What if you were told that you could earn regular dividends from your investments without the hassles relating to buying, managing or even financing a property? Sounds too good to be true, right? Well, that’s precisely what a REIT allows. A REIT, or real estate investment trust, is a company that owns multiple income-earning real estate. It enables individual investors to buy shares of the REIT and add to their investment portfolio.

The History of REIT

Before we dive into its benefits, let’s take a look at how REITs came into play in the United States. REIT was a part of the Cigar Excise Tax Extension of 1960 implemented by President Eisenhower to allow for an affordable platform for the public to be able to invest in income-making real estate. According to Forbes, these are the prerequisites a company must meet to qualify as a REIT -

- Invest at least 75% of total assets in real estate.

- Derive at least 75% of its gross income from rents from real property, interest on mortgages financing real property, or real estate sales.

- Pay at least 90% of taxable income as shareholder dividends each year.

- Have a minimum of 100 shareholders.

- Have no more than 50% of its shares held by five or fewer individuals.

Benefits of REIT Investment?

The biggest USP of investing in REITs is probably the fact that they offer a lower risk for investors looking to enter the real estate market but don’t want to burden themselves with the inconvenience of managing a property. Since 90% of the taxable income goes to its shareholders, individuals investing in REITs earn high dividends.

Despite the ongoing pandemic, 2021 turned out to be a spectacular year for investors. Retail strip centers went up by 65% while the mall REIT index was up by 95%. That’s not all, the FTSE Nareit All Equity REITs index saw a return of 41.3%. Experts expect this significant improvement to be an ongoing occurrence in the real estate investment market, owing to the expected economic growth, higher incomes and extended spending/purchasing power across the country.

Transforming Houston: Council Greenlights Progressive Changes for Affordable Housing and Pedestrian

Real Estate Articles / Nov 23, 2023

Revolutionizing Houston\'s Housing Landscape: City Council Approves Sweeping Changes for Affordable Housing and Pedestrian Safety

US REAL ESTATE REMAINS TOP DRAW FOR FOREIGN INVESTORS

Real Estate Articles / Mar 02, 2019

The US continues to be the world\'s leading recipient of cross-border capital, and it has no plans of slowing down. During the first half of 2017 the United States attracted 19.8 billion U.S dollars from foreign investors.

Late 2022, Early 2023 Market Trends

Real Estate Articles / Dec 05, 2022

Real estate investors are keen to invest in real estate. End of year real estate trends and market predictions and trends that can be expected in commercial real estate for 2023.

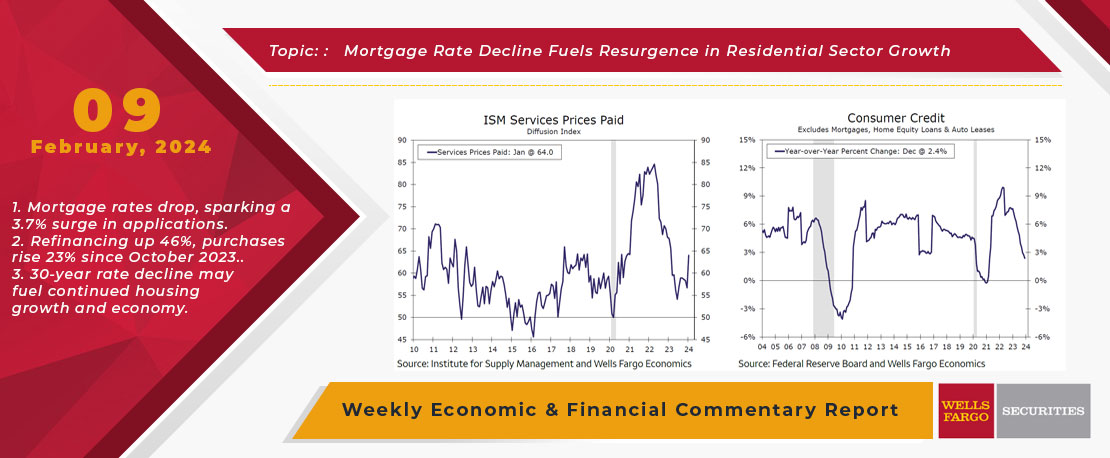

This Week's State Of The Economy - What Is Ahead? - 09 February 2024

Real Estate Articles / Feb 14, 2024

The ISM services index shot higher into expansion territory during January, which is the latest piece of evidence that economic growth is still firmly in positive territory.

Crypto is changing the real estate industry. Invest in real estate using crypto currency!

Real Estate Articles / Sep 01, 2022

With the economic inflation rising, the real estate and financial market is undergoing changes. Crypto currency is the new trend in real estate and in the investment world as more people are using crypto to invest in real estate.

Revolutionizing Student Housing: Advancements in Development and Design

Real Estate Articles / Jan 17, 2024

Capital Market Challenges and Design Evolution in Student Housing Development: Navigating Financing Hurdles, Innovative Trends, and Future Prospects in 2024

Wealth management tips. How to create wealth?

Real Estate Articles / Jun 08, 2022

We have listed the best ways through which you can make money in a low risk manner. Create wealth using these investment options. It is the easiest way to get rich.

What developers are saying about the 2023 real estate market

Real Estate Articles / Apr 26, 2023

The 2023 market condition,specifically commercial real estate development and construction industry is set for significant growth and innovation. Developers are saying that recession may be mild, and many growth and investment opportunities\'ll arise.

Extending a Warm Welcome to Savings for All Property OWNER

Real Estate Articles / Oct 27, 2023

Texas\' Landmark Property Tax Reform: Securing Affordable and Sustainable Homeownership for Texans, Envisioning Average Yearly Savings of $1,300.

The Ultimate List of Real Estate Terms

Real Estate Articles / Feb 25, 2022

We have compiled a list of top real estate words you need to know whether you are a real estate agent or are looking to buy a house or buy a commercial property. This is the real estate lingo you should know.