The U.S. data this week signaled that the economic expansion remains intact even as inflation continues to slow. The personal income and spending data for October showed that real household consumption growth remained solid, albeit not quite as strong as it was in the third quarter. Inflation-adjusted consumption growth in October was fueled by higher spending on services (+0.2%) and nondurable goods (+0.3%), while spending on durable goods declined by 0.3%. Real GDP growth in Q3 was revised up from 4.9% in the first release to an even-stronger 5.2% in the second release. A slowdown in Q4 from such a blistering pace is all but assured, but the initial consumer spending data for the quarter suggest that it will be a moderation rather than a nosedive.

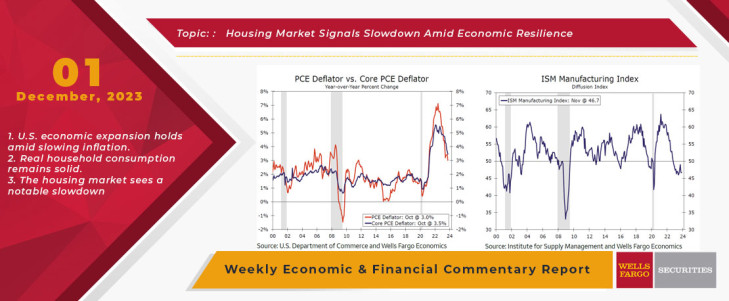

The October reading of the PCE deflator confirmed what the October CPI data showed a few weeks ago: Inflation continued its descent in the month. The headline PCE deflator was unchanged in October and up 3.0% from one year ago. Excluding food and energy, prices increased 0.2% in October and 3.5% year-over-year. These year-ago rates of headline and core PCE inflation were the lowest since March 2021 and April 2021, respectively. The FOMC is not yet ready to declare mission accomplished in its inflation fight. Despite the slowdown, price growth is still above the central bank's 2% target, and policymakers want to feel confident that this inflation pace is sustained over time. That said, the deceleration in prices bodes well for the widening path to a soft landing for the U.S. economy.

It is important to remember that slowing inflation still means that prices are rising, just at a slower rate. Data released this week showed that this dynamic is also playing out in the housing market. The S&P CoreLogic Case-Shiller Home Price Index rose 0.7% in September and is up 3.9% compared to one year ago. This is fairly close to the pace that prevailed in 2018-2019 and marks a notable slowdown from September 2021 and 2022, when home prices were up 19.1% and 10.5% year-over-year, respectively. Elevated mortgage rates have clearly helped induce the slowdown, but limited inventory for sale and a still-solid labor market have kept prices from outright declining in most parts of the country. Still-solid demand and limited inventory have kept new home sales buoyed despite the surge in mortgage rates. New home sales fell 5.6% in October but are still running at roughly the same pace that prevailed in 2019 when mortgage rates were much lower.

High interest rates also continue to weigh on the manufacturing sector. The ISM manufacturing index for November came in at 46.7, matching October's number. A reading below 50 is consistent with a manufacturing sector that is generally contracting. Among the subcomponents of the index, the employment and current production measures weakened relative to October, while new orders perked up somewhat. Overall, the ISM manufacturing index is near the weakest levels seen over the past 25 years outside the 2001 and 2008-2009 recessions. The prospects for a soft landing for the U.S. economy are better today than they were a year ago, but they are far from assured.

This Week's State Of The Economy - What Is Ahead? - 29 May 2020

Wells Fargo Economics & Financial Report / May 30, 2020

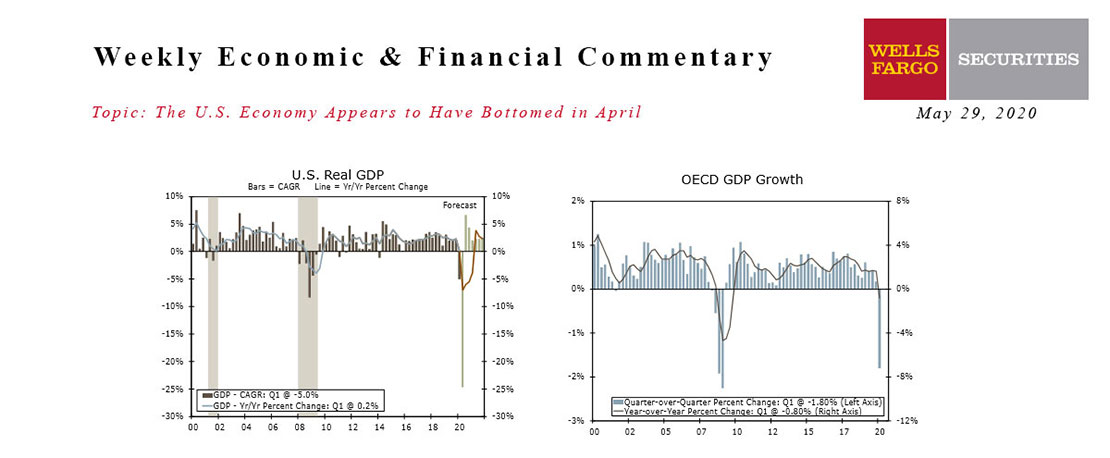

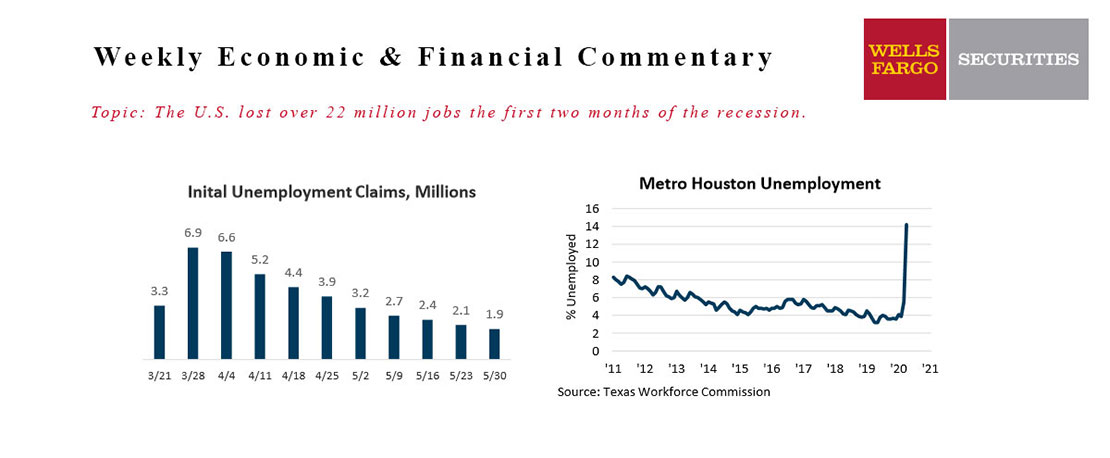

The beginning of this week saw some optimism that the economic downturn could be relatively short-lived, but data through the rest of the week provided grim reminder of the economic damage from COVID-19.

This Week's State Of The Economy - What Is Ahead? - 19 July 2024

Wells Fargo Economics & Financial Report / Jul 22, 2024

Retail sales, housing starts and industrial production all surprised to the upside this week.

June 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Jun 18, 2020

The Fed expects to hold interest rates near zero through the end of this year, perhaps well into next year, and maybe even into ’22.

This Week's State Of The Economy - What Is Ahead? - 23 October 2020

Wells Fargo Economics & Financial Report / Oct 24, 2020

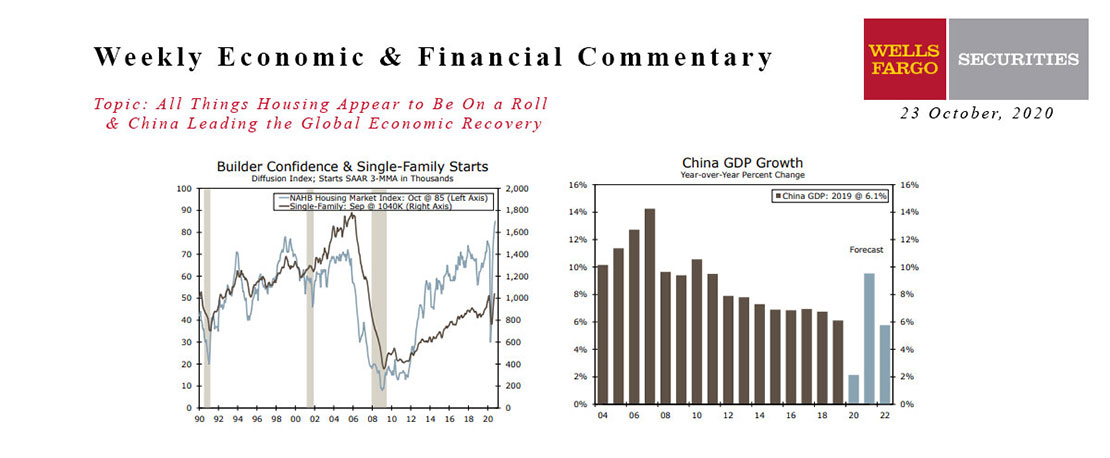

A recent strong report from the National Association of Homebuilders set the tone for another round of strong housing data. The NAHB index rose two points to a record high 85.

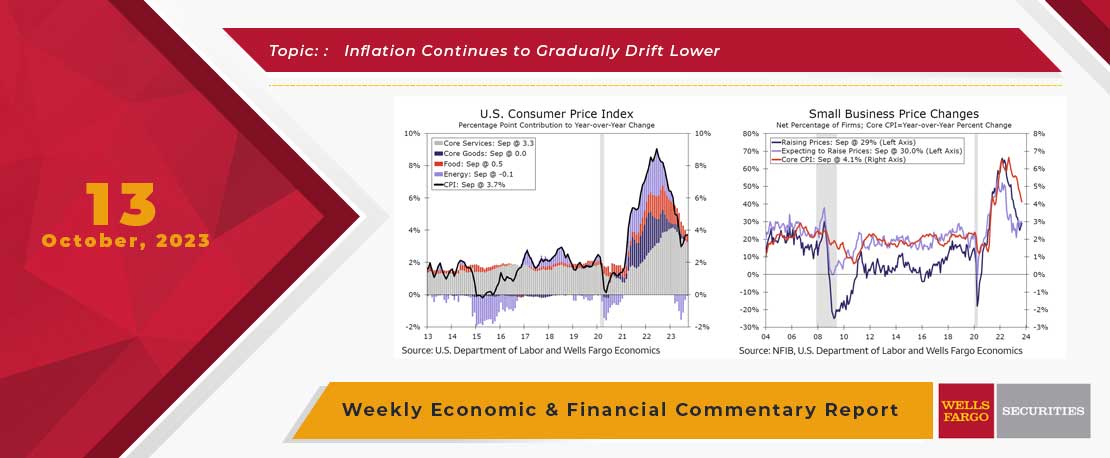

This Week's State Of The Economy - What Is Ahead? - 13 October 2023

Wells Fargo Economics & Financial Report / Oct 13, 2023

The Consumer Price Index (CPI) rose 0.4% in September, a monthly change that was a bit softer than the 0.6% increase registered in August. The core CPI rose 0.3% during the month, a pace unchanged from the month prior.

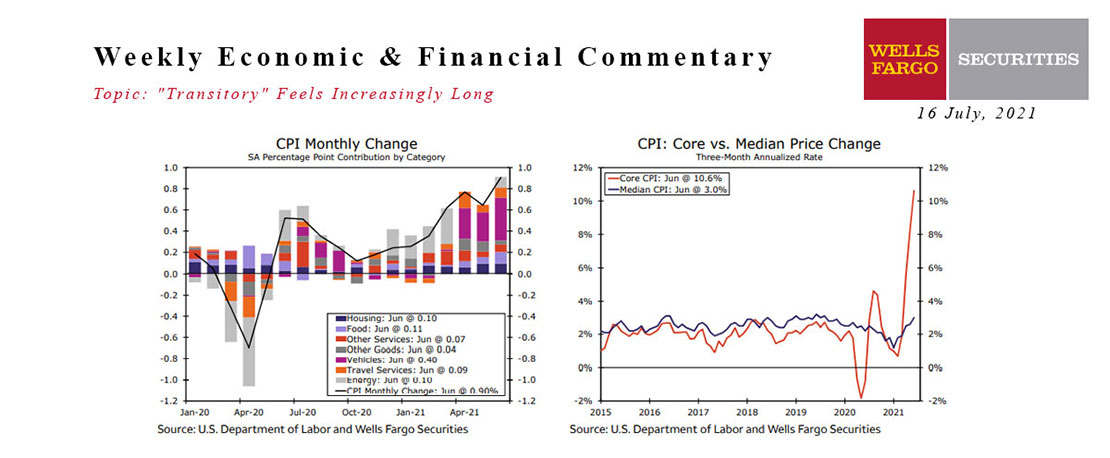

This Week's State Of The Economy - What Is Ahead? - 16 July 2021

Wells Fargo Economics & Financial Report / Jul 30, 2021

Visiting from Texas, it felt more like fall, which like the Texas cold-snap last February just goes to show that it’s a case of what you’re used to.

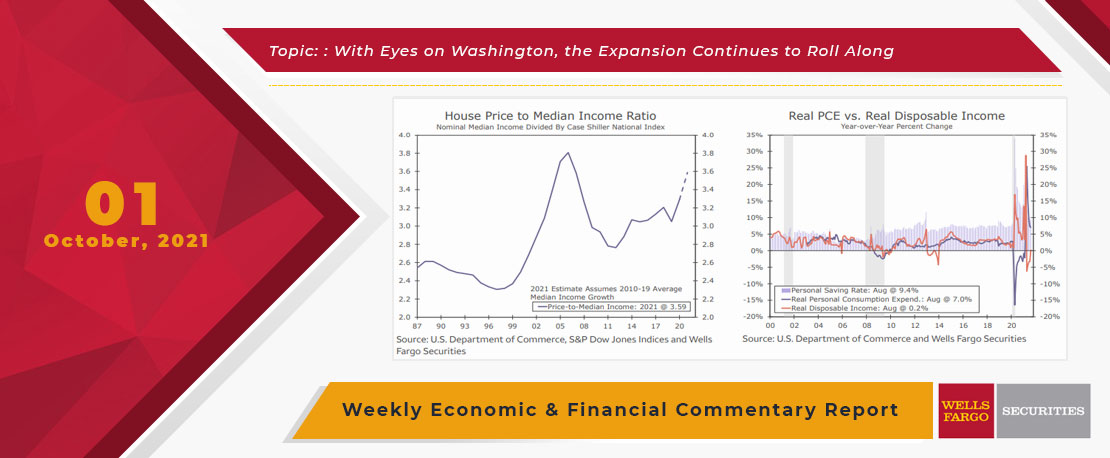

This Week's State Of The Economy - What Is Ahead? - 01 October 2021

Wells Fargo Economics & Financial Report / Oct 10, 2021

Economic data this week indicated that the ongoing expansion still has some momentum despite some familiar headwinds, though this week\'s releases were largely overshadowed by a busy week on Capitol Hill.

This Week's State Of The Economy - What Is Ahead? - 10 November 2022

Wells Fargo Economics & Financial Report / Nov 11, 2022

Relief in October inflation gives the FOMC the ability to slow the pace of rate hikes ahead. But make no mistake, the Fed\'s job of taming inflation remains far from over.

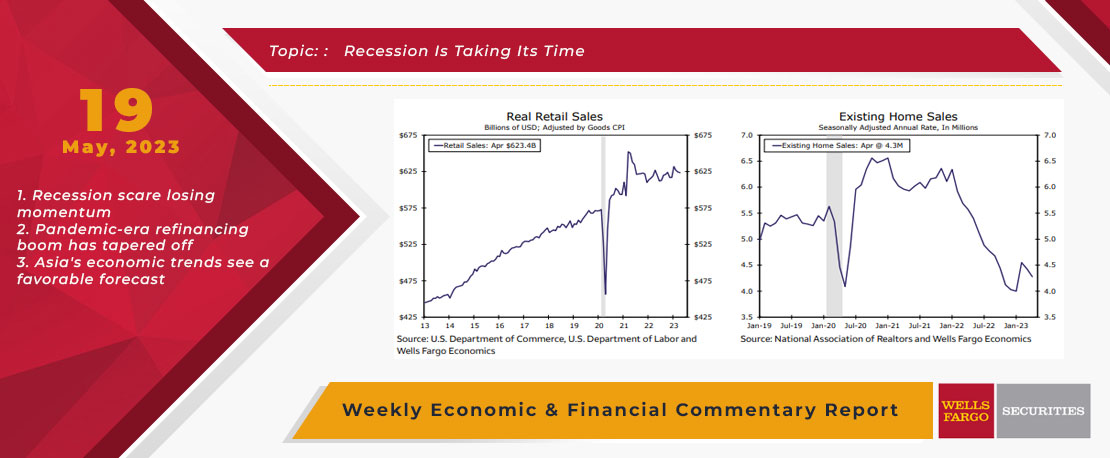

This Week's State Of The Economy - What Is Ahead? - 19 May 2023

Wells Fargo Economics & Financial Report / May 23, 2023

Economic data continue to suggest the U.S. economy is only gradually losing momentum. Consumers continue to spend, and industrial and housing activity are seeing some stabilization.

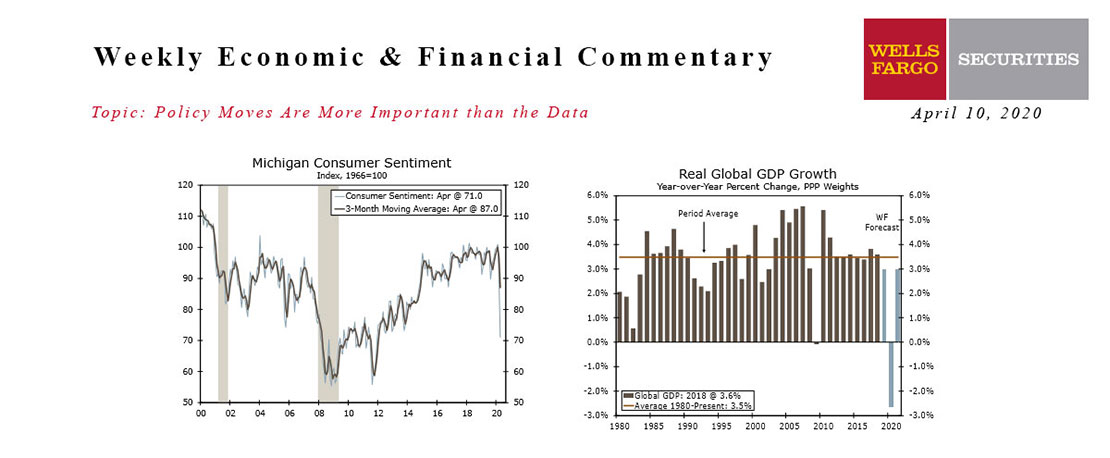

This Week's State Of The Economy - What Is Ahead? - 10 April 2020

Wells Fargo Economics & Financial Report / Apr 11, 2020

The Federal Reserve greatly expanded the collateral that it is willing to buy, further easing pressures in financial markets.