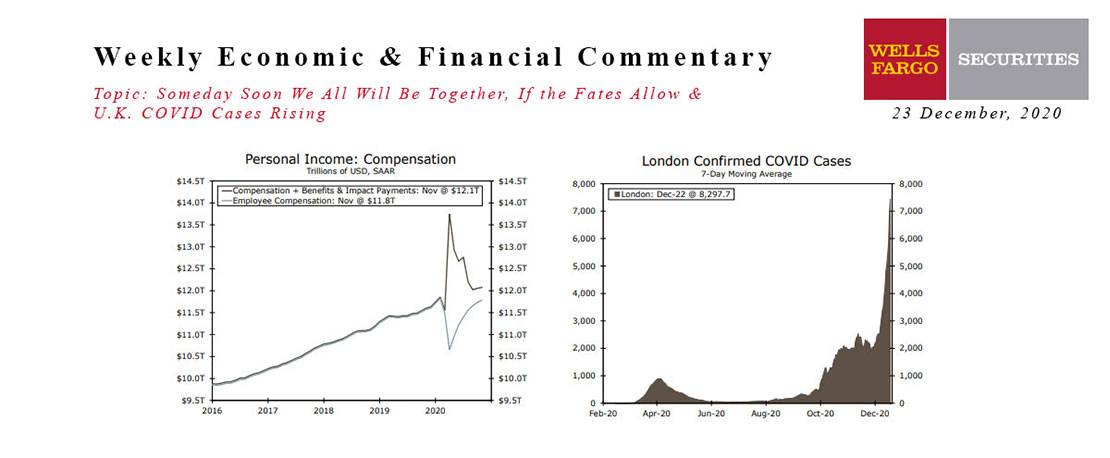

This Week's State Of The Economy - What Is Ahead? - 23 December 2020

Wells Fargo Economics & Financial Report / Dec 26, 2020

Vaccines are here, but they are not yet widely available in a way that can stem the spread of a disease that grows by 200K a day.

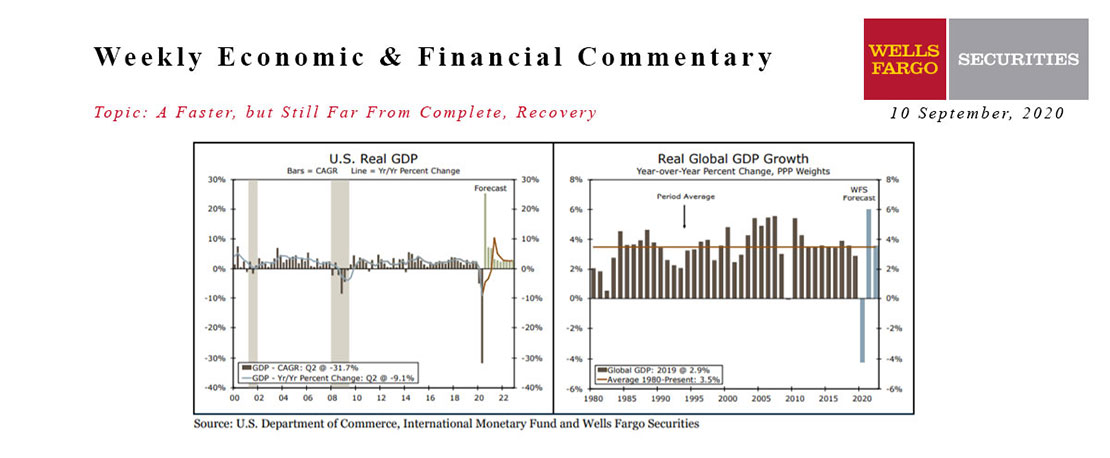

This Week's State Of The Economy - What Is Ahead? - 10 September 2020

Wells Fargo Economics & Financial Report / Sep 12, 2020

Although the recovery from the COVID recession is still far from over, the U.S. economy is bouncing back faster than many expected.

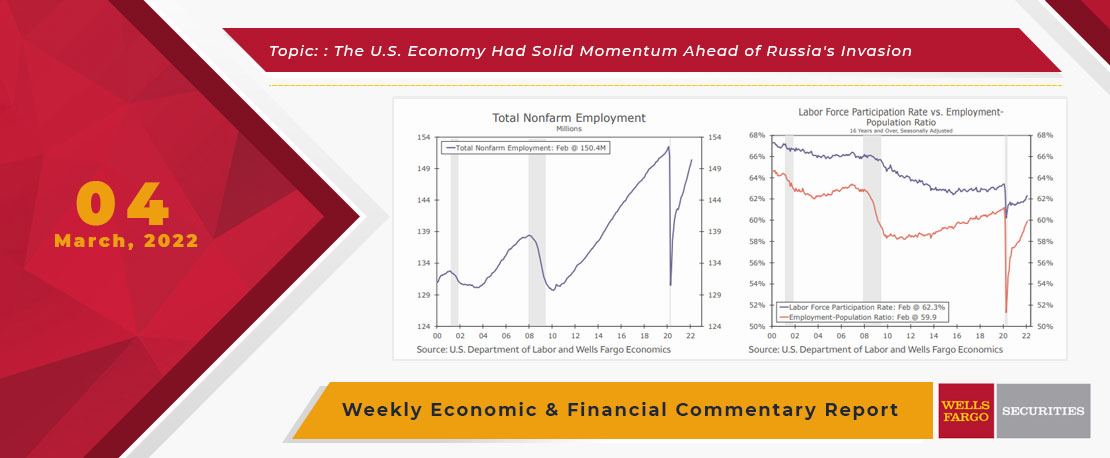

This Week's State Of The Economy - What Is Ahead? - 04 March 2022

Wells Fargo Economics & Financial Report / Mar 08, 2022

February\'s employment data showed the economy had strong momentum, but that seems pretty dated now with Russia\'s invasion of Ukraine and the Fed\'s shift to a more hawkish tone on monetary policy.

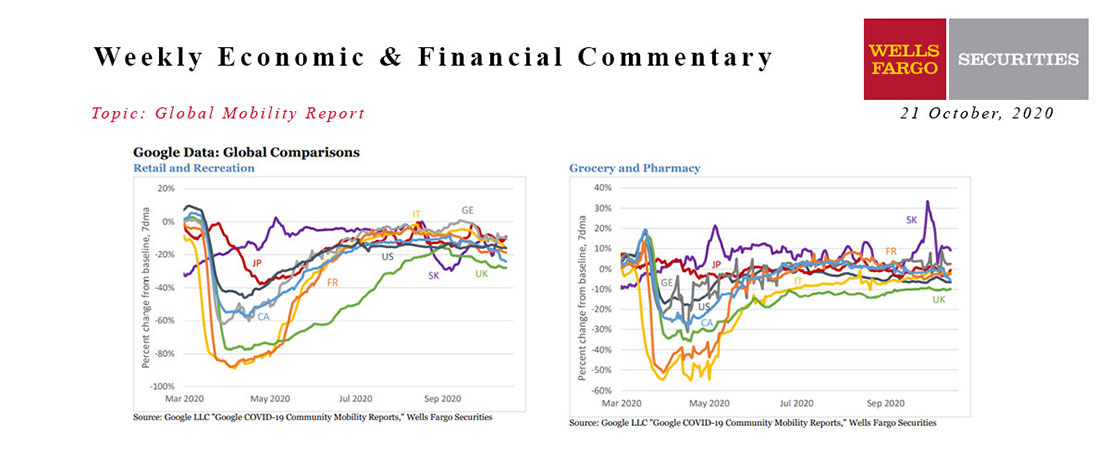

This Week's State Of The Economy - What Is Ahead? - 21 October 2020

Wells Fargo Economics & Financial Report / Oct 21, 2020

Mobility is continuing to trickle lower in several major developed market economies. The U.K., France, Italy and Canada have all seen some further modest declines in retail/recreation visits.

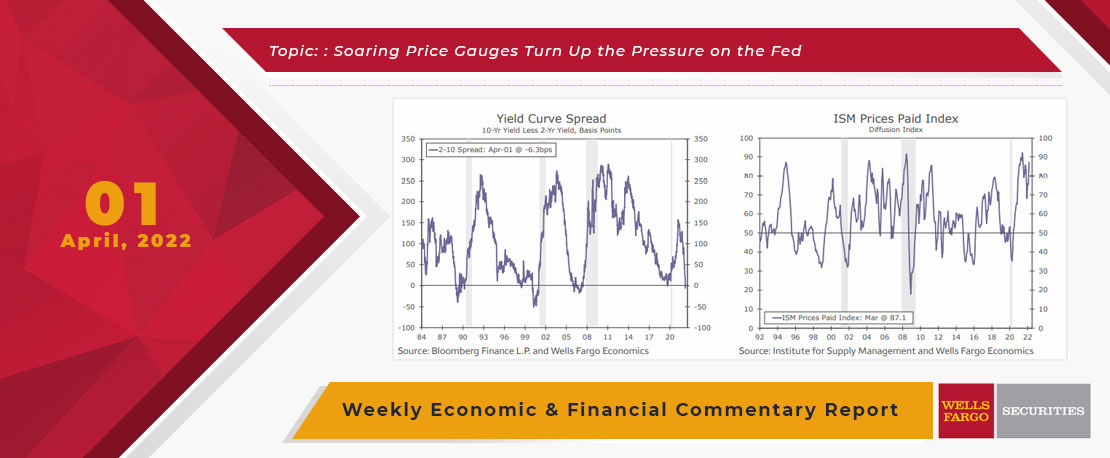

This Week's State Of The Economy - What Is Ahead? - 01 April 2022

Wells Fargo Economics & Financial Report / Apr 05, 2022

The key factor that will drive interest rates is the Fed’s belated effort to rein-in inflation.

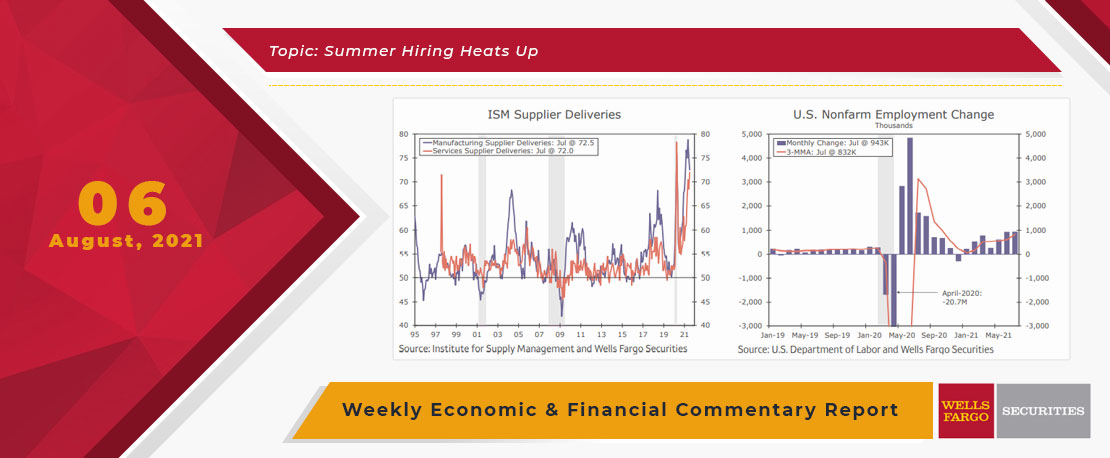

This Week's State Of The Economy - What Is Ahead? - 06 August 2021

Wells Fargo Economics & Financial Report / Aug 16, 2021

Back to the economy, issues with supply constraints remains a broken-record reference, but data this week highlighted the economy\'s resilience in spite of those continuing problems.

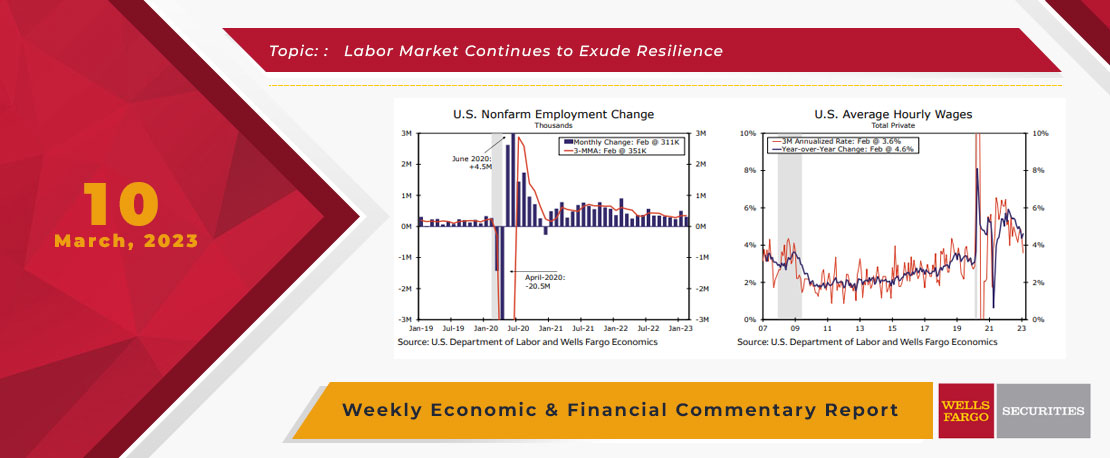

This Week's State Of The Economy - What Is Ahead? - 10 March 2023

Wells Fargo Economics & Financial Report / Mar 14, 2023

Financial markets were looking for validation that January\'s unexpected strength was not a fluke and that the downward slide in economic momentum experienced late last year had stabilized.

This Week's State Of The Economy - What Is Ahead? - 29 September 2023

Wells Fargo Economics & Financial Report / Oct 02, 2023

On the housing front, new home sales dropped more than expected in August, though an upward revision to July results left us about where everyone expected us to be year-to-date.