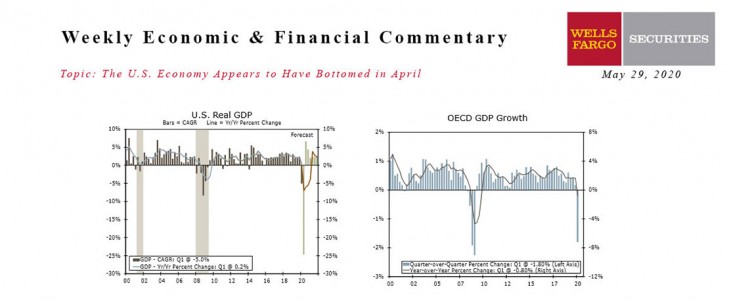

U.S. - The U.S. Economy Appears to Have Bottomed in April

- The beginning of this week saw some optimism that the economic downturn could be relatively short-lived, but data through the rest of the week provided grim reminder of the economic damage from COVID-19.

- Jobless claims declined for the eighth straight week, but continuing claims posted their first decline during the pandemic period, a positive signal for the labor market.

- The second estimate of Q1 U.S. output revealed a slightly worse decline in real GDP. Q2 will be much worse.

Global - Keep Looking Forward, Don’t Look Back

- Q1 GDP for the OECD economies, which includes most developed economies, fell 1.8% quarter-over-quarter and 0.8% year-over-year. Considering the slowdown seen in emerging economies such as China, India and Brazil, we expect the decline in Q2 GDP for the G20 economies to be even larger.

- Some modestly encouraging signs are starting to emerge. PMI surveys across many countries improved in May, as did German IFO business confidence and Eurozone economic confidence.

- That said, with the outlook still somewhat uncertain, we expect the ECB to ease monetary policy further next week.

This Week's State Of The Economy - What Is Ahead? - 10 January 2020

Wells Fargo Economics & Financial Report / Jan 11, 2020

The week began amid rising tensions carrying over from the U.S. killing of Iranian General Qasem Soleimani last Friday.

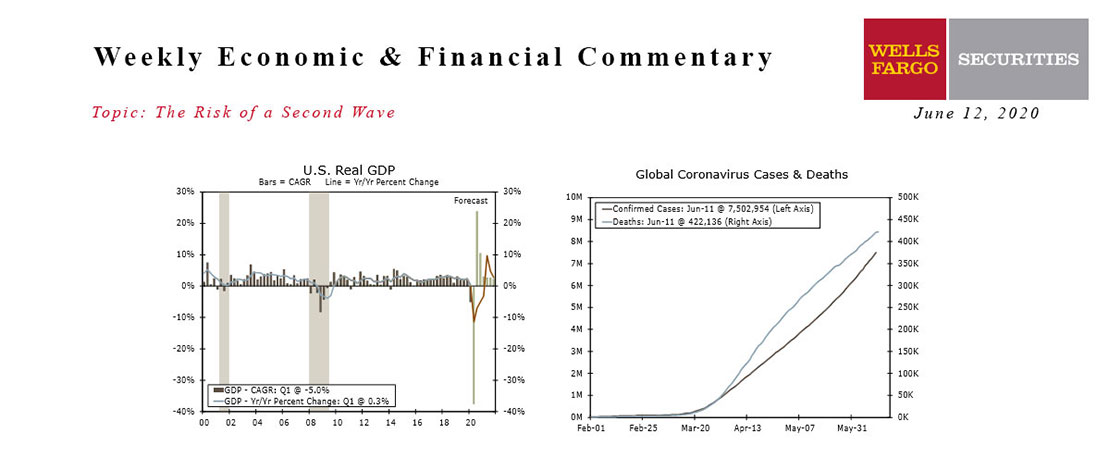

This Week's State Of The Economy - What Is Ahead? - 12 June 2020

Wells Fargo Economics & Financial Report / Jun 13, 2020

Lock downs began to be lifted across most of the country by the end of May and the total amount of daily new coronavirus cases has been trending lower. But the flattening case count has not been consistent across the country.

2021 Annual Economic Outlook

Wells Fargo Economics & Financial Report / Dec 16, 2020

The longest U.S. economic expansion since the end of the Second World War came to an abrupt end earlier this year as the COVID pandemic essentially shut down the economy.

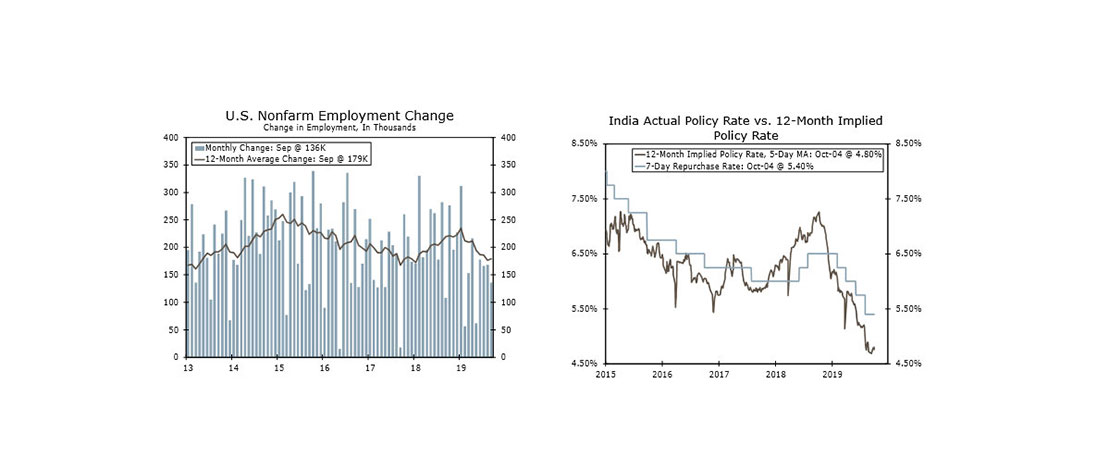

This Week's State Of The Economy - What Is Ahead? - 4 October 2019

Wells Fargo Economics & Financial Report / Oct 05, 2019

Survey evidence flashed signs of contraction in the manufacturing sector and indicated weakness spreading to the services side of the economy, while employers added a less-than-expected 136K jobs in September.

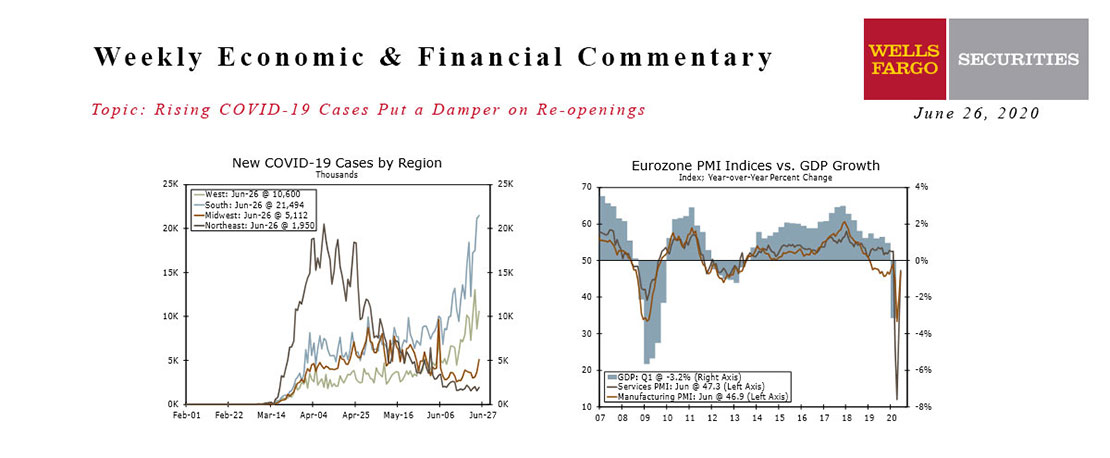

Rising COVID-19 Cases Put A Damper On Re-openings

Wells Fargo Economics & Financial Report / Jun 27, 2020

The rising number of COVID-19 infections gained momentum this week, with most of the rise occurring in the South and West. The rise in infections is larger than can be explained by increased testing alone and is slowing re-openings.

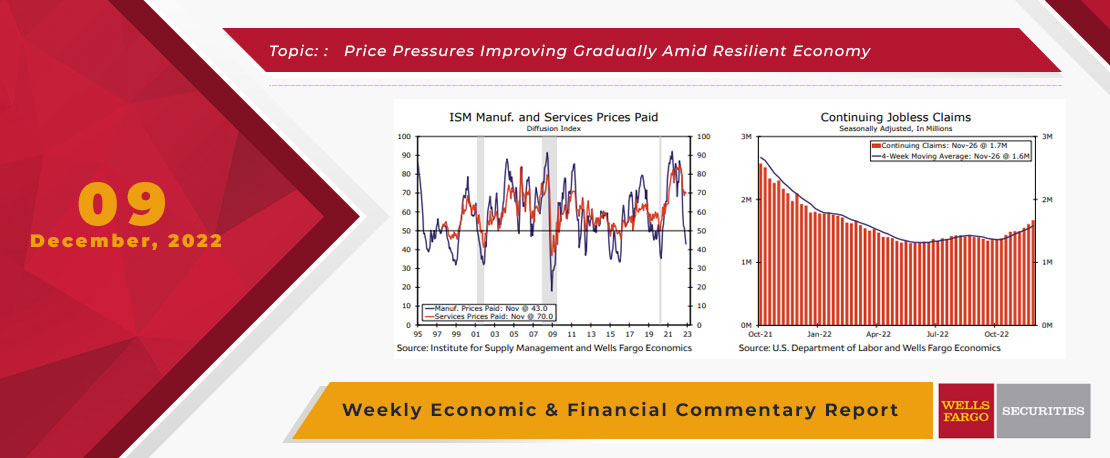

This Week's State Of The Economy - What Is Ahead? - 09 December 2022

Wells Fargo Economics & Financial Report / Dec 15, 2022

Various price metrics released this week showed some continued signs of inflation cooling, but gradually rather than rapidly.

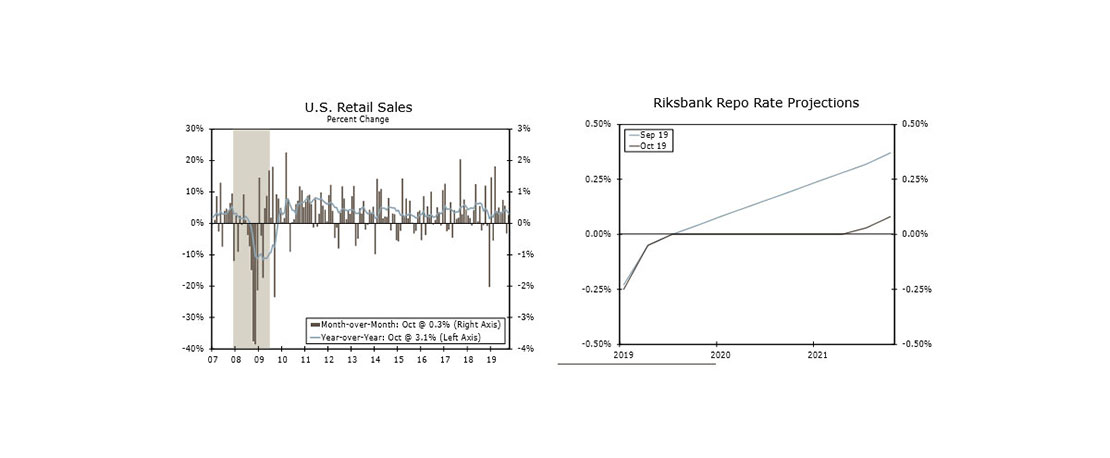

This Week's State Of The Economy - What Is Ahead? - 15 November 2019

Wells Fargo Economics & Financial Report / Nov 16, 2019

Retail sales beat expectations and rose 0.3% in October, reflecting the ongoing strength of the consumer. Control group sales, a major input to GDP, also increased 0.3%.

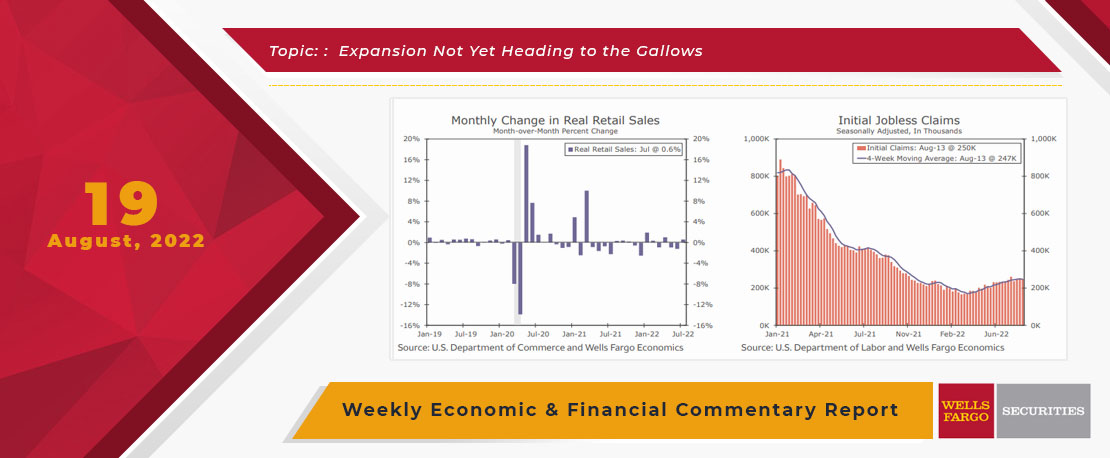

This Week's State Of The Economy - What Is Ahead? - 19August 2022

Wells Fargo Economics & Financial Report / Aug 23, 2022

July data indicates that we celebrated a decline in gas prices by going shopping, boosting retail sales figures. I’m not sure I get the connection...

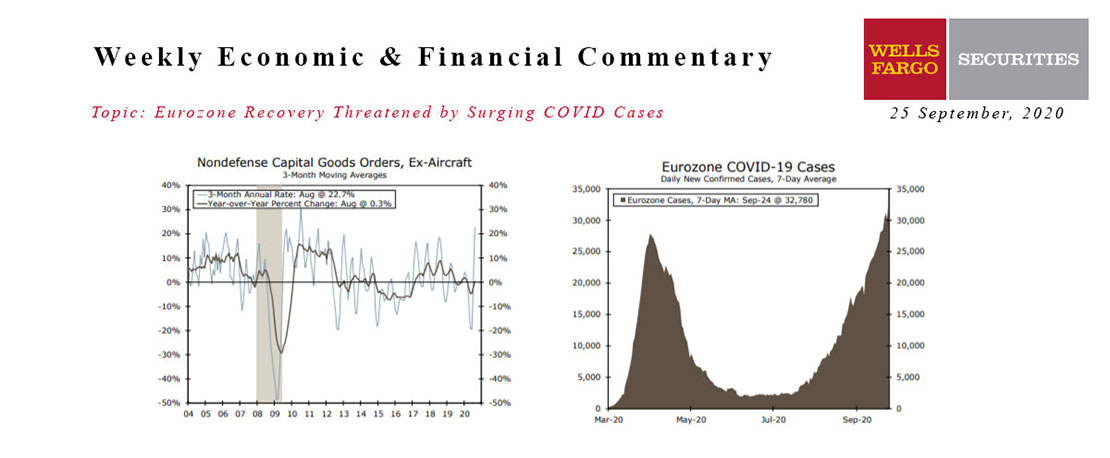

This Week's State Of The Economy - What Is Ahead? - 25 September 2020

Wells Fargo Economics & Financial Report / Sep 28, 2020

Existing home sales rose 2.4% to a 6.0-million unit annual pace. The surge in sales further depleted inventories and pushed prices sharply higher.

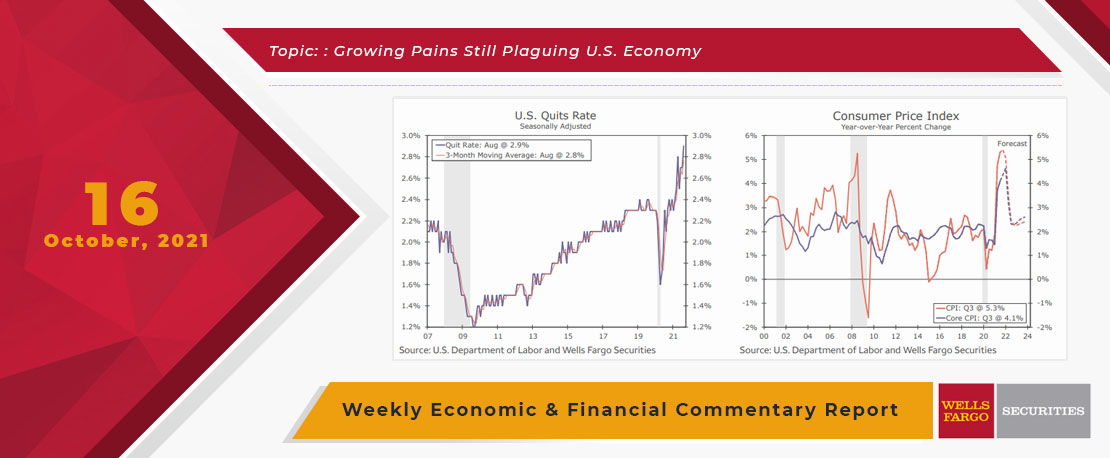

This Week's State Of The Economy - What Is Ahead? - 16 October 2021

Wells Fargo Economics & Financial Report / Oct 22, 2021

The first economic data released this week in the United States reinforced the theme that labor supply and demand are struggling to come into balance.